Increasing disposable incomes, rapid urbanization, shifting spending priorities of consumers, and changing consumption patterns toward more discretionary spending are significantly driving the demand for consumer electronics globally. This will augment the demand for fluid dispensing equipment over the forecast period. In the semiconductor industry, fluid dispensing equipment technology is used to deposit precise and controlled micro-volumes of thermally and electrically conductive pastes, adhesives, and encapsulants. Due to the complex microstructure of the PCB and other components, the ability of fluid dispensing units to deliver accuracy & reliability for individual requirements is a benefit. Components such as electrical contacts, semiconductors, electric motors, and generators need adhesives and encapsulants to adhere to the circuit board.

The growing disposable income of consumers worldwide is expected to lead to an increase in spending on personal vehicles. Over the past few decades, the number of personal vehicle owners has increased tremendously. Fluid dispensing equipment is used in the production line of automobiles. In LED automotive manufacturing, both silver paste and chip encapsulation dispensers play crucial roles in different aspects of the assembly process. Silver paste is primarily used for die-attach applications in LED automotive manufacturing.

Increasing consumer awareness regarding medical device benefits and the rising health consciousness worldwide propel the growth of the fluid dispensing equipment market over the forecast period. Various medical devices use Micro-Electro-Mechanical Systems (MEMS) sensors due to benefits such as their small size, high precision, low power consumption, and ability to provide real-time measurements. These sensors enhance the capabilities of medical devices by enabling accurate data collection, monitoring, and diagnostics. Products such as implantable medical devices, glucose monitoring machines, and blood pressure monitors use MEMS sensors for various functions.

The increasing investments and initiatives by various governments across the world to establish a strong service provider for semiconductor fabrication are expected to present further opportunities for fluid dispensing equipment manufacturers. Precision dispensing technology offers cost savings in chip production. Precision fluid dispensing also helps reduce waste generation by ensuring that the exact amount of material is dispensed at the exact location during chip fabrication. It also allows for high-quality production of the chips, which are further inspected using optical instruments to measure the thickness of the deposited layer.

Major players in the fluid dispensing equipment market include Nordson Corporation, PROTEC CO., LTD, Henkel Corporation, Graco, Mycronic, and Musashi Engineering. Strategies adopted by these companies usually include investments in R&D, new product development, and expansion of their distribution network. For instance, in November 2022, TECHCON launched the TS8200D series fluid dispensing equipment for two-component adhesives such as polyurethanes, acrylics, and epoxies. It comprises two improved M-Series Progressive Cavity pumps linked to a static mixing nozzle through a fluid manifold.

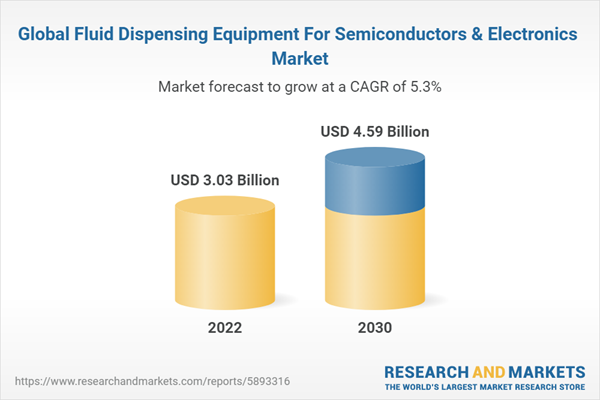

Fluid Dispensing Equipment For Semiconductors & Electronics Market Report Highlights

- The semiconductor application segment accounted for the highest share of 41.2% in the global market in 2022. Semiconductors/chips are employed in various products, including medical equipment, computers, appliances, gaming hardware, and smartphones. Fluid dispensing is a critical process in electronic manufacturing as this equipment combines electronic boards through the dispensing process

- The LED-automobile segment accounted for a 21.0% share of the global market in 2022, as LEDs are employed in the automotive sector due to them being energy and cost-efficient, especially with the transition to hybrid and electric vehicles. Also, the flexible LED light form allows for the creation of distinctive designs, thus driving the demand for more precise and accurate fluid dispensing equipment. Fluid dispensing equipment is used to pour liquid epoxy into an LED molding chamber in the LED automobile application industry

- The automatic fluid dispensing equipment segment is expected to witness a CAGR of 5.6% over the forecast period. The popularity of automated fluid dispensing equipment is rising as a result of their many advantages over manual ones. In addition to enhancing product quality and cutting costs, it enables faster, more precise, and consistent fluid dispensing

- The manual type segment is projected to advance at a CAGR of 4.3% over the forecast period. Manual fluid dispensing equipment is often used for applications that require careful placement and control of fluids, especially in cases where automated systems may not be practical or necessary

- In November 2022, Nordson Corporation completed the acquisition of CyberOptics Corporation. This move has helped the former to expand its test and inspection platform. The acquisition was conducted as an all-in cash transaction of approximately USD 380 million and was funded using the company’s revolving credit facility

Table of Contents

Companies Mentioned

- Nordson Corporation

- PROTEC CO., LTD

- NSW Automation

- ITW

- Musashi Engineering, Inc.

- GPD Global

- FISNAR

- Henkel Corporation

- TECHCON (Dover Corporation)

- INTERTRONICS

- Valco Cincinnati, Inc.

- Dymax

- ViscoTec Pumps and Dosing Technology GmbH

- Graco Inc.

- Shenzhen Tensun Precision Equipment Co., Ltd.

- IVEK Corporation

- Mycronic

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 168 |

| Published | September 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 3.03 Billion |

| Forecasted Market Value ( USD | $ 4.59 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |