The market for organic personal care products is expanding across the country as consumer tastes for organic goods change. Since tube packing enables precise and efficient dispensing and organic products are often sold in small amounts and at a premium price, it will continue to be in demand.

Changes in the price of raw materials including plastics, aluminum, and other materials is projected to make it difficult for expansion of the industry. Most plastic materials are made of polyethylene, polyethylene terephthalate, and polypropylene. The price of these polymers is closely tied to the volatile price of crude oil. Furthermore, strict government regulations regarding the use of plastic and its disposal as well as growing environmental concerns is anticipated to restrain the market growth over the course of the forecast period.

Market opportunities for innovative materials including bioplastics, aluminum, and other materials are projected to arise as plastic usage is further restricted. Plastics like polylactic acid are produced using majority of renewable energy sources, including maize starch, sugarcane, chips, tapioca roots, and other starches. Polylactic acid is the bioplastic that is currently most widely utilized. Biodegradability, recyclability, and non-toxicity are the main factors affecting the global demand for bioplastics.

The packaging tube market is segmented on the basis of product type, material and application, and region. Based on product type, the market is divided into squeeze & collapsible and twist. Based on material, the market is divided into plastic, and aluminum. Based on application, the market is divided into food & beverage, personal & oral care, pharmaceutical and cleaning products. Region wise, the global packaging tube market analysis is conducted across North America, Europe, Asia-Pacific, and LAMEA.

The major players profiled in the packaging tube market include Albea S. A., Amcor Limited, Essel Propack Limited, Sonoco Products Company, World Wide Packaging Inc., Montebello Packaging Inc., VisiPak, Inc., Intrapac International Corporation, CCL Industries Inc., and Hoffman Neopack AG. Major companies in the market have adopted acquisition, partnership and business expansion as their key developmental strategies to offer better products and services to customers in the packaging tube market.

KEY BENEFITS FOR STAKEHOLDERS

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the packaging tube market analysis from 2021 to 2031 to identify the prevailing packaging tube market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the packaging tube market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global packaging tube market trends, key players, market segments, application areas, and market growth strategies.

Key Market Segments

By Product

- Plastic

- Aluminum

By Type

- Twist

- Squeeze and Collapsible

By Application

- Food and beverage

- Personal and Oral Care

- Pharmaceutical

- Cleaning products

By Region

- North America

- U. S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

Key Market Players

- Hoffman Neopack AG

- Montebello Packaging Inc.

- VisiPak, Inc.

- Precision Concepts International

- Amcor Plc

- Essel propack Limited

- World Wide Packaging Inc.

- Albea Group S. A. S.

- Sonoco Products Company

- CCL Industries Inc.

Please note:

- Online Access price format is valid for 60 days access. Printing is not enabled.

- PDF Single and Enterprise price formats enable printing.

Table of Contents

CHAPTER 1: INTRODUCTION1.1. Report description

1.2. Key market segments

1.3. Key benefits to the stakeholders

1.4. Research Methodology

1.4.1. Secondary research

1.4.2. Primary research

1.4.3. Analyst tools and models

CHAPTER 2: EXECUTIVE SUMMARY

2.1. Key findings of the study

2.2. CXO Perspective

CHAPTER 3: MARKET OVERVIEW

3.1. Market definition and scope

3.2. Key findings

3.2.1. Top investment pockets

3.3. Porter’s five forces analysis

3.4. Market dynamics

3.4.1. Drivers

3.4.1.1. Rapid urbanization in emerging economies

3.4.1.2. Growth in construction sector

3.4.2. Restraints

3.4.2.1. Decrease in new construction activities and saturation in developed nations

3.4.3. Opportunities

3.4.3.1. Increase in government and private investments in the infrastructure sector

3.5. COVID-19 Impact Analysis on the market

CHAPTER 4: PACKAGING TUBE MARKET, BY TYPE

4.1 Overview

4.1.1 Market size and forecast

4.2. Squeeze and Collapsible

4.2.1 Key market trends, growth factors and opportunities

4.2.2 Market size and forecast, by region

4.2.3 Market share analysis by country

4.3. Twist

4.3.1 Key market trends, growth factors and opportunities

4.3.2 Market size and forecast, by region

4.3.3 Market share analysis by country

CHAPTER 5: PACKAGING TUBE MARKET, BY PRODUCT

5.1 Overview

5.1.1 Market size and forecast

5.2. Plastic

5.2.1 Key market trends, growth factors and opportunities

5.2.2 Market size and forecast, by region

5.2.3 Market share analysis by country

5.3. Aluminum

5.3.1 Key market trends, growth factors and opportunities

5.3.2 Market size and forecast, by region

5.3.3 Market share analysis by country

CHAPTER 6: PACKAGING TUBE MARKET, BY APPLICATION

6.1 Overview

6.1.1 Market size and forecast

6.2. Food and beverage

6.2.1 Key market trends, growth factors and opportunities

6.2.2 Market size and forecast, by region

6.2.3 Market share analysis by country

6.3. Personal and Oral Care

6.3.1 Key market trends, growth factors and opportunities

6.3.2 Market size and forecast, by region

6.3.3 Market share analysis by country

6.4. Pharmaceutical

6.4.1 Key market trends, growth factors and opportunities

6.4.2 Market size and forecast, by region

6.4.3 Market share analysis by country

6.5. Cleaning products

6.5.1 Key market trends, growth factors and opportunities

6.5.2 Market size and forecast, by region

6.5.3 Market share analysis by country

CHAPTER 7: PACKAGING TUBE MARKET, BY REGION

7.1 Overview

7.1.1 Market size and forecast

7.2 North America

7.2.1 Key trends and opportunities

7.2.2 North America Market size and forecast, by Type

7.2.3 North America Market size and forecast, by Product

7.2.4 North America Market size and forecast, by Application

7.2.5 North America Market size and forecast, by country

7.2.5.1 U. S.

7.2.5.1.1 Key market trends, growth factors and opportunities

7.2.5.1.2 Market size and forecast, by Type

7.2.5.1.3 Market size and forecast, by Product

7.2.5.1.4 Market size and forecast, by Application

7.2.5.2 Canada

7.2.5.2.1 Key market trends, growth factors and opportunities

7.2.5.2.2 Market size and forecast, by Type

7.2.5.2.3 Market size and forecast, by Product

7.2.5.2.4 Market size and forecast, by Application

7.2.5.3 Mexico

7.2.5.3.1 Key market trends, growth factors and opportunities

7.2.5.3.2 Market size and forecast, by Type

7.2.5.3.3 Market size and forecast, by Product

7.2.5.3.4 Market size and forecast, by Application

7.3 Europe

7.3.1 Key trends and opportunities

7.3.2 Europe Market size and forecast, by Type

7.3.3 Europe Market size and forecast, by Product

7.3.4 Europe Market size and forecast, by Application

7.3.5 Europe Market size and forecast, by country

7.3.5.1 Germany

7.3.5.1.1 Key market trends, growth factors and opportunities

7.3.5.1.2 Market size and forecast, by Type

7.3.5.1.3 Market size and forecast, by Product

7.3.5.1.4 Market size and forecast, by Application

7.3.5.2 UK

7.3.5.2.1 Key market trends, growth factors and opportunities

7.3.5.2.2 Market size and forecast, by Type

7.3.5.2.3 Market size and forecast, by Product

7.3.5.2.4 Market size and forecast, by Application

7.3.5.3 France

7.3.5.3.1 Key market trends, growth factors and opportunities

7.3.5.3.2 Market size and forecast, by Type

7.3.5.3.3 Market size and forecast, by Product

7.3.5.3.4 Market size and forecast, by Application

7.3.5.4 Italy

7.3.5.4.1 Key market trends, growth factors and opportunities

7.3.5.4.2 Market size and forecast, by Type

7.3.5.4.3 Market size and forecast, by Product

7.3.5.4.4 Market size and forecast, by Application

7.3.5.5 Rest of Europe

7.3.5.5.1 Key market trends, growth factors and opportunities

7.3.5.5.2 Market size and forecast, by Type

7.3.5.5.3 Market size and forecast, by Product

7.3.5.5.4 Market size and forecast, by Application

7.4 Asia-Pacific

7.4.1 Key trends and opportunities

7.4.2 Asia-Pacific Market size and forecast, by Type

7.4.3 Asia-Pacific Market size and forecast, by Product

7.4.4 Asia-Pacific Market size and forecast, by Application

7.4.5 Asia-Pacific Market size and forecast, by country

7.4.5.1 China

7.4.5.1.1 Key market trends, growth factors and opportunities

7.4.5.1.2 Market size and forecast, by Type

7.4.5.1.3 Market size and forecast, by Product

7.4.5.1.4 Market size and forecast, by Application

7.4.5.2 Japan

7.4.5.2.1 Key market trends, growth factors and opportunities

7.4.5.2.2 Market size and forecast, by Type

7.4.5.2.3 Market size and forecast, by Product

7.4.5.2.4 Market size and forecast, by Application

7.4.5.3 South Korea

7.4.5.3.1 Key market trends, growth factors and opportunities

7.4.5.3.2 Market size and forecast, by Type

7.4.5.3.3 Market size and forecast, by Product

7.4.5.3.4 Market size and forecast, by Application

7.4.5.4 India

7.4.5.4.1 Key market trends, growth factors and opportunities

7.4.5.4.2 Market size and forecast, by Type

7.4.5.4.3 Market size and forecast, by Product

7.4.5.4.4 Market size and forecast, by Application

7.4.5.5 Rest of Asia-Pacific

7.4.5.5.1 Key market trends, growth factors and opportunities

7.4.5.5.2 Market size and forecast, by Type

7.4.5.5.3 Market size and forecast, by Product

7.4.5.5.4 Market size and forecast, by Application

7.5 LAMEA

7.5.1 Key trends and opportunities

7.5.2 LAMEA Market size and forecast, by Type

7.5.3 LAMEA Market size and forecast, by Product

7.5.4 LAMEA Market size and forecast, by Application

7.5.5 LAMEA Market size and forecast, by country

7.5.5.1 Latin America

7.5.5.1.1 Key market trends, growth factors and opportunities

7.5.5.1.2 Market size and forecast, by Type

7.5.5.1.3 Market size and forecast, by Product

7.5.5.1.4 Market size and forecast, by Application

7.5.5.2 Middle East

7.5.5.2.1 Key market trends, growth factors and opportunities

7.5.5.2.2 Market size and forecast, by Type

7.5.5.2.3 Market size and forecast, by Product

7.5.5.2.4 Market size and forecast, by Application

7.5.5.3 Africa

7.5.5.3.1 Key market trends, growth factors and opportunities

7.5.5.3.2 Market size and forecast, by Type

7.5.5.3.3 Market size and forecast, by Product

7.5.5.3.4 Market size and forecast, by Application

CHAPTER 8: COMPANY LANDSCAPE

8.1. Introduction

8.2. Top winning strategies

8.3. Product Mapping of Top 10 Players

8.4. Competitive Dashboard

8.5. Competitive Heatmap

8.5. Top player positioning, 2021

CHAPTER 9: COMPANY PROFILES

9.1 Hoffman Neopack AG

9.1.1 Company overview

9.1.2 Key Executives

9.1.3 Company snapshot

9.1.4 Operating business segments

9.1.5 Product portfolio

9.1.6 Business performance

9.1.7 Key strategic moves and developments

9.2 Montebello Packaging Inc.

9.2.1 Company overview

9.2.2 Key Executives

9.2.3 Company snapshot

9.2.4 Operating business segments

9.2.5 Product portfolio

9.2.6 Business performance

9.2.7 Key strategic moves and developments

9.3 VisiPak, Inc.

9.3.1 Company overview

9.3.2 Key Executives

9.3.3 Company snapshot

9.3.4 Operating business segments

9.3.5 Product portfolio

9.3.6 Business performance

9.3.7 Key strategic moves and developments

9.4 Precision Concepts International

9.4.1 Company overview

9.4.2 Key Executives

9.4.3 Company snapshot

9.4.4 Operating business segments

9.4.5 Product portfolio

9.4.6 Business performance

9.4.7 Key strategic moves and developments

9.5 Amcor Plc

9.5.1 Company overview

9.5.2 Key Executives

9.5.3 Company snapshot

9.5.4 Operating business segments

9.5.5 Product portfolio

9.5.6 Business performance

9.5.7 Key strategic moves and developments

9.6 Essel propack Limited

9.6.1 Company overview

9.6.2 Key Executives

9.6.3 Company snapshot

9.6.4 Operating business segments

9.6.5 Product portfolio

9.6.6 Business performance

9.6.7 Key strategic moves and developments

9.7 World Wide Packaging Inc.

9.7.1 Company overview

9.7.2 Key Executives

9.7.3 Company snapshot

9.7.4 Operating business segments

9.7.5 Product portfolio

9.7.6 Business performance

9.7.7 Key strategic moves and developments

9.8 Albea Group S. A. S.

9.8.1 Company overview

9.8.2 Key Executives

9.8.3 Company snapshot

9.8.4 Operating business segments

9.8.5 Product portfolio

9.8.6 Business performance

9.8.7 Key strategic moves and developments

9.9 Sonoco Products Company

9.9.1 Company overview

9.9.2 Key Executives

9.9.3 Company snapshot

9.9.4 Operating business segments

9.9.5 Product portfolio

9.9.6 Business performance

9.9.7 Key strategic moves and developments

9.10 CCL Industries Inc.

9.10.1 Company overview

9.10.2 Key Executives

9.10.3 Company snapshot

9.10.4 Operating business segments

9.10.5 Product portfolio

9.10.6 Business performance

9.10.7 Key strategic moves and developments

Executive Summary

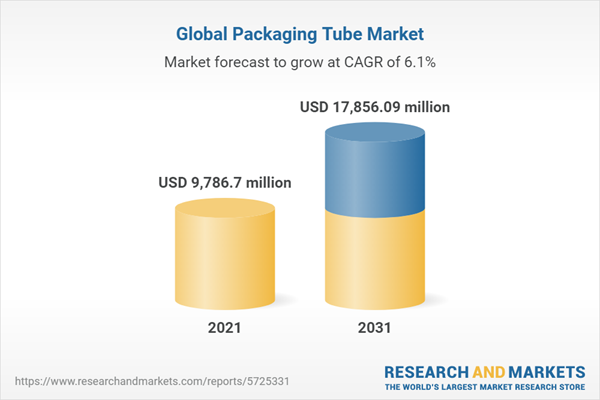

According to this report, titled, 'Packaging Tube Market,' the packaging tube market was valued at $9.8 billion in 2021, and is estimated to reach $17.9 billion by 2031, growing at a CAGR of 6.1% from 2022 to 2031.The Packaging Tube Market is likely to experience a significant growth rate of 6.1% from 2022-2031 owing to increasing market demand from packaging sector.

The collapsible tube known as a packaging tube, or squeeze tube is used to package viscous substances like toothpaste, artist's paint, glue, caulk, and ointments. A tube is essentially a cylindrical, hollow object made of plastic, paperboard, aluminum, or another metal with a round or oval form. A packaging tube is essentially a cylindrical, hollow object made of plastic, paperboard, aluminum, or another metal with a round or oval form. The packaging tube also known as squeeze tube, or collapsible tube and is used for viscous substances such as toothpaste, artist's paint, glue, caulk, and ointments.

Rise in consumer awareness of personal health and wellness is projected to be a major factor in the expansion of the personal care sector. A packaging tube is essentially a cylindrical, hollow object made of plastic, paperboard, aluminum, or another metal with a round or oval form. The packaging tube also known as squeeze tube, or collapsible tube and is used for viscous substances such as toothpaste, artist's paint, glue, caulk, and ointments.

There is a growth in the consumption of personal care products, due to growing self-consciousness, which will lead to an increase in the demand for tube packaging. The U.S. is one of the key markets in the global beauty and personal care industry because of consumer purchasing power. Moreover, increased demand for these types of packaging from application industries like cosmetics & personal care, healthcare, and food is predicted to be the main driver of the market. Due to consumer spending power, the U.S. is one of the major markets in the worldwide beauty and personal care sector. In addition, rise in demand for these types of packaging from application industries like cosmetics & personal care, healthcare, and food is anticipated to be the primary driver of the market.

The market for organic personal care products is expanding across the country as consumer tastes for organic goods change. Since tube packing enables precise and efficient dispensing and organic products are often sold in small amounts and at a premium price, it will continue to be in demand.

Changes in the price of raw materials including plastics, Aluminum, and other materials is projected to make it difficult for expansion of the industry. Most plastic materials are made of polyethylene, polyethylene terephthalate, and polypropylene. The price of these polymers is closely tied to the volatile price of crude oil. Furthermore, strict government regulations regarding the use of plastic and its disposal as well as growing environmental concerns is anticipated to restrain the market growth over the course of the forecast period.

The global packaging tube market is segmented on the basis of product type, material and application, and region. Based on product type, the market is divided into squeeze & collapsible and twist. Based on material, the market is divided into plastic, and aluminum. Based on application, the market is divided into food & beverage, personal & oral care, pharmaceutical and cleaning products.

Region wise, the global packaging tube market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

Key Market Insights

By type, the squeeze &collapsible segment was the highest revenue contributor to the market and is estimated to reach $13,786.1 million by 2031, with a CAGR of 5.8%.By product, the plastic segment dominated the global market. However, the aluminum segment is expected to be the fastest-growing segment with a CAGR of 7.1% during the forecast period.

Based on application, the personal & oral care segment was the highest revenue contributor to the market with a CAGR of 5.7% during the forecast period.

Based on region, Asia-Pacific garnered the largest revenue share in the market and is anticipated to grow at the highest CAGR of 6.9% during the forecast period

Companies Mentioned

- Hoffman Neopack AG

- Montebello Packaging Inc.

- Visipak, Inc.

- Precision Concepts International

- Amcor PLC

- Essel Propack Limited

- World Wide Packaging Inc.

- Albea Group SAS.

- Sonoco Products Company

- Ccl Industries Inc.

Methodology

The analyst offers exhaustive research and analysis based on a wide variety of factual inputs, which largely include interviews with industry participants, reliable statistics, and regional intelligence. The in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. The primary research efforts include reaching out participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions.

They are also in professional corporate relations with various companies that allow them greater flexibility for reaching out to industry participants and commentators for interviews and discussions.

They also refer to a broad array of industry sources for their secondary research, which typically include; however, not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic news articles and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecast

Furthermore, the accuracy of the data will be analyzed and validated by conducting additional primaries with various industry experts and KOLs. They also provide robust post-sales support to clients.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 210 |

| Published | November 2022 |

| Forecast Period | 2021 - 2031 |

| Estimated Market Value ( USD | $ 9786.7 million |

| Forecasted Market Value ( USD | $ 17856.09 million |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |