The increasing demand for reliable and uninterrupted communication networks is driving the North America telecom power systems market. The growing reliance on 4G and 5G technologies makes telecom operators invest in robust power systems to ensure consistent performance and avoid network downtime. For instance, in December 2023, AT&T announced its plans to invest $140 billion to enhance its 5G and fiber networks aiming to double its fiber footprint to 50 million locations by 2029. The company focuses on blending wireless and broadband services to improve customer retention anticipating 7% annual broadband revenue growth and a significant increase in fiber subscribers. Moreover, the expansion of data centers and the shift towards cloud-based services further boost the need for advanced telecom power systems to manage energy consumption efficiently and meet sustainability goals.

Renewable energy sources and energy efficiency in the telecom industries represent some of the key market trends. Solar and wind power as well as hybrid power solutions have begun to gain more acceptance with companies in an effort to reduce operational costs and environmental issues. These power systems eventually save money on costs over the long term while helping meet regulatory requirements for carbon reduction. According to the North America telecom power systems market forecast, renewable energy adoption will play a key role in market expansion. Furthermore, technological advancements in power backup systems including battery storage and fuel cells are enhancing the reliability and sustainability of telecom infrastructure. For instance, in December 2024, Rogers Communications launched Canada’s first home internet backup device featuring a rechargeable battery that provides up to four hours of power during outages.

North America Telecom Power Systems Market Trends:

Shift to Renewable Energy

Telecom firms in North America are integrating solar and wind energy sources into their network. This shift in their infrastructure minimizes the usage of traditional grid power therefore decreasing operational cost and carbon emission. Solar panels and wind turbines are integrated in the telecom towers, data centers and base stations particularly in remote areas or off-grid sites. The adoption of renewable energy not only fits into the sustainability goals but also enhances energy security through diversification of power sources. For instance, in October 2023, Aither Systems successfully deployed its first iQM550 energy storage system at a Tier-1 telecom carrier cell site. The system operated efficiently for three days demonstrating advantages over traditional power solutions. This milestone reflects Aither's commitment to innovative high-density energy solutions and enhancing network reliability. It reduces long-term energy costs and supports regulatory compliance because governments are now pushing for greener technologies and carbon reduction initiatives in the telecom sector.Energy Storage Solutions

The demand for battery storage systems in North America's telecom sector is increasing as a result of the need to provide an uninterrupted power supply in case of grid failure or at times of high demand. Base stations and data centers in the telecom infrastructure need constant energy supply especially in remote locations where power reliability is often limited. For instance, in January 2025, Exide Technologies launched Solition Telecom a pioneering lithium-ion energy storage system designed for telecom Base Transceiver Stations. Offering reliable backup power across diverse grid conditions it features advanced battery management, high energy efficiency and modular scalability promising safety and longevity while reducing operational costs for telecom operators. Advanced battery technologies like lithium-ion and flow batteries offer scalable approaches to store excess energy created by renewable sources such as solar and wind. These systems provide a backup power source reducing operational costs ensure continuous service even during power outages and help keep the telecommunication network stable and deliver customer expectation.Smart Grid Integration

Smart grid technology is gaining traction in North America's telecom power systems to enhance the delivery of power and minimize outages. This technology integrates real-time data monitoring, automated controls and advanced analytics to boost the efficiency of power delivery to telecom infrastructure. These grids facilitate fast identification and resolution of problems thereby preventing network outages and ensuring stable reliable power. They also enable dynamic load management optimizing energy consumption based on demand fluctuations. Predictive maintenance and improved fault detection help telecom operators manage energy use more efficiently, cut operational costs and ensure higher uptime for critical communication services.North America Telecom Power Systems Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the North America telecom power systems market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, component, power source, and grid type.Analysis by Product Type:

- DC

- AC

Analysis by Component:

- Rectifiers

- Converters

- Controllers

- Heat Management Systems

- Generators

- Others

Analysis by Power Source:

- Diesel-Battery

- Diesel-Solar

- Diesel-Wind

- Multiple Sources

Analysis by Grid Type:

- On Grid

- Off Grid

- Bad Grid

Regional Analysis:

- United States

- Canada

Competitive Landscape:

The North America telecom power systems market is characterized by intense competition among key players each striving to offer innovative, cost-effective and reliable power solutions for telecom infrastructure. Companies are focusing on integrating renewable energy sources such as solar, wind and hybrid systems to meet growing sustainability demands while ensuring power reliability. The market is witnessing a shift toward energy-efficient solutions with a strong emphasis on battery storage, smart grid technology and low-maintenance systems. Players are investing in advanced power management systems and automation to optimize energy usage and reduce downtime. Strategic partnerships and collaborations are also prevalent enabling companies to expand their portfolios, enhance technological capabilities and address the diverse power needs of telecom operators across the region.The report provides a comprehensive analysis of the competitive landscape in the North America telecom power systems market with detailed profiles of all major companies, including:

- Ascot Group

- Alpha Technologies

- General Electric

- Eaton Corp PLC

- Huawei Technologies

- ZTE Corporation

- Schneider Electric SE

- Cummins Inc.

- Delta Group

- ABB Group

Key Questions Answered in This Report

1. How big is the Telecom Power Systems market in the North America?2. What factors are driving the growth of the North America Telecom Power Systems market?

3. What is the forecast for the Telecom Power Systems market in the North America?

4. Which segment accounted for the largest North America Telecom Power Systems product type market share?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Telecom Power Systems Market

5.1 Market Performance

5.2 Market Breakup by Product Type

5.3 Market Breakup by Component

5.4 Market Breakup by Power Source

5.5 Market Breakup by Grid Type

5.6 Market Breakup by Region

5.7 Market Forecast

6 North America Telecom Power Systems Market

6.1 Market Performance

6.2 Impact of COVID-19

6.3 Market Forecast

7 North America Telecom Power Systems Market: Breakup by Product Type

7.1 DC

7.2 AC

8 North America Telecom Power Systems Market: Breakup by Component

8.1 Rectifiers

8.2 Converters

8.3 Controllers

8.4 Heat Management Systems

8.5 Generators

8.6 Others

9 North America Telecom Power Systems Market: Breakup by Power Source

9.1 Diesel-Battery

9.2 Diesel-Solar

9.3 Diesel-Wind

9.4 Multiple Sources

10 North America Telecom Power Systems Market: Breakup by Grid Type

10.1 On Grid

10.2 Off Grid

10.3 Bad Grid

11 North America Telecom Power Systems Market: Breakup by Country

11.1 United States

11.1.1 Historical Market Trends

11.1.2 Market Breakup by Product Type

11.1.3 Market Breakup by Component

11.1.4 Market Breakup by Power Source

11.1.5 Market Breakup by Grid Type

11.1.6 Market Forecast

11.2 Canada

11.2.1 Historical Market Trends

11.2.2 Market Breakup by Product Type

11.2.3 Market Breakup by Component

11.2.4 Market Breakup by Power Source

11.2.5 Market Breakup by Grid Type

11.2.6 Market Forecast

12 SWOT Analysis

12.1 Overview

12.2 Strengths

12.3 Weaknesses

12.4 Opportunities

12.5 Threats

13 Value Chain Analysis

14 Porter’s Five Forces Analysis

14.1 Overview

14.2 Bargaining Power of Buyers

14.3 Bargaining Power of Suppliers

14.4 Degree of Rivalry

14.5 Threat of New Entrants

14.6 Threat of Substitutes

15 Competitive Landscape

15.1 Market Structure

15.2 Key Players

15.3 Profiles of Key Players

15.3.1 Ascot Group

15.3.2 Alpha Technologies

15.3.3 General Electric

15.3.4 Eaton Corp PLC

15.3.5 Huawei Technologies

15.3.6 ZTE Corporation

15.3.7 Schneider Electric SE

15.3.8 Cummins Inc.

15.3.9 Delta Group

15.3.10 ABB Group

List of Figures

Figure 1: North America: Telecom Power Systems Market: Major Drivers and Challenges

Figure 2: Global: Telecom Power Systems Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Telecom Power Systems Market: Breakup by Product Type (in %), 2024

Figure 4: Global: Telecom Power Systems Market: Breakup by Component (in %), 2024

Figure 5: Global: Telecom Power Systems Market: Breakup by Power Source (in %), 2024

Figure 6: Global: Telecom Power Systems Market: Breakup by Grid Type (in %), 2024

Figure 7: Global: Telecom Power Systems Market: Breakup by Region (in %), 2024

Figure 8: Global: Telecom Power Systems Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 9: North America: Telecom Power Systems Market: Sales Value (in Billion USD), 2019-2024

Figure 10: North America: Telecom Power Systems Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 11: North America: Telecom Power Systems Market: Breakup by Product Type (in %), 2024

Figure 12: North America: Telecom Power Systems (DC) Market: Sales Value (in Million USD), 2019 & 2024

Figure 13: North America: Telecom Power Systems (DC) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 14: North America: Telecom Power Systems (AC) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: North America: Telecom Power Systems (AC) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: North America: Telecom Power Systems Market: Breakup by Component (in %), 2024

Figure 17: North America: Telecom Power Systems (Rectifiers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 18: North America: Telecom Power Systems (Rectifiers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 19: North America: Telecom Power Systems (Converters) Market: Sales Value (in Million USD), 2019 & 2024

Figure 20: North America: Telecom Power Systems (Converters) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 21: North America: Telecom Power Systems (Controllers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 22: North America: Telecom Power Systems (Controllers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 23: North America: Telecom Power Systems (Heat Management Systems) Market: Sales Value (in Million USD), 2019 & 2024

Figure 24: North America: Telecom Power Systems (Heat Management Systems) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 25: North America: Telecom Power Systems (Generators) Market: Sales Value (in Million USD), 2019 & 2024

Figure 26: North America: Telecom Power Systems (Generators) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 27: North America: Telecom Power Systems (Other Components) Market: Sales Value (in Million USD), 2019 & 2024

Figure 28: North America: Telecom Power Systems (Other Components) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 29: North America: Telecom Power Systems Market: Breakup by Power Source (in %), 2024

Figure 30: North America: Telecom Power Systems (Diesel-Battery) Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: North America: Telecom Power Systems (Diesel-Battery) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: North America: Telecom Power Systems (Diesel-Solar) Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: North America: Telecom Power Systems (Diesel-Solar) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: North America: Telecom Power Systems (Diesel-Wind) Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: North America: Telecom Power Systems (Diesel-Wind) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: North America: Telecom Power Systems (Multiple Sources) Market: Sales Value (in Million USD), 2019 & 2024

Figure 37: North America: Telecom Power Systems (Multiple Sources) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 38: North America: Telecom Power Systems Market: Breakup by Grid Type (in %), 2024

Figure 39: North America: Telecom Power Systems (On Grid) Market: Sales Value (in Million USD), 2019 & 2024

Figure 40: North America: Telecom Power Systems (On Grid) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 41: North America: Telecom Power Systems (Off Grid) Market: Sales Value (in Million USD), 2019 & 2024

Figure 42: North America: Telecom Power Systems (Off Grid) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 43: North America: Telecom Power Systems (Bad Grid) Market: Sales Value (in Million USD), 2019 & 2024

Figure 44: North America: Telecom Power Systems (Bad Grid) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 45: North America: Telecom Power Systems Market: Breakup by Country (in %), 2024

Figure 46: United States: Telecom Power Systems Market: Sales Value (in Million USD), 2019-2024

Figure 47: United States: Telecom Power Systems Market: Breakup by Product Type (in %), 2024

Figure 48: United States: Telecom Power Systems Market: Breakup by Component (in %), 2024

Figure 49: United States: Telecom Power Systems Market: Breakup by Power Source (in %), 2024

Figure 50: United States: Telecom Power Systems Market: Breakup by Grid Type (in %), 2024

Figure 51: United States: Telecom Power Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 52: Canada: Telecom Power Systems Market: Sales Value (in Million USD), 2019-2024

Figure 53: Canada: Telecom Power Systems Market: Breakup by Product Type (in %), 2024

Figure 54: Canada: Telecom Power Systems Market: Breakup by Component (in %), 2024

Figure 55: Canada: Telecom Power Systems Market: Breakup by Power Source (in %), 2024

Figure 56: Canada: Telecom Power Systems Market: Breakup by Grid Type (in %), 2024

Figure 57: Canada: Telecom Power Systems Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 58: North America: Telecom Power Systems Industry: SWOT Analysis

Figure 59: North America: Telecom Power Systems Industry: Value Chain Analysis

Figure 60: North America: Telecom Power Systems Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: North America: Telecom Power Systems Market: Key Industry Highlights, 2024 and 2033

Table 2: North America: Telecom Power Systems Market Forecast: Breakup by Product Type (in Million USD), 2025-2033

Table 3: North America: Telecom Power Systems Market Forecast: Breakup by Component (in Million USD), 2025-2033

Table 4: North America: Telecom Power Systems Market Forecast: Breakup by Power Source (in Million USD), 2025-2033

Table 5: North America: Telecom Power Systems Market Forecast: Breakup by Grid Type (in Million USD), 2025-2033

Table 6: North America: Telecom Power Systems Market Forecast: Breakup by Country (in Million USD), 2025-2033

Table 7: North America: Telecom Power Systems Market: Competitive Structure

Table 8: North America: Telecom Power Systems Market: Key Players

Companies Mentioned

- Ascot Group

- Alpha Technologies

- General Electric

- Eaton Corp PLC

- Huawei Technologies

- ZTE Corporation

- Schneider Electric SE

- Cummins Inc.

- Delta Group

- ABB Group

Table Information

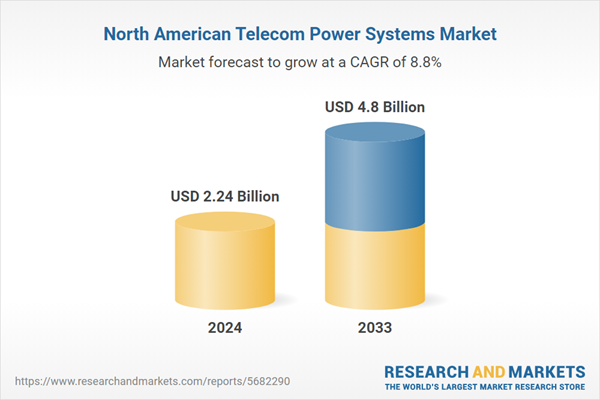

| Report Attribute | Details |

|---|---|

| No. of Pages | 121 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 2.24 Billion |

| Forecasted Market Value ( USD | $ 4.8 Billion |

| Compound Annual Growth Rate | 8.8% |

| Regions Covered | North America |

| No. of Companies Mentioned | 10 |