Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Additionally, the market benefits from strong resale networks, financing options, and the availability of certified used trucks with warranties. Environmental regulations are also encouraging the adoption of newer, more fuel-efficient used trucks over older, higher-emission models. As per the report, In March, the U.S. used truck market exceeded seasonal expectations, with a 28% monthly sales increase. Strong auction and wholesale activity reflected buyers seizing opportunities amid economic and political uncertainty.

Market Drivers

High Cost of New Commercial Vehicles

One of the most significant drivers of the North America used truck market is the rising cost of new commercial vehicles. Over the past few years, prices for new trucks - especially heavy-duty and Class 8 vehicles - have surged due to supply chain issues, rising input costs, stricter emission standards, and integration of advanced technologies such as telematics, ADAS (Advanced Driver-Assistance Systems), and fuel-efficiency enhancements.For small and medium-sized logistics operators and independent owner-operators, the upfront investment required for new trucks is often not feasible. As a result, many businesses are opting for used trucks as a cost-effective alternative that still meets their operational needs. According to study, the average price of a new truck in January was USD59,684, significantly higher than the average SUV price of USD 47,667. This substantial cost difference is driving increased demand for used trucks, as buyers seek more affordable alternatives without compromising utility and performance.

The higher depreciation rate of new trucks within the first few years also incentivizes buyers to prefer used models that offer better value. Moreover, used trucks that are just a few years old often come with features comparable to new ones, making them a viable solution for companies looking to balance performance with budget constraints. This economic advantage continues to support the expansion of the used truck market in the region.

Key Market Challenges

Inconsistent Vehicle Quality and Limited Transparency

One of the most pressing challenges in the North America used truck market is the inconsistency in vehicle quality and the lack of transparency surrounding the condition and history of used trucks. While certified pre-owned (CPO) programs and reputable dealerships provide inspection reports and warranties, a significant portion of used truck sales still takes place through independent dealers or private sellers, where such guarantees are absent.Buyers often face difficulty in assessing the mechanical integrity, accident history, mileage tampering, and maintenance records of used vehicles. Without comprehensive data or digital tracking systems, fleet operators risk purchasing trucks that may require costly repairs soon after acquisition. These uncertainties can significantly deter potential buyers, especially small businesses and owner-operators who cannot afford unplanned downtime or unexpected expenses. Although digital platforms and telematics integration are improving transparency, their adoption remains uneven across the market. Until standardized vehicle reporting becomes widespread, the issue of inconsistent vehicle quality will continue to challenge the growth of the used truck sector.

Key Market Trends

Digitization of Sales Channels

A major trend reshaping the North America used truck market is the rapid digitization of sales and remarketing channels. Traditional truck dealerships are increasingly integrating online platforms to offer virtual showrooms, detailed vehicle listings, digital financing options, and remote vehicle inspections. This shift is fueled by the broader adoption of e-commerce, accelerated during the COVID-19 pandemic, and now considered a standard expectation in the vehicle sales industry.Buyers can now access truck specifications, maintenance history, and high-resolution images or videos without visiting a dealership. Online auction platforms, such as Ritchie Bros. and IronPlanet, as well as OEM-backed marketplaces, have gained popularity for offering transparency, competitive pricing, and convenience. Additionally, some digital platforms provide predictive analytics and pricing tools that help buyers make more informed decisions based on truck condition, mileage, and market demand.

Key Market Players

- Paccar Inc.

- Daimler AG

- General Motors Company

- Ford Motor Company

- Isuzu Motor Ltd.

- AB Volvo

- Scania AB (Traton SE)

- Freightliner Limited

- Hino Motors

- Navistar International Corporation

Report Scope:

In this report, the North America Used Truck Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:North America Used Truck Market, By Tonnage Capacity:

- 3.5 Tons to 7.5 Tons

- 7.5 Tons to 16 Tons

- 16 Tons to 30 Tons

- Above 30 Tons

North America Used Truck Market, By Fuel Type:

- Diesel

- Petrol

- Others

North America Used Truck Market, By Application:

- Logistics

- Construction

- Mining

- Others

North America Used Truck Market, By Country:

- United States

- Canada

- Mexico

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the North America Used Truck Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Paccar Inc.

- Daimler AG

- General Motors Company

- Ford Motor Company

- Isuzu Motor Ltd.

- AB Volvo

- Scania AB ( Traton SE)

- Freightliner Limited

- Hino Motors

- Navistar International Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 131 |

| Published | August 2025 |

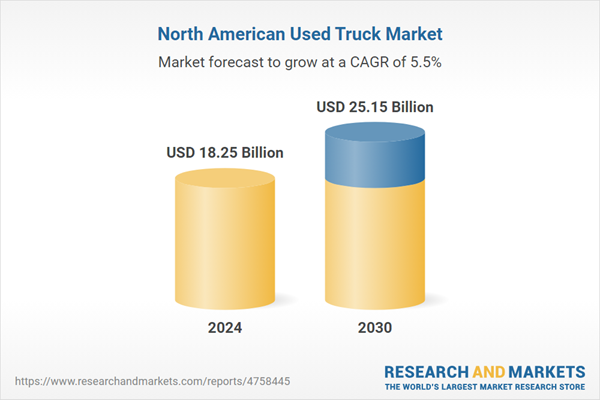

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 18.25 Billion |

| Forecasted Market Value ( USD | $ 25.15 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | North America |

| No. of Companies Mentioned | 10 |