The integration of Brushless DC (BLDC) Motors into motor vehicles has revolutionized the automotive industry, driving advancements in electric and hybrid vehicles. BLDC Motors offer several advantages over traditional internal combustion engines, including higher efficiency, lower maintenance requirements, and reduced emissions. In electric vehicles (EVs), BLDC Motors serve as the primary propulsion system, delivering torque to the wheels efficiently and reliably. Therefore, the US market consumed 1,301.8 thousand units motor vehicles in the market in 2022.

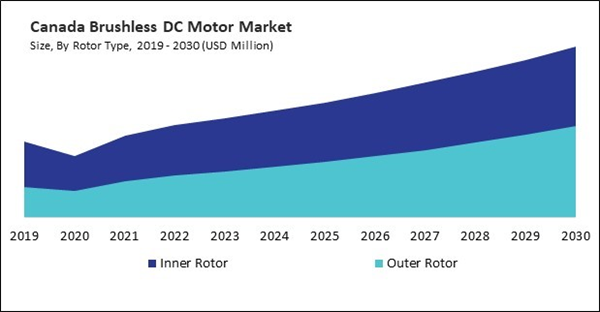

The US market dominated the North America Brushless DC Motor Market by Country in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $5,552.2 million by 2030. The Canada market is experiencing a CAGR of 8.8% during (2023 - 2030). Additionally, The Mexico market would exhibit a CAGR of 7.9% during (2023 - 2030).

The primary driver behind the adoption of BLDC motors is their remarkable energy efficiency. Compared to traditional brushed motors, BLDC motors boast higher efficiency levels due to the absence of brushes. The elimination of physical contact reduces energy loss and minimizes heat generation during operation. As industries globally prioritize energy conservation and seek ways to reduce operational costs, the superior energy efficiency of BLDC motors becomes a compelling factor in their adoption.

Traditional brushed motors require regular maintenance due to the wear and tear of brushes over time. This maintenance can be costly and lead to downtime, affecting overall operational efficiency. In contrast, BLDC motors, with their brushless design, exhibit a longer lifespan and reduced maintenance requirements. The lower maintenance costs associated with BLDC motors make them an attractive option for industries aiming to optimize operational expenditures.

As per the International Trade Administration, the EV industry in Mexico is fast expanding, with automakers establishing ambitious strategic goals to transition from gasoline to electric vehicles. These plans also involve lowering their carbon impact and that of their tier suppliers. Compared to 2021, the electric vehicles (EVs) and hybrids industry surged by 8.5% to 51,065 units in 2022. Hybrid vehicles account for 3.75 percent of the total EV industry, followed by EVs (0.51%) and Plug-In Hybrid vehicles (0.42%). Mexico is a significant player in the global automotive industry, and trends toward electric mobility global influence the adoption of BLDC motors. The integration of cutting-edge technologies in electric vehicles supports the growth of the EV industry in Mexico. Thus, all these factors will uplift the regional market’s expansion in the coming years.

Based on Rotor Type, the market is segmented into Inner Rotor, and Outer Rotor. Based on Voltage Type, the market is segmented into 0-750 Watts, 750 Watts to 3 kW, 3 kW - 75 kW, and Others. Based on End User, the market is segmented into Motor Vehicles, Industrial Machinery, HVAC Equipment, Household Appliances, Aerospace & Transportation, and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- ABB Group

- Toshiba Corporation

- Bühler Motor GmbH

- Nidec Corporation

- Maxon Motor Ag

- Ametek, Inc.

- Allient Inc.

- Johnson Electric Holdings Limited

- Rockwell Automation, Inc.

- ARC Systems, Inc.

Market Report Segmentation

By Rotor Type- Inner Rotor

- Outer Rotor

- 0-750 Watts

- 750 Watts to 3 kW

- 3 kW - 75 kW

- Others

- Motor Vehicles

- Industrial Machinery

- HVAC Equipment

- Household Appliances

- Aerospace & Transportation

- Others

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- ABB Group

- Toshiba Corporation

- Bühler Motor GmbH

- Nidec Corporation

- Maxon Motor Ag

- Ametek, Inc.

- Allient Inc.

- Johnson Electric Holdings Limited

- Rockwell Automation, Inc.

- ARC Systems, Inc.