Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Integrated Facility Management (IFM) refers to the consolidation of all facility management services under a single, unified system to optimize the efficiency and effectiveness of an organization's facilities. This approach combines various aspects of facility management, such as maintenance, security, janitorial services, space planning, and energy management, into one cohesive service framework. By integrating these functions, organizations can streamline operations, reduce costs, and improve service quality.

The IFM market encompasses a wide range of services provided by specialized firms that manage the day-to-day operations of an organization's physical assets. These firms employ advanced technologies and best practices to enhance the operational efficiency of buildings and infrastructure. Key services typically include asset management, sustainability consulting, compliance management, and vendor coordination. The market is driven by the increasing complexity of facility management, the need for cost-effective solutions, and the growing emphasis on sustainability and energy efficiency.

Companies across various industries, including healthcare, education, retail, and commercial real estate, leverage IFM services to ensure their facilities run smoothly and support their core business activities. As a result, the IFM market continues to grow, driven by technological advancements and the demand for more efficient and sustainable facility management solutions.

Key Market Drivers

Urbanization and Infrastructure Development

Rapid urbanization and infrastructure development in Saudi Arabia significantly propel the IFM market. With a growing population and increasing urban migration, the demand for residential, commercial, and industrial spaces has surged. The government's focus on developing modern infrastructure, including transportation networks, airports, healthcare facilities, and educational institutions, further fuels this growth. The NEOM smart city spans 26,500 square kilometers and incorporates advanced urban planning, AI-powered infrastructure, and sustainability frameworks. This scale and complexity create long-term demand for integrated facility management, including energy optimization, asset management, and smart maintenance systems.As cities expand and new infrastructures emerge, the complexity of managing these facilities increases. Integrated Facility Management services become essential to ensure these developments are sustainable, efficient, and cost-effective. IFM providers offer comprehensive solutions that encompass maintenance, security, energy management, and space planning, catering to the diverse needs of urban infrastructures.

The rise of smart cities and the adoption of advanced technologies such as IoT, AI, and big data analytics in facility management are transforming how buildings and infrastructures are managed. These technologies enable real-time monitoring, predictive maintenance, and data-driven decision-making, enhancing the efficiency and sustainability of urban infrastructures. The push towards smart and sustainable cities aligns with Saudi Arabia's broader goals under Vision 2030, further driving the demand for integrated facility management solutions.

- Approximately 83% of Saudi Arabia’s population lives in urban areas, with cities like Riyadh, Jeddah, and Dammam being the major urban centers.

- The population is expected to grow to around 45 million by 2030, driving further urban development needs.

- The Saudi government aims to deliver 1.5 million homes by 2030 under the Saudi Housing Program, investing around USD 25 billion.

Key Market Challenges

Regulatory and Compliance Complexity

One of the significant challenges facing the Integrated Facility Management (IFM) market in Saudi Arabia is the complexity of regulatory and compliance requirements. The country has a myriad of regulations that govern building safety, environmental standards, labor laws, and health and safety protocols. Navigating these regulations can be daunting for IFM providers, especially for those new to the Saudi market.Ensuring compliance with local laws and standards requires extensive knowledge and expertise, which can be a substantial barrier for companies entering the market. For instance, regulations related to fire safety, building codes, and waste management necessitate continuous monitoring and updates to practices and procedures. Failure to comply with these regulations can result in hefty fines, legal issues, and reputational damage.

The regulatory landscape in Saudi Arabia is dynamic, with frequent updates and changes. Keeping up with these changes demands significant resources and a proactive approach. IFM providers must invest in training and development to ensure their staff are well-versed in current regulations and best practices. This ongoing need for compliance can strain resources and impact the profitability of IFM operations.

The drive towards sustainability and energy efficiency introduces new compliance challenges. Achieving certifications such as LEED or BREEAM requires meeting stringent criteria, which involves significant investment in upgrading facilities and implementing new technologies. IFM providers must balance the cost of compliance with the benefits of certification, which can be a challenging endeavor in a competitive market.

Key Market Trends

Growth of Smart Cities and Digital Transformation

One of the most prominent trends in the Saudi Arabia Integrated Facility Management (IFM) market is the rapid growth of smart cities and digital transformation initiatives. Driven by the ambitious Vision 2030 plan, the Saudi government is heavily investing in developing smart city projects like NEOM, the Red Sea Project, and Qiddiya. These projects aim to integrate advanced technologies to create highly efficient, sustainable, and livable urban environments. As of 2023, 96% of government services in Saudi Arabia are now digital, according to the Digital Government Authority. This shift toward automation and tech integration is mirrored in the facilities sector, driving demand for IoT-enabled and AI-driven IFM solutions.Smart cities rely on the Internet of Things (IoT), artificial intelligence (AI), big data analytics, and other cutting-edge technologies to optimize the management of urban infrastructure. For IFM providers, this means a shift towards offering tech-enabled services that leverage these technologies to enhance building performance, energy efficiency, and overall operational efficiency. For example, IoT sensors can monitor real-time data on energy usage, occupancy levels, and environmental conditions, allowing facility managers to make data-driven decisions that improve efficiency and reduce costs.

Digital transformation in facility management also includes the adoption of Building Information Modeling (BIM) for better planning and management of facilities throughout their lifecycle. BIM provides a digital representation of a building, facilitating better coordination, reducing errors, and improving maintenance and operations. This trend towards digitalization not only enhances the efficiency of facility management but also aligns with the broader national goals of sustainability and innovation.

The increasing use of mobile applications and cloud-based platforms enables real-time communication and collaboration between facility managers, service providers, and occupants. These platforms streamline workflows, improve response times, and enhance the overall user experience, making facility management more proactive and responsive.

Key Market Players

- CBRE, Inc.

- ISS A/S

- Sodexo Group

- Compass Group PLC

- Cushman & Wakefield Plc

- Jones Lang LaSalle Incorporated

- Aramark

- Johnson Controls International plc

- ENGIE SA

- Mitie Group PLC

Report Scope:

In this report, the Saudi Arabia Integrated Facility Management Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Saudi Arabia Integrated Facility Management Market, By Type:

- Hard Service

- Soft Service

Saudi Arabia Integrated Facility Management Market, By Service:

- Building and Property Management

- Cleaning and Hygiene

- Security and Staffing

- IT Support

- Others

Saudi Arabia Integrated Facility Management Market, By End-User:

- BFSI

- Utilities

- Aerospace & Defense

- Telecommunication

- Manufacturing

- Supply Chain & Logistics

- Real Estate & Infrastructure

- Healthcare

- Retail

- Energy & Resources

- Others

Saudi Arabia Integrated Facility Management Market, By Region:

- Riyadh

- Makkah

- Madinah

- Eastern Province

- Dammam

- Rest of Saudi Arabia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Saudi Arabia Integrated Facility Management Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- CBRE, Inc.

- ISS A/S

- Sodexo Group

- Compass Group PLC

- Cushman & Wakefield Plc

- Jones Lang LaSalle Incorporated

- Aramark

- Johnson Controls International plc

- ENGIE SA

- Mitie Group PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 86 |

| Published | July 2025 |

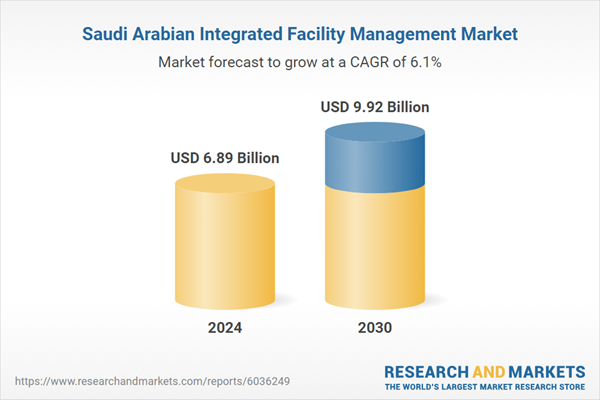

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.89 Billion |

| Forecasted Market Value ( USD | $ 9.92 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 10 |