Research and Development of Environment-Friendly Explosives Fuels North America Industrial Explosives Market

The growing environmental awareness, stringent regulations, and the need for sustainable practices in various applications such as mining, construction, and avalanche control are fostering the research on several environment-friendly explosives. Environment-friendly explosives or green explosives are developed to minimize their environmental impact while maintaining or improving performance and safety. Water-based explosives such as water gels and emulsions are gaining traction as they tend to be safe and produce few harmful byproducts. In the construction industry, the use of environment-friendly explosives can mitigate the impact of urban blasting operations. The reduced emissions by green explosives contribute to better air quality.Green explosives are an important subfamily of explosives due to the ban of explosives on the basis of heavy metals such as lead azide and lead styphnate, according to the REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) list. As per the research published by the American Chemical Society in 2023, the potassium salt of the tricyclic bistetrazole-fused compound, termed DTAT-K, has properties that might make it an environment-friendly primary explosive. Thus, the introduction of environment-friendly explosives is expected to become a significant trend in the North America industrial explosives market over the coming years.

North America Industrial Explosives Market Overview

North America has a strong mining industry coupled with the presence of several associations, such as The American Exploration & Mining Association and the International Society of Chemicals Engineers. These associations and organizations pertaining to mining develop working strategies and draft responses to legislative and regulatory issues among industries.According to the World Mining Data 2022 report by the Federal Ministry Republic of Austria, Canada marks the presence of major diamond reserves. Graphite mine production in Canada was estimated at 15,000 metric tons in 2022, an increase from 12,000 metric tons in 2021. The US also marks the presence of many mining companies, including American Lithium, EnCore Energy, Highland Copper Company, Hudbay Minerals, Kinross Gold, Lion Copper and Gold, Ucore Rare Metals, and Wolfden Resources.

According to a report published by the US Geological Survey (USGS) in 2023, the estimated value of mineral production in the US in 2022 was US$ 98.2 billion, a rise of 4% compared to US$ 94.6 billion in 2021. Industrial mineral production was valued at US$ 63.5 billion in 2022, a rise of 10% compared to 2021. Industrial explosives are widely used for loosening mineral rocks, quarrying, and other nonmetal mining.

Explosives are also used in excavation of ground, development of roads, and demolition activities. In July 2024, the US contractor 4 Seasons Demolition began demolition of a building at the University of North Carolina Wilmington (US). Thus, the rising mineral exploration, mining production, and demolition activities propel the utilization of industrial explosives in the region, which fuels the market growth.

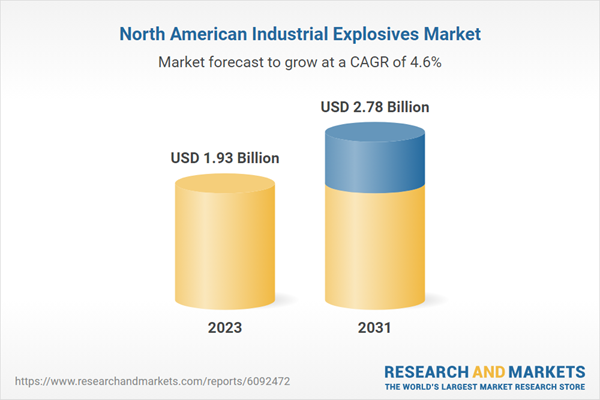

North America Industrial Explosives Market Revenue and Forecast to 2031 (US$ Million)

North America Industrial Explosives Market Segmentation

The North America industrial explosives market is categorized into type, application, and country.- Based on type, the North America industrial explosives market is segmented into high explosives, blasting agents, and low explosives. The blasting agents segment held the largest market share in 2023. The high explosives system segment is further sub segmented into dynamites, gelatins, and RDX. The blasting agents system segment is further sub segmented into slurries and emulsions, ANFO, and blends.

- In terms of application, the North America industrial explosives market is segmented into mining, construction, and others. The mining segment held the largest market share in 2023.

- By country, the North America industrial explosives market is segmented into the US, Canada, and Mexico. The US dominated the North America industrial explosives market share in 2023.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America industrial explosives market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the North America industrial explosives market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the North America industrial explosives market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the North America Industrial Explosives Market include:- Orica Ltd

- AECI Ltd

- Austin Powder Company

- Dyno Nobel Ltd

- Enaex SA

- MaxamCorp Holding, S.L.

- EPC Groupe

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 77 |

| Published | March 2025 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 1.93 Billion |

| Forecasted Market Value ( USD | $ 2.78 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | North America |

| No. of Companies Mentioned | 8 |