Increasing Need for Communications in Automobiles is Driving the North America Automotive Transceivers Market

Automobile manufacturers are continuously striving to improve safety and performance, and reduce the environmental impact of their products, along with enhancing comfort for vehicle occupants. This, in turn, increases the volume of data generated and communicated between electronic control units (ECUs) of vehicles, along with the reliance on the same, thereby contributing to the demand for automotive transceivers. Advanced vehicles, nowadays, utilize about five separate ECUs to address the elevating demand for next-generation, embedded networks, and high bandwidths. The growing requirement for bandwidth and embedded networks propels the deployment of transceivers in automobiles.Earlier, only high-end cars had comfort and other prime features. However, these features are gradually becoming common in other car segments due to the declining prices of sensors and ECUs with economies of scale. Nowadays, hatchbacks, and B and C segment sedans are also equipped with these comfort and safety features. This has created a huge demand for ECUs and sensors in the automotive market, which triggers the demand for transceivers, as they connect all ECUs and sensors on a single mesh network. FlexRay, one of the key players in the automotive transceivers market, provides CAN for mainstream powertrain communications and Local Interconnect Network for low-cost body electronics to optimize cost and reduce transition challenges in high-end applications. The increasing applications of LIN in body electronics such as mirrors, power seats, and accessories; CAN in powertrain components such as engine, transmission, and ABS; and FlexRay in high-performance powertrain and safety systems further trigger the adoption of transceivers. Thus, increasing communications needs in automobiles propel the growth of the North America automotive transceivers market.

North America Automotive Transceivers Market Overview

The North America automotive transceivers market is segmented into the US, Canada, and Mexico. The region has leading automotive transceivers manufacturers such as STMicroelectronics; Infineon Technologies AG; Renesas Electronics America Inc.; Microchip Technology Inc.; Broadcom Inc.; Semiconductor Components Industries, LLC; Texas Instruments Incorporated; NXP Semiconductors N.V.; and Analog Devices, Inc. In addition, the growing initiatives for advancing features in automotive transceivers from these players are fueling the market growth. For instance, in November 2022, Infineon Technologies AG introduced a new CMOS transceiver MMIC CTRX8181 with high performance, scalability, and reliability for automotive radar modules. This development offers a scalable platform approach for different sensors, including corner, front, and short range, along with flexibility for new software-defined vehicle architectures, which is boosting the market demand among consumers. In addition, in November 2022, Renesas Electronics Corporation introduced a 4x4-channel, 76-81GHz transceiver designed to cater to the growing needs of ADAS and Level 3 and higher autonomous driving applications. Also, in September 2022, NXP Semiconductors N.V. announced the production of its 2nd Generation 77GHz RFCMOS radar transceivers for ADAS and autonomous driving. This development enables 360° sensing for critical safety applications, such as adaptive cruise control, automated emergency braking, blind-spot monitoring, cross-traffic alert, and automated parking. Thus, such growing technological advancements for developing advanced automotive transceivers enable the players to achieve a competitive edge over the competitors, which is contributing to the North America automotive transceivers market growth over the forecast period.North America has a developed automotive industry due to the continuous production of passenger vehicles. For instance, as per the Organisation Internationale des Constructeurs d'Automobiles (OICA) 2021 report, the US produced 70,24,288 passenger vehicles in 2021 and 68,64,024 in 2020. Similarly, Canada produced 3,20,605 passenger vehicles in 2021 and 3,18,750 in 2020, as per the same report. As per OICA statistics, the US, Canada, and Mexico are leading in the production of passenger vehicles across the globe. Thus, with the continuous production of passenger vehicles across the region, the demand for automotive transceivers is also rapidly growing. This is owing to a rise in the demand for connected vehicles and the growing integration of electronic components in the vehicle such as ADAS and V2X module for enhancing passenger safety and security, which is further promoting the North America automotive transceivers market growth.

North America Automotive Transceivers Market Segmentation

The North America automotive transceivers market is segmented into protocol, application, vehicle type, and country.- Based on protocol, the North America automotive transceivers market is segmented into CAN, LIN, FLEXRAY, and others. The CAN segment held the largest market share in 2022.

- Based on application, the North America automotive transceivers market is segmented into safety, body control module, chassis, powertrain, steering wheel, engine, and door/seat. The safety segment held the larger market share in 2022.

- Based on vehicle type, the North America automotive transceivers market is bifurcated into passenger vehicles, and commercial vehicles. The passenger vehicles segment held the larger market share in 2022.

- Based on country, the North America automotive transceivers market is segmented into the US, Canada, and Mexico. The US dominated the market share in 2022.

Table of Contents

1. Introduction1.1 Study Scope

1.2 Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. North America Automotive Transceivers Market Landscape

4.1 Market Overview

4.2 North America - PEST Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. North America Automotive Transceivers Market - Key Industry Dynamics

5.1 Market Drivers

5.1.1 Increasing Need for Communications in Automobiles

5.1.2 Equipment of Advanced Communication and Safety Features in Electric Vehicles

5.2 Market Restraints

5.2.1 Increasing Complexities in Electronic Systems

5.3 Market Opportunities

5.3.1 Growing Adoption of Self-Driving or Autonomous Vehicles

5.4 Trends

5.4.1 Drive-By-Wire, Steer-By-Wire, and Brake-By-Wire

5.5 Impact Analysis of Drivers and Restraints

6. North America Automotive Transceivers Market -Market Analysis

6.1 North America Automotive Transceivers Market Overview

6.2 North America Automotive Transceivers Market Forecast and Analysis

7. North America Automotive Transceivers Market Analysis - By Protocol

7.1 Overview

7.2 North America Automotive Transceivers Market, By Protocol (2021 & 2028)

7.3 CAN

7.3.1 Overview

7.3.2 CAN: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

7.4 LIN

7.4.1 Overview

7.4.2 LIN: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

7.5 FLEXRAY

7.5.1 Overview

7.5.2 FLEXRAY: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

7.6 OTHERS

7.6.1 Overview

7.6.2 Others: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

8. North America Automotive Transceivers Market Revenue and Forecast to 2028 - By Application

8.1 Overview

8.2 North America Automotive Transceivers Market, By Application (2021 & 2028)

8.3 Safety

8.3.1 Overview

8.3.2 Safety: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

8.4 Body Control Module

8.4.1 Overview

8.4.2 Body Control Module: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

8.5 Chassis

8.5.1 Overview

8.5.2 Chassis: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

8.6 Powertrain

8.6.1 Overview

8.6.2 Powertrain: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

8.7 Steering Wheel

8.7.1 Overview

8.7.2 Steering Wheel: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

8.8 Engine

8.8.1 Overview

8.8.2 Engine: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

8.9 Door/Seat

8.9.1 Overview

8.9.2 Door/Seat: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

9. North America Automotive Transceivers Market Revenue and Forecast to 2028 - Vehicle Type

9.1 Overview

9.2 North America Automotive Transceivers Market, By Vehicle Type (2021 & 2028)

9.3 Passenger Vehicles

9.3.1 Overview

9.3.2 Passenger Vehicles: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

9.4 Commercial Vehicles

9.4.1 Overview

9.4.2 Commercial Vehicles: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

10. North America Automotive Transceivers Market - Country Analysis

10.1 Overview

10.1.1 North America Automotive Transceivers Market, by Key Country

10.1.1.1 US: Automotive Transceivers - Revenue, and Forecast to 2028 (US$ Million)

10.1.1.1.1 US: Automotive Transceivers, By Protocol

10.1.1.1.2 US: Automotive Transceivers, By Application

10.1.1.1.3 US: Automotive Transceivers, By Vehicle Type

10.1.1.2 Canada: Automotive Transceivers - Revenue, and Forecast to 2028 (US$ Million)

10.1.1.2.1 Canada: Automotive Transceivers, By Protocol

10.1.1.2.2 Canada: Automotive Transceivers, By Application

10.1.1.2.3 Canada: Automotive Transceivers, By Vehicle Type

10.1.1.3 Mexico: Automotive Transceivers - Revenue, and Forecast to 2028 (US$ Million)

10.1.1.3.1 Mexico: Automotive Transceivers, By Protocol

10.1.1.3.2 Mexico: Automotive Transceivers, By Application

10.1.1.3.3 Mexico: Automotive Transceivers, By Vehicle Type

11. Industry Landscape

11.1 Overview

11.2 Market Initiative

11.3 New Product Development

11.4 Merger and Acquisition

12. Company Profiles

12.1 Broadcom Inc

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Cypress Semiconductor Corp

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Renesas Electronics Corp

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Maxim Integrated Products Inc

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Microchip Technology Inc

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 NXP Semiconductors NV

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Robert Bosch

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Texas Instruments Inc

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 Toshiba Corp

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 STMicroelectronics NV

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

13. Appendix

13.1 About the Publisher

13.2 Word Index

Table 1. North America Automotive Transceivers Market - Revenue and Forecast to 2028 (US$ Million)

Table 2. North America Automotive Transceivers Market, By Protocol - Revenue and Forecast to 2028 (US$ Million)

Table 3. North America: North America Automotive Transceivers Market, By Application - Revenue and Forecast to 2028 (US$ Million)

Table 4. North America: North America Automotive Transceivers Market, By Vehicle Type - Revenue and Forecast to 2028 (US$ Million)

Table 5. US: Automotive Transceivers, By Protocol -Revenue and Forecast to 2028 (US$ Million)

Table 6. US: Automotive Transceivers, By Application -Revenue and Forecast to 2028 (US$ Million)

Table 7. US: Automotive Transceivers, By Vehicle Type -Revenue and Forecast to 2028 (US$ Million)

Table 8. Canada: Automotive Transceivers, By Protocol -Revenue and Forecast to 2028 (US$ Million)

Table 9. Canada: Automotive Transceivers, By Application -Revenue and Forecast to 2028 (US$ Million)

Table 10. Canada: Automotive Transceivers, By Vehicle Type -Revenue and Forecast to 2028 (US$ Million)

Table 11. Mexico: Automotive Transceivers, By Protocol -Revenue and Forecast to 2028 (US$ Million)

Table 12. Mexico: Automotive Transceivers, By Application -Revenue and Forecast to 2028 (US$ Million)

Table 13. Mexico: Automotive Transceivers, By Vehicle Type -Revenue and Forecast to 2028 (US$ Million)

Table 14. List of Abbreviation

Figure 1. North America Automotive Transceivers Market Segmentation

Figure 2. North America Automotive Transceivers Market Segmentation - By Country

Figure 3. North America Automotive Transceivers Market Overview

Figure 4. CAN Segment held the Largest Share of North America Automotive Transceivers Market

Figure 5. US to Show Great Traction During Forecast Period

Figure 6. North America- PEST Analysis

Figure 7. Ecosystem Analysis: North America Automotive Transceivers Market

Figure 8. Expert Opinion

Figure 9. North America Automotive Transceivers Market: Impact Analysis of Drivers and Restraints

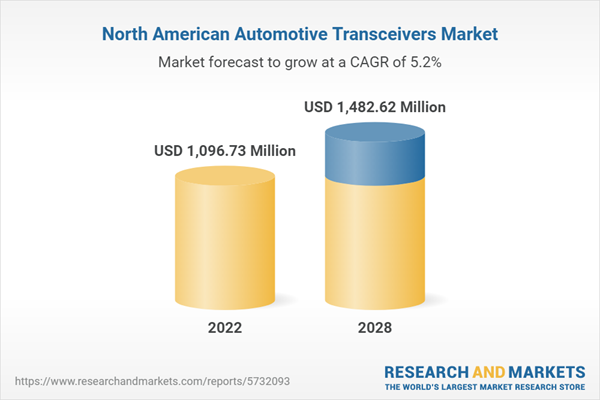

Figure 10. North America Automotive Transceivers Market Forecast and Analysis (US$ Million)

Figure 11. North America Automotive Transceivers Market Revenue Share, By Protocol (2021 & 2028)

Figure 12. CAN: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 13. LIN: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 14. FLEXRAY: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 15. Others: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 16. North America Automotive Transceivers Market Revenue Share, By Application (2021 & 2028)

Figure 17. Safety: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 18. Body Control Module: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 19. Chassis: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 20. Powertrain: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 21. Steering Wheel: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 22. Engine: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 23. Door/Seat: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 24. North America Automotive Transceivers Market Revenue Share, By Vehicle Type (2021 & 2028)

Figure 25. Passenger Vehicles: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 26. Commercial Vehicles: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

Figure 27. North America Automotive Transceivers, by Key Country - Revenue (2021) (US$ Million)

Figure 28. North America Automotive Transceivers Market Revenue Share, by Key Country (2021 & 2028)

Figure 29. US: Automotive Transceivers - Revenue, and Forecast to 2028 (US$ Million)

Figure 30. Canada: Automotive Transceivers - Revenue, and Forecast to 2028 (US$ Million)

Figure 31. Mexico: Automotive Transceivers - Revenue, and Forecast to 2028 (US$ Million)

Companies Mentioned

- Broadcom Inc

- Cypress Semiconductor Corp

- Maxim Integrated Products Inc

- Microchip Technology Inc

- NXP Semiconductors NV

- Renesas Electronics Corp

- Robert Bosch

- STMicroelectronics NV

- Texas Instruments Inc

- Toshiba Corp

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 139 |

| Published | January 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 1096.73 Million |

| Forecasted Market Value ( USD | $ 1482.62 Million |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | North America |

| No. of Companies Mentioned | 10 |