Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite this growth, market progress is often hindered by technological inertia and the difficulties associated with merging advanced systems into legacy workflows. Companies frequently find it challenging to adjust internal processes to maximize modern software capabilities, leading to reluctance in upgrading or adopting new tools. This hesitation toward digital transformation is reflected in the slow integration of emerging technologies within the industry. For instance, the International Project Management Association noted in 2024 that 42% of project managers stated they were not yet utilizing artificial intelligence tools in their project management activities.

Market Drivers

The integration of AI and automation acts as a major driver of innovation within the Global Project Portfolio Management Software Market. Advanced algorithms have become indispensable for predictive risk analysis and intelligent resource scheduling, enabling enterprises to transition from static reporting to proactive decision-making. This technological shift meets the urgent requirement for data-driven insights in complex settings, compelling vendors to advance beyond simple digitization. In its 'Global Project Management Job Trends 2024' report from May 2024, the Project Management Institute noted that 82% of senior leaders anticipate AI adoption will influence project execution within their companies over the next five years. Consequently, software providers are aggressively incorporating machine learning features to maintain a competitive edge and satisfy the growing leadership demand for automated efficiency.Additionally, the increasing need for cost control and resource optimization is fueling widespread platform adoption. With organizations facing tighter economic pressures, removing administrative redundancy and operational inefficiencies has become a strategic necessity. PPM solutions are increasingly utilized to gain the visibility required to recover lost productivity and ensure daily activities align with broader business value.

According to Asana’s 'State of Work Innovation 2024' report from March 2024, 53% of workers' time is consumed by busywork, such as searching for information and chasing status updates, rather than skilled labor. This inefficiency highlights a market-wide pivot toward value-stream management, where success is gauged by strategic outcomes rather than volume of output. Highlighting this trend toward sophisticated frameworks, Planview identified in 2024 that elite organizations were twice as likely to utilize a product operating model compared to lower-performing peers.

Market Challenges

The expansion of the Global Project Portfolio Management Software Market is significantly constrained by technological inertia and the complexities of melding advanced systems with legacy workflows. Many enterprises rely on entrenched, fragmented data structures that are challenging to synchronize with modern, centralized platforms. This operational inflexibility causes organizations to postpone digital transformation efforts, as the perceived effort and risk associated with process re-engineering and data migration often appear to exceed immediate gains. As a result, the market suffers from reduced adoption rates and extended sales cycles, with potential buyers delaying software investments to avoid disturbing their established, though often inefficient, operational routines.This stagnation is intensified by a lack of internal readiness to handle the technical requirements of contemporary software tools. Organizations frequently face difficulties in aligning their workforce’s skills with the features provided by updated portfolio management solutions, resulting in resistance to procurement and underutilization. According to the Project Management Institute in 2024, organizations provided AI-related technology benefits to merely 13% of their employees, highlighting a significant shortfall in the support structures necessary for technical adaptation. This gap in organizational enablement stops companies from fully utilizing digital tools, thereby reducing demand for advanced software and directly hindering overall market growth.

Market Trends

The Global Project Portfolio Management Software Market is undergoing a distinct shift toward adaptive project management as organizations increasingly move away from rigid, universal frameworks in favor of flexible, hybrid methodologies. PPM platforms are being redesigned to accommodate diverse workflows, enabling software teams to use Agile or Scrum while compliance and construction units continue to operate within Waterfall parameters on the same system. This versatility is becoming a crucial procurement criteria as enterprises aim to unify varied work styles without compromising team autonomy. According to the 'Pulse of the Profession 2024' report by the Project Management Institute in March 2024, the adoption of hybrid project management approaches has risen by 57% since 2020, indicating a significant industry-wide pivot toward tools capable of supporting mixed delivery models.Simultaneously, there is a strategic move from tactical project execution toward Strategic Portfolio Management (SPM) to ensure daily operations actively support long-term business objectives. This trend stems from the expanding divide between ground-level delivery and high-level corporate strategy, creating a need for software that bridges this gap through real-time value tracking and objective-based roadmapping. Organizations are prioritizing solutions that visualize how specific initiatives advance broader success metrics to avoid expending effort on low-value tasks. As noted in the '17th State of Agile Report' by Digital.ai in January 2024, only 11% of organizations expressed high satisfaction with their delivery processes, with many citing the persistent disconnect between technical execution and business objectives as a primary obstacle.

Key Players Profiled in the Project Portfolio Management Software Market

- ServiceNow, Inc.

- Microsoft Corporation

- Planview, Inc.

- Asana, Inc.

- Oracle Corporation

- NVIDIA Corporation

- Broadcom Inc.

- SAP SE

- Smartsheet Inc.

- Wrike, Inc.

Report Scope

In this report, the Global Project Portfolio Management Software Market has been segmented into the following categories:Project Portfolio Management Software Market, by Component:

- Solution

- Services

Project Portfolio Management Software Market, by Deployment:

- Cloud

- On-Premises

Project Portfolio Management Software Market, by Organization Size:

- SMEs

- Large Enterprise

Project Portfolio Management Software Market, by Vertical:

- Retail & Consumer Goods

- Energy & Utilities

- Media & Entertainment

- Healthcare

- IT & Telecommunication

- Transportation & Logistics

- Manufacturing

- Others

Project Portfolio Management Software Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Project Portfolio Management Software Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Project Portfolio Management Software market report include:- ServiceNow, Inc.

- Microsoft Corporation

- Planview, Inc.

- Asana, Inc.

- Oracle Corporation

- NVIDIA Corporation

- Broadcom Inc.

- SAP SE

- Smartsheet Inc.

- Wrike, Inc.

Table Information

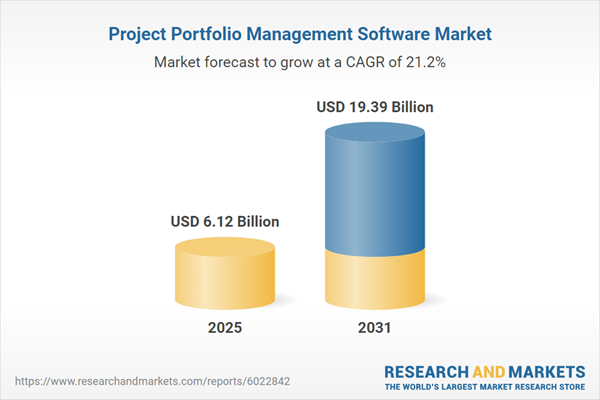

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 6.12 Billion |

| Forecasted Market Value ( USD | $ 19.39 Billion |

| Compound Annual Growth Rate | 21.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |