A tire is a ring shaped component of a vehicle that contains a rim and compressed air. It can be manufactured using natural and synthetic materials, such as rubber, carbon black, wire, cotton, glass, silica, and steel. It helps in offering cushions against shocks, supporting the load of the vehicle, and dealing with forces that are performing on the vehicle during its motion. It also improves the performance of a vehicle and enhances mileage and passenger safety. It provides grip, facilitates braking, and improves vehicle handling on mountain roads. It is available in different sizes, shapes, and designs to meet several types of vehicles and driving conditions. It is commonly offered as tubed and tubeless tires and has a bead, bead filler, inner liner, sidewall, belts, body ply, and tread.

North America Tire Market Trends:

The increasing production and sales of luxury, autonomous, passenger, or commercial vehicles and significant improvements in the automotive industry represent one of the major factors driving the demand for tires in the North American region. Moreover, there is a rise in the demand for premium quality tires in ultra-high-performance vehicles for longer operational life, enhanced stability and reliability, and high puncture resistance. This, coupled with the growing focus on improving driver and passenger safety due to the increasing number of fatal road accidents, is influencing the market positively in the region. In addition, the rising adoption of winter tires during extreme weather conditions, such as snow and ice, is favoring the growth of the market. Apart from this, the growing preference for premium vehicles and tires for logistics and transportation activities to deliver packages on time on account of their numerous advantages, such as enhanced stopping power, improved overall safety, and better handling, is creating a positive outlook for the market across the region. Furthermore, product manufacturers are focusing on recovering and recycling used tires to minimize their environmental impact and save a significant amount of energy that is required to manufacture new ones. They are also focusing on launching eco-friendly, lightweight, and airless three-dimensional (3D) printed variants to expand their product portfolio. Key players are introducing tires that are equipped with sensors to observe tire pressure and temperature and enhance the experience of the users.Key Market Segmentation:

The publisher provides an analysis of the key trends in each sub-segment of the North America tire market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on segment and application.Segment Insights:

- OEM Market

- Replacement Market

Application Insights:

- Passenger Car/ Light Truck

- Commercial Tires (Trucks)

- Commercial Tires (Off- Highway)

Country Insights:

- United States

- Canada

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the North America tire market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.Key Questions Answered in This Report:

- How has the North America tire market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the North America tire market?

- What is the impact of each driver, restraint, and opportunity on the North America tire market?

- Which countries represent the most attractive North America tire market?

- What is the breakup of the market based on the segment?

- Which is the most attractive segment in the North America tire market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the North America tire market?

- What is the competitive structure of the North America tire market?

- Who are the key players/companies in the North America tire market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Tire Market

5.1 Market Performance

5.2 Market Breakup by Segment

5.3 Market Breakup by Application

5.4 Market Breakup by Region

5.5 Market Forecast

6 North America Tire Market

6.1 Market Performance

6.2 Impact of COVID-19

6.3 Market Forecast

7 North America Tire Market: Breakup by Segment

7.1 OEM Market

7.2 Replacement Market

8 North America Tire Market: Breakup by Application

8.1 Passenger Car/ Light Truck

8.2 Commercial Tires (Trucks)

8.3 Commercial Tires (Off- Highway)

9 North America Tire Market: Breakup by Country

9.1 United States

9.1.1 Historical Market Trends

9.1.2 Market Breakup by Segment

9.1.3 Market Breakup by Application

9.1.4 Market Forecast

9.2 Canada

9.2.1 Historical Market Trends

9.2.2 Market Breakup by Segment

9.2.3 Market Breakup by Application

9.2.4 Market Forecast

10 SWOT Analysis

10.1 Overview

10.2 Strengths

10.3 Weaknesses

10.4 Opportunities

10.5 Threats

11 Value Chain Analysis

11.1 Overview

11.2 Research and Development

11.3 Raw Material Suppliers

11.4 Manufacturers

11.5 Distributors

11.6 Retailers/Exporters

11.7 End-Users

12 Porter’s Five Forces Analysis

12.1 Overview

12.2 Bargaining Power of Buyers

12.3 Bargaining Power of Suppliers

12.4 Degree of Rivalry

12.5 Threat of New Entrants

12.6 Threat of Substitutes

13 Price Analysis

14 Competitive Landscape

14.1 Market Structure

14.2 Key Players

14.3 Profiles of Key Players

List of Figures

Figure 1: North America: Tire Market: Major Drivers and Challenges

Figure 2: Global: Tire Market: Sales Volume (in Billion Units), 2019-2024

Figure 3: Global: Tire Market: Breakup by Segment (in %), 2024

Figure 4: Global: Tire Market: Breakup by Application (in %), 2024

Figure 5: Global: Tire Market: Breakup by Region (in %), 2024

Figure 6: Global: Tire Market Forecast: Sales Volume (in Billion Units), 2025-2033

Figure 7: North America: Tire Market: Sales Volume (in Million Units), 2019-2024

Figure 8: North America: Tire Market Forecast: Sales Volume (in Million Units), 2025-2033

Figure 9: North America: Tire Market: Breakup by Segment (in %), 2024

Figure 10: North America: Tire (OEM) Market: Sales Volume (in Million Units), 2019 & 2024

Figure 11: North America: Tire (OEM) Market Forecast: Sales Volume (in Million Units), 2025-2033

Figure 12: North America: Tire (Replacement) Market: Sales Volume (in Million Units), 2019 & 2024

Figure 13: North America: Tire (Replacement) Market Forecast: Sales Volume (in Million Units), 2025-2033

Figure 14: North America: Tire Market: Breakup by Application (in %), 2024

Figure 15: North America: Tire (Passenger Car/ Light Truck) Market: Sales Volume (in Million Units), 2019 & 2024

Figure 16: North America: Tire (Passenger Car/ Light Truck) Market Forecast: Sales Volume (in Million Units), 2025-2033

Figure 17: North America: Tire (Commercial Tires - Trucks) Market: Sales Volume (in Million Units), 2019 & 2024

Figure 18: North America: Tire (Commercial Tires - Trucks) Market Forecast: Sales Volume (in Million Units), 2025-2033

Figure 19: North America: Tire (Commercial Tires - Off-Highway) Market: Sales Volume (in Million Units), 2019 & 2024

Figure 20: North America: Tire (Commercial Tires - Off-Highway) Market Forecast: Sales Volume (in Million Units), 2025-2033

Figure 21: North America: Tire Market: Breakup by Country (in %), 2024

Figure 22: United States: Tire Market: Sales Volume (in Million Units), 2019-2024

Figure 23: United States: Tire Market: Breakup by Segment (in %), 2024

Figure 24: United States: Tire Market: Breakup by Application (in %), 2024

Figure 25: United States: Tire Market Forecast: Sales Volume (in Million Units), 2025-2033

Figure 26: Canada: Tire Market: Sales Volume (in Million Units), 2019-2024

Figure 27: Canada: Tire Market: Breakup by Segment (in %), 2024

Figure 28: Canada: Tire Market: Breakup by Application (in %), 2024

Figure 29: Canada: Tire Market Forecast: Sales Volume (in Million Units), 2025-2033

Figure 30: North America: Tire Industry: SWOT Analysis

Figure 31: North America: Tire Industry: Value Chain Analysis

Figure 32: North America: Tire Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: North America: Tire Market: Key Industry Highlights, 2024 and 2033

Table 2: North America: Tire Market Forecast: Breakup by Segment (in Million Units), 2025-2033

Table 3: North America: Tire Market Forecast: Breakup by Application (in Million Units), 2025-2033

Table 4: North America: Tire Market Forecast: Breakup by Country (in Million Units), 2025-2033

Table 5: North America: Tire Market: Competitive Structure

Table 6: North America: Tire Market: Key Players

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 125 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

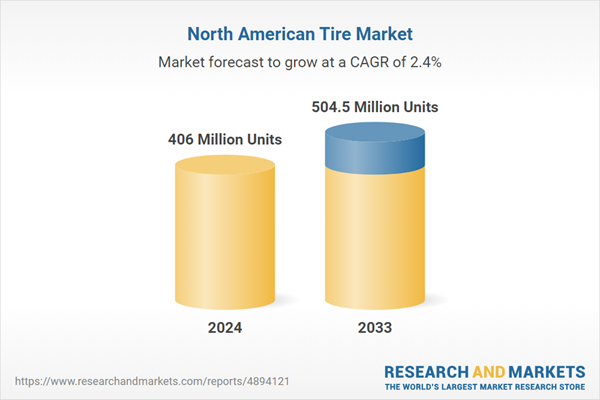

| Estimated Market Value in 2024 | 406 Million Units |

| Forecasted Market Value by 2033 | 504.5 Million Units |

| Compound Annual Growth Rate | 2.4% |

| Regions Covered | North America |