Global Non-Opioid Pain Treatment Market - Key Trends & Drivers Summarized

Why Is the Global Healthcare Industry Moving Away from Opioid-Based Pain Management?

The global transition toward non-opioid pain treatment represents one of the most significant shifts in modern pain management, catalyzed by growing concerns over opioid addiction, dependence, and associated healthcare burdens. In response to decades of rising opioid misuse - particularly in North America - clinicians, regulators, and pharmaceutical innovators are prioritizing safer, non-addictive alternatives for both acute and chronic pain. The devastating consequences of opioid overprescription have led to regulatory crackdowns, medical guideline revisions, and a major cultural rethinking of how pain should be treated. This has created a fertile environment for non-opioid treatments, which include a wide range of pharmaceuticals (such as NSAIDs, antidepressants, and anticonvulsants), targeted biologics, nerve-blocking agents, and device-based therapies like TENS (Transcutaneous Electrical Nerve Stimulation) and spinal cord stimulators. Many of these treatments can effectively manage pain without altering mood, cognitive function, or risking dependence, making them attractive across patient demographics - from elderly patients with arthritis to younger populations recovering from sports injuries or surgeries. In palliative and post-operative care, multimodal approaches are now becoming the norm, wherein non-opioid solutions are integrated with physical therapy, psychological support, and lifestyle adjustments. As awareness grows around the risks of opioids - even when taken under medical supervision - patients themselves are increasingly seeking out and requesting non-opioid alternatives, placing additional pressure on healthcare systems to evolve. This global paradigm shift is redefining pain treatment not just as a clinical challenge but as a multidisciplinary, personalized, and public health-driven priority.How Are Innovations in Pharmacology and Medical Devices Expanding the Pain Treatment Toolbox?

Recent innovations in pharmacology and medical technology are vastly expanding the range and efficacy of non-opioid pain treatments, offering hope for millions of patients previously dependent on narcotics for relief. On the pharmaceutical front, companies are developing novel compounds that target specific pain pathways without affecting the brain’ s reward system - thereby reducing the potential for misuse. For instance, selective nerve growth factor (NGF) inhibitors are showing promise for chronic conditions like osteoarthritis, while COX-2 inhibitors and next-generation NSAIDs are delivering improved pain relief with reduced gastrointestinal risks. Beyond oral drugs, localized delivery systems such as topical gels, transdermal patches, and injectable biologics offer site-specific relief with minimal systemic exposure. On the medical device side, wearable technologies that modulate nerve signals - like TENS units and neuromodulation implants - are emerging as effective solutions for conditions such as neuropathy, fibromyalgia, and post-surgical pain. These non-invasive or minimally invasive devices are particularly appealing in outpatient settings where patients require long-term symptom management without pharmacologic intervention. Virtual reality (VR)-based therapies, which use distraction and cognitive reframing techniques, are also being explored for pain reduction in clinical trials. Meanwhile, AI-powered platforms are helping clinicians tailor pain treatment regimens to individual patients by analyzing genetics, behavior, and lifestyle data. The convergence of biotechnology, digital therapeutics, and precision medicine is making non-opioid pain treatment not only viable but in many cases, preferable. These innovations are transforming how pain is understood and addressed - shifting the focus from suppression to modulation and long-term management.Are Public Health Policies and Payer Strategies Accelerating the Shift to Non-Opioid Options?

The rising adoption of non-opioid pain treatments is being significantly driven by public health policies, insurance payer strategies, and institutional prescribing guidelines aimed at curbing opioid dependency. In the wake of national opioid crises, governments across the globe - especially in the U.S., Canada, and Australia - are implementing stringent prescription monitoring programs and providing grants for the development and dissemination of non-opioid pain solutions. Regulatory agencies like the FDA have fast-tracked approval for several non-opioid pain relief drugs and devices, recognizing the urgent need for alternatives. Insurance companies are revising reimbursement frameworks to support broader coverage of non-opioid therapies, including non-pharmacological interventions such as physical therapy, acupuncture, chiropractic care, and cognitive behavioral therapy (CBT). Some healthcare systems are also introducing financial incentives for hospitals and clinics that adopt opioid-sparing protocols. Moreover, professional associations in orthopedics, dentistry, anesthesiology, and palliative care have issued updated guidelines recommending non-opioid options as first-line treatments for specific conditions or post-operative scenarios. Educational campaigns are simultaneously targeting both physicians and the public, emphasizing the long-term dangers of opioids and presenting safer, evidence-based alternatives. Hospitals and academic medical centers are launching dedicated pain management programs that integrate multiple non-opioid modalities to treat pain holistically. These policy-level efforts are not only reshaping medical practice standards but are also reducing stigma around non-drug and non-opioid approaches, fostering a new culture of sustainable, patient-centered pain management.What Factors Are Driving the Growth of the Non-Opioid Pain Treatment Market Globally?

The growth in the non-opioid pain treatment market is driven by several interlinked factors spanning technology, healthcare delivery, patient behavior, and epidemiological trends. Technologically, the development of safer, more targeted therapies - including biologics, nerve blockers, and digital therapeutics - is expanding the clinical viability of non-opioid pain management across a wider array of conditions. The increasing prevalence of chronic pain - stemming from aging populations, sedentary lifestyles, surgical procedures, and conditions like arthritis, cancer, and diabetes - is creating sustained global demand for effective and tolerable pain solutions. Clinically, the integration of multidisciplinary care teams and personalized medicine approaches is reinforcing the need for diverse, non-addictive treatment modalities. From a systems perspective, healthcare providers are prioritizing opioid-sparing strategies to reduce legal liabilities, improve patient satisfaction, and meet institutional performance metrics. Insurance coverage is gradually becoming more inclusive of non-opioid therapies, enabling broader patient access and reducing out-of-pocket costs. On the consumer side, growing health literacy and social awareness around opioid-related harm are pushing patients to actively seek alternative treatments and advocate for safer care pathways. Additionally, the COVID-19 pandemic exposed the vulnerability of opioid-dependent systems, further validating the importance of decentralized, device-based, or non-pharmacologic interventions that can be managed at home. Pharmaceutical companies and medtech firms are responding with robust R&D pipelines and strategic partnerships aimed at expanding market penetration globally. Together, these technological, clinical, economic, and cultural shifts are driving a durable and accelerating wave of growth in the non-opioid pain treatment market.Report Scope

The report analyzes the Non-opioid Pain Treatment market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Drug Class (Non-Steroidal Anti-Inflammatory Drugs, Acetaminophen Drugs, Local Anesthetics Drugs, Other Drug Classes); Pain (Chronic Pain, Post-operative Pain, Cancer Pain, Other Pains); Route of Administration (Oral Route of Administration, Topical Route of Administration, Injectable Route of Administration, Other Route of Administrations); Distribution Channel (Retail Pharmacies, Hospital Pharmacies, Online Pharmacies).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Non-Steroidal Anti-Inflammatory Drugs segment, which is expected to reach US$29.6 Billion by 2030 with a CAGR of a 8%. The Acetaminophen Drugs segment is also set to grow at 7.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $12.0 Billion in 2024, and China, forecasted to grow at an impressive 11.1% CAGR to reach $13.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Non-opioid Pain Treatment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Non-opioid Pain Treatment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Non-opioid Pain Treatment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., Alfanar Group, Bonomi Eugenio SpA, CG Power and Industrial Solutions Ltd., CHINT Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Non-opioid Pain Treatment market report include:

- Almatica Pharma LLC

- Amgen Inc.

- Cipla Inc.

- Dr. Reddy’s Laboratories Ltd.

- Eli Lilly and Company

- Fresenius Kabi AG

- GlaxoSmithKline plc (GSK)

- Haleon Group

- Heron Therapeutics

- Hyloris Pharmaceuticals

- Johnson & Johnson Consumer Inc.

- LNK International, Inc.

- Novartis AG

- Pacira Pharmaceuticals, Inc.

- Perrigo Company plc

- Pfizer Inc.

- Pierrel S.p.A.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Vertex Pharmaceuticals Incorporated

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Almatica Pharma LLC

- Amgen Inc.

- Cipla Inc.

- Dr. Reddy’s Laboratories Ltd.

- Eli Lilly and Company

- Fresenius Kabi AG

- GlaxoSmithKline plc (GSK)

- Haleon Group

- Heron Therapeutics

- Hyloris Pharmaceuticals

- Johnson & Johnson Consumer Inc.

- LNK International, Inc.

- Novartis AG

- Pacira Pharmaceuticals, Inc.

- Perrigo Company plc

- Pfizer Inc.

- Pierrel S.p.A.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Vertex Pharmaceuticals Incorporated

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 480 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

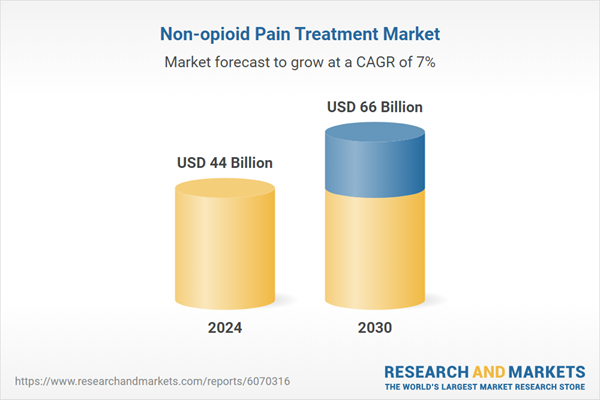

| Estimated Market Value ( USD | $ 44 Billion |

| Forecasted Market Value ( USD | $ 66 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |