The North America data center server market growth is driven by accelerating demand for high-performance computing, cloud adoption, and the expansion of AI and ML applications. Organizations across industries are migrating workloads to cloud-based infrastructures, requiring scalable, energy-efficient, and high-speed servers to handle complex data processing needs. The hyperscale cloud providers, led by the technology giants and large enterprise-level service providers, are heavily investing in advanced server architecture to support their growing cloud ecosystems. Hybrid and multi-cloud strategies continue to heighten preference for software-defined infrastructure (SDI), edge computing, and colocation facilities-further fueling server deployments. Businesses looking for more agility, automation, and workload efficiency in their systems deploy high-density computing solutions, such as graphics processing units (GPUs) and custom-built processors specifically designed for workloads in AI, among others. The advent of 5G networks, Internet of Things (IoT) applications, and real-time data analytics also heighten the need for low-latency, high-performance servers to process volumes of information in minimal latency. For instance, in March 2024, NVIDIA launched the Blackwell platform, enabling real-time generative AI on trillion-parameter models with up to 25x lower cost and energy consumption, driving breakthroughs across multiple industries.

Energy efficiency concerns, sustainability initiatives, and regulatory compliance are also key drivers for server advancement in North America's data center market. Governments and enterprises are focusing on ecofriendly infrastructure by embracing liquid cooling, energy-efficient processors, and modular server designs that consume less power without sacrificing performance. As data center operations account for most of the energy consumption, organizations are investing in innovations, such as AI-driven workload management and dynamic resource allocation to optimize power utilization. For example, in February 2024, Microsoft launched the Azure Boost DPU, its first data processing unit, designed for high-efficiency, low-power data-centric workloads, offering four times better performance and three times lower power consumption than existing servers. Moreover, security and compliance requirements further influence server procurement as sensitive data industries require high-security hardware with encryption capabilities, secure boot mechanisms, and real-time threat detection. This boosting advancement of cyber threats, including ransomware and supply chain attacks, is making organizations embrace trusted server architectures with integrated security to maintain data integrity and business continuity. Furthermore, government initiatives and funding for digital infrastructure projects in North America support investments in the expansion of data centers, deployment of high-performance servers, and next-generation networking solutions, further bolstering overall market growth.

North America Data Center Server Market Trends:

Rising Adoption of ARM-Based and Custom-Built Processors

The North America data center server market is witnessing a shift toward Advanced RISC Machine (ARM)-based and custom-built processors as enterprises and cloud service providers seek higher efficiency, lower power consumption, and improved workload optimization. Traditional x86-based architectures, dominated by Intel and AMD, are highly competing with ARM-based alternatives that offer better power efficiency and cost-effectiveness. For instance, in October 2024, AMD introduced the MI325X AI accelerator, featuring 153 billion transistors, 19,456 stream processors, 1,216 matrix cores, 2100 MHz clock speed, and up to 2.61 PFLOPs peak FP8 performance. Moreover, hyperscale cloud providers are investing in proprietary chip designs to achieve greater control over performance, security, and energy consumption, reducing reliance on third-party semiconductor manufacturers. Companies are leveraging ARM architectures for their ability to handle specialized workloads, such as AI, big data analytics, and real-time processing with reduced heat output and increased parallel processing capabilities. The encouragement toward sustainability is further driving demand for these processors, as businesses prioritize lower energy costs and reduced carbon footprints in large-scale data centers. Additionally, ARM-based servers enable enterprises to achieve improved price-performance ratios while enhancing computing capabilities for emerging workloads.Expansion of Edge Data Centers and Distributed Computing

The boosting demand for low-latency applications, real-time data processing, and 5G infrastructure is accelerating the expansion of edge data centers and distributed computing architectures. Organizations are deploying decentralized server solutions to process data closer to the source, reducing network congestion and improving application response times. Edge computing is critical for industries such as autonomous vehicles, industrial automation, healthcare, and smart cities, where real-time decision-making depends on rapid data transmission. Telecom operators and cloud providers are investing in regional micro data centers and modular server solutions to enhance processing efficiency while minimizing data transmission delays to central cloud facilities. The rollout of private 5G networks and IoT ecosystems is further escalating demand for scalable, high-density edge servers that can handle localized workloads efficiently. Additionally, advancements in containerization, serverless computing, and AI-driven edge analytics are transforming data center architectures, enabling businesses to operate in a more distributed and responsive manner.Growing Investments in Liquid Cooling and Energy-Efficient Server Technologies

The North America data center server market is experiencing a surge in investments toward liquid cooling and energy-efficient server technologies as organizations seek to optimize thermal management and reduce operational costs. With boosting server densities and higher power consumption in modern data centers, air cooling solutions are becoming less effective, driving the adoption of direct-to-chip liquid cooling and immersion cooling systems. These solutions enhance energy efficiency, extend hardware lifespan, and support high-performance workloads such as AI model training and advanced simulations. Data center operators are also integrating AI-driven cooling management systems that dynamically adjust cooling mechanisms based on workload intensity, reducing unnecessary energy expenditure. The demand for energy-efficient processors, power management units (PMUs), and sustainable server rack designs is growing, as enterprises focus on compliance with environmental regulations and corporate sustainability goals. These trends are reshaping server infrastructure by enabling improved performance, lower operating costs, and reduced environmental impact in large-scale deployments.North America Data Center Server Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the North America data center server market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product and application.Analysis by Product:

- Rack Servers

- Blade Servers

- Micro Servers

- Tower Servers

Analysis by Application:

- Industrial

- Commercial

Country Analysis:

- United States

- Canada

Competitive Landscape:

The competitive landscape of the data center server market in North America is characterized by a wide variety of players that focus on product innovation, performance optimization, and energy efficiency. The main competitors are heavily investing in research and development (R&D) in order to meet growing demand for high-density computing solutions capable of carrying out modern workloads like AI, ML, and big data analytics. Companies are also focusing on energy-efficient technologies. Many companies have already started using advanced cooling techniques such as liquid cooling and AI-driven power management systems to cut down operational costs and environmental impact. Server vendors are also coming up with customizable solutions based on the needs of the industries, like high-performance computing for research or low-latency solutions for financial services. As the market expands, so do strategic collaborations and acquisitions due to the nature of companies requiring expansion of portfolios and strengthening the market position with more products in the pipeline. Additionally, trends toward cloud and edge computing force competitors to compete with the needs of the marketplace in terms of technological advancement of products.The report provides a comprehensive analysis of the competitive landscape in the North America data center server market with detailed profiles of all major companies.

Key Questions Answered in This Report

1. How big is the data center server market in the North America?2. What factors are driving the growth of the North America data center server market?

3. What is the forecast for the data center server market in the North America?

4. Which segment accounted for the largest North America data center server segment market share?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Data Center Server Market

5.1 Market Performance

5.2 Market Breakup by Product

5.3 Market Breakup by Application

5.4 Market Breakup by Region

5.5 Market Forecast

6 North America Data Center Server Market

6.1 Market Performance

6.2 Impact of COVID-19

6.3 Market Forecast

7 North America Data Center Server Market: Breakup by Product

7.1 Rack Servers

7.2 Blade Servers

7.3 Micro Servers

7.4 Tower Servers

8 North America Data Center Server Market: Breakup by Application

8.1 Industrial

8.2 Commercial

9 North America Data Center Server Market: Breakup by Country

9.1 United States

9.1.1 Historical Market Trends

9.1.2 Market Breakup by Product

9.1.3 Market Breakup by Application

9.1.4 Market Forecast

9.2 Canada

9.2.1 Historical Market Trends

9.2.2 Market Breakup by Product

9.2.3 Market Breakup by Application

9.2.4 Market Forecast

10 SWOT Analysis

10.1 Overview

10.2 Strengths

10.3 Weaknesses

10.4 Opportunities

10.5 Threats

11 Value Chain Analysis

11.1 Overview

11.2 Research and Design

11.3 Raw Material Procurement

11.4 Production and Testing

11.5 Logistics

11.6 Assembly and Package

11.7 Distribution and After-Sales Service

11.8 Repair and Recycling

12 Porter’s Five Forces Analysis

12.1 Overview

12.2 Bargaining Power of Buyers

12.3 Bargaining Power of Suppliers

12.4 Degree of Rivalry

12.5 Threat of New Entrants

12.6 Threat of Substitutes

13 Competitive Landscape

13.1 Market Structure

13.2 Key Players

13.3 Profiles of Key Players

List of Figures

Figure 1: North America: Data Center Server Market: Major Drivers and Challenges

Figure 2: Global: Data Center Server Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Data Center Server Market: Breakup by Product (in %), 2024

Figure 4: Global: Data Center Server Market: Breakup by Application (in %), 2024

Figure 5: Global: Data Center Server Market: Breakup by Region (in %), 2024

Figure 6: Global: Data Center Server Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 7: North America: Data Center Server Market: Sales Value (in Billion USD), 2019-2024

Figure 8: North America: Data Center Server Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 9: North America: Data Center Server Market: Breakup by Product (in %), 2024

Figure 10: North America: Data Center Server (Rack Servers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 11: North America: Data Center Server (Rack Servers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 12: North America: Data Center Server (Blade Servers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 13: North America: Data Center Server (Blade Servers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 14: North America: Data Center Server (Micro Servers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: North America: Data Center Server (Micro Servers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: North America: Data Center Server (Tower Servers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: North America: Data Center Server (Tower Servers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: North America: Data Center Server Market: Breakup by Application (in %), 2024

Figure 19: North America: Data Center Server (Industrial) Market: Sales Value (in Million USD), 2019 & 2024

Figure 20: North America: Data Center Server (Industrial) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 21: North America: Data Center Server (Commercial) Market: Sales Value (in Million USD), 2019 & 2024

Figure 22: North America: Data Center Server (Commercial) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 23: North America: Data Center Server Market: Breakup by Country (in %), 2024

Figure 24: United States: Data Center Server Market: Sales Value (in Million USD), 2019-2024

Figure 25: United States: Data Center Server Market: Breakup by Product (in %), 2024

Figure 26: United States: Data Center Server Market: Breakup by Application (in %), 2024

Figure 27: United States: Data Center Server Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: Canada: Data Center Server Market: Sales Value (in Million USD), 2019-2024

Figure 29: Canada: Data Center Server Market: Breakup by Product (in %), 2024

Figure 30: Canada: Data Center Server Market: Breakup by Application (in %), 2024

Figure 31: Canada: Data Center Server Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: North America: Data Center Server Industry: SWOT Analysis

Figure 33: North America: Data Center Server Industry: Value Chain Analysis

Figure 34: North America: Data Center Server Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: North America: Data Center Server Market: Key Industry Highlights, 2024 and 2033

Table 2: North America: Data Center Server Market Forecast: Breakup by Product (in Million USD), 2025-2033

Table 3: North America: Data Center Server Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 4: North America: Data Center Server Market Forecast: Breakup by Country (in Million USD), 2025-2033

Table 5: North America: Data Center Server Market: Competitive Structure

Table 6: North America: Data Center Server Market: Key Players

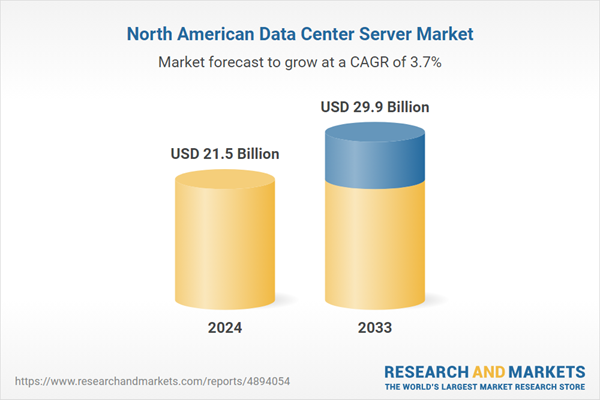

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 124 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 21.5 Billion |

| Forecasted Market Value ( USD | $ 29.9 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | North America |