Global Plug-in Hybrid Electric Vehicles (PHEV) Market - Key Trends and Drivers Summarized

Driving the Future: The Rise of Plug-In Hybrid Electric Vehicles (PHEV)

Plug-in Hybrid Electric Vehicles (PHEVs) represent a significant advancement in automotive technology, combining the benefits of traditional internal combustion engines (ICE) with electric propulsion. Unlike conventional hybrids, PHEVs feature larger batteries that can be recharged by plugging into an external power source. This design allows PHEVs to operate in all-electric mode for a certain distance, typically between 20 to 50 miles, before switching to the gasoline engine. The dual powertrain provides flexibility, enabling drivers to utilize electric power for short trips and gasoline for longer journeys, thus enhancing fuel efficiency and reducing emissions. The integration of regenerative braking, which captures and stores energy typically lost during braking, further boosts the vehicle's efficiency. This innovative combination of technologies offers a practical solution for reducing dependence on fossil fuels while maintaining the convenience of conventional vehicles.How Are PHEVs Impacting the Automotive Industry?

PHEVs are making a considerable impact on the automotive industry by bridging the gap between traditional gasoline-powered vehicles and fully electric vehicles (EVs). For consumers, PHEVs offer a compelling proposition: the ability to significantly reduce fuel consumption and emissions without sacrificing the range and flexibility associated with ICE vehicles. This appeal is driving demand in both the consumer and commercial sectors, as businesses seek to lower operational costs and meet sustainability targets. Automakers are responding by expanding their PHEV offerings, investing in research and development to enhance battery technology, improve energy efficiency, and extend electric-only range. Furthermore, PHEVs are contributing to the gradual shift in automotive manufacturing towards electrification, encouraging the development of charging infrastructure and the integration of smart grid technologies. As a result, PHEVs are playing a critical role in the transition towards more sustainable transportation solutions.What Are the Current Trends in PHEV Technology?

The evolution of PHEV technology is marked by several key trends that are shaping its future. One prominent trend is the continuous improvement in battery technology, with advancements in lithium-ion and solid-state batteries leading to higher energy densities, faster charging times, and longer lifespans. These enhancements are crucial for increasing the electric-only range of PHEVs, making them more appealing to a broader audience. Another significant trend is the integration of advanced driver-assistance systems (ADAS) and connectivity features, which enhance safety, convenience, and the overall driving experience. Automakers are also focusing on reducing the weight of PHEVs through the use of lightweight materials and innovative design, further improving their efficiency. Additionally, the expansion of charging infrastructure, including fast-charging stations and home charging solutions, is facilitating the adoption of PHEVs by making it more convenient for users to recharge their vehicles. These trends highlight the dynamic nature of PHEV technology and its potential to revolutionize the automotive landscape.What Factors Are Driving the Growth in the PHEV Market?

The growth in the PHEV market is driven by several factors, reflecting the increasing demand for sustainable and efficient transportation solutions. Rising environmental awareness and stringent emissions regulations are major drivers, as governments and consumers seek to reduce carbon footprints and combat climate change. Financial incentives, such as tax credits and rebates for PHEV buyers, are also boosting market growth by making these vehicles more affordable. Technological advancements in battery and vehicle technology are enhancing the performance and appeal of PHEVs, encouraging wider adoption. The expansion of charging infrastructure is making it easier for consumers to use PHEVs for daily commuting and long-distance travel. Furthermore, the increasing availability of diverse PHEV models across different vehicle segments is attracting a broader customer base. These factors collectively ensure robust growth in the PHEV market, underscoring the critical role of these vehicles in the future of sustainable transportation.Report Scope

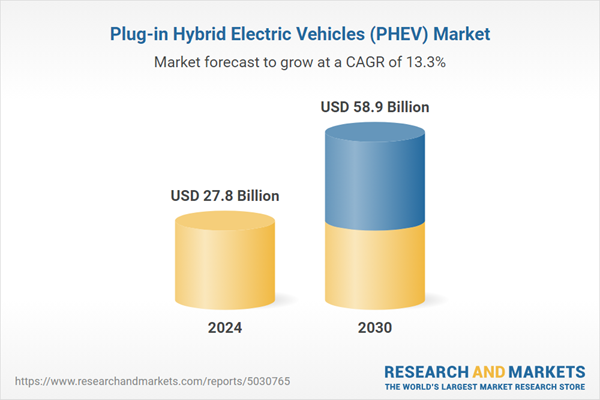

The report analyzes the Plug-in Hybrid Electric Vehicles (PHEV) market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Power Source (Stored Electricity, On-Board Electric Generator); Powertrain (Series Hybrid, Parallel Hybrid, Combined Hybrid).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Stored Electricity Power Source segment, which is expected to reach US$48 Billion by 2030 with a CAGR of 14%. The On-Board Electric Generator Power Source segment is also set to grow at 10.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.6 Billion in 2024, and China, forecasted to grow at an impressive 12.2% CAGR to reach $8.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Plug-in Hybrid Electric Vehicles (PHEV) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Plug-in Hybrid Electric Vehicles (PHEV) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Plug-in Hybrid Electric Vehicles (PHEV) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Artesyn Embedded Power, Electric Transportation Engineering, Honda Motor Co., Ltd., Mitsubishi Motors Corporation, Schill GmbH & Co. KG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Plug-in Hybrid Electric Vehicles (PHEV) market report include:

- Artesyn Embedded Power

- Electric Transportation Engineering

- Honda Motor Co., Ltd.

- Mitsubishi Motors Corporation

- Schill GmbH & Co. KG

- Toyota Motor Corporation

- Volkswagen AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Artesyn Embedded Power

- Electric Transportation Engineering

- Honda Motor Co., Ltd.

- Mitsubishi Motors Corporation

- Schill GmbH & Co. KG

- Toyota Motor Corporation

- Volkswagen AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 176 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 27.8 Billion |

| Forecasted Market Value ( USD | $ 58.9 Billion |

| Compound Annual Growth Rate | 13.3% |

| Regions Covered | Global |