Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The global paints market is a dynamic and multifaceted industry with a wide range of applications, from enhancing aesthetics to providing protection and functionality. It plays a pivotal role in various sectors, including construction, automotive, industrial, and consumer goods. In this comprehensive exploration of the key drivers behind the global paints market, we delve into the factors propelling its growth and influencing its dynamics.Construction Boom and Infrastructure Development

One of the primary drivers of the global paints market is the ongoing construction boom and infrastructure development in both emerging and developed economies. The demand for architectural paints, including interior and exterior coatings, primers, and wood finishes, has surged in residential, commercial, and institutional buildings. This is attributed to urbanization, population growth, and increased investment in construction projects. Developing countries are witnessing rapid urbanization, leading to a surge in residential and commercial construction, while developed nations are renovating and upgrading existing infrastructure.Industrial Expansion and Maintenance

The industrial sector is another significant driver of the paints market. Industries such as manufacturing, aerospace, automotive, and marine rely on industrial coatings to protect their equipment and structures from corrosion, wear and tear, and harsh environmental conditions. As global industrialization continues, there is a continuous need for protective coatings, specialty coatings, and high-performance coatings to ensure the longevity and performance of industrial assets.Automotive Manufacturing and Refinishing

The automotive industry represents a substantial portion of the paints market. Automotive paints are critical for providing both aesthetics and protection to vehicles. As the global automotive manufacturing and sales volumes increase, so does the demand for automotive coatings. Furthermore, the automotive refinishing segment is driven by the need for paint repairs, restorations, and customization, bolstering the market's growth.Consumer Preferences and Decorative Coatings

Consumer preferences for interior and exterior aesthetics significantly influence the decorative paints segment. Homeowners and businesses seek paints that enhance the visual appeal of their properties. This has led to a growing demand for a wide range of decorative coatings, including paints with different finishes (matte, gloss, satin), textures, and colors. Consumer trends in home improvement, renovation, and customization drive innovation and product development in this segment.Global economic trends, including GDP growth, inflation, and trade dynamics, can significantly impact the paints market. A robust economy generally supports increased construction and industrial activity, driving up demand for coatings. Conversely, economic downturns may lead to reduced construction and renovation activities, affecting paint sales. Government-led infrastructure projects and investments in public facilities drive the demand for paints and coatings. These projects encompass the construction and renovation of bridges, roads, airports, public buildings, and utilities. Government contracts and initiatives can be significant revenue sources for paint manufacturers. Advancements in application techniques, including paint spraying, automated coating systems, and robotic painting, have improved efficiency and quality in various industries. The adoption of advanced application technologies enhances the consumption of paints and coatings in manufacturing and construction.

In conclusion, the global paints market is a dynamic and evolving industry driven by various factors, including construction activity, industrialization, technological advancements, sustainability, and consumer preferences. Understanding these drivers is essential for businesses operating in the paints market to adapt, innovate, and capitalize on opportunities for growth in this ever-changing landscape.

Key Market Challenges

Changing Consumer Preferences

Increasing environmental concerns have led to stricter regulations on the use of hazardous chemicals in paints and coatings. Paint manufacturers must comply with these regulations, which often require the development of low-VOC (volatile organic compound) and eco-friendly paint formulations. Adhering to sustainability practices while maintaining product performance can be challenging. The paints industry relies on various raw materials, including pigments, solvents, resins, and additives. Fluctuations in the prices of these raw materials can affect production costs and profit margins. Economic, geopolitical, and supply chain factors can contribute to price volatility. While technological innovations drive market growth, they also pose challenges. Rapid advancements in coatings technology require paint manufacturers to continuously invest in research and development to keep pace with competitors. Failing to adopt new technologies may lead to product obsolescence. The global paints market is highly competitive, with numerous local and international players. Intense competition can result in pricing pressures and reduced profit margins. Companies must differentiate themselves through product innovation, quality, and marketing strategies to maintain a competitive edge. Events such as natural disasters, pandemics (e.g., COVID-19), and geopolitical tensions can disrupt global supply chains, affecting the availability of raw materials and causing production delays. Companies must develop resilient supply chain strategies to mitigate these risks. Consumer preferences for paint colors, finishes, and textures are subject to trends and shifts. Manufacturers must monitor and adapt to these preferences to ensure that their product offerings remain attractive to consumers.Key Market Trends

Technological Advancements and Product Innovation

Technological advancements and innovations in the paints industry are crucial drivers. Manufacturers are continually developing new formulations, coatings, and application techniques to meet evolving customer demands and regulatory requirements. Innovations include low-VOC (volatile organic compound) and eco-friendly paints, self-cleaning coatings, nanotechnology-based paints, and smart coatings with functional properties like heat resistance, anti-microbial capabilities, and fire resistance.Regulatory Compliance and Environmental Concerns

Increasing environmental concerns and stringent regulations on the use of hazardous chemicals have shifted the industry towards eco-friendly and low-VOC paints. Governments worldwide are implementing regulations to reduce the emission of harmful pollutants, making it imperative for paint manufacturers to comply with eco-friendly and sustainable practices. This has led to the development of paints with reduced environmental impact, aligning with global sustainability goals.Architectural Trends and Design Innovation

Architectural and design trends drive demand for specialty and customized coatings. As architects and designers incorporate unique textures, colors, and effects into their projects, manufacturers respond with a diverse range of specialty coatings. Textured paints, metallic finishes, and paints with special effects (e.g., glitter or glow-in-the-dark) are examples of products catering to these trends.Emerging Markets and Urbanization

Emerging markets, characterized by rapid urbanization and a rising middle class, are significant growth drivers for the paints market. As more people move to urban areas, there is a higher demand for residential and commercial construction, boosting the need for architectural coatings. Additionally, as incomes rise, consumers in these markets have more disposable income to spend on home improvements and renovation projects.Real Estate Investment and Housing Demand

Real estate investment plays a vital role in the paints market. Fluctuations in real estate markets can influence the demand for paints and coatings. When the real estate market is robust, there is an increased need for paints for both new construction and home renovations. Conversely, economic downturns can impact housing demand and, consequently, paint sales.E-commerce and Digital Marketing

The advent of e-commerce and digital marketing channels has transformed the way consumers purchase paints and coatings. Online platforms offer a convenient way to explore product options, read reviews, and make informed choices. This digital shift has expanded market reach and accessibility for both consumers and manufacturers, allowing them to showcase products and offer customized solutions. Sustainability is a driving force in the paints market. Green building practices, which focus on energy efficiency and environmental impact reduction, have led to the adoption of eco-friendly and low-VOC paints. Building certifications such as LEED (Leadership in Energy and Environmental Design) incentivize the use of sustainable coatings, promoting their growth. Industry consolidation through mergers and acquisitions is a noteworthy driver. Large paint manufacturers acquire smaller companies to expand their product portfolios, access new markets, and achieve cost efficiencies. These strategic moves enable companies to offer a comprehensive range of coatings and enhance their competitive position in the market.Segmental Insights

Technology Insights

Solvent-borne paints are the most traditional type of paint. They are made with a solvent, such as mineral spirits or xylene, which helps to dissolve the resins and pigments in the paint. Solvent-borne paints are easy to apply and have a good drying time. However, they also have high VOC emissions, which can contribute to air pollution. Water-borne paints are made with water instead of a solvent. This makes them less harmful to the environment and safer to use. Water-borne paints also have a lower odor than solvent-borne paints. However, they can be more difficult to apply and have a longer drying time.Application Insights

The architectural segment is expected to dominate the market during the forecast period, due to the increasing demand for decorative paints and coatings in residential and commercial buildings. There is an increasing demand for decorative paints and coatings in residential and commercial buildings. This is due to the growing trend of homeowners and businesses wanting to improve the appearance of their properties.Regional Insights

The Asia Pacific region has established itself as the leader in the Global Paints Market with a significant revenue share in 2022. Asia Pacific is expected to dominate the market during the forecast period, due to the rapid growth of the construction and automotive industries in the region. The construction industry in Asia Pacific is growing rapidly, which is driving the demand for paints. The automotive industry in Asia Pacific is also growing rapidly, which is driving the demand for paints. Governments in Asia Pacific are increasingly regulating the use of paints and coatings. This is to protect the environment and human health. Water-borne paints are often preferred over solvent-borne paints because they have lower VOC emissions.Key Market Players

- AkzoNobel

- PPG Industries

- Sherwin-Williams

- Nippon Paint

- Axalta Coating Systems

- Asian Paints

- Valspar (Sherwin-Williams)

- RPM International Inc

- Jotun

- Benjamin Moore

Report Scope

In this report, the Global Paints Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global Paints Market, by Technology:

- Solvent-Born

- Water-Borne

- Powder Coatings

Global Paints Market, by Application:

- Architectural

- Industrial

- Automotive

Global Paints Market, by Region:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Paints Market.Available Customizations

The following customization option is available based on your specific needs: Detailed analysis and profiling of additional market players (up to five).This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- AkzoNobel

- PPG Industries

- Sherwin-Williams

- Nippon Paint

- Axalta Coating Systems

- Asian Paints

- Valspar (Sherwin-Williams)

- RPM International Inc.

- Jotun

- Benjamin Moore

Table Information

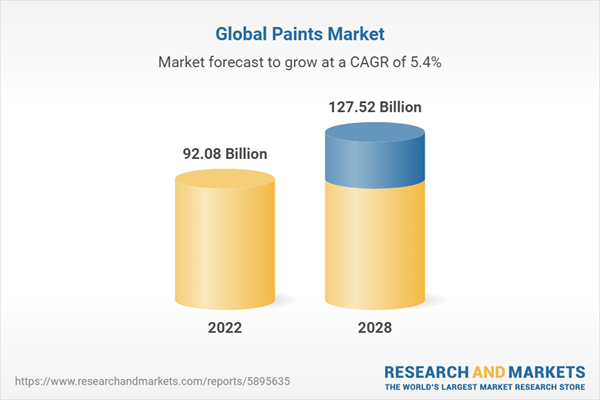

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | October 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 92.08 Billion |

| Forecasted Market Value ( USD | $ 127.52 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |