Speak directly to the analyst to clarify any post sales queries you may have.

Comprehensive introduction to polycarbonate resin fundamentals, technological priorities, and strategic forces shaping supply chains and downstream adoption across industries

Polycarbonate resin remains a cornerstone material across multiple industrial ecosystems due to its combination of toughness, optical clarity, thermal stability, and formability. This introduction frames the material’s role not only as a preferred engineering polymer but also as an enabler of design freedom in industries from automotive glazing to medical components. Over recent years advances in formulation and processing have expanded application envelopes, bringing polycarbonate into increasingly performance-sensitive assemblies.As end users demand lighter, more durable, and recyclable solutions, polycarbonate resin producers and converters have had to adapt along the entire value chain. R&D priorities have shifted toward higher heat deflection temperature formulations, enhanced flame retardancy without heavy halogen loadings, and improved impact retention after ageing. Concurrently, downstream fabricators are optimizing manufacturing footprints to reconcile tighter lead times and evolving regulatory constraints.

This introduction establishes the foundational technical attributes, downstream pressures, and strategic tensions that inform the rest of this executive summary. It sets the stage for an evidence-based examination of supply and demand dynamics, structural shifts driven by policy and technology, and the practical implications for manufacturers, compounders, and major end-use sectors.

How technological advances, sustainability mandates, and regulatory dynamics are jointly reshaping polycarbonate resin value chains and competitive positioning globally

The polycarbonate landscape is undergoing transformative shifts driven by technology, policy, and changing end-use requirements. Electrification and lightweighting initiatives in transportation accelerate demand for high-performance, flame-retardant grades that maintain impact resistance under thermal stress. At the same time, sustainability imperatives are elevating circularity as a commercial priority, prompting investment in recyclate-compatible blends and design-for-recycling initiatives that reduce lifecycle environmental footprints.Processing innovations are also redefining cost and performance trade-offs. Enhanced extrusion and injection molding techniques, along with improvements in pellet and granule formulations, are increasing throughput while tightening tolerances. Digitalization across production lines supports predictive maintenance and energy optimization, reducing operational variability and improving yield. These shifts feed into supply chain restructuring: producers are evaluating nearshoring to mitigate logistical risk, while converters reassess inventory models to balance service levels against capital efficiency.

Regulatory landscapes and global trade dynamics compound these trends. Stricter chemical and product regulations push formulators toward non-halogenated flame retardants and more transparent supply chains. In response, strategic partnerships between resin manufacturers, specialty additives suppliers, and major OEMs are becoming common, fostering co-development of application-specific solutions. The cumulative effect is a more integrated industrial ecosystem where material innovation, regulatory compliance, and operational agility determine competitive advantage.

Assessment of 2025 tariff-driven trade shifts and their operational impacts on sourcing strategies, nearshoring incentives, and supplier risk management across polycarbonate resin supply chains

The introduction of tariffs and trade policy measures in 2025 has imposed a new set of constraints and incentives that reverberate through polycarbonate supply chains and procurement strategies. Tariffs affect landed costs, influence sourcing patterns, and can accelerate strategic decisions such as supplier diversification, regionalization of production, and contractual hedging. Firms that previously relied on geographically distant suppliers have reassessed total landed cost models, factoring in increased duty exposure alongside transportation and inventory carrying costs.In practical terms, the policy landscape has amplified the appeal of near-market manufacturing and localized compounding to reduce exposure to import duties and logistical volatility. Some integrated producers have accelerated capacity investments within tariff-favored jurisdictions to preserve margin and service continuity. At the same time, downstream converters face the challenge of absorbing or passing through higher input costs in price-sensitive segments, necessitating negotiated cost-sharing arrangements and tighter collaboration on value engineering.

Tariff-induced uncertainty has also affected investment timelines and supplier qualification processes. Procurement teams are extending supplier evaluations to include trade-compliance risk assessments and scenario-based modeling of tariff impacts. This has strengthened the role of trade and customs expertise within commercial negotiations and encouraged multi-sourcing strategies that emphasize flexibility. Over time, these adjustments are likely to alter global trade flows, reshape regional supply bases, and influence where incremental resin and downstream capacity emerge.

Actionable segmentation insights linking product forms, formulation categories, manufacturing methods, and end-use applications to guide R&D prioritization and capacity deployment decisions

A nuanced understanding of segmentation is essential for aligning product development and commercial strategies with end-use demands. Based on Product Type, the market is studied across Blends, Films, Granules or Pellets, Moldings, and Sheets, and each form factor carries distinct implications for processing efficiency, scrap rates, and finished-part performance. Films and sheets, for instance, are central to optical and glazing applications where surface finish and clarity dominate, while granules and pellets are the currency of high-throughput molding and extrusion operations.Based on Category, the market is studied across Flame-Retardant, General-Purpose Polycarbonate, High-Performance, and Polycarbonate, which frames the spectrum from commodity resins to specialty grades engineered for high-temperature or chemically aggressive environments. High-performance and flame-retardant grades command distinct formulation expertise and certification pathways, particularly for electrical and medical applications where regulatory compliance is rigorous. General-purpose resins remain attractive for cost-sensitive consumer goods where basic mechanical properties suffice.

Based on Manufacturing Process, the market is studied across Blow Molding, Extrusion, and Injection Molding, and each process imposes unique material property priorities and quality control regimes. Injection molding emphasizes melt-flow control and thermal stability to deliver intricate geometries with consistent dimensional fidelity. Extrusion demands rheological stability across long runs, while blow molding prioritizes material toughness and elongation behavior. Based on Application, the market is studied across Automotive, Construction, Consumer Goods & ElectroniCS, Electrical & Electronics, Medical, Optical Media, Packaging, and Paints & Coatings, and these application clusters define performance thresholds, certification requirements, and volume cadence. Automotive and electrical applications often drive investment into flame-retardant and high-performance grades, whereas packaging and consumer electronics weigh cost, appearance, and recyclability more heavily.

Bringing these segmentation lenses together enables more accurate prioritization of R&D, capacity allocation, and go-to-market plays. For example, a strategic focus on granules optimized for extrusion can yield competitive advantage in construction profiles, while investment in high-performance pellet blends can unlock opportunities with OEMs targeting electrified vehicle components. Segmentation-driven roadmaps also inform certification investments and supply agreements tailored to end-use regulatory regimes.

Regional demand drivers and supply-side configurations across the Americas, Europe, Middle East & Africa, and Asia-Pacific that determine production priorities and trade strategies

Regional dynamics continue to exert first-order influence on production strategy, trade flows, and end-use demand patterns. In the Americas, industrial demand is anchored by transportation, infrastructure refurbishment, and a sizable consumer goods sector; proximity to automotive OEMs and diversified downstream converters supports rapid uptake of value-added resin grades. Policy responses and incentives for domestic manufacturing in this region are shaping decisions to expand compounding and reclamation capacity closer to major demand centers.Europe, Middle East & Africa exhibits a composite set of drivers where stringent regulatory frameworks and advanced recycling targets elevate demand for recyclable and low-emission formulations. Europe’s emphasis on circular economy policies and chemical regulation is accelerating adoption of certified recyclates and non-halogenated flame retardants. Meanwhile, manufacturers in the Middle East are leveraging petrochemical feedstock advantages to build export-oriented capacity, and Africa’s nascent converting industry presents opportunities for localized growth supported by targeted infrastructure investments.

Asia-Pacific remains a pivotal hub for both production scale and innovation, with established polymer manufacturing clusters and a vast base of downstream converters across electronics, automotive, and consumer goods. Rapid urbanization and infrastructure projects in select markets drive steady demand for construction-grade sheets and profiles, while regional supply chains continue to evolve in response to logistics optimization and tariff environments. Across regions, cross-border partnerships and regional supply strategies are becoming the norm as companies balance cost, service, and regulatory exposure.

Key corporate strategies in polycarbonate resin production and compounding focused on differentiation, vertical integration, and sustainability-driven innovation to secure competitive leadership

Competitive dynamics among producers and converters are converging around a set of strategic plays: portfolio differentiation through specialty grades, vertical integration to secure feedstock and distribution, and collaborative innovation with OEMs and additive suppliers. Leading firms are investing selectively in advanced compounding technologies that enable tailor-made formulations for demanding applications such as high-temperature automotive components and medical devices that require biocompatibility and sterilization resistance.Strategic partnerships and joint development agreements are increasingly common as companies seek to combine material expertise with application know-how. These alliances accelerate time-to-qualification for new grades, reduce technical risk for converters, and create preferential sourcing relationships for OEMs. At the same time, consolidation and capacity rationalization in certain regions are creating scale advantages for well-capitalized players, enabling them to offer broader product portfolios and integrated logistics solutions.

Innovation pipelines are also shifting toward sustainability metrics and regulatory compliance, with leading companies prioritizing non-halogenated flame retardant systems, improved recyclability, and low-emission processing. Companies that can transparently demonstrate compliance across supply chains and provide validated recyclate streams will find favored positions among buyers with aggressive environmental commitments. In short, corporate strategies that combine technological differentiation, supply security, and demonstrable sustainability performance will define competitive leadership.

Practical recommendations for producers and converters to strengthen resilience, accelerate sustainable product adoption, and optimize sourcing under evolving trade and regulatory pressures

Industry leaders must align strategy with operational resilience, regulatory foresight, and application-driven innovation to capture emerging opportunities. Prioritize investment in formulation platforms that balance performance with recyclability, enabling conversion partners to meet increasingly stringent environmental requirements while maintaining mechanical integrity for demanding applications. This dual focus accelerates adoption among OEMs that have explicit circularity goals and provides a defensible commercial proposition in regulated sectors.Reconfigure supply chain footprints to incorporate nearshoring options and multi-source contracts that explicitly account for tariff exposure and logistical disruptions. Strengthen commercial contracting by embedding trade compliance clauses, flexible volume commitments, and collaborative cost-sharing mechanisms that allow for transparent distribution of duty and freight impacts. Simultaneously, expand technical service capabilities so that converters receive prescriptive process settings and validation support, reducing qualification time for new grades.

Embed sustainability credentials into product development roadmaps by validating recyclate performance and investing in third-party certification where applicable. Foster co-development agreements with key customers to align material specifications with application testing protocols, thereby shortening time-to-adoption and reducing iteration cycles. Finally, accelerate digitalization initiatives across production and sales functions to improve demand forecasting, reduce waste, and support scenario-based planning under evolving trade and regulatory landscapes.

Transparent, multi-method research methodology combining primary interviews, technical validation, trade-flow analysis, and scenario testing to ensure robust and actionable insights

This research synthesis integrates qualitative and quantitative inputs to construct an evidence-based perspective on polycarbonate resin dynamics. Primary inputs include structured interviews with technical leaders at converting operations, procurement executives across major end-use sectors, and regulatory experts responsible for compliance pathways. These conversations were triangulated against plant-level operational metrics and public regulatory documents to ensure alignment between claimed performance attributes and real-world processing behavior.Secondary research drew on published technical literature, industry standards, and production process manuals to validate material property assumptions and to map common failure modes across manufacturing processes such as extrusion and injection molding. Trade-flow analysis combined customs-cleared shipment data with logistics lead-time metrics to assess probable rerouting and nearshoring responses to tariff changes. Scenario analysis was employed to test the sensitivity of supply configurations to duty changes, transportation disruptions, and regulatory shifts.

Where possible, findings were cross-validated through multiple independent sources to reduce single-source bias and to surface robust patterns. The methodology emphasizes transparency in assumptions, reproducibility of analytical steps, and scenario-driven recommendations that enable decision-makers to adapt to policy and technological contingencies.

Concluding synthesis of technological, regulatory, and supply-chain imperatives that define success pathways for polycarbonate resin stakeholders seeking long-term competitive advantage

In conclusion, polycarbonate resin is at an inflection point where technological advancement, sustainability imperatives, and trade-policy shifts jointly determine competitive outcomes. Producers and converters that invest in specialty formulations, robust supply chain architectures, and validated recyclate streams will be well positioned to meet evolving end-user requirements. The interplay of nearshoring incentives and tariff exposures will reshape trade flows and create opportunities for localized capacity expansions in favorable jurisdictions.Strategic alignment across R&D, procurement, and commercial functions is essential to convert technical innovations into commercial success. Firms that establish collaborative pathways with OEMs and additive suppliers, and that integrate regulatory foresight into product roadmaps, will shorten qualification cycles and reduce adoption friction. Equally important is the ability to operationalize sustainability commitments through validated recyclability and transparent supply-chain certification.

Ultimately, success in this environment will be defined by agility: the capacity to respond to policy shifts, to prioritize investments that yield both performance and environmental benefits, and to maintain resilient sourcing structures. Those who combine technical leadership with disciplined supply-chain strategy will capture disproportionate value as applications evolve and regulatory pressure continues to increase.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Polycarbonate Resin Market

Companies Mentioned

- Asahi Kasei Corporation

- Avient corporation

- BASF SE

- Bayer AG

- Chi Mei Corporation

- Covestro

- Covestro AG

- Dow Chemical Company

- Ensinger GmbH

- Evonik Industries

- Formosa Chemicals & Fibre Corporation

- Huntsman Corporation

- Idemitsu Kosan

- Lanxess AG

- LG Corporation

- Lotte Corporation

- Miller Waste Mills

- Mitsubishi Chemical Group Corporation

- SABIC by Aramco Chemicals Company

- Samyang Holdings Corporation

- Shenzhen Samtion Chemical Co., Ltd

- Sumitomo Chemical Co., Ltd.

- Teijin Limited

- Toray Industries, Inc.

- Trinseo S.A.

Table Information

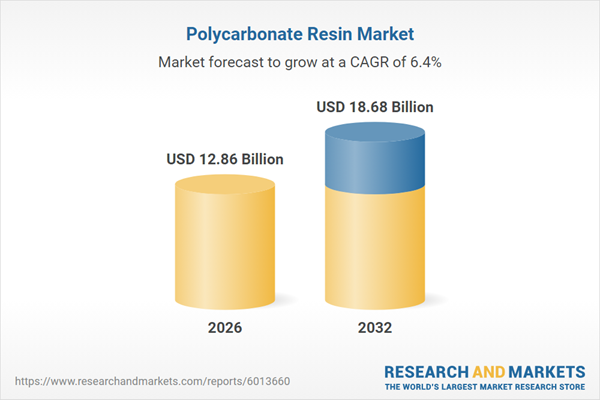

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 12.86 Billion |

| Forecasted Market Value ( USD | $ 18.68 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |