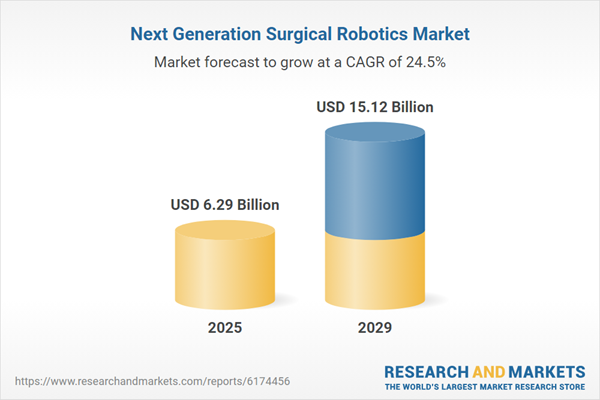

The next-generation surgical robotics market size is expected to see exponential growth in the next few years. It will grow to $15.12 billion in 2029 at a compound annual growth rate (CAGR) of 24.5%. The growth in the forecast period can be attributed to increasing investment in healthcare automation, rising demand for outpatient and minimally invasive surgical procedures, expansion of surgical robotics training programs, favorable reimbursement frameworks, and a growing emphasis on precision surgery. Major trends in the forecast period include miniaturization of robotic platforms, development of autonomous surgical robots, increased research and development activities, innovations in haptic feedback and imaging technologies, and advancements in cloud-enabled surgical systems.

The increasing demand for minimally invasive surgeries is expected to drive growth in the next-generation surgical robotics market. Minimally invasive surgeries, performed through small incisions using specialized tools, reduce patient pain, lower the risk of infection, shorten hospital stays, and accelerate recovery times. Next-generation surgical robotics further enhances these procedures by providing surgeons with improved precision, better visualization, and superior instrument control, reducing errors, limiting tissue damage, and enabling faster patient recovery. For example, in March 2023, the British Association of Aesthetic Plastic Surgeons reported that approximately 31,057 minimally invasive cosmetic surgeries were performed in the UK in 2022, a 102% increase from the previous year highlighting the growing demand for minimally invasive procedures.

Companies in the next-generation surgical robotics market are focusing on advanced orthopedic robotic platforms to improve precision and support minimally invasive techniques. Orthopedic robotic platforms assist surgeons in performing precise bone and joint surgeries, enhancing implant placement and supporting complex procedures. For instance, in March 2025, Stryker Corporation launched Mako 4, the fourth generation of its Mako SmartRobotics system. This platform integrates 3D CT-based planning and the fourth-generation Q Guidance System, enabling personalized surgical planning, real-time intraoperative guidance, and enhanced workflow efficiency for hip, knee, spine, and shoulder procedures, including robotic hip revisions.

In August 2024, KARL STORZ Endoscopy America Inc. acquired Asensus Surgical Inc. for \$0.35 per share in cash to expand its digital and robotic-assisted minimally invasive surgery capabilities. Asensus Surgical offers a next-generation robotic surgery platform, and this acquisition allows KARL STORZ to integrate advanced performance-guided surgery systems, enhancing precision, efficiency, and outcomes across minimally invasive surgical procedures.

Major players in the next generation surgical robotics market are Johnson & Johnson Services Inc., Medtronic plc, Stryker Corporation, Zimmer Biomet Holdings Inc., Smith & Nephew plc, Intuitive Surgical Inc., Accuray Incorporated, Medical Microinstruments Inc., PROCEPT BioRobotics Corporation, CMR Surgical Ltd., Noah Medical Inc., Distalmotion SA, Stereotaxis Inc., Neocis Inc., Moon Surgical SAS, Quantum Surgical SAS, Activ Surgical Inc., THINK Surgical Inc., Mendaera Inc., Galen Robotics Inc.

North America was the largest region in the next-generation surgical robotics market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in next-generation surgical robotics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the next-generation surgical robotics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The fast surge in U.S. tariffs and the trade tensions that followed in spring 2025 are heavily affecting the medical equipment sector, particularly for imported imaging machine components, surgical-grade stainless steel, and plastic disposables. Hospitals and clinics resist price hikes, pressuring manufacturers’ margins. Regulatory hurdles compound the problem, as tariff-related supplier changes often require re-certification of devices, delaying time-to-market. Companies are mitigating risks by dual-sourcing critical parts, expanding domestic production of commoditized items, and accelerating R&D in cost-efficient materials.

Next-generation surgical robotics are advanced robotic platforms designed to assist surgeons in performing highly precise, minimally invasive procedures. These systems combine enhanced imaging, improved dexterity, and intelligent software to increase surgical accuracy, reduce errors, and improve patient outcomes, enabling complex operations with greater control and faster recovery times.

The main component types of next-generation surgical robotics include systems, accessories, and services. Systems are integrated platforms comprising surgeon consoles, robotic arms, instruments, and software that enable minimally invasive surgeries with high precision and efficiency. They incorporate technologies such as master-slave robotic systems, minimally invasive robotics, robotic-assisted laparoscopy, and artificial intelligence with machine learning. Applications span gynecological, urological, neurosurgical, orthopedic, and general surgeries, among others, and end users include hospitals, ambulatory surgical centers, and related healthcare facilities.

The next-generation surgical robotics market research report is one of a series of new reports that provides next-generation surgical robotics market statistics, including next-generation surgical robotics industry global market size, regional shares, competitors with the next-generation surgical robotics market share, next-generation surgical robotics market segments, market trends, and opportunities, and any further data you may need to thrive in the next-generation surgical robotics industry. This next-generation surgical robotics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The next-generation surgical robotics market consists of revenues earned by entities by providing services such as robotic-assisted surgery, surgical navigation and guidance, preoperative planning, intraoperative imaging support and post-surgical monitoring. The market value includes the value of related goods sold by the service provider or included within the service offering. The next-generation surgical robotics market also includes sales of preoperative planning software, haptic feedback devices, imaging-guided navigation systems, surgical training simulators, and post-operative analytics platforms. Values in this market are ‘factory gate’ values; that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Next Generation Surgical Robotics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on next generation surgical robotics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for next generation surgical robotics? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The next generation surgical robotics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Components: Systems; Accessories; Services2) By Technology: Master-Slave Robotic Technology; Minimally Invasive Robotic Technology; Robotic-Assisted Laparoscopy; Artificial Intelligence and Machine Learning Integration

3) By Application: Gynecological Surgery; Urological Surgery; Neurosurgery; Orthopedic Surgery; General Surgery; Other Applications

4) By End-User: Hospitals; Ambulatory Surgical Centers; Other End-Users

Subsegments:

1) By Systems: Autonomous Surgical Robots; Semi-Autonomous Surgical Robots; Telesurgical Robots; Haptic Feedback Robots2) By Accessories: Surgical Instrument Sets; Endoscopic Tools; Robotic Arms and Graspers; Visualization and Imaging Modules

3) By Services: Maintenance and Support Services; Training and Education Services; Software Updates and Integration Services; Consulting and Implementation Services

Companies Mentioned: Johnson & Johnson Services Inc.; Medtronic plc; Stryker Corporation; Zimmer Biomet Holdings Inc.; Smith & Nephew plc; Intuitive Surgical Inc.; Accuray Incorporated; Medical Microinstruments Inc.; PROCEPT BioRobotics Corporation; CMR Surgical Ltd.; Noah Medical Inc.; Distalmotion SA; Stereotaxis Inc.; Neocis Inc.; Moon Surgical SAS; Quantum Surgical SAS; Activ Surgical Inc.; THINK Surgical Inc.; Mendaera Inc.; Galen Robotics Inc

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Next Generation Surgical Robotics market report include:- Johnson & Johnson Services Inc.

- Medtronic plc

- Stryker Corporation

- Zimmer Biomet Holdings Inc.

- Smith & Nephew plc

- Intuitive Surgical Inc.

- Accuray Incorporated

- Medical Microinstruments Inc.

- PROCEPT BioRobotics Corporation

- CMR Surgical Ltd.

- Noah Medical Inc.

- Distalmotion SA

- Stereotaxis Inc.

- Neocis Inc.

- Moon Surgical SAS

- Quantum Surgical SAS

- Activ Surgical Inc.

- THINK Surgical Inc.

- Mendaera Inc.

- Galen Robotics Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 6.29 Billion |

| Forecasted Market Value ( USD | $ 15.12 Billion |

| Compound Annual Growth Rate | 24.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |