Speak directly to the analyst to clarify any post sales queries you may have.

A precise introduction to the shifting roles of inert ingredients in formulation strategy driven by performance, compliance, and sustainability dynamics

The inert ingredient landscape in crop protection and vegetation management is undergoing substantive evolution driven by reformulation demands, regulatory scrutiny, and sustainability commitments. Recent years have seen formulators reassess component selection to improve efficacy, reduce environmental persistence, and respond to changing regulatory requirements for disclosure and safety assessment. At the same time, advances in adjuvant chemistry and novel carrier systems have opened pathways for performance gains without proportional increases in active ingredient loadings.Consequently, R&D teams and procurement leaders face greater complexity when balancing performance, cost, and compliance. Supply-chain resilience has become integral to procurement strategy as demand for specialty solvents, surfactants, and bio-based alternatives grows. Regulatory developments have intensified the need for transparent documentation of inert ingredient sources and impurity profiles. Stakeholders from agrochemical manufacturers to contract formulators are adapting by investing in formulation science, engaging earlier with raw-material suppliers, and expanding analytical capabilities to validate ingredient quality.

Looking ahead, the introduction of greener chemistries and stricter end-use testing will elevate the role of inert components in product differentiation. This shift places a premium on cross-disciplinary collaboration among chemists, toxicologists, and regulatory specialists to ensure new formulations meet performance expectations while satisfying evolving compliance frameworks.

How reformulation priorities, sustainability drivers, and analytical advances are fundamentally changing procurement, innovation, and compliance approaches for inert ingredients

The past several years have witnessed transformative shifts that are redefining how inert ingredients are selected, regulated, and commercialized. One major inflection is the move from considering inerts as mere carriers toward recognizing their synergistic contributions to efficacy, drift reduction, and application safety. This reclassification prompts companies to invest in targeted adjuvant design and to explore multifunctional molecules that deliver both formulation stability and enhanced delivery of active substances.Meanwhile, sustainability imperatives are catalyzing adoption of bio-based and low-toxicity options, prompting suppliers to scale fermentation and plant-extraction platforms. As a result, procurement strategies are becoming more diversified, with organizations balancing synthetic economies of scale against supplier risk and environmental credentials. Additionally, regulatory scrutiny on impurities and endocrine-active contaminants has driven greater transparency and upstream testing, thereby influencing sourcing decisions and supplier qualification criteria.

Technological integration is also reshaping the landscape; predictive formulation modeling, high-throughput screening, and advanced analytical methods are accelerating innovation cycles. Together, these shifts are creating an environment in which cross-functional coordination, data-driven decision-making, and supplier partnerships become core competitive differentiators for market participants.

Assessing the cascading effects of recent United States tariff measures on sourcing, manufacturing footprint decisions, and formulation supply-chain resilience

United States tariff measures implemented in recent policy cycles have exerted multidimensional effects across inert ingredient supply chains and commercial strategies. Tariffs on certain raw materials and intermediates have increased landed costs for many formulators, prompting a reassessment of sourcing footprints and encouraging nearshoring or supplier diversification to mitigate exposure. In response, procurement teams have accelerated supplier qualification programs and expanded the use of long-term contracts to stabilize input availability and pricing predictability.Beyond cost pressures, tariff-induced shifts have influenced supply-chain architecture by making some imported specialty solvents and surfactant precursors less competitive compared with domestically produced or regionally sourced alternatives. This has led to localized investment in manufacturing capacity, often accompanied by technical partnerships between formulators and material producers to adapt chemistries to regional feedstocks. At the same time, tariffs have intensified interest in alternative formulation pathways that reduce reliance on affected inputs, such as reformulating to utilize lower-cost carriers or adopting adjuvants with broader supplier bases.

Ultimately, tariffs have emphasized the need for scenario planning and supply-chain stress testing. Forward-looking companies are integrating tariff-risk assessments into product development timelines and are building stronger traceability frameworks to ensure continuity of supply while maintaining adherence to regulatory requirements and performance specifications.

Comprehensive segmentation insights linking inert ingredient types, formulation formats, sourcing origins, application contexts, and end-user priorities to strategic decision-making

Deep segmentation analysis reveals nuanced demand drivers and technical constraints across the inert ingredient ecosystem. When examining the market based on type of inert ingredient, there is increased focus on adjuvants & synergists for efficacy enhancement, carriers tailored for specific active payloads, emulsifiers & dispersants that stabilize complex mixtures, propellants designed for precise delivery, solvents that balance solvency with safety, stabilizers & preservatives that extend shelf-life, surfactants that control wettability and spread, and thickeners & antifoaming agents that tune application characteristics. In relation to formulation type, distinctions among gas-based inert ingredients, liquid inert ingredients, and solid inert ingredients dictate handling protocols, storage infrastructure, and field application methods, which in turn influence supplier selection and logistics planning.Source considerations separate bio-based / natural materials from synthetic alternatives, creating divergent procurement strategies: bio-based inputs often present sustainability claims and unique impurity profiles, whereas synthetic feedstocks frequently offer consistency and established supply chains. Application segmentation highlights varied performance priorities across agriculture, forestry, home & garden, and industrial vegetation management; within agriculture, specific requirements for fungicides, herbicides, and insecticides drive bespoke formulation architectures and safety testing pathways. Finally, end-user segmentation across agrochemical manufacturers, commercial applicators, contract formulators, and government & regulatory bodies underscores differing procurement cadences and compliance expectations, with manufacturers emphasizing scale and quality assurance, applicators focusing on ease of use and drift control, contract formulators prioritizing raw-material consistency, and regulatory stakeholders driving transparency and traceability standards.

Taken together, these segmentation lenses inform targeted R&D, tailored commercialization strategies, and differentiated supplier engagement models that reflect the unique constraints and value drivers of each cohort.

Regional dynamics and regulatory nuances across the Americas, Europe Middle East & Africa, and Asia-Pacific that determine sourcing, compliance, and commercialization strategies

Regional distinctions are shaping both supply dynamics and regulatory approaches to inert ingredients. In the Americas, developments in agricultural practice, regulatory emphasis on disclosure, and investments in domestic chemical manufacturing influence sourcing and R&D priorities; regional value chains favor scalability and streamlined logistics while also contending with varied state-level regulatory interpretations. Europe, Middle East & Africa exhibits heterogeneous regulatory landscapes, with parts of Europe advancing stringent hazard and exposure assessments that drive substitution toward lower-risk chemistries, while markets in the Middle East & Africa balance agricultural modernization needs with limited local manufacturing capacity, creating opportunities for strategic import strategies and regional distribution partnerships.Asia-Pacific remains a hub for both manufacturing scale and innovation in bio-based feedstocks, supported by growing investment in fermentation and extraction technologies. In this region, formulators frequently align with local raw-material producers to optimize cost structures and to meet accelerating demand for crop protection solutions. Across all regions, cross-border regulatory harmonization remains a work in progress, which compels multinational organizations to develop region-specific compliance dossiers, analytical protocols, and supplier qualification frameworks. Consequently, companies that synchronize product development timelines with regional regulatory cycles and cultivate robust local partnerships gain a comparative advantage in speed-to-market and operational resilience.

How capability-led competition, strategic partnerships, and quality-driven differentiation among companies are reshaping commercialization and sourcing dynamics for inert ingredients

Competitive dynamics among companies working with inert ingredients are increasingly defined by capabilities rather than solely by scale. Firms investing in advanced formulation science, quality management systems, and regulatory affairs expertise are better positioned to capture demand for differentiated adjuvants and low-risk carriers. Strategic collaborations between material producers and applicator-focused service providers are emerging as an effective route to accelerate adoption of novel inerts, enabling field validation and end-user education that reduce deployment friction.Concurrent consolidation activity among suppliers of specialty solvents, surfactants, and bio-based feedstocks has shifted negotiation power and elevated the importance of long-term sourcing agreements. At the same time, nimble contract formulators and niche innovators are leveraging agility to trial novel chemistries and to service segments with specialized performance requirements. Intellectual property around proprietary adjuvant systems and encapsulation technologies is becoming a key asset, informing partnership and licensing strategies.

Finally, companies that prioritize transparency in supply chains, invest in impurity testing, and proactively engage with regulators generate higher trust among buyers and authorities. Those that fail to demonstrate rigorous quality control and traceability risk losing contracts as end-users and governments demand clearer evidence of safety and environmental performance.

Actionable, integrated recommendations for leaders to align formulation innovation, supplier diversification, and regulatory readiness to secure competitive advantage

Industry leaders should adopt integrated strategies that align product innovation with supply-chain resilience and regulatory foresight. First, prioritizing multifunctional inerts that deliver both stability and efficacy will create differentiation while reducing overall formulation complexity. Investing in collaborative development agreements with material suppliers and contract formulators can shorten validation cycles and support rapid scale-up. Moreover, enhancing analytical and impurity-profiling capabilities across the value chain will mitigate regulatory risk and facilitate smoother market entry across jurisdictions.Next, diversifying supplier bases and developing regional sourcing options will lower exposure to tariff shocks and logistics disruptions. Leaders should incorporate scenario-based procurement planning that includes nearshoring where strategically viable and flexible inventory management to handle episodic supply interruptions. Concurrently, companies should cultivate clear sustainability claims supported by traceable supply chains and third-party verification, as these credentials increasingly influence buyer decisions.

Finally, strengthening cross-functional teams that integrate R&D, regulatory affairs, and commercial strategy will ensure that new formulations meet end-user needs and comply with evolving standards. By embedding these practices, organizations can accelerate innovation, reduce compliance friction, and secure enduring competitive advantages.

A rigorous mixed-methods research methodology combining primary stakeholder interviews, technical literature synthesis, and triangulated validation to underpin actionable insights

The research approach combined structured primary engagement with a broad review of technical literature and regulatory materials to create a robust evidence base. Primary inputs included in-depth interviews with formulation scientists, procurement specialists, contract formulators, and regulatory affairs experts, enabling the capture of operational realities and emergent practice. Secondary research drew on peer-reviewed journals, patent filings, regulatory guidance documents, and technical white papers to contextualize trends and validate technical assertions.Data synthesis employed triangulation to reconcile divergent viewpoints and to ensure findings are supported by multiple independent sources. Qualitative insights were augmented by case study analysis and scenario mapping to illustrate practical implications for sourcing, formulation, and compliance. Where appropriate, sensitivity analyses were used to test the resilience of strategic recommendations under varying supply-chain and regulatory conditions. Finally, limitations were acknowledged, including potential regional heterogeneity in regulatory interpretation and the proprietary nature of some formulation innovations, and these were addressed by emphasizing transparency in assumptions and by suggesting areas for targeted follow-up research.

Closing synthesis that positions inert ingredient strategies at the intersection of formulation science, supply-chain resilience, and regulatory alignment

In conclusion, inert ingredients are rapidly transitioning from background input to strategic enabler within the broader crop protection and vegetation management ecosystem. This evolution is driven by the need for improved performance, increased regulatory transparency, and stronger environmental credentials. Formulators, suppliers, and end-users that adapt by investing in multifunctional chemistries, analytical capability, and resilient sourcing practices will capture disproportionate value.Regulatory dynamics and trade policy developments will continue to influence supplier selection and product design, making early engagement with regulatory authorities and proactive impurity profiling critical. Additionally, regional manufacturing investments and the rise of bio-based feedstocks present both opportunities and technical challenges that require collaborative problem-solving and flexible commercialization approaches. Ultimately, firms that integrate formulation science with supply-chain strategy and regulatory foresight will be positioned to deliver safer, more effective, and more sustainable solutions to the market.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Pesticide Inert Ingredients Market

Companies Mentioned

The key companies profiled in this Pesticide Inert Ingredients market report include:- Ashland Global Holdings Inc

- BASF SE

- Brenntag AG

- Clariant AG

- Croda International Plc

- Dow Chemical Company

- Eastman Chemical Company

- Evonik Industries AG

- Exxon Mobil Corporation

- Helm AG

- Huntsman Corporation

- Ineos Group Holdings SA

- Kao Corporation

- LyondellBasell Industries

- Nouryon

- Sasol Limited

- Shell plc

- Solvay SA

- Stepan Company

- Univar Solutions Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | January 2026 |

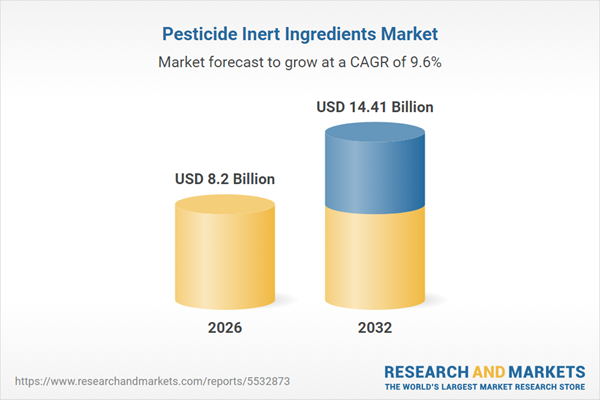

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 8.2 Billion |

| Forecasted Market Value ( USD | $ 14.41 Billion |

| Compound Annual Growth Rate | 9.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |