Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

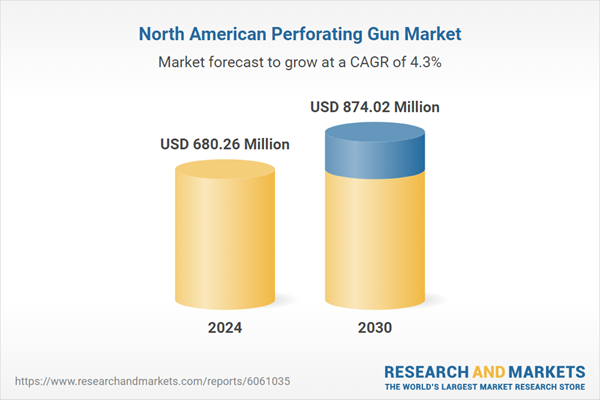

This market is expected to rise due to the growing demand for energy, particularly from shale oil and natural gas production in the U.S. and Canada. Technological advancements in perforating gun design, such as the development of more efficient, safer, and high-performance systems, are driving market growth. The increasing number of horizontal and deep-water wells - where perforating is critical for enhanced production - is also contributing to the market’s expansion. The rising number of oil and gas exploration and production activities in North America, coupled with the growing emphasis on improving well productivity and reducing operational costs, is fueling demand for advanced perforating technologies.

The shift toward digital technologies in the oilfield, including automation and remote monitoring, is prompting operators to invest in more sophisticated perforating solutions that offer greater precision and reliability. The market is also benefiting from the increasing trend of well optimization techniques, such as hydraulic fracturing (fracking), which requires high-performance perforating guns to facilitate effective stimulation. As oil and gas companies continue to seek higher production rates and cost efficiencies, the demand for advanced perforating guns is expected to remain robust, driving growth in the North American market. The rising focus on energy security and self-sufficiency in the region will lead to more exploration and production activities, further boosting the demand for perforating guns.

Key Market Drivers

Increased Demand for Unconventional Oil and Gas Production

The growing demand for unconventional oil and gas production, particularly from shale formations in North America, is a key driver of the Perforating Gun Market. Shale oil production has surged over the past decade, with hydraulic fracturing and horizontal drilling being widely adopted across the region. These methods require perforating guns to create perforations in the casing, allowing for efficient production from tight, low-permeability reservoirs. As North America continues to lead the global production of shale oil, especially in the United States, the need for reliable and advanced perforating technology has skyrocketed.Shale drilling, particularly in regions such as the Permian Basin and Eagle Ford, has driven significant investment in perforating guns to enhance well productivity and streamline operations. With the global push towards energy independence and security, the demand for unconventional oil production is expected to remain high, fueling growth in the perforating gun market. The United States alone accounted for approximately 80% of North America’s total shale oil production in 2023, which translates to over 8.5 million barrels per day, further highlighting the critical role of perforating guns in this market. The United States produced approximately 8.5 million barrels per day of shale oil in 2023, representing a significant portion of North America’s energy production, driving the demand for perforating guns.

Key Market Challenges

High Operational and Maintenance Costs

One of the significant challenges facing the North America Perforating Gun Market is the high operational and maintenance costs associated with perforating gun systems. Perforating guns, which are integral to the well completion process, often involve complex technology that requires substantial investment both in terms of equipment and human resources. The cost of acquiring advanced perforating gun systems can be prohibitive, particularly for smaller operators or companies with limited capital expenditures. In addition to initial capital investment, the operational costs related to the deployment and maintenance of these guns add to the financial burden. Regular maintenance and servicing are essential to ensure the guns perform optimally, as failure to do so can result in costly delays and downtime during drilling operations.As perforating guns are used in extreme conditions such as high pressures, high temperatures, and corrosive environments, they require specialized parts and frequent inspections, which can be expensive. These high costs can impact the overall profitability of operators, particularly in a market where fluctuating oil prices and economic uncertainty make it difficult to plan long-term investments. Any malfunction or failure of the perforating gun during the operation can lead to significant delays in the well completion process, incurring both direct financial costs and indirect losses due to delayed production timelines. The cost-intensive nature of perforating gun operations represents a barrier to entry for many smaller firms and a limiting factor for large-scale adoption, especially in an industry where margins can be tight.

Key Market Trends

Shift Toward Digital and Smart Perforating Guns

One of the prominent trends in the North America Perforating Gun Market is the increasing adoption of digital and smart perforating guns. These advanced systems incorporate real-time data transmission, remote monitoring, and automated operations, offering substantial improvements in efficiency, precision, and safety. Smart perforating guns are equipped with sensors and diagnostic tools that allow operators to monitor key parameters such as pressure, temperature, and perforating gun performance in real time. This data enables more informed decision-making during the well completion process and allows for the optimization of perforating operations. The integration of digital technologies helps reduce human error, improve safety by offering remote control features, and increase operational efficiency by minimizing the need for manual intervention.The use of smart perforating guns enhances the ability to execute precise perforations at the most optimal locations, thereby improving the overall productivity and recovery rates of wells. As more oil and gas companies adopt digitalization across their operations, the demand for smart perforating guns is expected to continue to rise. This shift is particularly significant as companies look to reduce downtime, enhance cost-efficiency, and meet the evolving demands of modern drilling techniques. The trend toward incorporating automation and smart technologies in perforating systems aligns with broader industry moves toward Industry 4.0, where advanced digital technologies are transforming traditional oilfield operations.

Key Market Players

- Schlumberger Limited

- NOV Inc.

- Baker Hughes Company

- Weatherford International plc

- Halliburton Company

- Hunting PLC

- DMC Global Inc.

- Core Laboratories Inc.

Report Scope:

In this report, the North America Perforating Gun Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:North America Perforating Gun Market, By Gun Type:

- Through Tubing Hollow Carrier & Exposed

- Wireline Conveyed Casing

- TCP

North America Perforating Gun Market, By Well Type:

- Horizontal

- Vertical

North America Perforating Gun Market, By Application:

- Onshore

- Offshore

North America Perforating Gun Market, By Country:

- United States

- Canada

- Mexico

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the North America Perforating Gun Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Schlumberger Limited

- NOV Inc.

- Baker Hughes Company

- Weatherford International plc

- Halliburton Company

- Hunting PLC

- DMC Global Inc.

- Core Laboratories Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | March 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 680.26 Million |

| Forecasted Market Value ( USD | $ 874.02 Million |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | North America |

| No. of Companies Mentioned | 8 |