The North America vascular stents market demand is primarily fueled by the increasing prevalence of cardiovascular diseases, such as coronary artery disease (CAD), which affects approximately 1 in 20 adults aged 20 and older (around 5%). This increase in CAD cases is due to factors such as an aging population, sedentary lifestyles, and poor dietary habits. Additionally, the growing preference for minimally invasive procedures and ongoing advancements in stent technology, such as drug-eluting and bioresorbable stents, are driving market expansion. Furthermore, improvements in healthcare infrastructure, increased awareness of the benefits of stent placement, and the rising adoption of these procedures in both hospitals and outpatient settings are further contributing to market growth.

At the same time, government initiatives and increased healthcare investments are playing a key role in driving the North America vascular stents market growth. The United States, in particular, has experienced a surge in the demand for vascular stents due to improved reimbursement policies and rising consumer awareness regarding preventive healthcare. For instance, heart attacks remain undetected in 1 out of 5 patients since the damage occurs without any awareness from the victim, highlighting the importance of early detection. The shift toward patient-centric care and the integration of digital technologies, such as telemedicine and artificial intelligence (AI)-driven diagnostics, is driving the adoption of innovative stent technologies, providing an impetus to the market. Moreover, the presence of top medical device manufacturers and research institutions in the region promotes ongoing innovation and guarantees a consistent supply of advanced vascular stents, further propelling market growth.

North America Vascular Stents Market Trends:

Rising Adoption of Drug-Eluting Stents (DES)The growing market demand for drug-eluting stents (DES) in the region is influencing the North America vascular stents market trends, as they demonstrate superior performance in minimizing restenosis compared to bare-metal stents. The medical coating on these stents blocks blood vessel re-narrowing which provides extended benefits to coronary artery disease patients. Moreover, the rising preference for DES emerges from better materials development safer profiles, and enhanced clinical results. For instance, research study between EES stents (everolimus-eluting stents) and BES stents (biolimus-eluting stents) showed similar results for device-oriented composite events (DOCE) and patient-oriented composite events (POCE) throughout the 10-year period with equal long-term effectiveness. Furthermore, healthcare providers are increasingly adopting DES as cardiovascular disease rates increase because this interventional therapy gives better treatment outcomes, thus catalyzing the market growth.

Growth of Bioresorbable Stents (BRS)

The growth of bioresorbable stents (BRS) in the region is expanding the North America vascular stents market share, as these devices have the ability to dissolve gradually. These stents provide the benefit of eliminating long-term metal implants so they might reduce the complications that traditional stents present. For example, in 2024, the Food and Drug Administration (FDA) gave its approval to Abbott Medical for the Esprit™ BTK Everolimus Eluting Resorbable Scaffold System. The device provides bioresorbable treatment for infrapopliteal arterial disease to peripheral artery disease patients while strengthening BRS technology adoption within this region. The latest technological progress has enabled BRS to effectively treat coronary artery disease while offering medical professionals an interim solution for vessel natural healing. Apart from this, patients choose natural and reversible procedures and clinical proof demonstrates their safety and effectiveness, which is significantly enhancing the North America vascular stents market outlook.

Integration of Advanced Imaging Technologies

The incorporation of advanced imaging technologies, like intravascular ultrasound (IVUS) and optical coherence tomography (OCT), into stent implantation procedures is greatly enhancing the accuracy and success rates of vascular stent placements. These technologies allow clinicians to better assess the vessel and accurately position the stent, reducing complications and improving patient recovery. Reports indicate that OCT-guided percutaneous coronary intervention (PCI) is linked to lower rates of cardiac death and stent thrombosis compared to traditional angiography-guided PCI. Besides this, the increasing use of these imaging modalities is enhancing procedural efficiency, supporting more personalized treatment approaches, and leading to better long-term results. Additionally, the rising adoption of more sophisticated tools in healthcare systems is thereby strengthening the market share.North America Vascular Stents Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the North America vascular stents market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on product type, material, mode of delivery, and end-user.Analysis by Product Type:

- Coronary Stents

- Peripheral Vascular Stents

- EVAR Stents Grafts

Analysis by Material:

- Metallic Stents

- Cobalt Chromium

- Platinum Chromium

- Nickel Titanium

- Stainless Steel

- Others

Analysis by Mode of Delivery:

- Balloon-Expandable Stents

- Self-Expanding Stents

Analysis by End-User:

- Hospitals and Cardiac Centers

- Ambulatory Surgical Centers

Country Analysis:

- United States

- Canada

- Mexico

Competitive Landscape:

The competitive landscape of the North America vascular stents market is highly dynamic, with numerous key players focusing on innovation and product differentiation to maintain market share. The market sees companies actively invest in developing next-generation stents through research that produces drug-eluting and bioresorbable stent technologies with improved security and performance. Furthermore, companies regularly form strategic alliances including mergers and acquisitions because they aim to enhance their product range alongside global market expansion. Additionally, strong distribution networks, regulatory compliance, and continuous improvements in stent materials and delivery systems, intensify competition and driving the market growth and innovation.The report provides a comprehensive analysis of the competitive landscape in the North America vascular stents market with detailed profiles of all major companies.

Key Questions Answered in This Report

1. How big is the vascular stents market in North America?2. What factors are driving the growth of the North America vascular stents market?

3. What is the forecast for the vascular stents market in North America?

4. Which segment accounted for the largest North America vascular stents product type market share?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Vascular Stents Market

5.1 Market Performance

5.2 Market Breakup by Product Type

5.3 Market Breakup by Material

5.4 Market Breakup by Mode of Delivery

5.5 Market Breakup by End-User

5.6 Market Breakup by Region

5.7 Market Forecast

6 North America Vascular Stents Market

6.1 Market Performance

6.2 Impact of COVID-19

6.3 Market Forecast

7 North America Vascular Stents Market: Breakup by Product Type

7.1 Coronary Stents

7.2 Peripheral Vascular Stents

7.3 EVAR Stent Grafts

8 North America Vascular Stents Market: Breakup by Material

8.1 Metallic Stents

8.1.1 Cobalt Chromium

8.1.2 Platinum Chromium

8.1.3 Nickel Titanium

8.1.4 Stainless Steel

8.2 Others

9 North America Vascular Stents Market: Breakup by Mode of Delivery

9.1 Balloon-Expandable Stents

9.2 Self-Expanding Stents

10 North America Vascular Stents Market: Breakup by End-User

10.1 Hospitals and Cardiac Centers

10.2 Ambulatory Surgical Centers

11 North America Vascular Stents Market: Breakup by Country

11.1 United States

11.1.1 Historical Market Trends

11.1.2 Market Breakup by Product Type

11.1.3 Market Breakup by Material

11.1.4 Market Breakup by Mode of Delivery

11.1.5 Market Breakup by End-User

11.1.6 Market Forecast

11.2 Canada

11.2.1 Historical Market Trends

11.2.2 Market Breakup by Product Type

11.2.3 Market Breakup by Material

11.2.4 Market Breakup by Mode of Delivery

11.2.5 Market Breakup by End-User

11.2.6 Market Forecast

11.3 Mexico

11.3.1 Historical Market Trends

11.3.2 Market Breakup by Product Type

11.3.3 Market Breakup by Material

11.3.4 Market Breakup by Mode of Delivery

11.3.5 Market Breakup by End-User

11.3.6 Market Forecast

12 SWOT Analysis

12.1 Overview

12.2 Strengths

12.3 Weaknesses

12.4 Opportunities

12.5 Threats

13 Value Chain Analysis

14 Porter’s Five Forces Analysis

14.1 Overview

14.2 Bargaining Power of Buyers

14.3 Bargaining Power of Suppliers

14.4 Degree of Rivalry

14.5 Threat of New Entrants

14.6 Threat of Substitutes

15 Price Analysis

16 Competitive Landscape

16.1 Market Structure

16.2 Key Players

16.3 Profiles of Key Players

List of Figures

Figure 1: North America: Vascular Stents Market: Major Drivers and Challenges

Figure 2: Global: Vascular Stents Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Vascular Stents Market: Breakup by Product Type (in %), 2024

Figure 4: Global: Vascular Stents Market: Breakup by Material (in %), 2024

Figure 5: Global: Vascular Stents Market: Breakup by Mode of Delivery (in %), 2024

Figure 6: Global: Vascular Stents Market: Breakup by End-User (in %), 2024

Figure 7: Global: Vascular Stents Market: Breakup by Region (in %), 2024

Figure 8: Global: Vascular Stents Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 9: North America: Vascular Stents Market: Sales Value (in Billion USD), 2019-2024

Figure 10: North America: Vascular Stents Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 11: North America: Vascular Stents Market: Breakup by Product Type (in %), 2024

Figure 12: North America: Vascular Stents (Coronary Stents) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 13: North America: Vascular Stents (Coronary Stents) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 14: North America: Vascular Stents (Peripheral Vascular Stents) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 15: North America: Vascular Stents (Peripheral Vascular Stents) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 16: North America: Vascular Stents (EVAR Stent Grafts) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 17: North America: Vascular Stents (EVAR Stent Grafts) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 18: North America: Vascular Stents Market: Breakup by Material (in %), 2024

Figure 19: North America: Vascular Stents (Metallic Stents) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 20: North America: Vascular Stents (Metallic Stents) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 21: North America: Vascular Stents (Other Materials) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 22: North America: Vascular Stents (Other Materials) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 23: North America: Vascular Stents Market: Breakup by Mode of Delivery (in %), 2024

Figure 24: North America: Vascular Stents (Balloon-Expandable Stents) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 25: North America: Vascular Stents (Balloon-Expandable Stents) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 26: North America: Vascular Stents (Self-Expanding Stents) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 27: North America: Vascular Stents (Self-Expanding Stents) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 28: North America: Vascular Stents Market: Breakup by End-User (in %), 2024

Figure 29: North America: Vascular Stents (Hospitals and Cardiac Centers) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 30: North America: Vascular Stents (Hospitals and Cardiac Centers) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 31: North America: Vascular Stents (Ambulatory Surgical Centers) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 32: North America: Vascular Stents (Ambulatory Surgical Centers) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 33: North America: Vascular Stents Market: Breakup by Country (in %), 2024

Figure 34: United States: Vascular Stents Market: Sales Value (in Billion USD), 2019-2024

Figure 35: United States: Vascular Stents Market: Breakup by Product Type (in %), 2024

Figure 36: United States: Vascular Stents Market: Breakup by Material (in %), 2024

Figure 37: United States: Vascular Stents Market: Breakup by Mode of Delivery (in %), 2024

Figure 38: United States: Vascular Stents Market: Breakup by End-User (in %), 2024

Figure 39: United States: Vascular Stents Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 40: Canada: Vascular Stents Market: Sales Value (in Billion USD), 2019-2024

Figure 41: Canada: Vascular Stents Market: Breakup by Product Type (in %), 2024

Figure 42: Canada: Vascular Stents Market: Breakup by Material (in %), 2024

Figure 43: Canada: Vascular Stents Market: Breakup by Mode of Delivery (in %), 2024

Figure 44: Canada: Vascular Stents Market: Breakup by End-User (in %), 2024

Figure 45: Canada: Vascular Stents Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 46: Mexico: Vascular Stents Market: Sales Value (in Billion USD), 2019-2024

Figure 47: Mexico: Vascular Stents Market: Breakup by Product Type (in %), 2024

Figure 48: Mexico: Vascular Stents Market: Breakup by Material (in %), 2024

Figure 49: Mexico: Vascular Stents Market: Breakup by Mode of Delivery (in %), 2024

Figure 50: Mexico: Vascular Stents Market: Breakup by End-User (in %), 2024

Figure 51: Mexico: Vascular Stents Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 52: North America: Vascular Stents Industry: SWOT Analysis

Figure 53: North America: Vascular Stents Industry: Value Chain Analysis

Figure 54: North America: Vascular Stents Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: North America: Vascular Stents Market: Key Industry Highlights, 2024 and 2033

Table 2: North America: Vascular Stents Market Forecast: Breakup by Product Type (in Billion USD), 2025-2033

Table 3: North America: Vascular Stents Market Forecast: Breakup by Material (in Billion USD), 2025-2033

Table 4: North America: Vascular Stents Market Forecast: Breakup by Mode of Delivery (in Billion USD), 2025-2033

Table 5: North America: Vascular Stents Market Forecast: Breakup by End-User (in Billion USD), 2025-2033

Table 6: North America: Vascular Stents Market Forecast: Breakup by Country (in Billion USD), 2025-2033

Table 7: North America: Vascular Stents Market: Competitive Structure

Table 8: North America: Vascular Stents Market: Key Players

Table Information

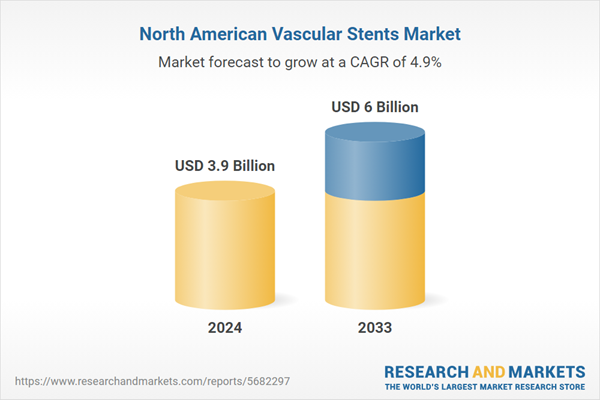

| Report Attribute | Details |

|---|---|

| No. of Pages | 123 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 3.9 Billion |

| Forecasted Market Value ( USD | $ 6 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | North America |