Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, market players face substantial hurdles regarding the price volatility of raw materials, particularly natural latex and synthetic rubber components. Unforeseen shifts in the costs of these critical manufacturing inputs can diminish profit margins and disrupt supply chain stability. Consequently, these financial pressures threaten to hinder broader market growth and limit product accessibility in regions where cost sensitivity is high, potentially stalling expansion efforts.

Market Drivers

A primary catalyst for the Global Self-Adherent Wraps Market is the rising adoption of these products within veterinary medicine and animal healthcare. These cohesive bandages are particularly effective for veterinary use as they bond securely to themselves without adhering to animal fur or skin, thereby preventing the pain and trauma often caused by removing traditional adhesives.This characteristic has established them as the standard solution for wound management, catheter securement, and joint support among companion animals. This segment's growth is further bolstered by significant consumer spending on pet wellness. According to the American Pet Products Association's 'State of the Industry' presentation in June 2025, U.S. pet industry expenditures totaled $152 billion in 2024, demonstrating the immense economic backing for high-quality veterinary consumables.

Another major driver is the escalating consumer demand for home healthcare and first aid solutions, propelled by a trend toward self-administered care and managing chronic conditions outside of clinical environments. Self-adherent wraps are increasingly preferred in home care settings due to their simplicity, offering controlled compression without requiring clips or fasteners, which benefits elderly patients and non-professional caregivers. This shift is evidenced by the financial performance of major medical distributors serving the home channel. For instance, Owens & Minor reported in their March 2025 earnings call that their Patient Direct segment achieved mid-single-digit growth in 2024, outperforming the general market. Additionally, overall industry stability remains robust; 3M, a leading manufacturer, announced full-year net sales of $24.6 billion in their January 2025 results, underscoring the strong commercial infrastructure sustaining these medical products.

Market Challenges

The fluctuation of raw material prices, especially for natural latex and synthetic rubber, represents a major obstacle to the growth of the Global Self-Adherent Wraps Market. Manufacturers that depend heavily on these resources encounter volatile production costs, which complicate the formulation of long-term pricing strategies and jeopardize financial stability. When material expenses surge, companies are frequently compelled to raise the wholesale prices of cohesive bandages. This inflation makes the products less affordable for cost-sensitive healthcare regions and budget-constrained veterinary practices, potentially pushing buyers toward less expensive, traditional fastening methods and slowing overall adoption rates.Moreover, ongoing imbalances between supply and demand intensify these cost variations, resulting in material shortages that can disrupt manufacturing timelines and delay order deliveries. This instability is highlighted by recent industrial data pointing to a severe shortfall. According to the Association of Natural Rubber Producing Countries, global natural rubber consumption was expected to hit 15.75 million tons in 2024, significantly exceeding the production forecast of 14.50 million tons. This marked supply deficit exerts continuous upward pressure on input costs, directly reducing profit margins for wrap manufacturers and limiting their capacity to invest in expanding market distribution.

Market Trends

The transition toward latex-free synthetic formulations is fundamentally reshaping the product landscape of the Global Self-Adherent Wraps Market. Clinical preferences are swiftly moving away from natural rubber latex to reduce the risk of Type I allergic reactions and sensitization in patients undergoing long-term compression therapy. In response, manufacturers are developing cohesive bandages utilizing advanced synthetic elastomers and silicone-based technologies that provide reliable elasticity without the allergenic proteins found in traditional materials. This commercial shift toward high-performance synthetics is supported by the financial outcomes of key industry leaders. For example, the HARTMANN Group reported in March 2025 that its Wound Care segment achieved sales of EUR 608.9 million for the 2024 financial year, attributing organic growth largely to the robust adoption of advanced silicone-based dressings.Simultaneously, the adoption of eco-friendly and biodegradable materials is becoming a crucial competitive differentiator, driven by rising regulatory pressures and institutional sustainability requirements. Healthcare systems are increasingly evaluating the environmental impact of single-use consumables, prompting suppliers to manufacture wraps from compostable non-woven fabrics and utilize renewable packaging to minimize landfill waste. This industry-wide focus on circular economy principles is reflected in the operational strategies of major medical distributors. As noted in Medline's September 2025 'Sustainability Report,' the company reprocessed over 2.2 million medical devices in 2024, highlighting the extensive supply chain transformation that compels consumable manufacturers to adhere to stricter environmental standards to secure vendor contracts.

Key Players Profiled in the Self-Adherent Wraps Market

- 3M Co

- Cardinal Health Inc.

- PRIMED Medical Products Inc.

- Johnson & Johnson Consumer Inc.

- Walgreens Co

- Dynarex Corp

- Milliken & Co

- Medline Industries LP

- Essity AB

- Steroplast Healthcare Ltd.

Report Scope

In this report, the Global Self-Adherent Wraps Market has been segmented into the following categories:Self-Adherent Wraps Market, by Type:

- Sterile

- Non-Sterile

Self-Adherent Wraps Market, by End Use:

- Hospitals

- Specialty Clinics

- Household Healthcare

- Others

Self-Adherent Wraps Market, by Distribution Channel:

- Drugs/Pharmacy Stores

- Convenience Stores

- Online

- Others

Self-Adherent Wraps Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Self-Adherent Wraps Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Self-Adherent Wraps market report include:- 3M Co

- Cardinal Health Inc

- PRIMED Medical Products Inc

- Johnson & Johnson Consumer Inc

- Walgreens Co

- Dynarex Corp

- Milliken & Co

- Medline Industries LP

- Essity AB

- Steroplast Healthcare Ltd

Table Information

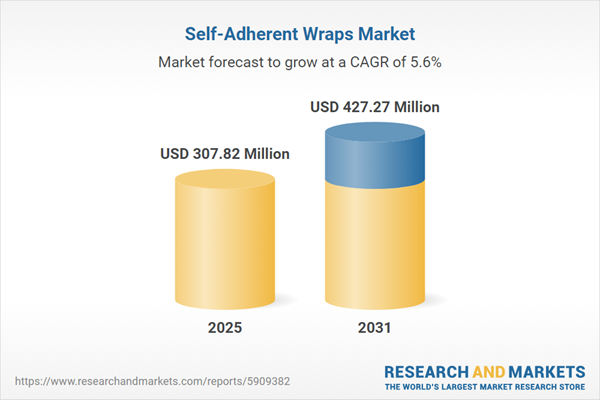

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 307.82 Million |

| Forecasted Market Value ( USD | $ 427.27 Million |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |