Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Continued high vehicle ownership and reliance on internal combustion engines across the U.S. and Canada underpin consistent gasoline and diesel demand. Additionally, strong industrial activity in chemicals, plastics, and heavy manufacturing supports the need for refined feedstocks. Jet fuel consumption is also rising in line with increased passenger and cargo air travel.

North America’s advanced refinery infrastructure, combined with extreme seasonal weather - especially in northern regions - further sustains demand for heating oil and kerosene. Despite the rise of renewable energy and electric vehicles, refined petroleum remains critical to the energy mix, given the current pace of transition and infrastructure development. The region’s role as a major exporter, alongside expanding economic and urban development, reinforces the importance of refined petroleum in the near to mid-term energy landscape.

Key Market Drivers

Sustained Demand from the Transportation Sector

The transportation sector continues to be the largest consumer of refined petroleum products in North America. High dependence on internal combustion engines in private and commercial vehicles, as well as widespread geographic dispersion and suburban lifestyles, maintains strong demand for gasoline and diesel.Heavy-duty trucking, the backbone of regional freight movement, heavily relies on diesel, while ongoing investments in road infrastructure further support fuel usage. Simultaneously, the aviation sector contributes significantly to jet fuel consumption due to rebounding passenger travel and rising air cargo volumes linked to e-commerce. Public transit systems, many of which operate on diesel, also contribute to this sustained demand.

In 2023, motor gasoline consumption in the U.S. reached approximately 8.88 million barrels per day, highlighting the transportation sector’s central role in maintaining refined fuel demand across the region.

Key Market Challenges

Regulatory Pressure and Environmental Compliance Costs

Stringent environmental policies across North America are creating operational challenges for the refined petroleum products market. Regulations such as low-sulfur fuel mandates, carbon emissions caps, and renewable fuel blending requirements are compelling refiners to invest heavily in emissions control, desulfurization technologies, and compliance systems.Uncertainties around evolving legislation, combined with the financial burden of implementing environmentally compliant infrastructure, pose risks to profitability - especially for smaller and mid-sized refiners. Land-use restrictions and delays in regulatory approvals further complicate efforts to expand or modernize refining capacity. These cumulative pressures threaten to erode the competitiveness of regional refiners and act as constraints on market growth.

Key Market Trends

Integration of Advanced Refining Technologies for Operational Efficiency

Refiners in North America are increasingly adopting advanced technologies to enhance efficiency, reduce emissions, and optimize output. Investments in catalytic reforming, hydrocracking, and fluid catalytic cracking upgrades are improving yields and enabling refiners to handle varied crude types more effectively.Digital technologies, including real-time analytics, machine learning, and predictive maintenance, are helping refineries boost operational uptime and reduce costs. Automation and remote monitoring are enhancing safety and performance across refinery operations.

These upgrades support compliance with environmental regulations while enabling refiners to respond quickly to market fluctuations. As refiners strive for greater agility and sustainability, technology-driven modernization is emerging as a strategic imperative for long-term growth and competitiveness.

Key Players Profiled in this North America Refined Petroleum Products Market Report

- Exxon Mobil Corporation

- Chevron Corporation

- BP p.l.c.

- Suncor Energy Inc.

- ConocoPhillips Company

- Phillips 66

- Enbridge Inc.

- PBF Energy Inc.

Report Scope:

In this report, the North America Refined Petroleum Products Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:North America Refined Petroleum Products Market, by Product Type:

- Diesel

- Gasoline

- Fuel Oils

- Kerosene

- Others

North America Refined Petroleum Products Market, by Application:

- Automobile

- Power Generation

- Chemical

- Others

North America Refined Petroleum Products Market, by Fraction:

- Light Distillates

- Middle Distillates

- Heavy Oils

North America Refined Petroleum Products Market, by Country:

- United States

- Canada

- Mexico

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the North America Refined Petroleum Products Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this North America Refined Petroleum Products market report include:- Exxon Mobil Corporation

- Chevron Corporation

- BP p.l.c.

- Suncor Energy Inc.

- ConocoPhillips Company

- Phillips 66

- Enbridge Inc.

- PBF Energy Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | May 2025 |

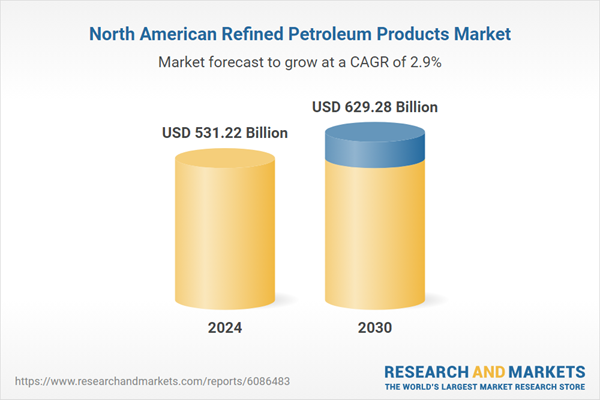

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 531.22 Billion |

| Forecasted Market Value ( USD | $ 629.28 Billion |

| Compound Annual Growth Rate | 2.8% |

| Regions Covered | North America |

| No. of Companies Mentioned | 8 |