Speak directly to the analyst to clarify any post sales queries you may have.

A clear and strategic introduction to how capacity growth, coherent optics innovation, and architectural modernization are redefining optical transport network equipment choices

The optical transport network (OTN) equipment landscape is undergoing a rapid evolution driven by the convergence of capacity demand, architectural modernization, and component-level innovation. Network operators and cloud providers are investing in higher-density optical layers to support the relentless growth of east-west traffic in data centers as well as increasingly bandwidth-hungry consumer and enterprise services. At the same time, advances in coherent optics, flexible grid technologies, and programmable ROADMs are enabling operators to extract more value from existing fiber while simplifying service provisioning.

Transitioning from legacy dense wavelength division multiplexing (DWDM) systems toward flexible-spectrum and packet-optical solutions, decision-makers are prioritizing equipment that delivers lower operational complexity and improved spectral efficiency. The role of transceivers, ROADMs, optical switches and amplifiers has become more strategic, as equipment choices dictate not only throughput but also agility for service activation and fault isolation. Moreover, the interplay between component choices and system architectures is shaping integration strategies across subsea, long haul, metro and data center interconnect applications.

Given these dynamics, executives evaluating OTN investment options require a synthesis that links component technology, system architecture and deployment context to near-term operational priorities and medium-term network transformation paths. This executive summary provides a focused appraisal designed to help technology planners, procurement leaders, and strategic investors make actionable decisions amid an era of rapid technological and policy shifts.

How high-capacity coherent optics, disaggregation trends, and software-defined automation are reshaping supplier dynamics and operator investment priorities

The optical transport domain is experiencing transformative shifts that reconfigure supplier strategies and operator investment patterns. First, the migration to higher data rates and flexible-grid coherent solutions has accelerated, driven by the need to maximize fiber asset utilization and reduce cost per bit. This technical pivot is enabling new deployment models in which flexible-spectrum ROADMs, programmable optical switches, and coherent transceivers collaborate to support bandwidth-on-demand and elastic service delivery.

Second, the push for disaggregated optics and interoperable components is gaining traction. Operators are increasingly looking to decouple pluggable transceivers from chassis and to leverage modular amplifier and filtering subsystems that permit incremental upgrades. This change is fostering greater supplier diversity and encouraging component-level innovation from specialized vendors. At the same time, systems that tightly integrate packet-optical capabilities are rising in importance, particularly where latency-sensitive workloads and simplified orchestration are prioritized.

Third, network design practices are shifting toward software-defined control and automation. The adoption of telemetry-rich optical elements and standardized control interfaces allows real-time impairment awareness and automated wavelength grooming, thereby reducing manual intervention. As a result, capital planning and operational playbooks are evolving: operators now assess equipment not only for raw performance but for its ability to integrate with orchestration stacks, provide meaningful telemetry, and deliver lower total cost of ownership through automation efficiencies.

Analysis of how 2025 tariff adjustments from the United States are altering sourcing footprints, procurement practices, and technology choices across optical transport equipment supply chains

The introduction and evolution of tariff policies originating from the United States have introduced new layers of complexity across optical transport supply chains, particularly in 2025 when adjustments to import duties and trade restrictions intersect with geopolitical supply resilience strategies. Tariff policy changes have influenced sourcing decisions, compelling buyers and vendors to reassess supplier footprints, manufacturing localization, and the cost structure associated with key components such as transceivers, ROADMs, optical switches, amplifiers, and advanced modulators.

Consequently, many suppliers have accelerated diversification of manufacturing sites or increased local assembly to mitigate tariff exposure. This shift has implications for lead times and quality assurance processes because localized assembly may require new supplier relationships and qualification cycles. For operators, the cumulative impact is visible in procurement timelines and contract structures: buyers are placing greater emphasis on supplier risk clauses, price adjustment mechanisms, and multi-sourcing strategies to preserve supply continuity.

In parallel, tariff-induced cost pressures have elevated the strategic importance of technology choices that improve spectral efficiency and reduce equipment footprint. Investments in higher-order modulation formats, flexible-spectrum ROADMs, and advanced amplifier designs help offset increased component costs by enabling greater capacity per fiber and lower operations expenditure per bit. Moreover, tariff-related uncertainty has encouraged operators to adopt longer-term vendor partnerships, joint inventory strategies, and collaborative roadmaps that align product roadmaps with regional manufacturing capabilities, thereby reducing margin pressure while maintaining deployment velocity.

In-depth segmentation insights explaining how component, data rate, application, system type, technology, and network topology choices collectively drive differentiated equipment strategies

Segment-driven insights reveal differentiated technology and procurement behaviors that will shape equipment selection and deployment strategies. Based on component segmentation, the market’s functional decisions hinge on the adoption patterns across amplifiers, multiplexers/demultiplexers, optical switches, ROADMs, and transceivers, with deeper nuance inside amplifier subcategories such as EDFA, Raman, and SOA, optical switch variations that include port switches and wavelength selective switches, ROADM types spanning CDC, CDC flex spectrum, and colorless-directionless architectures, and transceiver form factors from CFP2 and CFP4 to QSFP-DD and QSFP28. These component-level distinctions influence where operators prioritize capex versus opex trade-offs, and they determine upgrade paths where modular or pluggable designs allow incremental capacity growth.

From a data rate perspective, decisions are being driven by adoption curves among 100G, 200G, 400G and emerging 1T solutions. Network planners weigh the operational benefits of higher-rate optics against the need for granular capacity provisioning and the interoperability of existing ROADMs and switch fabrics. Application segmentation across data center interconnect, long haul, metro, and submarine contexts illustrates that system requirements differ materially: for example, submarine deployments emphasize amplifier and optical power optimization, while data center interconnects prioritize low-latency coherent modulation and compact pluggable transceivers.

System-type segmentation-covering CWDM systems, DWDM systems, OTN switches, and packet-optical transport platforms-highlights divergent architectural approaches to capacity growth and service convergence. Operators selecting CWDM or DWDM often do so based on fiber availability and spectral efficiency needs, whereas those prioritizing packet-optical integration are seeking simplified operational stacks that converge OTN switching and packet grooming. Finally, technology segmentation into CWDM, DWDM and flex spectrum options, and network-type segmentation across access, core and metro networks, all underscore that deployment context and existing fiber assets remain primary determinants of equipment choice and upgrade sequencing.

Regional strategic perspectives showing how differing infrastructure profiles, regulatory environments, and procurement priorities shape equipment adoption across major global markets

Regional dynamics are creating distinct demand patterns and procurement behaviors across the Americas, Europe, Middle East & Africa, and Asia-Pacific, each presenting unique operational priorities and supplier interactions. In the Americas, operators and cloud providers are accelerating deployments of higher-rate coherent optical systems and flexible ROADMs to meet hyperscale data center interconnect needs, while also prioritizing resilience and rapid provisioning through programmable optical elements. That region’s operators tend to emphasize vendor interoperability, disaggregated optics options, and rapid time-to-service as key decision criteria.

Within Europe, Middle East & Africa, regulatory diversity and varying fiber infrastructures are shaping differentiated strategies; operators in this broader region balance investments between metro densification, long haul modernization, and submarine link augmentation. Procurement approaches here frequently reflect a hybrid model that values both integrated system reliability and increasing openness at the transceiver and component level. The Asia-Pacific landscape is characterized by aggressive capacity buildouts, extensive submarine cable projects, and strong interest in compact, energy-efficient transceivers to support dense metro and data center environments. Suppliers targeting Asia-Pacific are responding with localized manufacturing and supply partnerships to meet scale and speed expectations.

Across all regions, the common thread is that local regulatory frameworks, spectrum constraints, and fiber asset topologies exert measurable influence on technology selection, deployment sequencing, and supplier engagement models. As a result, regional strategies increasingly combine global product roadmaps with tailored local supply and operations plans to ensure predictable performance and timely scaling.

Key insights into supplier strategies, specialization trends, and partnership models that determine competitive advantage in optical transport equipment markets

The competitive landscape among suppliers is being redefined by specialization, vertical integration, and strategic partnerships. Established systems integrators continue to leverage portfolio breadth to offer end-to-end solutions that combine ROADMs, coherent line systems, amplifiers and management software, while component-focused vendors concentrate on advancing transceiver density, coherent DSP performance, and amplifier linearity. At the same time, a wave of smaller, specialized suppliers is introducing innovative modular components and pluggable optics that address niche performance or cost points, prompting incumbents to accelerate their own roadmaps.

Partnership models are increasingly important: chipset makers, optical component manufacturers, and system vendors are forming closer co-development agreements to ensure interoperability and reduce time-to-market for new data-rate and modulation offerings. Supply chain integration has also become a competitive lever; vendors that can demonstrate multi-region manufacturing and local certification capabilities are more successful in winning multi-year agreements, particularly where tariff and regulatory uncertainties persist. Finally, service and software differentiation-telemetry, automation, and lifecycle management-are emerging as decisive factors in vendor selection, as buyers seek suppliers who can deliver measurable operational efficiencies and streamlined integration with orchestration platforms.

Actionable recommendations for network operators and suppliers to manage supplier risk, accelerate automation adoption, and preserve deployment agility amid evolving trade and technology dynamics

Industry leaders should adopt a pragmatic yet proactive approach to navigate technological change and policy-driven supply shifts. First, prioritize modular and interoperable architectures that allow incremental capacity upgrades and component swap-outs, thereby reducing the risk associated with tariff-driven supplier volatility. Second, accelerate qualification of alternative suppliers and establish multi-sourcing arrangements for critical components such as coherent transceivers, ROADMs and amplifiers to ensure continuity and bargaining leverage.

Third, invest in automation and telemetry integration early in procurement cycles so that new equipment delivers operational savings through reduced provisioning times and faster fault isolation. Fourth, align procurement contracts with flexible pricing and inventory strategies, including regional stocking hubs, to mitigate cost and lead-time exposure. Fifth, incorporate scenario-based planning into capital allocation exercises; evaluate how different tariff, supply chain, and technology adoption scenarios could affect deployment timelines and interoperability requirements. By implementing these actions, leaders can maintain deployment momentum while managing supplier risk and capturing the benefits of next-generation optical technologies.

A rigorous mixed-methods research approach combining expert interviews, vendor briefings, standards analysis, supply chain mapping, and scenario-based sensitivity testing

The research methodology underpinning this analysis combined structured primary engagement with secondary validation and scenario analysis. Primary research included in-depth interviews with network architects, procurement leaders, and senior engineering managers across operators, cloud providers, and system vendors, providing qualitative insights into procurement drivers, interoperability priorities, and deployment challenges. These interviews were complemented by vendor briefings and technical workshops that clarified product roadmaps and integration timelines.

Secondary research encompassed technical literature, standards bodies publications, and public regulatory filings to verify technological trends such as coherent modulation trajectories, ROADM evolution, and amplifier innovation. Supply chain mapping exercises identified key component flows and manufacturing footprints, while sensitivity and scenario analysis explored how tariff shifts, regional manufacturing changes, and rapid adoption of higher-rate optics could impact procurement strategies and deployment sequencing. Throughout, findings were triangulated to ensure consistency and to surface both consensus views and dissenting perspectives, providing a balanced evidence base for the recommendations presented.

A concluding synthesis that ties technological innovation, procurement agility, and supply chain resilience into an executable strategy for next-generation optical transport modernization

In conclusion, optical transport network equipment decision-making is being reshaped by a confluence of technology advances, evolving deployment models, and policy-driven supply chain adjustments. Operators and suppliers that prioritize flexible, interoperable architectures; diversify sourcing and manufacturing footprints; and accelerate automation integration will be better positioned to capture the benefits of higher-rate optics and flexible-spectrum technologies. Meanwhile, tariff and regional policy dynamics are making supplier qualification, contract flexibility, and local manufacturing capabilities central to procurement success.

Looking forward, the most resilient strategies will pair technical rigor with procurement agility: adopt modular component architectures, invest in telemetry-enabled operational practices, and establish multi-sourcing and inventory approaches that reduce exposure to regional trade fluctuations. By synthesizing these elements into a coherent strategy, decision-makers can ensure that network evolution delivers both performance improvements and predictable operational economics. This summary is intended to inform executive deliberations and support rapid, evidence-based decision-making as networks transition to their next phase of optical modernization.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Optical Transport Network Equipment Market

Companies Mentioned

The key companies profiled in this Optical Transport Network Equipment market report include:- ADVA Optical Networking SE

- Ciena Corporation

- Cisco Systems, Inc.

- Coriant GmbH & Co. KG.

- ECI Telecom Ltd.

- FiberHome Telecommunication Technologies Co., Ltd.

- Fujikura Ltd.

- Fujitsu Limited

- Huawei Technologies Co., Ltd.

- II-VI Incorporated

- Infinera Corporation

- Lumentum Holdings Inc.

- NEC Corporation

- Nokia Corporation

- Ribbon Communications Inc.

- Samsung Electronics Co., Ltd.

- Sumitomo Electric Industries, Ltd.

- Telefonaktiebolaget LM Ericsson

- Tellabs, Inc.

- ZTE Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2026 |

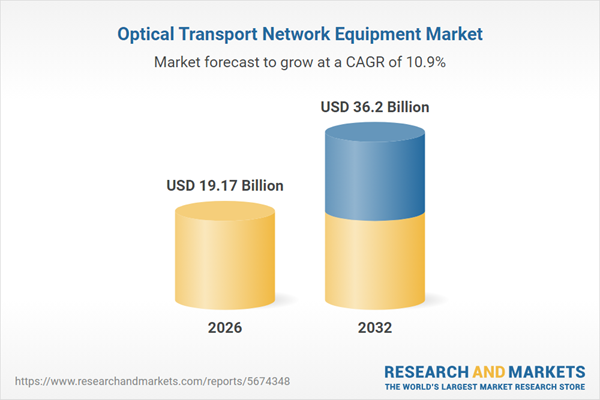

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 19.17 Billion |

| Forecasted Market Value ( USD | $ 36.2 Billion |

| Compound Annual Growth Rate | 10.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |