Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, a significant obstacle to market growth involves concerns over driver visibility and safety regulations. Aftermarket sunshades that lack transparency or are incorrectly installed can block sightlines and blind spots, potentially violating local traffic laws and safety standards. These regulatory constraints effectively restrict the usage of such accessories in specific jurisdictions.

Market Drivers

The growth of the global automotive fleet and increasing vehicle ownership rates act as primary catalysts for the side window sunshades market, as a larger number of operating vehicles expands the consumer base for cabin accessories. Emerging economies play a crucial role in this trend, driving new vehicle registrations and the demand for interior protection. For instance, the China Association of Automobile Manufacturers reported in January 2025 that total automobile sales in China reached 31.44 million units for the year 2024, highlighting the massive scale of vehicles entering the market. This expansion is accompanied by a shift toward larger vehicle formats that require extensive solar protection due to increased glass surfaces; the Society of Indian Automobile Manufacturers noted in April 2025 that Utility Vehicles (UVs) accounted for 65 percent of India's passenger vehicle sales in the 2024-25 fiscal year, reinforcing the trend toward accessories for larger cabin windows.Simultaneously, the growth of the automotive aftermarket and online retail channels has improved access to specialized sun protection products, allowing consumers to look beyond limited OEM options. E-commerce platforms facilitate the purchase of custom-fit, magnetic, or snap-on shades that provide better thermal comfort and UV protection than generic alternatives. This trend is supported by significant consumer spending on vehicle personalization; according to the Specialty Equipment Market Association, in July 2025, consumers in the United States spent approximately $52.65 billion on vehicle accessorization and modification in 2024. This reflects a strong market demand for aftermarket enhancements that improve the driving experience and protect interiors from environmental damage.

Market Challenges

Strict enforcement of safety regulations regarding driver visibility poses a significant barrier to the Global Automotive Side Window Sunshades Market. Although these accessories provide thermal advantages, covering glass surfaces can obstruct sightlines and interfere with blind spot monitoring. As a result, regulatory authorities in many jurisdictions vigorously enforce traffic codes that ban or severely restrict non-transparent aftermarket covers on front side windows to ensure drivers retain full situational awareness.This regulatory landscape is further complicated by the widespread adoption of advanced driver-assistance technologies that depend on unobstructed fields of view. According to the Specialty Equipment Market Association (SEMA), over 91% of new vehicles sold in 2024 were equipped with collision warning or mitigation systems, emphasizing the critical need for clear driver visibility. The integration of such safety technology empowers authorities to uphold strict limits on window obstructions, which consequently lowers consumer adoption rates and impedes sales volumes of aftermarket sunshades in regions with stringent vehicle safety laws.

Market Trends

The manufacturing processes in the global automotive side window sunshades market are being fundamentally reshaped by the use of sustainable and recycled materials. Manufacturers are increasingly replacing traditional virgin polyester and nylon with textiles made from post-consumer recycled plastics (rPET) and bio-based fibers to meet stringent OEM circular economy requirements. This shift addresses both regulatory compliance and growing consumer demand for eco-friendly accessories that reduce carbon footprints while maintaining thermal performance. This trend is highlighted by aggressive targets from major automakers; for example, in its September 2024 'Volvo Cars Position on Sustainable Materials' report, Volvo Cars set a goal to include 35 percent recycled and bio-based content in all new models by 2030, pressuring accessory suppliers to verify sustainable supply chains.Concurrently, the sector is moving toward the development of photochromic and variable-opacity fabrics, which bridge the gap between static shades and costly switchable glazing technologies. These advanced materials automatically adjust light transmission based on UV intensity or voltage, offering dynamic glare control without complex mechanical retraction systems. The commercial potential and adoption of these solutions are evident in the financial results of key technology providers; Gentex Corporation reported in its 'Third Quarter 2024 Financial Results' in October 2024 that automotive net sales reached $596.5 million, a 6 percent year-over-year increase. As these variable-opacity technologies evolve, they are expected to replace traditional mesh screens in premium vehicles, providing enhanced visibility and integrated thermal management.

Key Players Profiled in the Automotive Side Window Sunshades Market

- WeatherTech, Inc.

- Covercraft Industries, LLC

- EGR Group Ltd.

- Motor Trend Accessories, Inc.

- ShadeSox, Inc.

- Bubba's Auto Accessories

- Auto Ventshade, Inc.

- TYC Brother Industrial Co., Ltd.

- Car Shades, Inc.

- SunTek Automotive Films

Report Scope

In this report, the Global Automotive Side Window Sunshades Market has been segmented into the following categories:Automotive Side Window Sunshades Market, by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Automotive Side Window Sunshades Market, by Type:

- Roller/Retractable

- Suction-Cup

Automotive Side Window Sunshades Market, by Sales:

- In-Built

- Aftermarket

Automotive Side Window Sunshades Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive Side Window Sunshades Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Automotive Side Window Sunshades market report include:- WeatherTech, Inc.

- Covercraft Industries, LLC

- EGR Group Ltd.

- Motor Trend Accessories, Inc.

- ShadeSox, Inc.

- Bubba's Auto Accessories

- Auto Ventshade, Inc.

- TYC Brother Industrial Co., Ltd.

- Car Shades, Inc.

- SunTek Automotive Films

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2026 |

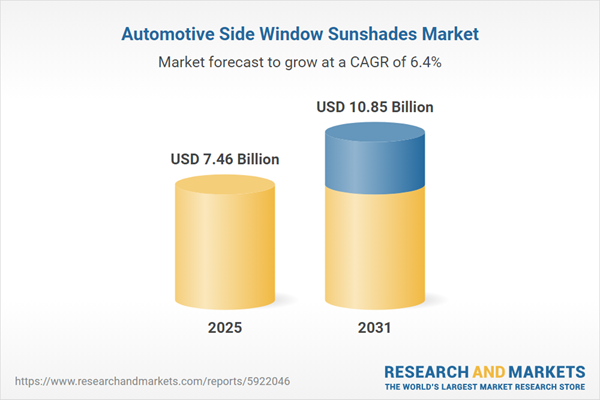

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 7.46 Billion |

| Forecasted Market Value ( USD | $ 10.85 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |