Rising Number of Aging Pipeline Infrastructure Fuels North America Trenchless Pipe Relining Market

The pipeline infrastructure across the world is aging day by day. There were over two and a half million miles of pipeline across the US as of 2020, half of which is over fifty years old. The aging pipeline infrastructure can lead to severe consequences, such as regional bottlenecks, supply disruptions due to leaks and maintenance shutdowns, increased potential for environmental damage, as well as safety concerns.In December 2021, the US Environmental Protection Agency (EPA) and the City of Fall River signed an agreement on a five-year plan to reduce and treat combined sewer discharges by fixing the wastewater infrastructure. In addition, in May 2020, Upper Arlington, a city in Ohio, US, awarded Performance Pipelining Inc. a US$ 1 million project to fix pipelines of untreated sewage. The majority of the project involved the installation of linings in existing public and private sanitary sewers across the city.

With these aging infrastructures, maintaining, repairing, and monitoring these pipelines has become necessary. As a result, there is a growing need to invest in restoring aging infrastructure, which also leads to increased demand for solutions such as trenchless pipe relining. Trenchless pipe relining solutions are gaining traction due to their performance and technical advantages.

These solutions repair existing underground pipelines with limited or no excavation while avoiding traffic jams, landscape destruction, and other environmental impacts. Many pipeline operators are increasingly adopting trenchless pipe relining solutions to overcome the problem of aging infrastructure. Thus, the rising number of aging pipeline infrastructure drives the trenchless pipe relining market.

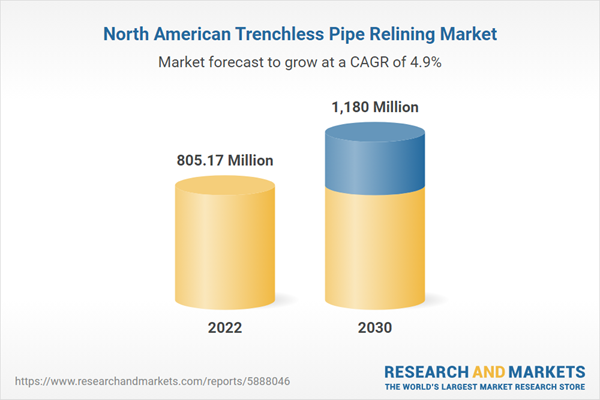

North America Trenchless Pipe Relining Market Overview

North America is the second-largest contributor to the global trenchless pipe relining market. In North America, the growing adoption of trenchless technology for fast repairing of water pipelines while disrupting the lives of citizens is boosting the growth of the trenchless pipe relining market. In addition, the rising adoption of new pipe-relining technologies in the region creates an opportunity for market growth.For instance, in February 2023, GE Research, Warren Environmental, and Garver announced that they are planning to conduct in-ground field tests with their newly developed PLUTO system. This new PLUTO system can help in the flexible deployment of SIPP (Sprayed-in-Place Pipe) over long distances and at different diameters from a single excavation. Thus, growing product innovation by the market players in the region is expected to drive the trenchless pipe relining market growth in North America.

Municipalities in the US, Canada, and Mexico are increasingly putting efforts to renovate their sewage and drainage systems. For instance, in October 2023, the Canadian government and British Columbia, the municipalities of Burns Lake, and the District of Mackenzie announced more than US$ 10 billion of investment for water and wastewater projects in the North America region. Thus, such government initiatives are anticipated to spur the growth of the trenchless pipe relining market.

North America Trenchless Pipe Relining Market Segmentation

- The North America trenchless pipe relining market is categorized into method, end user, diameter, and country.

- Based on method, the North America trenchless pipe relining market is divided into cured in place pipe, pull-in-place, pipe bursting, and internal pipe coating. The cured in place pipe segment held the largest North America trenchless pipe relining market share in 2022.

- In terms of end user, the North America trenchless pipe relining market is segmented into residential, commercial, industrial, and municipal. The residential segment held the largest North America trenchless pipe relining market share in 2022.

- By diameter, the North America trenchless pipe relining market is divided into below DN 50, DN 51 - DN 150, DN 151 - DN 250, and above DN 251. The below DN 50 segment held the largest North America trenchless pipe relining market share in 2022.

- Based on country, the North America trenchless pipe relining market is categorized into the US, Canada, and Mexico. The US dominated the North America trenchless pipe relining market share in 2022.

- SAERTEX MultiCom GmbH, United Felts Inc, Vortex Co LLC, NuFlow Technologies Inc, Trelleborg AB, RelineEurope GmbH, and Waterline Renewal Technologies Inc. are some of the leading companies operating in the North America trenchless pipe relining market.

Market Highlights

- Based on method, the North America trenchless pipe relining market is divided into cured in place pipe, pull-in-place, pipe bursting, and internal pipe coating. The cured in place pipe segment held 37.0% market share in 2022, amassing US$ 297.85 million. It is projected to garner US$ 469.13 million by 2030 to register 5.8% CAGR during 2022-2030.

- In terms of end user, the North America trenchless pipe relining market is segmented into residential, commercial, industrial, and municipal. The residential segment held 38.5% share of North America trenchless pipe relining market in 2022, amassing US$ 309.99 million. It is anticipated to garner US$ 460.83 million by 2030 to expand at 5.1% CAGR during 2022-2030.

- The below DN 50 segment held 38.9% share of North America trenchless pipe relining market in 2022, amassing US$ 312.88 million. It is projected to garner US$ 464.00 million by 2030 to expand at 5.0% CAGR from 2022 to 2030.

- This analysis states that the US captured 77.4% share of North America trenchless pipe relining market in 2022. It was assessed at US$ 622.82 million in 2022 and is likely to hit US$ 908.02 million by 2030, registering a CAGR of 4.8% during 2022-2030.

- In February 2023, The Vortex Companies has introduced a UV CIPP Systems portfolio, including curing equipment, liners, and custom truck builds, for aging infrastructure rehabilitation. The company, in partnership with IMS Robotics, offers advanced UV curing equipment for pipe diameters 6" to 80. The new EnviroCure UV Liner is pre-impregnated with resin and corrosion resistant. Vortex also provides an immersive training program with classroom and live field training.

- In February 2021, Waterline Renewal Technology, Inc. ("WRT" or "the company") announced the launch of the new LightRay LR3 from Perma-Liner Industries, which incorporated the latest in UV trenchless technology - significantly reducing the curing time during installations.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America trenchless pipe relining market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the North America trenchless pipe relining market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the North America trenchless pipe relining market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the North America Trenchless Pipe Relining market include:- SAERTEX MultiCom GmbH

- United Felts Inc

- Vortex Co LLC

- NuFlow Technologies Inc

- Trelleborg AB

- RelineEurope GmbH

- Waterline Renewal Technologies Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | August 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 805.17 Million |

| Forecasted Market Value ( USD | $ 1180 Million |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | North America |

| No. of Companies Mentioned | 8 |