Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market faces a substantial obstacle in the form of strict regulatory frameworks regarding plastic waste management and environmental sustainability. These regulations compel manufacturers to commit significant resources toward alternative technologies and compliance, which often pressures profit margins. According to European Bioplastics, the global production capacity for bioplastics was approximately 2.47 million tonnes in 2024. This data illustrates a gradual industry shift toward sustainable alternatives, yet the elevated costs involved in this transition continue to hinder mass adoption.

Market Drivers

The rapid growth of the e-commerce sector acts as a major catalyst for the Global Polymers Market, driving the need for flexible packaging solutions. As online retail continues to surge, manufacturers are increasingly depending on lightweight, durable polymer films like polyethylene and polypropylene to minimize shipping expenses while ensuring product safety during transit. This trend is especially prominent in the consumer goods and food sectors, where advanced barrier films are critical for extending shelf life and preventing spoilage. According to the Flexible Packaging Association's "FPA Reflects on 2024" report from February 2025, the U.S. flexible packaging industry generated estimated annual sales of $42.9 billion in 2023, a figure largely driven by these shifting logistical and consumer demands.Concurrently, the automotive industry's increasing adoption of lightweight materials to support electric vehicle (EV) architectures and enhance fuel efficiency is further propelling market expansion. Automakers are actively substituting traditional metal parts with high-performance polymer composites to reduce vehicle weight, a factor essential for maximizing the range of battery-powered models. The American Chemistry Council's "Chemistry and Automobiles 2025" report, released in September 2025, notes that a mid-size electric vehicle now utilizes roughly 45% more polymer composites and plastics than a comparable internal combustion engine vehicle. This structural shift is underpinned by strong manufacturing figures; for example, the National Bureau of Statistics of China reported that the country's plastic products output reached 18.35 million tons in the first quarter of 2025, indicating sustained industrial demand.

Market Challenges

Strict regulatory frameworks regarding environmental sustainability and plastic waste management present a significant constraint on the expansion of the Global Polymers Market. Adhering to these rigorous policies requires substantial capital investment in circular economy processes and waste reduction technologies. Consequently, manufacturers are forced to divert financial resources away from market development and capacity expansion to satisfy mandatory ecological standards. This reallocation of funds increases operational expenditures and squeezes profit margins, complicating efforts to maintain competitive pricing while absorbing the high costs associated with the transition to sustainability.The tangible financial impact of these pressures is evident in recent industry performance metrics, which highlight the strain on established markets. According to Plastics Europe, the European plastics sector reported a turnover of €398 billion for the fiscal year 2024 in 2025, marking a sharp 13% decline compared to 2022 levels. This contraction underscores how the combined burden of regulatory compliance and the substantial expense of implementing alternative production methods are actively eroding market value and impeding financial growth.

Market Trends

The market is being reshaped by the integration of circular economy principles, with stakeholders increasingly adopting advanced recycling technologies to address the limitations of mechanical processing. Chemical recycling allows for the conversion of contaminated and mixed plastic waste into high-quality feedstock that rivals virgin resins, enabling the production of food-grade polymers. This transition is being accelerated by government support aimed at mitigating the risks associated with these capital-intensive projects. For instance, in February 2025, the European Commission approved a €500 million French State aid scheme to support the chemical recycling of plastic waste, effectively incentivizing the industrial-scale development of facilities capable of processing complex waste streams.Simultaneously, AI-driven material discovery is revolutionizing the formulation of high-performance polymers. By utilizing machine learning algorithms, manufacturers can explore the vast chemical landscape of polymer combinations with unprecedented speed, significantly reducing the time required for product innovation. This technological advancement enables the rapid identification of optimal formulations that balance conflicting properties such as flexibility and thermal stability. According to a July 2025 article in MIT News titled "New system dramatically speeds the search for polymer materials," researchers deployed a fully autonomous platform capable of generating and testing 700 new polymer blends daily, demonstrating the power of computational tools to expedite material breakthroughs.

Key Players Profiled in the Polymers Market

- The Dow Chemical Company

- LyondellBasell Industries N.V.

- Exxon Mobil Corporation

- Saudi Basic Industries Corp.

- BASF SE

- INEOS AG

- Eni S.p.A.

- Chevron Phillips Chemical Company LLC

- LANXESS AG

- Covestro AG

Report Scope

In this report, the Global Polymers Market has been segmented into the following categories:Polymers Market, by Type:

- Thermoplastics

- Thermosets

- Others

Polymers Market, by Product:

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Polyurethane

- Polyethylene Terephthalate (PET)

- Polystyrene

- Others

Polymers Market, by Application:

- Packaging

- Building & Construction

- Automotive

- Electrical & Electronic

- Household

- Agriculture

- Others

Polymers Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Polymers Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Polymers market report include:- The Dow Chemical Company

- LyondellBasell Industries N.V.

- ExxonMobil Corporation

- Saudi Basic Industries Corp.

- BASF SE

- INEOS AG

- Eni S.p.A.

- Chevron Phillips Chemical Company LLC

- LANXESS AG

- Covestro AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

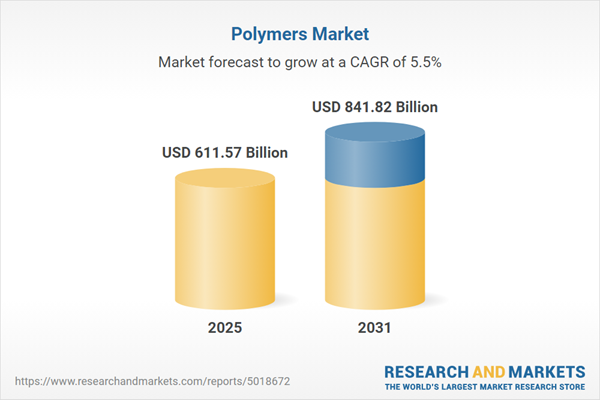

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 611.57 Billion |

| Forecasted Market Value ( USD | $ 841.82 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |