Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Aluminum curtain walls are widely used in commercial towers, airports, hotels, and increasingly in residential high-rises. The market is being propelled by sustainable construction trends, evolving urban skylines, and regulatory pushes for energy-efficient building envelopes. These systems not only improve building performance but also align with green building certification goals. As urban centers like New York, Toronto, and Los Angeles continue to modernize, aluminum curtain walls are becoming an integral part of contemporary architecture.

Key Market Drivers

Accelerating Demand for Energy-Efficient and Sustainable Building Envelopes

The growing focus on energy-efficient and sustainable construction is a significant driver for the North America Aluminum Curtain Wall Market. Stricter energy codes and environmental regulations across major urban centers are pushing developers to adopt facade solutions that minimize energy consumption and reduce a building’s carbon footprint. Aluminum curtain walls, especially those featuring thermally broken frames and advanced glazing, help reduce heating and cooling demands, contributing to operational energy savings. Their recyclability and compatibility with green building certifications make them attractive to both public and private projects targeting LEED or equivalent ratings. The material’s durability and low maintenance further enhance its value proposition in long-term infrastructure investments. With increasing federal and municipal incentives for sustainable construction, demand for energy-efficient curtain wall systems continues to rise, especially in high-density cities seeking to meet climate action goals and improve urban sustainability.Key Market Challenges

Escalating Raw Material Prices and Supply Chain Volatility

A major challenge confronting the North America Aluminum Curtain Wall Market is the rising and unpredictable cost of aluminum, driven by global supply chain disruptions, geopolitical tensions, and energy crises in key producing nations. Aluminum, being the primary component of curtain wall systems, is highly susceptible to price volatility, which can strain budgets for developers and contractors. These fluctuations disrupt planning, inflate construction costs, and affect project timelines, particularly for large-scale commercial and institutional developments. Manufacturers also face challenges in maintaining cost-competitiveness and profit margins amid fluctuating raw material prices. Furthermore, logistical delays and shortages in specialized aluminum profiles and coatings further exacerbate lead time and procurement issues, making cost management a persistent concern across the supply chain.Key Market Trends

Integration of Sustainable and Energy-Efficient Curtain Wall Systems

The market is witnessing a significant shift toward the adoption of energy-efficient and sustainable aluminum curtain wall systems. This trend is driven by heightened awareness of environmental impact, the demand for better thermal performance, and government mandates for green construction. Curtain wall systems are increasingly being developed with thermally insulated frames, double or triple glazing, and low-emissivity coatings to improve energy efficiency without compromising natural light and visual appeal.Additionally, some systems incorporate photovoltaic panels to generate on-site renewable energy, aligning with decarbonization initiatives. These innovations are particularly favored in commercial and institutional projects aiming for net-zero emissions. As green building certifications become a standard rather than a niche pursuit, the demand for high-performance aluminum curtain wall systems that contribute to energy savings and sustainability is set to grow. This shift is prompting manufacturers to invest in R&D and offer product lines that meet evolving efficiency and environmental standards.

Key Market Players

- Apogee Enterprises, Inc.

- YKK Corporation

- Arconic Corporation

- Enclos Corp.

- Schüco International KG

- Oldcastle BuildingEnvelope, Inc.

- Reynaers Aluminium NV

- EFCO Corporation

Report Scope:

In this report, the North America Aluminum Curtain Wall Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below.North America Aluminum Curtain Wall Market, By Type:

- Stick-Built Aluminum Curtain Walls

- Unitized Aluminum Curtain Walls

North America Aluminum Curtain Wall Market, By Construction Type:

- New Construction

- Retrofit & Renovation

North America Aluminum Curtain Wall Market, By End-Use Industry:

- Commercial Buildings

- Residential Buildings

- Public & Institutional Buildings

North America Aluminum Curtain Wall Market, By Glazing Type:

- Double-Glazed Aluminum Curtain Walls

- Triple-Glazed Aluminum Curtain Walls

- Single-Glazed Aluminum Curtain Walls

North America Aluminum Curtain Wall Market, By Country:

- United States

- Canada

- Mexico

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the North America Aluminum Curtain Wall Market.Available Customizations

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Apogee Enterprises, Inc.

- YKK Corporation

- Arconic Corporation

- Enclos Corp.

- Schüco International KG

- Oldcastle BuildingEnvelope, Inc.

- Reynaers Aluminium NV

- EFCO Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | April 2025 |

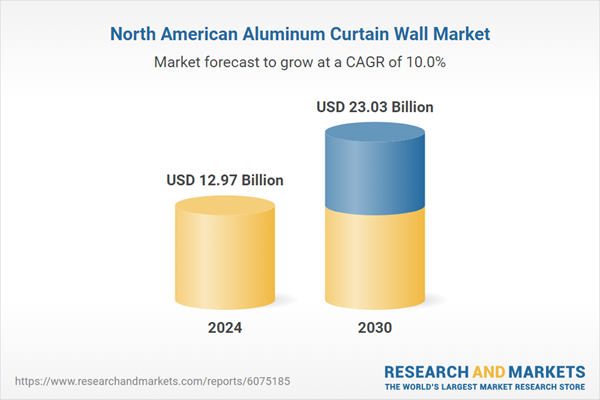

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 12.97 Billion |

| Forecasted Market Value ( USD | $ 23.03 Billion |

| Compound Annual Growth Rate | 10.0% |

| Regions Covered | North America |

| No. of Companies Mentioned | 8 |