Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite these positive indicators, the market encounters a substantial obstacle regarding the significant upfront capital investment needed for electric nutrunner systems relative to conventional pneumatic options. Smaller companies often delay upgrades because of these prohibitive costs and the technical intricacies involved in merging intelligent tools with existing infrastructure. This financial hurdle effectively restricts the widespread uptake of sophisticated fastening solutions, particularly within manufacturing regions that are highly sensitive to pricing structures.

Market Drivers

The rapid shift toward electric mobility acts as a major driver for the nutrunner industry, as automotive manufacturers overhaul assembly lines to handle complex electric drivetrains and battery packs. This transition escalates the need for high-precision fastening tools offering specific torque control, which is essential for securing high-voltage connections where joint failure could endanger safety. According to the International Energy Agency's 'Global EV Outlook 2024' published in April 2024, electric car sales reached nearly 14 million in 2023, a significant increase in assembly volume that demands specialized tightening technologies. This surge forces factories to acquire advanced tools capable of managing the distinct assembly requirements and new materials inherent in modern vehicle designs.In parallel, the broad implementation of Industry 4.0 principles is accelerating the preference for intelligent electric nutrunners over standard pneumatic versions. Contemporary manufacturing settings require tools that perform real-time data collection to guarantee traceability and facilitate predictive maintenance, allowing operators to remotely monitor tightening processes and lower error rates. Rockwell Automation's '9th Annual State of Smart Manufacturing Report' from March 2024 notes that 95% of manufacturers are currently utilizing or assessing smart manufacturing technology, a factor heavily influencing the modernization of fastening systems. Additionally, the demand for durable assembly tools extends to renewable energy infrastructure; the Global Wind Energy Council reported in 2024 that the global wind sector installed a record 117 GW of new capacity in 2023, generating specific demand for heavy-duty bolting solutions for turbine installation and upkeep.

Market Challenges

A significant impediment to the widespread expansion of the global market is the substantial initial capital investment necessitated by electric nutrunner systems. In contrast to traditional pneumatic tools, which are inexpensive and easy to maintain, electric versions require considerable upfront spending on the tools themselves, along with the required controllers and software infrastructure. This cost gap is especially challenging for small and medium-sized enterprises (SMEs), which often work with narrow margins and lack the financial elasticity of large automotive OEMs. As a result, these cost-conscious manufacturers often delay modernization initiatives or keep using legacy equipment to save capital, directly restricting the total addressable market for intelligent fastening solutions and retarding the industry's general technology replacement rate.This reluctance to invest in costly capital equipment mirrors recent industrial trade performance, indicating a broader trend of diminished investment in manufacturing assets. According to the Mechanical Engineering Industry Association (VDMA), exports of machinery and equipment from Germany fell by 5.0% in nominal terms in 2024 compared to the prior year. This contraction in the trade of capital goods highlights the financial prudence currently dominating industrial buyers, who are reducing high-value acquisitions, thereby hindering the uptake of advanced tools such as electric nutrunners.

Market Trends

The global nutrunner market is being reshaped by the extensive adoption of cordless battery-powered technology, as manufacturers place a premium on operational flexibility. The elimination of restrictive pneumatic hoses in favor of advanced lithium-ion tools removes tripping hazards and permits unhindered operator movement across complex assembly lines. Innovations in brushless motors have accelerated this transition by enabling cordless models to equal the high torque output of tethered versions, rendering them suitable for heavy-duty industrial tasks. As noted in Techtronic Industries' 'Annual Report 2023' released in March 2024, their flagship Milwaukee brand realized a 10.7% sales increase in local currency, a growth explicitly attributed to the strategic goal of converting industrial users from legacy pneumatic power to cordless alternatives.Concurrently, there is a growing emphasis on developing ergonomic tool designs to address occupational health risks linked to high-torque fastening. Manufacturers are increasingly implementing nutrunners equipped with vibration dampening and reaction management systems to lower operator fatigue and avert repetitive strain injuries. These human-focused innovations are essential for maintaining workforce productivity by mitigating the physical strain of continuous industrial assembly work. According to the Health and Safety Executive (Great Britain) in their 'Health and safety statistics 2024' report from November 2024, 543,000 workers experienced work-related musculoskeletal disorders during the 2023/24 period, leading to 7.8 million lost working days, which underscores the critical need for injury-preventing tools.

Key Players Profiled in the Nutrunner Market

- Atlas Copco Group

- Estic Corporation

- Sanyo Machine Works, Ltd.

- Ingersoll Rand Inc.

- Daiichi Dentsu Ltd.

- Maschinenfabrik Wagner GmbH & Co. KG

- Aimco Global

- Stanley Engineered Fastening

Report Scope

In this report, the Global Nutrunner Market has been segmented into the following categories:Nutrunner Market, by Type:

- Electric Nutrunner

- Pneumatic Nutrunner

- Hydraulic Nutrunner

Nutrunner Market, by Distribution Channel:

- In Store

- Online

Nutrunner Market, by End-User Industry:

- Construction

- Industrial

- Automotive

- Others

Nutrunner Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Nutrunner Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Nutrunner market report include:- Atlas Copco Group

- Estic Corporation

- Sanyo Machine Works, Ltd.

- Ingersoll Rand Inc.

- Daiichi Dentsu Ltd.

- Maschinenfabrik Wagner GmbH & Co. KG

- Aimco Global

- Stanley Engineered Fastening

Table Information

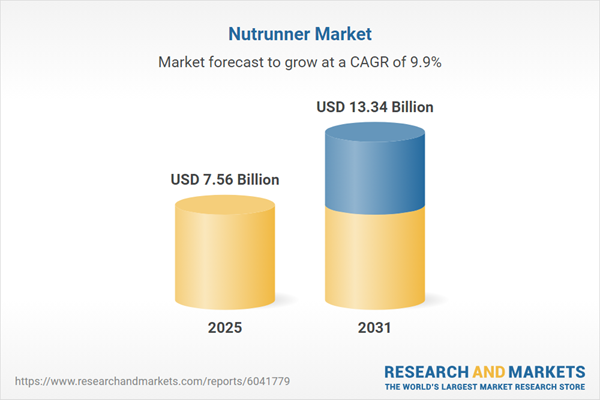

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 7.56 Billion |

| Forecasted Market Value ( USD | $ 13.34 Billion |

| Compound Annual Growth Rate | 9.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |