Businesses depending on digital platforms for managing hiring across geographically dispersed teams efficiently. Recruitment software supports virtual interviews, enabling seamless communication between candidates and employers from any location. Cloud-based platforms ensure real-time access to recruitment tools, promoting flexibility and remote collaboration. Features like automated resume screening help recruiters handle high volumes of applications quickly and effectively. Integration with video conferencing tools simplifies remote interviews, saving time and travel costs for companies. Remote hiring emphasizes the need for global compliance, which recruitment software addresses through localization features. Hybrid work models require advanced onboarding tools to ensure smooth transitions for new hires in different setups. AI-driven analytics enable recruiters to identify candidates who thrive in remote and hybrid environments. Mobile-compatible platforms enhance candidate engagement, allowing job seekers to apply and interact conveniently.

The United States recruitment software market demand is driven by increasing automation of the interview process. Automated interview scheduling tools reduce administrative tasks, improving efficiency for HR teams and recruiters. Video interviewing platforms with AI-driven analytics enhance candidate evaluations and streamline remote hiring processes. In July 2024, Zappyhire launched ZappyVue, an automated video interviewing platform to revolutionize US talent acquisition. It streamlines hiring by automating interviews, offering language assessments, technical evaluations, and knowledge analysis. Automation ensures consistent interview formats, reducing human bias and promoting fairness in candidate assessments. AI-powered tools provide real-time insights, helping recruiters identify top talent more accurately and efficiently. Automated feedback systems improve candidate experiences by delivering prompt and personalized responses after interviews. Integration of chatbots and AI assistants enhances communication and accelerates initial candidate screening processes. Automation supports scalability, enabling businesses to handle high application volumes without compromising quality or speed. Software with machine learning (ML) capabilities refines interview strategies by analyzing past hiring trends and outcomes. Automated tools integrate seamlessly with applicant tracking systems, ensuring smooth workflow management during the hiring process.

Recruitment Software Market Trends:

Increasing use of cloud-based solutions

The growing usage of cloud-based solutions is a significant factor that is resulting in numerous market opportunities. According to Eurostat, the percentage of big organizations utilizing cloud computing increased from 65% in 2020 to 72% in 2021. Recruiters are better able to link qualified candidates with job seekers due to cloud services. Additionally, technology is helping recruiters focus more intently and increase the number of eligible applicants for available positions. Cloud solutions eliminate upfront costs, making recruitment software accessible for small and SMEs. Mobile compatibility in cloud-based platforms allows recruiters to manage hiring processes on-the-go (OTG) seamlessly. Data centralization ensures consistent and secure access to candidate information from multiple locations and devices. Enhanced analytics and AI integration within cloud platforms improve decision-making and candidate evaluation accuracy. The ability to share real-time data fosters collaboration among recruitment teams in different geographic locations is further strengthening the market growth.Increasing demand for streamlined recruitment processes

The market is driven by the rising demand for streamlined recruitment processes. Regardless of size or sector, the hiring process is crucial to all industries. Finding qualified candidates with talent who can advance the organization's development is the main goal of recruitment. This is leading to a notable increase in the demand for recruitment software, catalyzing recruitment software market recent developments. Organizations opt for automated hiring solutions as there are many candidates. These systems can manage the overall hiring process efficiently. For instance, Applicant tracking systems (ATS) and other recruitment technologies are becoming widely used worldwide, and on average, businesses are saving a significant amount of time per recruiter. According to recent research, an efficient applicant tracking system (ATS) can reduce the typical hiring cycle by up to 60%. With the use of automated recruiting systems, which provide benefits like resume parsing, applicant monitoring, and candidate management, hiring companies can easily monitor and handle applications as they move through the hiring process. Recruiting software acts as a centralized platform for handling candidate data, promotes hiring team coordination, and streamlines manual activities.Rapid innovations

The continuing advancements in ML and AI are driving the demand for recruitment software. According to a survey, the number of virtual online interviews has increased by almost 50% over the last ten years in US. AI algorithms are integrated into modern platforms to anticipate candidate success rates, match candidate profiles with job descriptions, and even forecast retention rates. These characteristics improve the caliber of workers while also expediting the hiring process. The recruitment software market outlook shows more innovations in the future. Some innovations incorporate advanced analytics to measure recruiting metrics are going to be released in the future. The usage of blockchain for verification procedures, and the creation of mobile-friendly recruitment apps, is bolstering the growth of the market.Recruitment Software Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on deployment model, component, enterprise size, and vertical.Analysis by Deployment Model:

- On-premises

- SaaS Based

SaaS-based recruitment software is cloud-hosted, accessible via subscription, and suitable for businesses of all sizes. It eliminates the need for substantial upfront costs, growing its usage among small and medium-sized enterprises. This deployment mode supports scalability, enabling businesses to adapt quickly to fluctuating recruitment demands. SaaS solutions provide automatic updates, integrated security, and minimal maintenance requirements, reducing operational burdens. They enable remote access, allowing recruitment teams to work flexibly from any location.

Analysis by Component:

- Software

- Contact Management

- Resume Management

- Mobile Recruitment

- Reporting and Analytics

- Workflow Management

- Others

- Services

- Professional

- Managed

Analysis by Enterprise Size:

- Small and Medium-Sized Enterprises

- Large Enterprises

Analysis by Vertical:

- Manufacturing

- Healthcare

- Hospitality

- BFSI

- Education

- Others

Healthcare organizations rely on recruitment software to fill critical roles quickly and efficiently. The sector demands platforms that ensure compliance with strict licensing and credential verification requirements. Recruitment tools streamline hiring for diverse roles, including medical staff, administrators, and technicians. Software with scheduling features helps optimize staffing for 24/7 healthcare operations. Rising demand for telemedicine is increasing the need for software that supports remote hiring.

The hospitality industry uses recruitment software to manage seasonal and high-turnover hiring efficiently. Platforms with applicant tracking and onboarding features streamline the hiring process for roles across locations. Software assists businesses in ensuring compliance with labor laws and manage multicultural workforces. Hospitality companies prioritize tools with mobile compatibility to attract tech-savvy candidates. Integrated scheduling features ensure optimal staffing for peak seasons, improving operational efficiency.

The BFSI sector benefits from recruitment software by streamlining hiring for highly skilled financial roles. Automated tools reduce time-to-hire, helping institutions respond to market demands effectively. Platforms with advanced security ensure compliance with data protection regulations critical in the financial sector. AI-driven features help identify candidates with the right skills for specialized positions. Recruitment software integrates with existing HR and compliance systems, enhance workflow efficiency.

The education sector utilizes recruitment software to manage hiring for teaching and administrative roles. Platforms simplify screening and credential verification processes, ensuring candidates meet qualification standards. Schools and institutions benefit from tools that support remote hiring for online and hybrid teaching models. Software with scheduling features help align staff availability with academic calendars. Recruitment tools enhance outreach, aiding institutions attract diverse talent across the globe.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Recruitment Software Market Analysis

The United States hold 83.30% of the market share in North America. The rapid digital shift in hiring processes across different sectors is driving the market for recruitment software in the United States. According to data from the US Bureau of Labor Statistics, more than 30 million jobs are created every year due to which and big businesses and employment agencies are catalyzing the demand for automation in hiring processes. The increased focus on diversity, equity, and inclusion (DEI) to reduce unconscious bias is also leading to the growing adoption of AI-driven hiring tools. According to the American Staffing Association, there were over 27,000 recruiting and staffing firms in the United States in 2021, with a total of nearly 54,000 offices. Many of these organizations use Applicant Tracking Systems (ATS) and Customer Relationship Management (CRM) tools to make the process of finding, screening, and onboarding candidates more efficient. In addition, the types of recruiting software solutions required are being increasingly driven by sectors such as technology, healthcare, and retail, which employ a large proportion of people. With more than 70% of U.S. organizations considering switching to remote or hybrid work patterns as per a survey, cloud-based recruitment solutions are gaining traction.Europe Recruitment Software Market Analysis

Market drivers in the Europe include labour law compliance and regional digitization. The demand for secure recruitment services that include safe and General Data Protection Regulation (GDPR) compliant hiring with the protection of data privacy had been driven from the European Union through its GDPR, where Eurostat reports that during 2022, there was a total count of more than 32 million active businesses and that 3.4 million out of all these were newly found in the 11% percentages, and other data from newly established businesses gave birth to around 3.7 million job openings in Europe in 2022. Many of these companies are incorporating talent acquisition and ATS to make hiring easier. Some of the trending solutions in Germany, the UK, and France include automation and AI-powered solutions as millions of jobs are available yearly in important sectors like manufacturing, finance, and healthcare. According to the data reported by the European Parliament, in 2022, more than 28.3 million persons in the EU were employed by digital labor platforms, and that number is estimated to increase to 43 million by 2025. In addition, investment in technology-enhanced hiring methods is growing because of government measures to lower unemployment, especially in Southern European nations like Spain and Italy.Asia Pacific Recruitment Software Market Analysis

Due to the rising labor force in the region and growing digitization of HR processes, Asia Pacific is noticing rapid growth in the market. The rising adoption of recruitment software in countries like China, India, and Japan, particularly in India, where the organized labor market is expanding at a rapid pace every year. The NITI Ayog report on India's flourishing gig and platform economy envisages that the gig labor would reach to 2.35 crore (23.5 million) by 2029-2030. Demand for AI-based recruitment solution is growing due to a rapidly growing IT business that are employing 15 million plus IT experts, according to reports. Companies are leveraging automation to speed up the hiring process for specialized positions in Japan, where the aging population is a specific challenge in the hiring. With over 1 billion internet users and government initiatives promoting smart hiring, cloud-based platforms are gaining traction in China, as per reports. The region's thriving startup scene, which comprises more than 800,000 firms, according to reports, also significantly influences adoption of recruitment solutions.Latin America Recruitment Software Market Analysis

The growing formal employment sector in the region and rising investments in HR technologies are driving the market for recruitment software in Latin America. As the UN Economic Commission for Latin America or ECLA depicts, 50.8 percent of people employed in Latin America are expected to rise up to 54.6 percent by the year 2050. The leading firms and worldwide organizations based in the region implement ATS with other workforce management technologies in their HR for a simplified recruiting process and abidance in the labor regulations. Another factor is that hundreds of thousands are employed directly through e-commerce operations in the area. This is because, recruitment software is used to recruit to customer service and logistics positions. More than 99% of SMEs employ cloud-based hiring solutions for hiring, according to various reports.Middle East and Africa Recruitment Software Market Analysis

The increasing efforts towards diversification and digitization, is making Middle East and Africa one of the emerging markets for recruitment software. The United Arab Emirates and Saudi Arabia are the top contributors in the market. Under UAE’s Vision 2030, jobs in the non-oil sectors such as tourism and technology are favored. With a reported number of over 8 million expatriates working in the country, the UAE relies mainly on recruitment tools for speedy hiring, as per reports. Adoption of recruitment software is growing in African countries like South Africa and Nigeria due to their young labor force and the expanding gig economy. Cloud-based platforms are increasingly being used especially when large numbers of African businesses shift to digital HR systems. Additionally, the region's focus on job creation and upskilling initiatives drives the demand for recruiting technology solutions.Competitive Landscape:

The recruitment software market overview shows a lower-than-anticipated demand compared to pre-pandemic levels. However, this is likely to witness a paradigm shift over the next decade with the rising incorporation of advanced features by key players, including applicant tracking systems (ATS), resume parsing, candidate relationship management (CRM), AI-powered automation, interview scheduling, video interviewing, and analytics/reporting capabilities into their recruitment software solutions. Key players are investing in improving the user experience of their software platforms by introducing features like intuitive interfaces, mobile accessibility, customizable workflows, and seamless integration with other HR systems. For instance, in September 2024, Oracle unveiled new features in its Cloud HCM platform to optimize workforce performance and talent. The new capabilities include AI-powered skills inventory and enhanced data enrichment for HR teams. Organizations can integrate enriched skills data and create a comprehensive skills catalog for better workforce alignment. Oracle’s platform helps HR teams assess skills gaps, supporting targeted development and recruitment strategies. The skills library offers pre-populated data for easier adoption of a skills-based talent strategy. These enhancements aim to help companies better align talent to business priorities and improve performance.The global recruitment software market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Accenture Plc

- ADP LLC

- Ceridian HCM Inc.

- Cognizant Technology Solutions

- Cornerstone OnDemand

- iCIMS

- Kenexa Corporation (IBM)

- Oracle

- PeopleAdmin

- SAP

- SumTotal Systems Inc.

- Zoho Corporation

Key Questions Answered in This Report

1. How big is the recruitment software market?2. What is the future outlook of recruitment software market?

3. What are the key factors driving the recruitment software market?

4. Which region accounts for the largest recruitment software market share?

5. Which are the leading companies in the global recruitment software market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Recruitment Software Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Deployment Model

6.1 On-premises

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 SaaS Based

6.2.1 Market Trends

6.2.2 Market Forecast

7 Market Breakup by Component

7.1 Software

7.1.1 Market Trends

7.1.2 Major Types

7.1.2.1 Contact Management

7.1.2.2 Resume Management

7.1.2.3 Mobile Recruitment

7.1.2.4 Reporting and Analytics

7.1.2.5 Workflow Management

7.1.2.6 Others

7.1.3 Market Forecast

7.2 Services

7.2.1 Market Trends

7.2.2 Major Types

7.2.2.1 Professional

7.2.2.2 Managed

7.2.3 Market Forecast

8 Market Breakup by Enterprise Size

8.1 Small and Medium-Sized Enterprises

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Large Enterprises

8.2.1 Market Trends

8.2.2 Market Forecast

9 Market Breakup by Vertical

9.1 Manufacturing

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Healthcare

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 Hospitality

9.3.1 Market Trends

9.3.2 Market Forecast

9.4 BFSI

9.4.1 Market Trends

9.4.2 Market Forecast

9.5 Education

9.5.1 Market Trends

9.5.2 Market Forecast

9.6 Others

9.6.1 Market Trends

9.6.2 Market Forecast

10 Market Breakup by Region

10.1 North America

10.1.1 United States

10.1.1.1 Market Trends

10.1.1.2 Market Forecast

10.1.2 Canada

10.1.2.1 Market Trends

10.1.2.2 Market Forecast

10.2 Asia Pacific

10.2.1 China

10.2.1.1 Market Trends

10.2.1.2 Market Forecast

10.2.2 Japan

10.2.2.1 Market Trends

10.2.2.2 Market Forecast

10.2.3 India

10.2.3.1 Market Trends

10.2.3.2 Market Forecast

10.2.4 South Korea

10.2.4.1 Market Trends

10.2.4.2 Market Forecast

10.2.5 Australia

10.2.5.1 Market Trends

10.2.5.2 Market Forecast

10.2.6 Indonesia

10.2.6.1 Market Trends

10.2.6.2 Market Forecast

10.2.7 Others

10.2.7.1 Market Trends

10.2.7.2 Market Forecast

10.3 Europe

10.3.1 Germany

10.3.1.1 Market Trends

10.3.1.2 Market Forecast

10.3.2 France

10.3.2.1 Market Trends

10.3.2.2 Market Forecast

10.3.3 United Kingdom

10.3.3.1 Market Trends

10.3.3.2 Market Forecast

10.3.4 Italy

10.3.4.1 Market Trends

10.3.4.2 Market Forecast

10.3.5 Spain

10.3.5.1 Market Trends

10.3.5.2 Market Forecast

10.3.6 Russia

10.3.6.1 Market Trends

10.3.6.2 Market Forecast

10.3.7 Others

10.3.7.1 Market Trends

10.3.7.2 Market Forecast

10.4 Latin America

10.4.1 Brazil

10.4.1.1 Market Trends

10.4.1.2 Market Forecast

10.4.2 Mexico

10.4.2.1 Market Trends

10.4.2.2 Market Forecast

10.4.3 Others

10.4.3.1 Market Trends

10.4.3.2 Market Forecast

10.5 Middle East and Africa

10.5.1 Market Trends

10.5.2 Market Breakup by Country

10.5.3 Market Forecast

11 SWOT Analysis

11.1 Overview

11.2 Strengths

11.3 Weaknesses

11.4 Opportunities

11.5 Threats

12 Value Chain Analysis

13 Porters Five Forces Analysis

13.1 Overview

13.2 Bargaining Power of Buyers

13.3 Bargaining Power of Suppliers

13.4 Degree of Competition

13.5 Threat of New Entrants

13.6 Threat of Substitutes

14 Competitive Landscape

14.1 Market Structure

14.2 Key Players

14.3 Profiles of Key Players

14.3.1 Accenture Plc

14.3.1.1 Company Overview

14.3.1.2 Product Portfolio

14.3.1.3 Financials

14.3.1.4 SWOT Analysis

14.3.2 ADP LLC

14.3.2.1 Company Overview

14.3.2.2 Product Portfolio

14.3.3 Ceridian HCM Inc.

14.3.3.1 Company Overview

14.3.3.2 Product Portfolio

14.3.3.3 Financials

14.3.4 Cognizant Technology Solutions

14.3.4.1 Company Overview

14.3.4.2 Product Portfolio

14.3.4.3 Financials

14.3.4.4 SWOT Analysis

14.3.5 Cornerstone OnDemand

14.3.5.1 Company Overview

14.3.5.2 Product Portfolio

14.3.6 iCIMS

14.3.6.1 Company Overview

14.3.6.2 Product Portfolio

14.3.7 Kenexa Corporation (IBM)

14.3.7.1 Company Overview

14.3.7.2 Product Portfolio

14.3.8 Oracle

14.3.8.1 Company Overview

14.3.8.2 Product Portfolio

14.3.8.3 Financials

14.3.8.4 SWOT Analysis

14.3.9 PeopleAdmin

14.3.9.1 Company Overview

14.3.9.2 Product Portfolio

14.3.10 SAP

14.3.10.1 Company Overview

14.3.10.2 Product Portfolio

14.3.11 SumTotal Systems Inc.

14.3.11.1 Company Overview

14.3.11.2 Product Portfolio

14.3.12 Zoho Corporation

14.3.12.1 Company Overview

14.3.12.2 Product Portfolio

List of Figures

Figure 1: Global: Recruitment Software Market: Major Drivers and Challenges

Figure 2: Global: Recruitment Software Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Recruitment Software Market: Breakup by Deployment Model (in %), 2024

Figure 4: Global: Recruitment Software Market: Breakup by Component (in %), 2024

Figure 5: Global: Recruitment Software Market: Breakup by Enterprise Size (in %), 2024

Figure 6: Global: Recruitment Software Market: Breakup by Vertical (in %), 2024

Figure 7: Global: Recruitment Software Market: Breakup by Region (in %), 2024

Figure 8: Global: Recruitment Software Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 9: Global: Recruitment Software (On-premises) Market: Sales Value (in Million USD), 2019 & 2024

Figure 10: Global: Recruitment Software (On-premises) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 11: Global: Recruitment Software (SaaS Based) Market: Sales Value (in Million USD), 2019 & 2024

Figure 12: Global: Recruitment Software (SaaS Based) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 13: Global: Recruitment Software (Software) Market: Sales Value (in Million USD), 2019 & 2024

Figure 14: Global: Recruitment Software (Software) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 15: Global: Recruitment Software (Services) Market: Sales Value (in Million USD), 2019 & 2024

Figure 16: Global: Recruitment Software (Services) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 17: Global: Recruitment Software (Small and Medium-Sized Enterprises) Market: Sales Value (in Million USD), 2019 & 2024

Figure 18: Global: Recruitment Software (Small and Medium-Sized Enterprises) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 19: Global: Recruitment Software (Large Enterprises) Market: Sales Value (in Million USD), 2019 & 2024

Figure 20: Global: Recruitment Software (Large Enterprises) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 21: Global: Recruitment Software (Manufacturing) Market: Sales Value (in Million USD), 2019 & 2024

Figure 22: Global: Recruitment Software (Manufacturing) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 23: Global: Recruitment Software (Healthcare) Market: Sales Value (in Million USD), 2019 & 2024

Figure 24: Global: Recruitment Software (Healthcare) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 25: Global: Recruitment Software (Hospitality) Market: Sales Value (in Million USD), 2019 & 2024

Figure 26: Global: Recruitment Software (Hospitality) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 27: Global: Recruitment Software (BFSI) Market: Sales Value (in Million USD), 2019 & 2024

Figure 28: Global: Recruitment Software (BFSI) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 29: Global: Recruitment Software (Education) Market: Sales Value (in Million USD), 2019 & 2024

Figure 30: Global: Recruitment Software (Education) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 31: Global: Recruitment Software (Other Verticals) Market: Sales Value (in Million USD), 2019 & 2024

Figure 32: Global: Recruitment Software (Other Verticals) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 33: North America: Recruitment Software Market: Sales Value (in Million USD), 2019 & 2024

Figure 34: North America: Recruitment Software Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 35: United States: Recruitment Software Market: Sales Value (in Million USD), 2019 & 2024

Figure 36: United States: Recruitment Software Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 37: Canada: Recruitment Software Market: Sales Value (in Million USD), 2019 & 2024

Figure 38: Canada: Recruitment Software Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 39: Asia Pacific: Recruitment Software Market: Sales Value (in Million USD), 2019 & 2024

Figure 40: Asia Pacific: Recruitment Software Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 41: China: Recruitment Software Market: Sales Value (in Million USD), 2019 & 2024

Figure 42: China: Recruitment Software Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 43: Japan: Recruitment Software Market: Sales Value (in Million USD), 2019 & 2024

Figure 44: Japan: Recruitment Software Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 45: India: Recruitment Software Market: Sales Value (in Million USD), 2019 & 2024

Figure 46: India: Recruitment Software Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 47: South Korea: Recruitment Software Market: Sales Value (in Million USD), 2019 & 2024

Figure 48: South Korea: Recruitment Software Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 49: Australia: Recruitment Software Market: Sales Value (in Million USD), 2019 & 2024

Figure 50: Australia: Recruitment Software Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 51: Indonesia: Recruitment Software Market: Sales Value (in Million USD), 2019 & 2024

Figure 52: Indonesia: Recruitment Software Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 53: Others: Recruitment Software Market: Sales Value (in Million USD), 2019 & 2024

Figure 54: Others: Recruitment Software Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 55: Europe: Recruitment Software Market: Sales Value (in Million USD), 2019 & 2024

Figure 56: Europe: Recruitment Software Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 57: Germany: Recruitment Software Market: Sales Value (in Million USD), 2019 & 2024

Figure 58: Germany: Recruitment Software Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 59: France: Recruitment Software Market: Sales Value (in Million USD), 2019 & 2024

Figure 60: France: Recruitment Software Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 61: United Kingdom: Recruitment Software Market: Sales Value (in Million USD), 2019 & 2024

Figure 62: United Kingdom: Recruitment Software Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 63: Italy: Recruitment Software Market: Sales Value (in Million USD), 2019 & 2024

Figure 64: Italy: Recruitment Software Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 65: Spain: Recruitment Software Market: Sales Value (in Million USD), 2019 & 2024

Figure 66: Spain: Recruitment Software Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 67: Russia: Recruitment Software Market: Sales Value (in Million USD), 2019 & 2024

Figure 68: Russia: Recruitment Software Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 69: Others: Recruitment Software Market: Sales Value (in Million USD), 2019 & 2024

Figure 70: Others: Recruitment Software Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 71: Latin America: Recruitment Software Market: Sales Value (in Million USD), 2019 & 2024

Figure 72: Latin America: Recruitment Software Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 73: Brazil: Recruitment Software Market: Sales Value (in Million USD), 2019 & 2024

Figure 74: Brazil: Recruitment Software Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 75: Mexico: Recruitment Software Market: Sales Value (in Million USD), 2019 & 2024

Figure 76: Mexico: Recruitment Software Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 77: Others: Recruitment Software Market: Sales Value (in Million USD), 2019 & 2024

Figure 78: Others: Recruitment Software Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 79: Middle East and Africa: Recruitment Software Market: Sales Value (in Million USD), 2019 & 2024

Figure 80: Middle East and Africa: Recruitment Software Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 81: Global: Recruitment Software Industry: SWOT Analysis

Figure 82: Global: Recruitment Software Industry: Value Chain Analysis

Figure 83: Global: Recruitment Software Industry: Porter’s Five Forces Analysis

List of Tables

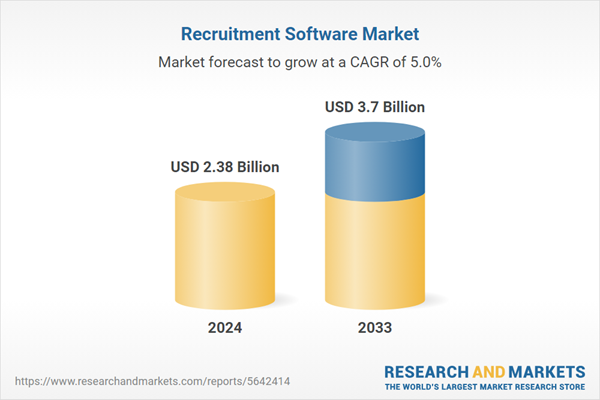

Table 1: Global: Recruitment Software Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Recruitment Software Market Forecast: Breakup by Deployment Model (in Million USD), 2025-2033

Table 3: Global: Recruitment Software Market Forecast: Breakup by Component (in Million USD), 2025-2033

Table 4: Global: Recruitment Software Market Forecast: Breakup by Enterprise Size (in Million USD), 2025-2033

Table 5: Global: Recruitment Software Market Forecast: Breakup by Vertical (in Million USD), 2025-2033

Table 6: Global: Recruitment Software Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 7: Global: Recruitment Software Market: Competitive Structure

Table 8: Global: Recruitment Software Market: Key Players

Companies Mentioned

- Accenture Plc

- ADP LLC

- Ceridian HCM Inc.

- Cognizant Technology Solutions

- Cornerstone OnDemand

- iCIMS

- Kenexa Corporation (IBM)

- Oracle

- PeopleAdmin

- SAP

- SumTotal Systems Inc.

- Zoho Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 2.38 Billion |

| Forecasted Market Value ( USD | $ 3.7 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |