Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Conversely, the market faces a substantial obstacle in the form of high upfront capital expenditure required for hybrid inverter systems compared to standard grid-tied options. This financial hurdle, often exacerbated by the complexity of components and installation expenses, limits accessibility for a wider demographic of residential consumers. Consequently, these elevated costs threaten to slow the pace of market expansion, particularly in regions where consumers are highly sensitive to price points.

Market Drivers

The establishment of supportive government policies and financial incentives serves as a fundamental catalyst for the Global Residential Solar Hybrid Inverter Market. Governments globally are increasingly implementing legislative frameworks, such as investment tax credits and rebates, which significantly reduce the entry barriers associated with adopting advanced energy systems. These incentives are specifically structured to encourage homeowners to upgrade from basic grid-tied setups to more resilient solar-plus-storage architectures, thereby necessitating the use of hybrid inverters. According to the Solar Energy Industries Association’s 'U.S. Solar Market Insight Q3 2024' report from September 2024, the residential solar sector added 1.1 GWdc of capacity in the second quarter of 2024, a growth trajectory heavily supported by federal tax credits that promote the integration of storage capabilities.Simultaneously, the falling costs of lithium-ion battery storage solutions are fundamentally widening the addressable market for hybrid inverters. As battery prices decrease, the economic justification for storing surplus solar generation for later use becomes stronger, shifting consumer preference toward self-consumption and energy independence. This price reduction enables hybrid inverters to serve as efficient central hubs for energy management without the prohibitive costs previously associated with battery integration. The International Energy Agency’s 'Global Critical Minerals Outlook 2024', published in May 2024, noted that the price of lithium dropped by 75% in 2023, directly alleviating manufacturing costs for the storage systems these inverters manage. Furthermore, SolarPower Europe reported in 2024 that global solar capacity additions reached 447 GW in the preceding year, fostering a vast ecosystem for the deployment of intelligent hybrid inversion technologies.

Market Challenges

The central challenge hindering the Global Residential Solar Hybrid Inverter Market is the substantial upfront capital expenditure necessary for these advanced systems. Unlike standard grid-tied inverters, hybrid units must integrate complex battery management capabilities and additional hardware to handle energy storage and islanding during outages. This technological sophistication significantly raises both component and installation costs, creating a high barrier to entry for the mass market. As a result, price-sensitive consumers often delay investment or choose cheaper, non-hybrid alternatives, which directly limits the potential customer base and slows the conversion rate from traditional solar setups to resilient storage-ready systems.This financial sensitivity is clearly observable in major markets where economic pressures have tightened consumer spending. For instance, the Solar Energy Industries Association reported in 2024 that the residential solar market in the United States contracted by 31% compared to the prior year. This decline was largely driven by high interest rates and financing costs that exacerbated the burden of initial system outlays. Such data illustrates how elevated upfront costs, compounded by unfavorable financing conditions, can rapidly decelerate adoption rates and impede the broader expansion of hybrid inverter technologies.

Market Trends

The integration of residential solar hybrid inverters into Virtual Power Plant (VPP) networks is fundamentally transforming their function from passive energy storage managers into active grid assets. Manufacturers are increasingly outfitting these devices with sophisticated software capable of aggregating distributed energy resources to dispatch power during peak demand periods, allowing homeowners to monetize their stored energy while stabilizing the electrical grid. This shift toward bidirectional grid interaction is scaling rapidly, creating a new value proposition that extends beyond individual self-consumption. According to Tesla's 'Q3 2024 Update Letter' from November 2024, over 100,000 Powerwall units were enrolled in Virtual Power Plant programs globally, demonstrating the significant volume of residential hybrid systems now being integrated into broader utility energy markets.The development of modular all-in-one energy systems represents a critical evolution in market preferences, favoring cohesive units that combine inversion, battery management, and connectivity into a single streamlined interface. This trend addresses the technical complexity and aesthetic concerns of multi-component installations, offering simplified commissioning for installers and a unified user experience for consumers. Consequently, the attachment rate of storage to solar systems - necessitating the deployment of hybrid inverters - has surged as the market prioritizes these holistic, pre-integrated solutions over standalone components. The Solar Energy Industries Association’s 'U.S. Solar Market Insight Q2 2025' report from June 2025 noted that 40% of new residential solar installations were paired with storage in the first half of 2025, underscoring the accelerating transition toward these comprehensive hybrid architectures.

Key Players Profiled in the Residential Solar Hybrid Inverter Market

- Huawei Technologies Co., Ltd.

- Sungrow Power Supply Co., Ltd.

- SolarEdge Technologies Inc.

- Enphase Energy, Inc.

- SMA Solar Technology AG

- GoodWe Power Supply Technology Co., Ltd.

- Fronius International GmbH

- Growatt New Energy Technology Co., Ltd.

- Ginlong Technologies

- Sofar Solar

Report Scope

In this report, the Global Residential Solar Hybrid Inverter Market has been segmented into the following categories:Residential Solar Hybrid Inverter Market, by Type:

- Single-phase hybrid

- Three-phase hybrid

Residential Solar Hybrid Inverter Market, by Application:

- Energy generation

- Solar energy storage

- Others

Residential Solar Hybrid Inverter Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Residential Solar Hybrid Inverter Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Residential Solar Hybrid Inverter market report include:- Huawei Technologies Co., Ltd.

- Sungrow Power Supply Co., Ltd.

- SolarEdge Technologies Inc.

- Enphase Energy, Inc.

- SMA Solar Technology AG

- GoodWe Power Supply Technology Co., Ltd.

- Fronius International GmbH

- Growatt New Energy Technology Co., Ltd.

- Ginlong Technologies

- Sofar Solar

Table Information

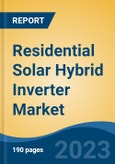

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 2.25 Billion |

| Forecasted Market Value ( USD | $ 3.33 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |