Speak directly to the analyst to clarify any post sales queries you may have.

Understanding the Fundamentals and Strategic Importance of Potassium Salt in Today’s Multifaceted Industrial and Commercial Environments

In recent years, potassium salt has emerged as a cornerstone chemical across multiple industries, underpinning critical functions from nutritional supplementation in animal feed to process optimization in glass manufacturing. Its versatility is rooted in distinct physicochemical properties that enable flake, granular, liquid, and powder variants to address specific operational requirements. Consequently, stakeholders spanning agricultural, food & beverage, pharmaceutical, and water treatment sectors closely monitor advancements in production techniques and distribution networks.Over the past decade, shifts in supply chain architectures and evolving purity standards have elevated the strategic importance of food, pharmaceutical, and technical grades. These purity thresholds dictate formulation stability in drug manufacturing and regulatory compliance in human consumption applications, while also influencing sourcing and cost structures for industrial uses. As a result, market participants must navigate a complex array of quality criteria and logistical considerations to secure consistent supply and maintain competitive pricing.

This executive summary provides a holistic portrait of the global landscape of potassium salt, integrating insights on technological innovations, tariff impacts, segmentation nuances, regional dynamics, corporate strategies, and research methodologies. It aims to furnish decision-makers with a robust foundation to align investments with emerging trends and optimize supply chain resilience amid shifting regulatory regimes and sustainability imperatives.

In light of growing demand driven by agricultural intensification, stringent environmental regulations, and the expansion of specialty chemical applications, an in-depth exploration of market drivers and constraints is essential. By synthesizing these elements, this summary empowers executives to formulate adaptive strategies that preempt potential disruptions and unlock new avenues for value creation.

Exploring the Transformative Technological and Regulatory Shifts Redefining Potassium Salt Applications and Supply Dynamics Worldwide

In the past five years, the potassium salt landscape has been reshaped by a confluence of technological breakthroughs and evolving regulatory imperatives. Advanced crystallization methods now enable producers to isolate higher-purity grades with reduced energy consumption, while solvent-free processes and membrane separation systems deliver compelling sustainability benefits. These innovations not only drive down operational expenditures but also facilitate adherence to tightening environmental criteria in key jurisdictions.Concurrently, digital transformation has permeated supply chain operations through real-time monitoring platforms that track raw material provenance, inventory positions, and logistics performance. Integration of predictive analytics and artificial intelligence into procurement and demand planning models enhances decision-making precision, mitigating risks associated with demand volatilities and transportation disruptions.

On the policy front, amendments to chemical registration frameworks such as REACH in Europe and updates to domestic trade regulations in North America have intensified scrutiny on impurity thresholds and waste management protocols. These regulatory milestones have prompted collaborative initiatives between industry consortia and regulatory agencies to harmonize testing standards and accelerate approval processes. Consequently, industry participants are allocating resources to compliance infrastructure and third-party certification to safeguard market access and build credibility among end users.

Looking ahead, the trajectory of potassium salt will be defined by the dynamic interplay between innovation, sustainability imperatives, and governance frameworks. Entities that proactively embrace these transformative shifts are poised to establish durable competitive advantages and unlock new growth corridors across diverse end-use segments.

Assessing the Cumulative Consequences of 2025 United States Tariffs on Potassium Salt Import Structures, Pricing Strategies, and Global Trade Alliances

The imposition of United States tariffs in early 2025 has generated ripple effects across the global potassium salt value chain, reshaping import structures and pricing methodologies. Duties applied at incremental rates have elevated landed costs for external suppliers, prompting buyers to reassess contractual arrangements and explore alternate procurement routes. This recalibration has accelerated discussions on supplier diversification and the potential for nearshoring raw material feeds to reduce exposure to price fluctuations.Moreover, the cumulative nature of these tariffs has spurred shifts in trade alliances, as non-US producers seek to negotiate preferential trade terms within regional economic blocs. Comparative cost analyses now factor in duty liabilities, currency fluctuations, and logistical overheads, altering the calculus for sourcing decisions. In response, strategic players are forging new collaboration models that emphasize joint investment in processing infrastructure closer to demand centers in North America.

The tariff regime has also underscored the importance of vertical integration as a risk mitigation strategy. Manufacturers with upstream assets or long-standing partnerships with brine producers have demonstrated greater resilience, maintaining consistent supply and stabilizing downstream pricing for end users. This has encouraged investors to evaluate the merits of equity stakes in mining operations or to pursue tolling agreements that secure capacity without significant capital outlay.

While the immediate impact has manifested in cost adjustments and contractual realignments, the longer-term consequence may involve the reconfiguration of global trade patterns and the emergence of alternative supply corridors. Stakeholders that adapt their sourcing strategies swiftly and leverage strategic partnerships are better positioned to navigate tariff-induced disruptions and capitalize on evolving market dynamics.

Delving into In-Depth Segmentation of Potassium Salt Markets by Type, Purity, Application, End-Use Industries, and Distribution Channels Diversity

A holistic view of the potassium salt market demands scrutiny across multiple segmentation dimensions. Analysis by type reveals distinct performance and handling characteristics associated with flake, granular, liquid, and powder forms, each tailored to specific processing requirements and end-user preferences. Flake variants excel in glass and detergent applications, granular forms are favored for fertilizer blending, while liquid concentrates enable precise dosing in industrial chemical processes and water treatment operations.Segmentation by purity grade further informs competitive positioning, as food grade materials must satisfy stringent safety regulations for human consumption, pharmaceutical grade products underpin critical drug formulations, and technical grade salts serve as cost-effective alternatives for industrial batch processes. The relative distribution of these grades influences production scheduling, quality assurance protocols, and supply chain logistics.

Applications span a diverse spectrum, encompassing animal feed-divided into livestock and poultry feed formulations-and fertilizer solutions that include compound fertilizers, NPK blends, and potassic monofertilizers. In the food additives arena, potassium salt enhances textural qualities in bakery products and preserves meat during processing, while the industrial chemicals segment leverages it for glass manufacturing, soap and detergent production, and water treatment processes. Pharmaceuticals rely on high-purity salt for drug formulations that demand consistent chemical profiles.

End use industry analysis highlights the pivotal roles of agriculture, food & beverage, pharmaceuticals, and water treatment in driving consumption patterns. Distribution channels comprise direct sales agreements with end users, partnerships with regional distributors to extend market reach, and online retail platforms that cater to smaller-volume buyers and fast-moving inventories. Together, these segmentation insights illuminate the multifaceted demand drivers shaping strategic initiatives across the value chain.

Highlighting Regional Dynamics and Emerging Opportunities for Potassium Salt Across Americas, Europe, Middle East & Africa, and the Asia-Pacific Zone

The Americas region has witnessed robust demand for granular and liquid potassium salt variants, underpinned by intensive agricultural operations and expanding animal feed production. North American producers have capitalized on proximity to large-scale farming zones, optimizing logistics and reducing lead times. South American markets, driven by corn and soy cultivation, present opportunities for suppliers capable of integrating with domestic distribution networks and adapting to diverse regulatory frameworks.In Europe, Middle East, and Africa, regulatory stringency around impurity levels and environmental compliance has catalyzed investments in local purification and testing facilities. European chemical hubs are intensifying collaboration on sustainable extraction methods, while Middle Eastern saltworks expand capacity to supply downstream markets. African economies, leveraging untapped brine reserves, are forging partnerships aimed at upgrading infrastructure and meeting growing regional demand for water treatment applications.

The Asia-Pacific region remains a focal point for expansion given its rapidly evolving agricultural landscapes and burgeoning industrial sectors. Producers in this zone are scaling up operations to serve demand in fertilizer blending, animal feed supplements, and specialty chemical production. High-growth markets in Southeast Asia and China are increasingly adopting higher-purity potassium salt for pharmaceutical and food applications, necessitating investments in advanced processing lines and rigorous quality management systems.

Across these regions, suppliers must tailor value propositions to address localized drivers-be it proximity to feedstock sources in the Americas, regulatory alignment in Europe, environmental stewardship in the Middle East & Africa, or capacity development in the Asia-Pacific-to capitalize on emerging consumption corridors and fortify global supply chain networks.

Uncovering Key Corporate Strategies, Innovation Pathways, and Competitive Profiles of Leading Potassium Salt Manufacturers and Distributors Across Global Markets

Leading manufacturers and distributors are shaping the competitive landscape through targeted investments and strategic alliances. Key corporate entities have embarked on capacity expansions, commissioning new crystallization and dehydration plants to meet rising purity requirements and shorten delivery cycles. Concurrently, joint ventures between global chemical majors and regional operators have become common, enabling the fusion of technological expertise with market-specific distribution capabilities.Innovation pathways are also distinguishing market leaders, with certain firms pioneering circular economy initiatives that recover potassium-rich byproducts from industrial effluents. Such approaches not only reduce feedstock costs but also resonate with sustainability aspirations among downstream customers. In parallel, companies are diversifying their product portfolios to include bespoke formulations-ranging from high-performance industrial salts to precision-grade additives tailored for pharmaceutical applications.

Competitive profiles reveal a trend toward integration across the supply chain. Firms with upstream mining or brine extraction assets enjoy greater visibility into raw material availability and cost structures, affording them leverage over pricing negotiations and contract terms. Meanwhile, distributors are bolstering their logistics networks and digital platforms to provide value-added services such as real-time inventory tracking and demand forecasting support.

Through these concerted efforts, leading market participants are reinforcing their positions by delivering consistent quality, optimizing total cost of ownership for buyers, and aligning production footprints with key consumption corridors. The collective result is an increasingly sophisticated ecosystem where innovation, operational excellence, and strategic partnerships converge to define market leadership.

Providing Actionable Recommendations for Stakeholders to Navigate Market Volatility, Drive Innovation, and Strengthen Potassium Salt Supply Chains

Stakeholders seeking to thrive in the potassium salt landscape should prioritize the expansion of high-purity production capabilities, ensuring alignment with evolving regulatory thresholds and specialty application requirements. Investing in advanced crystallization and membrane separation technologies will not only enhance product quality but also yield operational efficiencies that reinforce competitive positioning.Diversification of raw material sourcing emerges as another critical strategy. By establishing relationships with multiple brine suppliers and exploring alternative feedstock origins, organizations can mitigate supply disruptions precipitated by tariff shifts, geopolitical tensions, or regional regulatory changes. Incorporating digital procurement platforms and predictive analytics into sourcing workflows will further strengthen resilience by providing real-time visibility into market dynamics.

Digital transformation initiatives should extend beyond the supply chain to encompass quality assurance and customer engagement. Implementing integrated data management systems that track purity parameters, batch histories, and shipment performance will foster transparency and bolster trust among end users. Enhanced traceability frameworks are particularly vital for food and pharmaceutical segments, where compliance and safety considerations are paramount.

Collaborative ventures, including tolling agreements and joint investments in processing infrastructure, offer a pathway to scale efficiently while sharing capital risk. Partnerships with academic institutions and technology providers can accelerate innovation in sustainable extraction methods and circular economy applications. Simultaneously, stakeholders should explore downstream integration opportunities, such as alliances with fertilizer blenders or pharmaceutical formulators, to capture additional value and secure long-term offtake agreements.

Detailing the Rigorous Research Methodology and Data Collection Framework Underpinning Potassium Salt Market Analysis, Ensuring Reliability and Transparency

The research methodology underpinning this analysis integrates both primary and secondary data sources to ensure comprehensive and reliable insights. Primary research involved in-depth interviews with industry executives, procurement specialists, production managers, and regulatory experts. These discussions provided qualitative perspectives on operational challenges, compliance priorities, and strategic investment trends.Secondary research encompassed a thorough review of regulatory filings, company annual reports, patent databases, trade association publications, and peer-reviewed journals. Publicly available trade statistics and customs data were analyzed to corroborate supply chain patterns and cross-border movement of potassium salt. This dual approach facilitated robust triangulation of information and the validation of emerging themes.

Data consolidation was followed by quantitative and qualitative analysis stages. Quantitative techniques included segmentation analytics and trend identification, while qualitative methods focused on thematic coding of expert insights and validation through follow-up consultations. A rigorous quality control protocol was applied at every stage, with findings subjected to peer review and cross-verification to minimize bias.

Ethical standards and transparency measures guided the entire process. Confidentiality agreements with industry participants protected proprietary information, and methodological disclosures ensure that readers can assess the credibility and reproducibility of the analysis. This methodology provides a solid foundation for strategic decision-making and underscores the integrity of the resulting insights.

Synthesizing Principal Insights and Strategic Imperatives from the Potassium Salt Market Study to Guide Future Decision-Making and Investment Priorities

This study synthesizes the principal insights derived from an exhaustive examination of the potassium salt market, capturing the strategic imperatives that will guide future decision-making. The exploration of technological innovations highlights the transformative potential of sustainable crystallization and digital supply chain management, while the assessment of tariff impacts underscores the need for proactive risk mitigation through sourcing diversification and vertical integration.Segmentation analysis reveals the nuanced demand patterns across type, purity grade, application, end-use industry, and distribution channel dimensions, illuminating growth corridors and specialization opportunities. Regional insights emphasize the importance of tailoring market approaches to the Americas, Europe, Middle East & Africa, and Asia-Pacific landscapes, each characterized by distinct regulatory frameworks, consumption drivers, and infrastructure capabilities.

Competitive profiling of leading manufacturers and distributors underscores the strategic value of capacity expansion, circular economy initiatives, and collaborative ventures. Actionable recommendations center on bolstering high-purity production, digitalizing quality assurance and procurement systems, and forging partnerships that enhance supply chain resilience and value creation.

Underpinned by a rigorous research methodology, these findings equip stakeholders with the clarity needed to navigate market volatility, capitalize on innovation trends, and align investments with emergent opportunities. As the global potassium salt sector continues to evolve, organizations that integrate these insights into their strategic roadmaps will be best positioned to secure sustainable growth and competitive advantage.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Potassium Chloride

- Potassium Nitrate

- Potassium Sulfate

- Form

- Flake

- Granular

- Liquid

- Powder

- Purity Grade

- Food Grade

- Pharmaceutical Grade

- Technical Grade

- Application

- Animal Feed

- Livestock Feed

- Poultry Feed

- Fertilizer

- Compound Fertilizer

- NPK Fertilizer

- Potassic Monofertilizer

- Food Additives

- Bakery Products

- Meat Processing

- Industrial Chemicals

- Glass Manufacturing

- Soap & Detergent

- Water Treatment

- Pharmaceuticals

- Animal Feed

- End Use Industry

- Agriculture

- Food & Beverage

- Pharmaceuticals

- Water Treatment

- Distribution Channel

- Offline Retail

- Direct Sales

- Distributors

- Online Retail

- Offline Retail

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- K+S Aktiengesellschaft

- Nutrien Ltd.

- Cargill, Incorporated

- Arab Potash Company

- Biosynth Ltd

- Canpotex Limited

- Dr. Paul Lohmann GmbH & Co. KGaA

- EuroChem Group

- Intrepid Potash, Inc.

- Israel Chemicals Ltd

- Junsei Chemical Co.,Ltd.

- Kishida Chemical Co.,Ltd.

- Merck Group

- Nacalai Tesque, Inc.

- Compass Minerals International, Inc.

- Otsuka Chemical Co.,Ltd.

- Qinghai Salt Lake Potash Co., Ltd.

- Rishi Chemical Works Pvt.Ltd

- Santa Cruz Biotechnology, Inc.

- Solisom Healthcare LLP

- Takasugi Pharmaceutical Co., Ltd.

- The Mosaic Company

- Thermo Fisher Scientific Inc.

- Vinipul Inorganics Pvt. Ltd

- Vynova Group

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Potassium Salt market report include:- K+S Aktiengesellschaft

- Nutrien Ltd.

- Cargill, Incorporated

- Arab Potash Company

- Biosynth Ltd

- Canpotex Limited

- Dr. Paul Lohmann GmbH & Co. KGaA

- EuroChem Group

- Intrepid Potash, Inc.

- Israel Chemicals Ltd

- Junsei Chemical Co.,Ltd.

- Kishida Chemical Co.,Ltd.

- Merck Group

- Nacalai Tesque, Inc.

- Compass Minerals International, Inc.

- Otsuka Chemical Co.,Ltd.

- Qinghai Salt Lake Potash Co., Ltd.

- Rishi Chemical Works Pvt.Ltd

- Santa Cruz Biotechnology, Inc.

- Solisom Healthcare LLP

- Takasugi Pharmaceutical Co., Ltd.

- The Mosaic Company

- Thermo Fisher Scientific Inc.

- Vinipul Inorganics Pvt. Ltd

- Vynova Group

Table Information

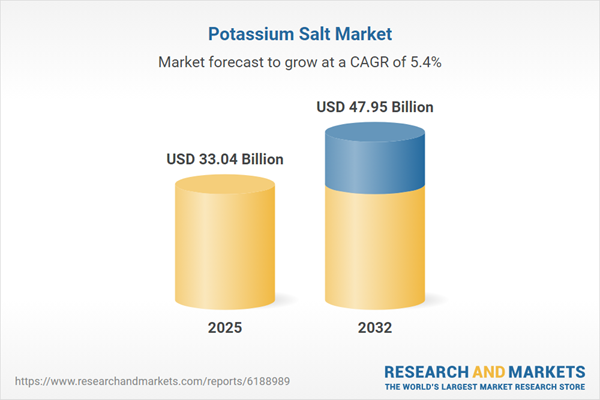

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | October 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 33.04 Billion |

| Forecasted Market Value ( USD | $ 47.95 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |