Global Octyl Alcohol Market - Key Trends & Drivers Summarized

Why Is Octyl Alcohol Emerging as a Key Ingredient in Industrial and Consumer Applications?

Octyl alcohol, also known as 1-octanol, is steadily gaining strategic significance across multiple industries owing to its versatile chemical properties and broad spectrum of end uses. As a straight-chain fatty alcohol with eight carbon atoms, octyl alcohol is predominantly utilized as an intermediate in the production of plasticizers, surfactants, defoamers, and lubricants. One of its most notable applications is in the manufacture of phthalate and non-phthalate plasticizers, where it acts as a critical alcohol component in esterification processes. The compound's hydrophobic yet reactive nature makes it highly suitable for surfactants and emulsifiers, particularly in the cosmetics and personal care industries, where it contributes to product consistency and skin feel. The pharmaceutical industry also leverages octyl alcohol in drug formulation as a penetration enhancer, especially in topical delivery systems. In agrochemicals, it functions as a carrier solvent and co-formulant, enhancing the delivery and stability of active ingredients. Moreover, octyl alcohol is used in flavors and fragrances due to its mild odor and compatibility with other aromatic compounds. Its growing relevance in bio-based chemical production - where it can be synthesized from renewable feedstocks like castor oil and palm kernel oil - aligns well with the global movement toward sustainable and environmentally friendly industrial practices. As demand rises for multifunctional, efficient, and biodegradable chemical intermediates, octyl alcohol stands out for its adaptability and broad industrial relevance.How Are Regional Dynamics and End-Use Sectors Shaping Demand for Octyl Alcohol?

The octyl alcohol market is evolving rapidly, with regional demand patterns largely shaped by industrial maturity, regulatory frameworks, and downstream application growth. In Asia-Pacific, especially China and India, the demand is being driven by rapid industrialization and expansion in sectors such as plastics, coatings, agrochemicals, and personal care. These countries serve both as manufacturing hubs and end-user markets, benefiting from relatively low production costs and large-scale capacity expansion. Europe, on the other hand, remains a stronghold for high-purity applications, particularly in cosmetics, pharmaceuticals, and fine chemicals. Stringent environmental regulations in the EU are encouraging the use of bio-based and low-toxicity chemical intermediates, which is boosting the market for sustainably sourced octyl alcohol. North America’ s market is largely shaped by innovation in specialty chemicals and increased demand for high-performance lubricants, coatings, and solvents. The Middle East and Africa, while still emerging markets, are seeing increased investment in petrochemical infrastructure, which in turn supports octyl alcohol production and consumption in plasticizer and lubricant applications. Latin America, particularly Brazil, is witnessing growing adoption in agrochemicals and cosmetics, aligned with the country’ s strong bioeconomy policies. Across all regions, fluctuations in raw material pricing, especially that of ethylene and natural fatty alcohols, are impacting market dynamics. Trade regulations, import-export tariffs, and availability of local feedstock also play significant roles in shaping regional market competitiveness and influencing sourcing strategies for octyl alcohol across the globe.Is Green Chemistry Influencing the Production and Use of Octyl Alcohol?

Green chemistry and sustainability imperatives are significantly altering the landscape of octyl alcohol production and application. Traditionally produced through petrochemical routes such as the oxo process using ethylene and carbon monoxide, octyl alcohol is now increasingly being synthesized via renewable pathways. Bio-based processes utilizing natural fatty acids from palm kernel oil, coconut oil, or castor oil are gaining prominence as companies seek to reduce their carbon footprint and dependence on fossil resources. This shift is being propelled not only by consumer demand for sustainable products but also by global regulatory frameworks targeting emission reductions and circular chemical production. Life cycle analysis (LCA) metrics are becoming integral in procurement decisions, especially in sectors like personal care, where green labels and certifications influence product marketability. Manufacturers are also exploring closed-loop production systems, recycling solvents, and reducing waste to align with ISO and REACH compliance requirements. Additionally, the downstream use of octyl alcohol in biodegradable surfactants and low-VOC coatings supports broader sustainability objectives in consumer goods and construction sectors. In the agricultural domain, the push for eco-friendly pesticide formulations is driving the inclusion of octyl alcohol as a safer co-solvent alternative. Meanwhile, advancements in biocatalysis and fermentation technologies are offering cost-effective, scalable options for producing high-purity octyl alcohol from sustainable feedstocks. As the market shifts toward greener formulations and responsible sourcing, companies positioned with bio-based octyl alcohol and robust ESG (environmental, social, governance) credentials are gaining a competitive edge.What Are the Key Drivers Powering the Global Growth of the Octyl Alcohol Market?

The growth in the octyl alcohol market is driven by several factors related to end-use diversification, product innovation, and global consumption trends. The plastics industry remains a major growth engine, where octyl alcohol is a crucial precursor in the synthesis of both traditional and non-phthalate plasticizers used in PVC and other polymers. As the demand for flexible packaging, automotive interiors, and construction materials continues to climb, so does the need for high-quality plasticizers. In the personal care and cosmetics sector, rising consumer demand for multifunctional and safe ingredients is boosting the use of octyl alcohol in emulsifiers, moisturizers, and skin conditioning agents. The fragrance industry is also fueling demand, particularly for high-purity grades, due to the compound’ s mild scent and fixative properties. In agrochemicals, octyl alcohol’ s role as a co-solvent and carrier is becoming increasingly valuable in the formulation of stable and efficient pesticide products, especially as farming intensifies to meet global food security needs. Pharmaceutical applications are expanding with octyl alcohol being incorporated into new drug delivery systems requiring skin penetration or lipid solubility enhancement. Furthermore, global trends toward industrial automation and machinery maintenance are increasing the demand for specialty lubricants and metalworking fluids, sectors where octyl alcohol functions as an additive to improve viscosity and performance. On the supply side, advancements in catalytic synthesis, purification technologies, and bio-refinery capabilities are enhancing production efficiency and product consistency. As industries diversify their material requirements and prioritize chemical performance alongside safety and sustainability, octyl alcohol is well-positioned for sustained and dynamic market growth.Report Scope

The report analyzes the Octyl Alcohol market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product (2-Ethylhexanol, 1-Octanol, 2-Octanol).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the 2-Ethylhexanol segment, which is expected to reach US$5.5 Billion by 2030 with a CAGR of a 2.5%. The 1-Octanol segment is also set to grow at 3.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.9 Billion in 2024, and China, forecasted to grow at an impressive 2.7% CAGR to reach $1.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Octyl Alcohol Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Octyl Alcohol Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Octyl Alcohol Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Octyl Alcohol market report include:

- Arkema Group

- Axxence Aromatic GmbH

- BASF SE

- Bharat Petroleum Corporation Limited

- Dow Chemical Company

- Eastman Chemical Company

- Ecogreen Oleochemicals

- Evonik Industries AG

- ExxonMobil Chemical

- Formosa Plastics Corporation

- Huntsman Corporation

- INEOS Group Holdings

- KLK OLEO

- LG Chem

- Liaoning Huaxing Group Chemical

- Mitsui Chemicals

- SABIC

- Sasol Limited

- Shell Chemicals

- The Andhra Petrochemicals Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Arkema Group

- Axxence Aromatic GmbH

- BASF SE

- Bharat Petroleum Corporation Limited

- Dow Chemical Company

- Eastman Chemical Company

- Ecogreen Oleochemicals

- Evonik Industries AG

- ExxonMobil Chemical

- Formosa Plastics Corporation

- Huntsman Corporation

- INEOS Group Holdings

- KLK OLEO

- LG Chem

- Liaoning Huaxing Group Chemical

- Mitsui Chemicals

- SABIC

- Sasol Limited

- Shell Chemicals

- The Andhra Petrochemicals Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 110 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

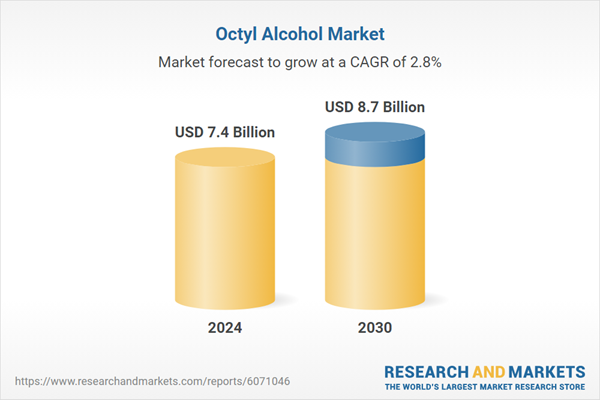

| Estimated Market Value ( USD | $ 7.4 Billion |

| Forecasted Market Value ( USD | $ 8.7 Billion |

| Compound Annual Growth Rate | 2.8% |

| Regions Covered | Global |