Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The North America Bloodstream Infection Testing Market encompasses the sale and utilization of diagnostic products and services designed to detect and identify microorganisms, such as bacteria, fungi, and viruses, in the bloodstream. The goal is to provide accurate and timely results that inform treatment decisions, reduce complications, and improve patient outcomes.

Key Market Drivers

Increasing Incidence of Bloodstream Infections

The increasing incidence of bloodstream infections is a significant driver that fuels the growth of the North America Bloodstream Infection Testing Market. This driver is rooted in several key factors and trends within the healthcare landscape that directly impact the demand for effective infection testing solutions.The aging population in North America has a substantial impact on the rising incidence of bloodstream infections. Elderly individuals often have weaker immune systems, making them more susceptible to infections. Additionally, as people age, they may require more medical interventions, such as surgeries and intravenous treatments, which can introduce pathogens into their bloodstream. This demographic shift, with a larger proportion of elderly individuals, is contributing to an increased incidence of infections, thereby driving the demand for bloodstream infection testing. Chronic diseases, such as diabetes, cancer, and autoimmune conditions, are on the rise in North America. These diseases can compromise the body's immune response, making patients more susceptible to infections. Patients with chronic illnesses often require frequent hospitalization, surgeries, and medical procedures, all of which increase the risk of bloodstream infections. This rise in chronic diseases directly correlates with the growing demand for effective testing methods to identify and manage these infections promptly.

In the modern healthcare landscape, there is an increasing reliance on invasive medical procedures, such as surgeries, catheter insertions, and dialysis. These procedures can introduce pathogens directly into the bloodstream, elevating the risk of infection. The need for efficient bloodstream infection testing is particularly critical in healthcare settings where these procedures are commonly performed, as early detection can prevent complications and improve patient outcomes. Hospital-acquired infections, also known as healthcare-associated infections, are a significant concern in North American healthcare facilities. HAIs can result from various factors, including contaminated medical equipment, improper hand hygiene, and overuse of antibiotics. Bloodstream infections are a common type of HAI, and they pose a serious threat to patient safety. The rising awareness of HAIs has led to increased scrutiny and a greater focus on prevention and timely diagnosis, thereby driving the demand for bloodstream infection testing.

Advancements in Diagnostic Technologies

Advancements in diagnostic technologies play a crucial role in driving the growth of the North America Bloodstream Infection Testing Market. These technological innovations have revolutionized the way bloodstream infections are detected, diagnosed, and managed. The market growth is closely linked to the continuous evolution of diagnostic methods, which offer improved accuracy, efficiency, and speed. Molecular diagnostic techniques, such as polymerase chain reaction (PCR) and nucleic acid amplification tests (NAATs), have significantly contributed to the growth of the bloodstream infection testing market. These methods enable the rapid detection of the genetic material of pathogens, allowing for highly specific identification. Molecular diagnostics have the advantage of detecting infections even in cases with a low pathogen load, providing early and accurate results. This technology is essential for identifying the causative pathogens of bloodstream infections, determining their resistance profiles, and guiding appropriate treatment decisions.Mass spectrometry has gained prominence as a powerful tool for identifying microorganisms. Matrix-assisted laser desorption/ionization time-of-flight mass spectrometry (MALDI-TOF MS) is widely used for the rapid and accurate identification of bacteria and fungi. It has revolutionized the diagnostic process by providing results in minutes or hours, compared to traditional culture-based methods that may take days. This advancement in technology enables healthcare providers to make informed treatment decisions promptly, reducing the risk of complications and improving patient outcomes. Traditional blood culture methods have limitations, such as long incubation times and a high rate of false negatives. Automated blood culture systems have addressed these issues by incorporating advanced technology to enhance detection. These systems continuously monitor blood cultures for the growth of microorganisms, triggering alarms when positive results are detected. The automation reduces the time required for detection and minimizes the risk of contamination, leading to faster and more accurate results. This technology is pivotal in the early diagnosis of bloodstream infections.

Point-of-care testing devices have become increasingly sophisticated, enabling rapid and on-site detection of bloodstream infections. These devices are particularly valuable in emergency departments, critical care units, and other healthcare settings where quick decisions are crucial. POCT allows healthcare professionals to obtain results within minutes, facilitating immediate intervention and treatment. The convenience and speed of point-of-care testing contribute to the growth of the bloodstream infection testing market. Advancements in data integration and analysis tools have streamlined the interpretation of diagnostic results. Healthcare facilities can now manage and analyze large volumes of data generated by various diagnostic technologies, facilitating the identification of trends and patterns in infection rates. This data-driven approach supports proactive measures to prevent infections and optimize treatment strategies, enhancing patient care.

Antimicrobial Stewardship Programs

Antimicrobial Stewardship Programs (ASPs) are a critical driver behind the growth of the North America Bloodstream Infection Testing Market. These programs have gained significant importance in healthcare settings due to their role in addressing the growing concern of antimicrobial resistance and the prudent use of antibiotics. ASPs have a profound impact on the demand for bloodstream infection testing, as they emphasize the appropriate use of antibiotics, accurate diagnosis, and effective patient management.Antimicrobial stewardship programs are designed to ensure the judicious use of antibiotics. They promote the selection of the most appropriate and effective antibiotics while avoiding unnecessary or excessive antibiotic prescriptions. This prudent use of antibiotics is directly related to bloodstream infection testing because it necessitates accurate diagnosis to determine the causative pathogen and its susceptibility to specific antibiotics. ASPs drive the demand for advanced diagnostic technologies that can provide rapid and precise results, allowing healthcare professionals to choose the right antibiotics for treatment. One of the primary goals of ASPs is to combat antimicrobial resistance. Inappropriate or excessive antibiotic use can lead to the development of resistant strains of pathogens, making infections harder to treat. Accurate diagnosis and targeted antibiotic therapy, which bloodstream infection testing enables, are instrumental in preventing the development and spread of antibiotic-resistant microorganisms. ASPs thus fuel the demand for sophisticated testing methods to support the broader goal of reducing antibiotic resistance.

Antimicrobial stewardship programs emphasize the development and implementation of clinical pathways that guide healthcare professionals in managing infections. These pathways often incorporate bloodstream infection testing as a critical step in the decision-making process. The results of these tests help determine the most appropriate treatment strategies, including antibiotic selection and dosing. ASPs drive the adoption of advanced diagnostic technologies that can seamlessly integrate into these clinical pathways, facilitating streamlined and effective patient care. Regulatory bodies and healthcare accreditation organizations increasingly require healthcare facilities to have antimicrobial stewardship programs in place. Compliance with these standards is essential for maintaining high-quality patient care and ensuring patient safety. As a result, healthcare facilities invest in the necessary infrastructure, including advanced diagnostic technologies, to meet the requirements of ASPs. The demand for bloodstream infection testing solutions is propelled by the need to comply with these regulatory standards.

Increasing Awareness and Healthcare Expenditure

Increasing awareness and healthcare expenditure are significant drivers that propel the growth of the North America Bloodstream Infection Testing Market. These drivers are closely linked to healthcare policy, patient safety, and quality of care, as well as financial considerations.Healthcare providers and policymakers in North America have increasingly prioritized patient safety and the quality of care. Bloodstream infections can have severe consequences for patients, leading to prolonged hospital stays, increased healthcare costs, and even mortality. Consequently, there is a growing awareness of the need for early and accurate diagnosis of these infections. Bloodstream infection testing is seen as a critical component in ensuring patient safety and improving healthcare quality, thereby driving the demand for advanced diagnostic solutions.

Bloodstream infections can lead to extended hospitalization, additional medical interventions, and increased healthcare expenditures. Preventing these infections and managing them efficiently through timely diagnosis can result in significant cost savings for healthcare facilities. As healthcare expenditure continues to rise, there is a financial incentive to invest in bloodstream infection testing. By preventing complications and reducing the length of hospital stays, healthcare providers can optimize resource utilization and improve cost-effectiveness. The allocation of healthcare budgets is influenced by various factors, including the importance of diagnostic testing. In North America, as healthcare systems adapt to the changing landscape, there is a growing recognition of the role of diagnostic testing in improving patient outcomes. Healthcare facilities allocate budgets for the acquisition of advanced diagnostic technologies, including those for bloodstream infection testing. These budget allocations reflect the priority placed on diagnostic solutions that contribute to patient safety and better healthcare outcomes.

The availability of healthcare insurance coverage also plays a role in driving the growth of the bloodstream infection testing market. Patients with insurance coverage are more likely to seek timely medical care, including diagnostic testing, when needed. Additionally, healthcare facilities are more inclined to invest in advanced testing methods knowing that these services can be reimbursed by insurance providers. As access to healthcare insurance expands, it facilitates increased utilization of diagnostic services, contributing to market growth. Public health initiatives, driven by government agencies and non-governmental organizations, have played a role in raising awareness about the impact of bloodstream infections. These initiatives often emphasize the importance of early detection and appropriate management of infections to prevent complications and reduce healthcare costs. They can drive public and professional awareness, ultimately increasing the demand for bloodstream infection testing.

Key Market Challenges

Cost Constraints and Budgetary Pressures

Healthcare systems in North America often face budgetary constraints and financial pressures. The high cost associated with acquiring, implementing, and maintaining advanced bloodstream infection testing technologies can be a significant challenge for healthcare facilities, particularly in smaller or underfunded institutions. The initial capital expenditure for sophisticated diagnostic equipment, along with ongoing costs for consumables, maintenance, and staff training, can strain budgets. This challenge can slow down market growth as healthcare providers may delay or limit their investments in bloodstream infection testing technologies due to financial constraints.Antimicrobial Resistance and Evolving Pathogens

The rise of antimicrobial resistance is a significant challenge in the battle against bloodstream infections. As pathogens continue to evolve and develop resistance to commonly used antibiotics, there is a growing need for more comprehensive testing methods that can identify these resistant strains accurately. Developing and implementing advanced diagnostic technologies to detect drug-resistant pathogens can be complex and costly. Moreover, it may require regular updates to keep pace with emerging resistance patterns, posing an ongoing challenge for the market.Regulatory and Reimbursement Challenges

The regulatory landscape and reimbursement policies in North America can present obstacles to the adoption of bloodstream infection testing solutions. Regulatory approval processes can be time-consuming and rigorous, delaying the introduction of new diagnostic technologies to the market. Additionally, inconsistent reimbursement policies can hinder healthcare providers' ability to invest in these technologies. If diagnostic tests are not adequately reimbursed, healthcare facilities may be hesitant to adopt them, potentially slowing down market growth. It is essential for the industry to navigate these challenges by working closely with regulatory agencies and payers to ensure that innovative diagnostic solutions are approved and adequately reimbursed.Key Market Trends

Rise of Rapid Molecular Diagnostics

One significant trend in the North America Bloodstream Infection Testing Market is the increasing adoption of rapid molecular diagnostic techniques. Molecular diagnostics, such as polymerase chain reaction (PCR) and nucleic acid amplification tests (NAATs), have gained prominence for their ability to provide rapid and highly accurate results. These tests can detect the genetic material of pathogens, enabling healthcare professionals to identify the causative microorganism and its antimicrobial resistance profile quickly. Rapid molecular diagnostics play a pivotal role in early diagnosis and treatment, reducing the time between specimen collection and result reporting. This trend is improving patient care by allowing for more targeted and effective treatments, ultimately enhancing patient outcomes.Growing Emphasis on Antimicrobial Stewardship

Antimicrobial stewardship programs have become a critical trend in the management of bloodstream infections. These programs emphasize the prudent and appropriate use of antibiotics to combat antimicrobial resistance. In response to this trend, there is an increasing demand for bloodstream infection testing technologies that can provide information about the susceptibility of pathogens to specific antibiotics. Advanced diagnostic methods, such as mass spectrometry and multiplex assays, are playing a pivotal role in guiding antibiotic therapy decisions. This trend aligns with efforts to optimize patient care, reduce the risk of resistance, and improve the quality of healthcare in North America.Integration of Artificial Intelligence and Big Data Analytics

The integration of artificial intelligence (AI) and big data analytics into bloodstream infection testing is a rapidly emerging trend. AI can assist in the interpretation of complex diagnostic data and patterns, helping healthcare professionals make more informed decisions. Machine learning algorithms can analyze vast datasets to identify trends and provide insights into the epidemiology of bloodstream infections. Additionally, AI can improve the accuracy of diagnostic results by reducing human error. The utilization of AI and big data analytics in the bloodstream infection testing process not only enhances the efficiency of testing but also supports infection control efforts and surveillance.Segmental Insights

Product Insights

Based on the category of product, the reagents & consumables segment emerged as the dominant player in the North America market for Bloodstream Infection Testing in 2023. Reagents and consumables are essential components of diagnostic testing kits and systems, playing a crucial role in various testing methodologies such as blood culture, molecular diagnostics, and mass spectrometry. They contain chemicals, culture media, antibodies, and other materials necessary for specific tests, enabling the identification of pathogens and their susceptibility to antibiotics in the context of bloodstream infection testing. These products facilitate the growth and analysis of microorganisms from patient samples, ensuring accurate and reliable diagnostics. In clinical settings, the use of reagents and consumables is ongoing and frequent, driven by the continuous admission of patients to hospitals, clinics, and laboratories. Due to their consumable nature, reagents and consumables require regular replacement, especially in high-throughput diagnostic laboratories. This constant demand for these products ensures a stable and consistent market demand, contributing to the dominance of this segment in the diagnostic industry.Reagents and consumables offer versatility, catering to a wide range of applications within bloodstream infection testing. They are utilized in blood culture systems to promote microorganism growth, in molecular diagnostics for DNA and RNA extraction, and in mass spectrometry for pathogen identification. This versatility allows them to meet diverse diagnostic needs, making them a universal component across various testing methodologies and ensuring comprehensive and multi-faceted diagnostic approaches. Leading manufacturers of diagnostic technology often collaborate with reagent and consumable suppliers to offer complete diagnostic solutions to healthcare facilities. This partnership approach simplifies the procurement process for healthcare providers, as they can source both diagnostic instruments and necessary reagents and consumables from a single supplier. Integrated solutions streamline operations and encourage healthcare facilities to opt for a one-stop-shop for their diagnostic requirements. These factors are expected to propel the growth of the reagents and consumables segment in the diagnostic industry.

Sample Type Insight

Based on the category of Sample type, the blood culture segment emerged as the dominant player in the North America market for Bloodstream Infection Testing in 2023. Blood culture testing is renowned for its high sensitivity and specificity in detecting a wide range of pathogens causing bloodstream infections. It effectively identifies bacteria, fungi, and sometimes other microorganisms present in the bloodstream, ensuring accurate diagnosis and tailored treatment. This reliability positions blood culture testing as the preferred method in clinical practice, applicable across diverse healthcare settings such as hospitals, clinics, and laboratories, for both inpatient and outpatient populations. Blood culture testing is a standard diagnostic approach guided by medical guidelines and protocols, with healthcare professionals well-trained in its execution and interpretation. This established status as the standard of care reinforces the dominance of the blood culture segment in the market.Also, blood culture testing relies on a well-established infrastructure and expertise within healthcare facilities, with dedicated laboratories equipped with trained staff and specialized equipment. This infrastructure ensures the accurate collection, processing, and interpretation of blood culture results, supporting widespread adoption across North America. These factors are expected to drive the growth of this segment in the market..

Country Insights

United States emerged as the dominant country in the North America Bloodstream Infection Testing market in 2023, holding the largest market share in terms of value. The United States possesses a robust healthcare infrastructure and an advanced medical technology ecosystem. With numerous hospitals, clinics, and diagnostic laboratories equipped with cutting-edge facilities, the nation has the capacity to conduct extensive bloodstream infection testing. Additionally, the presence of leading healthcare institutions and research centers fosters innovation, driving the development of state-of-the-art diagnostic technologies for detecting bloodstream infections. The United States experiences a high prevalence of bloodstream infections, necessitating comprehensive testing and monitoring to prevent outbreaks and enhance patient outcomes. Factors such as a large population, aging demographics, the prevalence of chronic diseases, and widespread use of invasive medical procedures contribute to the substantial demand for bloodstream infection testing.Also, favorable regulatory policies and reimbursement frameworks in the United States facilitate the adoption of innovative diagnostic tests for bloodstream infections. Regulatory agencies like the Food and Drug Administration (FDA) ensure the safety and efficacy of diagnostic devices, while reimbursement mechanisms enable patient access to testing services, stimulating market growth. The presence of major healthcare companies and diagnostic manufacturers in the United States further solidifies the region's dominance in the bloodstream infection testing market. Leveraging their research and development capabilities, extensive distribution networks, and marketing expertise, these companies drive the adoption of their testing solutions within the domestic market.

Key Market Players

- bioMerieux, Inc.

- Becton Dickinson & Co

- Cepheid, Inc.

- Seegene USA Inc.

- Abbott Laboratories Inc

- Roche Laboratories, Inc.

- Siemens Medical Solutions USA, Inc.

- QIAGEN, Inc.

- Bruker Corp

- Accelerate Diagnostics, Inc.

Report Scope:

In this report, the North America Bloodstream Infection Testing Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:North America Bloodstream Infection Testing Market, By Product:

- Reagents & Consumables

- Instruments

North America Bloodstream Infection Testing Market, By Sample Type:

- Whole Blood

- Blood Culture

North America Bloodstream Infection Testing Market, By Technology:

- PCR

- Mass Spectroscopy

- In Situ Hybridization

- Others

North America Bloodstream Infection Testing Market, By End-User:

- Hospitals & Diagnostic Centers

- Custom Laboratory Service Providers

- Academic & Research Institutes

- Others

North America Bloodstream Infection Testing Market, By Country:

- United States

- Canada

- Mexico

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the North America Bloodstream Infection Testing Market.Available Customizations:

North America Bloodstream Infection Testing market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- bioMerieux, Inc.

- Becton Dickinson & Co

- Cepheid, Inc.

- Seegene USA Inc.

- Abbott Laboratories Inc

- Roche Laboratories, Inc.

- Siemens Medical Solutions USA, Inc.

- QIAGEN, Inc.

- Bruker Corp

- Accelerate Diagnostics, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 132 |

| Published | August 2024 |

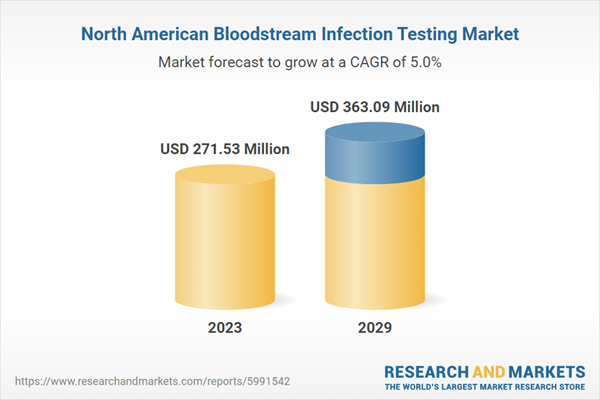

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 271.53 Million |

| Forecasted Market Value ( USD | $ 363.09 Million |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | North America |

| No. of Companies Mentioned | 10 |