Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

A major obstacle potentially hindering market progress is the high cost structure inherent to organic production and certification. Sourcing certified raw materials entails navigating complex supply chains and adhering to rigorous agricultural standards, which substantially elevates operational costs compared to conventional tissue manufacturing. As a result, the necessary premium retail pricing frequently discourages price-sensitive buyers and restricts widespread market penetration in developing economies where purchasing decisions are largely dictated by affordability.

Market Drivers

The Global Organic Tissue Paper Market is being fundamentally reshaped by an accelerated transition toward bamboo and other non-wood fiber sources as manufacturers aim to lessen the environmental footprint of traditional wood pulp. This shift is motivated by the superior renewability of materials such as bamboo, wheat straw, and sugarcane, which demand significantly fewer resources for cultivation than virgin timber and possess rapid growth cycles that facilitate scalable, eco-friendly production. Major corporations are actively reorganizing their supply chains to incorporate these non-wood inputs, thereby decreasing reliance on raw materials linked to deforestation and managing supply volatility. Illustrating this strategic pivot, Kimberly-Clark noted in its '2023 Sustainability Progress Report' in June 2024 that it had decreased its fiber sourcing from natural forests in Canada and Latin America by '39 percent' relative to its 2011 baseline, aiming to meet long-term ecological objectives.Concurrently, the market is driven by rising consumer demand for environmentally sustainable hygiene items, with transparency and ethical sourcing acting as essential purchasing requirements. Modern consumers increasingly examine product labels for certifications ensuring chemical-free processing and responsible forestry, frequently avoiding brands that cannot prove verified ecological stewardship. This growing awareness is influencing market dynamics; according to the '2024 UK Consumer Survey' by the Forest Stewardship Council in October 2024, '76 percent' of millennials expressed a need for reassurance that their forest products are responsibly sourced. Capitalizing on this trend, leading industry players are strengthening their financial standing through sustainable product lines, as evidenced by Essity, which reported in its 'Annual Report 2024' in March 2025 that it achieved net sales of 'SEK 146 billion', largely attributed to structural enhancements and innovations in sustainable hygiene solutions.

Market Challenges

The elevated cost structure inherent in organic manufacturing acts as a significant impediment to the expansion of the Global Organic Tissue Paper Market. Creating hygiene products from responsibly sourced fibers without the use of aggressive chemicals demands specialized procedures and strict compliance with certification standards, factors that dramatically increase operational expenses. This financial strain is compounded by persistently high input costs that directly affect the final retail pricing of these eco-friendly goods. For example, the 'Confederation of European Paper Industries' noted in '2024' that energy prices remained 'two times higher' than pre-pandemic levels, putting immense pressure on the cost competitiveness of energy-intensive industries such as tissue production.To preserve financial viability, manufacturers are forced to transfer these rising expenditures to consumers, leading to premium pricing that is frequently inaccessible to the mass market. Consequently, this price gap restricts adoption among price-sensitive groups and inhibits growth in developing economies where affordability remains the primary driver of purchasing decisions. As a result, the market faces difficulties in translating consumer interest in sustainability into actual sales volume, thereby limiting the overall global growth potential of the organic segment.

Market Trends

The rise of Direct-to-Consumer (DTC) subscription models is significantly transforming market distribution by circumventing traditional retail limitations to directly reach eco-conscious consumers. These platforms utilize recurring delivery schedules and high-density bulk shipping to reduce carbon footprints, attracting customers who value convenience alongside environmental ethics. This operational evolution is generating considerable financial benefits for specialized organic brands leveraging these digital avenues; according to a report by Retail Times in July 2025 titled 'Who Gives A Crap doubles UK profit in FY24 UK results', Who Gives A Crap posted a 17 percent revenue increase to £45.5 million in the UK, driven by enduring demand for its subscription-based, plastic-free hygiene products.Simultaneously, the shift toward zero-waste and compostable packaging solutions has emerged as a crucial differentiator as manufacturers strive to remove single-use plastics from their supply chains. This trend is marked by a broad transition from polyethylene film wraps to paper-based or biodegradable substitutes, ensuring the entire product lifecycle remains environmentally benign. Major industry leaders are swiftly re-engineering their packaging strategies to align with these circular economy standards; for instance, Kimberly-Clark stated in its '2024 Sustainability Report' in June 2025 that 99.4 percent of its packaging materials were designed to be recyclable, reusable, or compostable, indicating a firm commitment to packaging circularity.

Key Players Profiled in the Organic Tissue Paper Market

- Greenline Paper

- Shanghai Xuanjie Trade

- Zhangzhou Lianan Paper

- Weroca Kartonagen

- Seventh Generation

- Bum Boosa

- Pure Planet Club

- Green Forest

Report Scope

In this report, the Global Organic Tissue Paper Market has been segmented into the following categories:Organic Tissue Paper Market, by Type:

- Bamboo Pulp

- Recycled Pulp

- Straw Pulp

- Mix Wood Pulp

- Others

Organic Tissue Paper Market, by Distribution Channel:

- Offline

- Online

Organic Tissue Paper Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Organic Tissue Paper Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Organic Tissue Paper market report include:- Greenline Paper

- Shanghai Xuanjie Trade

- Zhangzhou Lianan Paper

- Weroca Kartonagen

- Seventh Generation

- Bum Boosa

- Pure Planet Club

- Green Forest

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2026 |

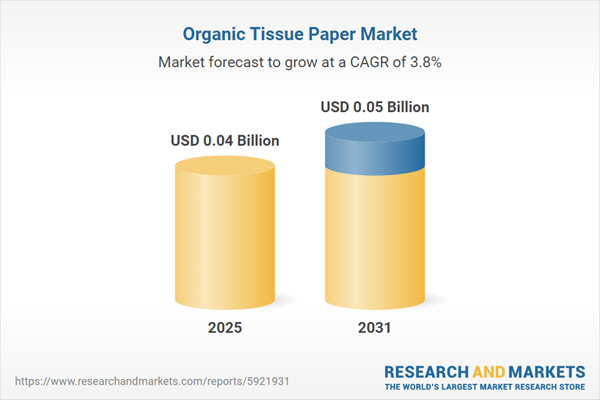

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 0.04 Billion |

| Forecasted Market Value ( USD | $ 0.05 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |