The growing environmental awareness among consumers drives the demand for eco-friendly diapers in North America. Sustainability being a new imperative, several parents want biodegradable, compostable, and organic diapers. Responding to these demands, diaper manufacturers have integrated natural materials, such as bamboo, cotton, and plant-based polymers, into diaper products. They present these diapers as an environmentally responsible alternative to conventional disposable diapers that take hundreds of years to decompose. However, increasing consumers ready to pay an added premium to seek environmentally friendly diapers contribute to continued changes in this trend. This is representative of a trend toward sustainable consumption patterns in the region.

Technological advancement is the major driving force of the North American diaper market. Manufacturers are trying to improve on the features that make diapers the most comfortable and performative item of convenience to wear. Features such as long-lasting absorbency, better leakage protection, breathable fabrics, or wetness indicators are some developments that keep a baby or an adult dry for a longer time. Innovations such as a hypoallergenic material would appeal to a health-conscious individual who would desire safety and comfort. The manufacturing process now involves the integration of technology, which leads to efficient production and cost savings, which are often trickled down to consumers. These advancements also fuel growth and encourage consumer loyalty in the market.

North America Diaper Market Trends:

Shift toward eco-friendly and sustainable diapers

There is an increasing trend for environmental considerations into the diaper selection in North America, as consumers are becoming more environmentally conscious. According to Kinder Cloth Diaper Co., about 20 billion disposable diapers are sent to waste in a year in the United States alone. In response, manufacturers now produce biodegradable, compostable, or recyclable diapers. This means that such diapers are probably made from natural products, such as cotton, bamboo, or even plant-based polymers, so they have less carbon footprint than a traditional disposable diapers. However, North America diaper market price analysis indicates that these sustainable options typically come at a premium due to higher production costs associated with organic materials and eco-friendly manufacturing processes. Besides this, the integration of sustainable production processes is also helping brands reduce packaging waste. This trend is primarily driven by growing awareness about environmental issues and consumer demand for products that resonate with eco-conscious values, thus becoming a critical driver of the North American diaper market.Rising popularity of premium diaper products

Premium diapers are gaining substantial growth in the North America diaper market, and consumers are getting more inclined toward investing in superior quality for their babies. Advanced features of such diapers are mostly enhanced absorbency, fit, and skin-friendly materials for enhanced comfort and protection. The premium brands also adding features such as wetness indicators, hypoallergenic, and dermatologically tested material, which helps satisfy the increased need for safety and convenience. According to the US Bureau of Labor Statistics, wages and salaries of civilian workers increased 0.9% and benefit costs increased 0.8% from September 2024. As disposable income increases and parents seek the best possible products for their children, the demand for premium diaper options is expected to continue rising.Growth of online and subscription-based diaper services

There has been a shift toward online purchasing and subscription-based services in the North American diaper market. Due to convenient options such as home delivery and customized offers, the sales of diapers increasingly take place via e-commerce. According to reports, the United States e-commerce sales increased by 14.6% online. Subscription services, including diaper delivery subscriptions, have gained popularity because they provide convenience, cost savings, and customization based on baby age and size. The trend is attractive to busy parents who want to simplify their buying decisions and have a constant supply of diapers. As digital platforms continue to expand, the online and subscription-based segment will be an increasingly significant force, thereby fueling North America diaper market demand.North America Diaper Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the North America diaper market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type and distribution channel.Analysis By Product Type:

- Baby Diaper by Product Type

- Disposable Diapers

- Training Diapers

- Cloth Diapers

- Swim Diapers

- Biodegradable Diapers

- Adult Diaper by Product Type

- Pad Type

- Flat Type

- Pant Type

Analysis By Distribution Channel:

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online Stores

- Others

Country Analysis:

- United States

- Canada

Key Questions Answered in This Report

1. How big is the diaper market in North America?2. What factors are driving the growth of the North America diaper market?

3. What is the forecast for the diaper market in North America?

4. Which segment accounted for the largest North America diaper product type market share?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Diaper Market

5.1 Market Performance

5.2 Market Breakup by Baby Diaper Product Type

5.3 Market Breakup by Adult Diaper Product Type

5.4 Market Breakup by Distribution Channel

5.5 Market Breakup by Region

5.6 Market Forecast

6 North America Diaper Market

6.1 Market Performance

6.2 Impact of COVID-19

6.3 Market Forecast

7 North America Diaper Market: Baby Diaper Breakup by Product Type

7.1 Disposable Diapers

7.2 Training Diapers

7.3 Cloth Diapers

7.4 Swim Pants

7.5 Biodegradable Diapers

8 North America Diaper Market: Adult Diaper Breakup by Product Type

8.1 Pad Type

8.2 Flat Type

8.3 Pant Type

9 North America Diaper Market: Breakup by Distribution Channel

9.1 Supermarkets and Hypermarkets

9.2 Pharmacies

9.3 Convenience Stores

9.4 Online Stores

9.5 Others

10 North America Diaper Market: Breakup by Country

10.1 United States

10.1.1 Historical market Trends

10.1.2 Market Breakup by Baby Diaper Product Type

10.1.3 Market Breakup by Adult Diaper Product Type

10.1.4 Market Breakup by Distribution Channel

10.1.5 Market Forecast

10.2 Canada

10.2.1 Historical market Trends

10.2.2 Market Breakup by Baby Diaper Product Type

10.2.3 Market Breakup by Adult Diaper Product Type

10.2.4 Market Breakup by Distribution Channel

10.2.5 Market Forecast

11 SWOT Analysis

11.1 Overview

11.2 Strengths

11.3 Weaknesses

11.4 Opportunities

11.5 Threats

12 Value Chain Analysis

12.1 Overview

12.2 Raw Material Suppliers

12.3 Diaper Manufacturers

12.4 Distributors

12.5 Hospitals

12.6 Retailers

12.7 Exporters

12.8 End-Users

13 Porter’s Five Forces Analysis

13.1 Overview

13.2 Bargaining Power of Buyers

13.3 Bargaining Power of Suppliers

13.4 Degree of Rivalry

13.5 Threat of New Entrants

13.6 Threat of Substitutes

14 Price Analysis

15 Competitive Landscape

15.1 Market Structure

15.2 Key Players

15.3 Profiles of Key Players

List of Figures

Figure 1: North America: Diaper Market: Major Drivers and Challenges

Figure 2: Global: Diaper Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Diaper Market: Baby Diaper Breakup by Product Type (in %), 2024

Figure 4: Global: Diaper Market: Adult Diaper Breakup by Product Type (in %), 2024

Figure 5: Global: Diaper Market: Breakup by Distribution Channel (in %), 2024

Figure 6: Global: Diaper Market: Breakup by Region (in %), 2024

Figure 7: Global: Diaper Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 8: North America: Diaper Market: Sales Value (in Billion USD), 2019-2024

Figure 9: North America: Diaper Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 10: North America: Diaper Market: Breakup by Product Type (Baby Diaper) (in %), 2024

Figure 11: North America: Diaper (Disposable Diapers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 12: North America: Diaper (Disposable Diapers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 13: North America: Diaper (Training Diapers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 14: North America: Diaper (Training Diapers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 15: North America: Diaper (Cloth Diapers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 16: North America: Diaper (Cloth Diapers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 17: North America: Diaper (Swim Pants) Market: Sales Value (in Million USD), 2019 & 2024

Figure 18: North America: Diaper (Swim Pants) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 19: North America: Diaper (Biodegradable Diapers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 20: North America: Diaper (Biodegradable Diapers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 21: North America: Diaper Market: Breakup by Product Type (Adult Diaper) (in %), 2024

Figure 22: North America: Diaper (Pad Type) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: North America: Diaper (Pad Type) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: North America: Diaper (Flat Type) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: North America: Diaper (Flat Type) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: North America: Diaper (Pant Type) Market: Sales Value (in Million USD), 2019 & 2024

Figure 27: North America: Diaper (Pant Type) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: North America: Diaper Market: Breakup by Distribution Channel (in %), 2024

Figure 29: North America: Diaper Market: Sales Through Supermarkets and Hypermarkets (in Million USD), 2019 & 2024

Figure 30: North America: Diaper Market Forecast: Sales Through Supermarkets and Hypermarkets (in Million USD), 2025-2033

Figure 31: North America: Diaper Market: Sales Through Pharmacies (in Million USD), 2019 & 2024

Figure 32: North America: Diaper Market Forecast: Sales Through Pharmacies (in Million USD), 2025-2033

Figure 33: North America: Diaper Market: Sales Through Convenience Stores (in Million USD), 2019 & 2024

Figure 34: North America: Diaper Market Forecast: Sales Through Convenience Stores (in Million USD), 2025-2033

Figure 35: North America: Diaper Market: Sales Through Online Stores (in Million USD), 2019 & 2024

Figure 36: North America: Diaper Market Forecast: Sales Through Online Stores (in Million USD), 2025-2033

Figure 37: North America: Diaper Market: Sales Through Other Distribution Channels (in Million USD), 2019 & 2024

Figure 38: North America: Diaper Market Forecast: Sales Through Other Distribution Channels (in Million USD), 2025-2033

Figure 39: North America: Diaper Market: Breakup by Country (in %), 2024

Figure 40: United States: Diaper Market: Sales Value (in Million USD), 2019-2024

Figure 41: United States: Diaper Market: Baby Diaper Breakup by Product Type (in %), 2024

Figure 42: United States: Diaper Market: Adult Diaper Breakup by Product Type (in %), 2024

Figure 43: United States: Diaper Market: Breakup by Distribution Channel (in %), 2024

Figure 44: United States: Diaper Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 45: Canada: Diaper Market: Sales Value (in Million USD), 2019-2024

Figure 46: Canada: Diaper Market: Baby Diaper Breakup by Product Type (in %), 2024

Figure 47: Canada: Diaper Market: Adult Diaper Breakup by Product Type (in %), 2024

Figure 48: Canada: Diaper Market: Breakup by Distribution Channel (in %), 2024

Figure 49: Canada: Diaper Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 50: North America: Diaper Industry: SWOT Analysis

Figure 51: North America: Diaper Industry: Value Chain Analysis

Figure 52: North America: Diaper Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: North America: Diaper Market: Key Industry Highlights, 2024 and 2033

Table 2: North America: Diaper Market Forecast: Baby Diaper Breakup by Product Type (in Million USD), 2025-2033

Table 3: North America: Diaper Market Forecast: Adult Diaper Breakup by Product Type (in Million USD), 2025-2033

Table 4: North America: Diaper Market Forecast: Breakup by Distribution Channel (in Million USD), 2025-2033

Table 5: North America: Diaper Market Forecast: Breakup by Country (in Million USD), 2025-2033

Table 6: North America: Diaper Market: Competitive Structure

Table 7: North America: Diaper Market: Key Players

Table Information

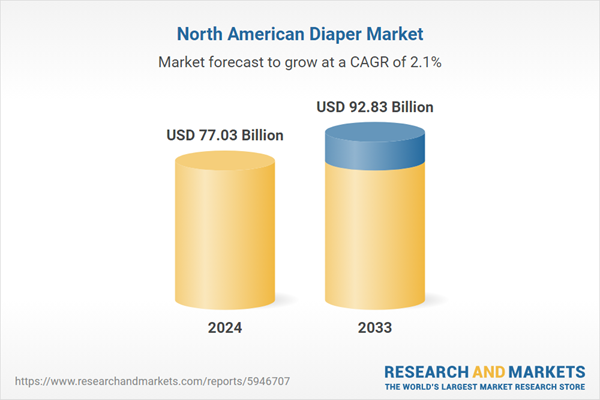

| Report Attribute | Details |

|---|---|

| No. of Pages | 125 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 77.03 Billion |

| Forecasted Market Value ( USD | $ 92.83 Billion |

| Compound Annual Growth Rate | 2.1% |

| Regions Covered | North America |