Speak directly to the analyst to clarify any post sales queries you may have.

The Automotive Safe Exit System Market is undergoing rapid transformation as the industry integrates these solutions into standard vehicle safety designs and addresses new urban mobility demands. Senior executives will gain essential clarity on industry dynamics, strategic technology adoption, and the regulatory environment influencing the future of automotive safety exits.

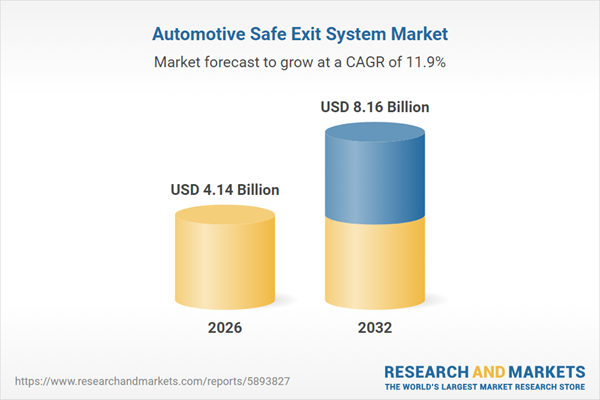

Market Snapshot: Automotive Safe Exit System Market

The global Automotive Safe Exit System Market expanded from USD 3.71 billion in 2025 to USD 4.14 billion in 2026 and is projected to achieve USD 8.16 billion by 2032, registering a CAGR of 11.92%. This robust growth mirrors the strategic shift in the automotive sector, where safe exit technologies are steadily moving from being elective accessories to fundamental components of modern vehicles. The shift is driven by widespread urbanization, the growing emphasis on micromobility, and rising global safety expectations. As mobility patterns evolve, manufacturers are investing in scalable architectures and unified solutions that meet increasingly rigorous safety requirements and adapt to diverse regulatory landscapes.

Scope & Segmentation

- Vehicle Categories: Demand variation exists among Heavy Commercial Vehicles, Light Commercial Vehicles, and Passenger Cars, each necessitating tailored detection and integration strategies for effective deployment.

- Sensing Technologies: Use of camera modules for object recognition, radar for reliable performance in adverse conditions, and ultrasonic sensors for accurate short-range detection, commonly within multi-sensor networks.

- Functional Applications: Implementation for blind spot detection, door opening warnings, and rear cross traffic alerts, each requiring distinct validation and customized sensing solutions.

- Distribution Channels: Integration through OEM-installed systems prioritizing network and cybersecurity, alongside aftermarket options designed for retrofit compatibility and streamlined usability.

- Regional Markets: Assessment of challenges and opportunities across the Americas, Europe Middle East & Africa, and Asia-Pacific, considering regulation, local vehicle usage, and the impacts of urban congestion.

Primary Keyword Focus: Automotive Safe Exit System Market

Key Takeaways

- Safe exit systems have become integral to vehicle safety portfolios, addressing the rise in incidents involving pedestrians and other vulnerable road users and reflecting the need for heightened consumer trust in safety solutions.

- Deeper integration with advanced driver-assistance systems allows automakers to proactively apply safe exit considerations during platform development, resulting in more cohesive vehicle safety offerings.

- Advancing sensor fusion and the adoption of software-defined vehicle architectures enable over-the-air system updates, improving adaptability and optimizing the interface between sensors and machine learning perception models.

- Continuous changes in urban mobility, such as growing micromobility and shared vehicle adoption, are driving suppliers to support diverse operating environments and broadening the relevance of safe exit innovations.

- Business models are evolving, with original equipment manufacturers favoring scalable integration partners and the aftermarket shifting toward modular, retrofit-friendly, software-centric safe exit solutions.

Tariff Impact: U.S. Measures Accelerate Supply Chain Resilience

Recent U.S. tariff policies introduced in 2025 increased supply chain challenges for safe exit system components. Automotive manufacturers responded by adopting dual-sourcing strategies, enhancing partnerships with local suppliers, and emphasizing the use of regionally available subcomponents. They also focused on technology flexibility, favoring modular solutions such as standard camera and ultrasonic modules, while revising agreements to ensure risk and cost transparency between manufacturers and suppliers. In parallel, the industry accelerated requalification processes to maintain regulatory compliance despite shifting sources. These steps collectively improved supply chain agility and underscored the importance of modular system design to withstand trade pressures.

Methodology & Data Sources

This analysis applies a mixed-methods approach, combining in-depth interviews with sector engineers and commercial leaders, field validation from pilot deployments, and secondary data from regulatory sources, technical standards, patents, and product literature. Scenario planning and direct input from industry stakeholders support the relevance and actionability of findings.

Why This Report Matters

- Equips decision-makers to evaluate strategies against fast-evolving regulatory and market conditions worldwide.

- Offers targeted recommendations to smooth technology integration, boost user acceptance, and limit supply risks across global vehicle fleets.

- Supports procurement, compliance, and R&D teams in aligning safe exit solutions with local operational requirements.

Conclusion

Success in the Automotive Safe Exit System Market relies on combining advanced technical solutions, resilient sourcing practices, and strategies tailored to regional needs. This report delivers actionable analysis to help industry stakeholders strengthen safety and operational efficiency during industry transformation.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Automotive Safe Exit System Market

Companies Mentioned

The key companies profiled in this Automotive Safe Exit System market report include:- Autoliv Inc.

- Brandmotion

- Continental AG

- Dahua Technology Co., Ltd.

- DENSO CORPORATION

- Felio Group

- HELLA GmbH & Co. KGaA

- Hyundai Motor Company

- Infineon Technologies AG

- Johnson Electric Holdings Limited

- Magna International Inc.

- RACELOGIC, Ltd.

- Ralph’s Radio Ltd.

- Rydeen Mobile Electronics

- Sensata Technologies, Inc.

- Steelmate Automotive, Ltd.

- STMicroelectronics

- Texas Instruments Incorporated

- Toyoda Gosei Co. Ltd.

- TSS Group

- Valeo SA

- VOXX Electronics Corp.

- Zen Micro Systems

- ZF Friedrichshafen AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 4.14 Billion |

| Forecasted Market Value ( USD | $ 8.16 Billion |

| Compound Annual Growth Rate | 11.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |