Speak directly to the analyst to clarify any post sales queries you may have.

Navigating the evolving landscape of photochromic lens innovations by exploring key drivers emerging trends insights to empower industry leadership

Photochromic lenses have emerged as a cornerstone of adaptive eyewear solutions, seamlessly adjusting to changing light conditions while addressing user comfort and ocular health. This technology, which dynamically shifts lens tint in response to ultraviolet exposure, has matured significantly since its inception, balancing responsiveness, durability and aesthetic appeal. Innovations in material science and coating technologies have expanded the application horizon far beyond traditional eyeglass designs, touching sports, safety and specialized optical instruments.Consumer interest in photochromic lenses is being driven by heightened awareness of UV-related eye damage and the desire for a consolidated eyewear experience. As outdoor lifestyles become more prevalent and digital screen usage continues to climb, the demand for versatile lenses that transition effortlessly from bright environments to low-light settings is intensifying. At the same time, fashion sensibilities and the pursuit of lightweight, impact-resistant eyewear are reshaping specifications for lens performance and design.

For industry leaders, gaining a holistic understanding of these converging factors is critical. By examining technological advancements, shifting consumer preferences and regulatory frameworks in tandem, stakeholders can develop informed strategies that anticipate market trajectories. This introduction sets the stage for a comprehensive exploration of pivotal market shifts, policy impacts, segmentation dynamics and regional patterns that will define the next phase of growth for the photochromic lenses sector.

Uncovering the paradigm shifts transforming consumer expectations supply chain dynamics and technological innovation in photochromic lens development

The trajectory of the photochromic lenses market is being reshaped by fundamental shifts that extend well beyond incremental improvements in light-reactive coatings. Rapid developments in digital manufacturing and advanced polymers are enabling greater precision in color transition thresholds, while automation is driving down production variability. Concurrently, collaboration between optical manufacturers and research institutions has accelerated the refinement of lens chemistries, yielding materials that darken and clear with unprecedented speed and consistency.Moreover, the rise of sustainability as a core consumer demand is compelling brands to adopt eco-friendly substrates and streamlined manufacturing processes. This movement is complemented by the integration of IoT and smart eyewear capabilities, allowing photochromic lenses to be paired with sensors that monitor UV exposure and adjust performance parameters in real time. As a result, end users are no longer passive recipients of light-adaptive eyewear; they are engaged participants in a feedback loop that shapes product evolution.

Supply chain dynamics are also in flux, driven by globalization pressures and the need for resilient sourcing strategies. Partnerships with specialized chemical suppliers and precision coating facilities are becoming strategic imperatives. In this context, early adopters of modular production systems are gaining a competitive advantage by rapidly scaling new formulations to market. These transformative shifts underscore the necessity for companies to remain agile, aligning innovation roadmaps with emergent consumer expectations and operational imperatives.

Assessing the effects of 2025 United States tariffs on material costs manufacturing efficiency and global competitiveness in photochromic lens supply chains

Anticipated tariff changes in the United States as of 2025 are poised to exert a significant influence on the photochromic lens landscape. Higher import duties on specialized glass and high-grade polymers will directly elevate material costs, prompting manufacturers to reassess sourcing strategies and explore alternative suppliers in less-affected regions. Early analysis suggests that these cost pressures could ripple across the value chain, from coating laboratories to final assembly operations, challenging profit margins at each stage.In response, some producers are already negotiating long-term agreements with domestic chemical refiners to secure volume discounts and mitigate volatility. Others are accelerating investments in in-mass integration technologies, which reduce dependence on imported coatings by embedding photochromic compounds directly into thermoplastic matrices. This shift toward vertically integrated facilities not only curbs exposure to tariff fluctuations but also shortens lead times, enhancing responsiveness to customer orders.

Global competitiveness will hinge on the ability to absorb or transfer additional costs without eroding brand equity. Strategic alliances with logistics providers and consolidated shipping routes are being evaluated to optimize cross-border transport expenses. Furthermore, manufacturers that invest in advanced analytics to simulate cost pass-through scenarios will be best positioned to make agile pricing decisions and maintain market share. As the industry braces for the full impact of 2025 tariffs, proactive mitigation strategies will define winners and losers in the evolving photochromic lens arena.

Insights on segmentation of type materials technology applications and sales channels revealing strategic pathways in photochromic lens markets

Segmentation analysis reveals that differences in base material versus coated photochromic lenses yield distinct technical and commercial implications. Lenses formed entirely from a photochromic substrate exhibit uniform darkening characteristics, whereas coated designs allow for targeted performance enhancements and aesthetic customization. Within these material-based divisions, the choice between glass lenses renowned for optical clarity and weightier durability versus plastic and polycarbonate alternatives emphasizes trade-offs between scratch resistance, lightweight comfort and cost efficiency.Technology segmentation further differentiates market dynamics. Imbibing and trans bonding processes deliver exceptional molecular integration of photochromic molecules, while in-mass techniques offer streamlined production at scale. Innovations in UV and visible light activation chemistry have broadened application windows, enabling lenses to adapt not only to sunshine but also to indoor lighting transitions. These technical pathways have, in turn, shaped the way that eyeglasses, goggles, safety glasses and sports eyewear are engineered to meet specific performance requirements.

The channel through which these products reach end users also drives strategic decisions. Offline distribution remains anchored in optical retail stores and supermarket chains, where personalized fitting and immediate purchase foster consumer confidence. Conversely, the rise of online direct-to-consumer platforms and eCommerce marketplaces demands robust digital engagement tactics, from virtual try-on tools to dynamic pricing algorithms. Understanding these segmentation frameworks is essential to crafting market entry approaches that resonate with diverse buyer preferences.

Analyzing regional diversity in the Americas Europe Middle East Africa and Asia Pacific to inform targeted approaches in the photochromic lens market

Regional market patterns for photochromic lenses demonstrate notable diversity in consumer behavior and regulatory environments. In the Americas, robust outdoor recreation cultures and stringent UV protection standards drive premium positioning of high-performance lens offerings. Manufacturers focusing on outdoor sports and lifestyle segments in North and South America have prioritized rapid-switching capabilities and enhanced impact resistance to align with active use cases.Europe Middle East and Africa present a complex tapestry of market maturity and policy frameworks. In Western Europe, comprehensive safety regulations have propelled adoption in occupational contexts such as construction and laboratory eyewear, whereas emerging markets in Eastern Europe, the Gulf and North Africa are increasingly receptive to fashion-forward photochromic sunglasses. Across this vast region, partnerships with local distributors and targeted marketing campaigns have proven critical to overcoming logistical challenges and cultural diversity.

Asia Pacific continues to emerge as the fastest-growing regional bloc, fueled by expanding professional eyewear markets in Japan and South Korea alongside rising consumer spending in China India and Southeast Asia. Rapid urbanization and escalating awareness of digital eye strain have spurred demand for lenses that balance indoor-outdoor adaptability. As a result, manufacturers prioritizing regional R&D hubs and localized supply networks are well positioned to capture the unique needs of these diverse markets.

Highlighting competitive positioning partnerships and innovation benchmarks from leading photochromic lens manufacturers driving industry evolution

Leading manufacturers are leveraging a mix of organic innovation and strategic alliances to maintain competitive positioning in the photochromic lenses domain. Pioneers in advanced coating technologies have forged partnerships with specialty chemical firms to develop proprietary photochromic compounds that achieve faster darkening speeds without sacrificing long-term stability. Meanwhile, emerging players are differentiating through modular production platforms, allowing them to customize lens performance profiles to specific customer segments on demand.Intellectual property portfolios have become crucial indicators of future leadership. Companies that have secured patents around in-mass embedding processes and next-generation polymer blends are safeguarding their innovation pipelines, thereby creating high-barrier entry points for new entrants. At the same time, mergers and acquisitions activity is intensifying, as market leaders absorb vertical specialists to integrate critical steps such as substrate extrusion and coating application.

Collaboration extends beyond the laboratory, with several firms engaging in consortiums to standardize testing protocols and safety benchmarks. These cooperative efforts not only streamline regulatory compliance across multiple jurisdictions but also build collective credibility for photochromic solutions. Companies embracing such synergies are simultaneously mitigating risk and positioning themselves as influential stakeholders in setting industry norms.

Proposing targeted action plans and strategic initiatives to optimize innovation collaboration and market penetration in the photochromic lens sector

Industry leaders should prioritize investment in advanced material research to differentiate their product portfolios. By allocating resources toward next-generation polymers and coating chemistries that enhance transition speed and durability, organizations can meet rising consumer expectations while commanding premium pricing. Integrating sustainability goals into R&D roadmaps will further resonate with environmentally conscious end users and regulators alike.Digital transformation efforts must extend beyond eCommerce presence to encompass the full customer journey. Implementing virtual try-on technologies, AI-driven personalization engines and seamless omnichannel fulfillment processes can strengthen brand loyalty and foster repeat purchases. In parallel, supply chain resilience should be bolstered through diversified supplier networks, dual-sourcing agreements and scenario-based risk modeling to mitigate the effects of geopolitical disruptions and tariff fluctuations.

Strategic collaborations with adjacent industries offer additional growth pathways. Partnerships with wearable electronics companies can enable the development of smart photochromic lenses that respond to biometric data, while alliances with outdoor recreation brands can unlock co-branded product lines. By adopting a proactive stance on ecosystem integration and cross-sector innovation, stakeholders can position themselves at the vanguard of an evolving competitive landscape.

Outlining rigorous research design data collection analytical frameworks and validation processes underpinning the study of photochromic lens markets

This study employs a multi-tiered research design combining extensive secondary research, primary interviews with industry experts and rigorous data triangulation. Secondary sources include regulatory filings, patent databases and peer-reviewed journals, which provide context on technological advances and policy developments. Primary research encompasses in-depth discussions with R&D managers, supply chain executives and end-user focus groups to validate findings and uncover nuanced market dynamics.Analytical frameworks incorporate both qualitative and quantitative methodologies. SWOT and Porter’s Five Forces analyses offer structured insights into competitive and environmental factors. Concurrently, cross-segment correlation models and sensitivity analyses quantify the relationships between pricing shifts, adoption rates and regional growth indicators. These tools enable scenario planning and the assessment of strategic investments under varying market conditions.

Validation is achieved through an iterative review process involving external advisors and internal subject matter experts. This ensures that conclusions and recommendations are grounded in both empirical evidence and practical industry perspectives. The resulting research integrity provides stakeholders with a high degree of confidence in the report’s strategic implications and operational guidance.

Synthesizing key findings strategic insights and market imperatives to guide future advancements and investments in the photochromic lens domain

The photochromic lens sector stands at a pivotal juncture, where technological breakthroughs and shifting market forces converge to redefine both performance expectations and strategic imperatives. From molecular-level innovations that enhance transition speed to evolving regional demand profiles shaped by regulatory landscapes and consumer lifestyles, the myriad factors at play underscore the complexity of future growth pathways.Successful market participants will be those who integrate segmentation insights, tariff mitigation strategies and regional adaptability into cohesive business models. By synthesizing cross-cutting trends-from sustainability demands to digital engagement and supply chain resilience-companies can craft differentiated offerings that align with evolving user requirements and geopolitical realities.

Looking ahead, the interplay between material science, digital augmentation and collaborative ecosystems will determine the next frontier of product excellence. Organizations that embrace agile methodologies, foster open innovation partnerships and maintain an unwavering focus on user-centric design will be best equipped to capitalize on emerging opportunities and navigate the challenges of a dynamic photochromic lens landscape.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Photochromic Lenses Market

Companies Mentioned

The key companies profiled in this Photochromic Lenses market report include:- BBGR Optical

- Carl Zeiss AG

- Chemiglas Corporation

- Corning Incorporated

- Essilor International S.A.

- Foshan Nanhai Liangyu Hardware And Plastic Co., Ltd.

- GKB Optic Technologies Pvt. Ltd.

- Hoya Corporation

- Jiangsu Aogang Optical Glasses Co. Ltd

- JIANGSU HONGCHEN OPTICAL CO,LTD.

- Mitsui Chemicals, Inc.

- Nikon Corporation

- Rodenstock GMBH

- S.T International Ophthalmic Lenses

- Sundex Optical CO.,LTD.

- Tokai Optical Co., Ltd.

- Vision Dynamics, LLC

- VISION EASE

- WENZHOU TOUCH OPTICAL CO., LTD

- Younger Optics, Inc.

Table Information

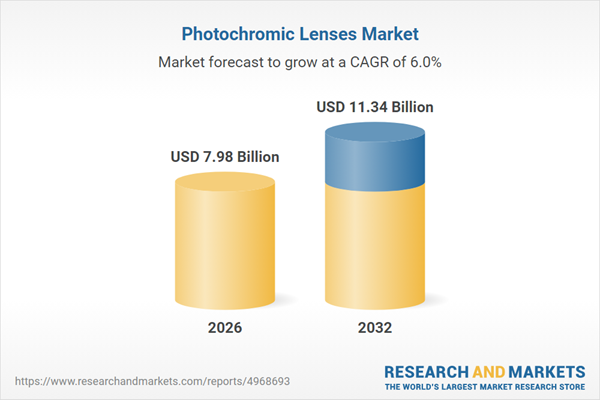

| Report Attribute | Details |

|---|---|

| No. of Pages | 199 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 7.98 Billion |

| Forecasted Market Value ( USD | $ 11.34 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |