Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Unlike solvent-based alternatives, solventless laminating adhesives do not emit volatile organic compounds (VOCs), making them a more sustainable and regulatory-compliant option. Their high versatility and ability to form durable bonds have further accelerated their use in applications where both performance and environmental responsibility are priorities. As global industries continue shifting toward greener solutions, solventless adhesives stand out as a key innovation in achieving sustainability goals while maintaining high product quality.

Key Market Drivers

Growing Demand for Flexible Packaging

The rising demand for flexible packaging is a major driver for the global solventless laminating adhesive market. With a market value approaching USD 900 million, flexible packaging continues to grow rapidly, particularly within the food and FMCG sectors, which together represent a significant share and are expanding at nearly 20% annually. Formats like films, pouches, and bags offer several benefits over rigid packaging, such as lightweight design, cost-efficiency, and easier customization. These attributes appeal to both manufacturers and consumers, especially in environmentally conscious markets. Flexible packaging also helps extend product shelf life, reduce material usage, and improve user convenience. Solventless laminating adhesives play a crucial role in enabling these advantages by providing strong, efficient, and eco-friendly bonding solutions, thus aligning perfectly with the ongoing industry shift toward sustainability.Key Market Challenges

More Expensive than Solvent-Based Laminating Adhesives

The higher upfront cost of solventless laminating adhesives compared to their solvent-based counterparts remains a key challenge limiting broader market adoption. Although solventless options provide clear benefits - such as reduced VOC emissions, enhanced safety, and better long-term performance - their initial price can deter manufacturers, especially in cost-sensitive industries.The challenge is compounded by the rising demand for flexible packaging fueled by the global e-commerce boom, where efficient, reliable adhesives are essential. Smaller businesses may struggle to justify the investment in costlier materials and the capital required for new or upgraded equipment. However, solventless technology offers long-term gains through lower operational risks, better compliance with environmental standards, and minimized solvent handling costs. As market education and demand continue to evolve, the price barrier is expected to lessen, paving the way for increased adoption of solventless laminating adhesives.

Key Market Trends

Growing Demand for Water-Based Solventless Laminating Adhesives

A key trend shaping the market is the growing preference for water-based solventless laminating adhesives. These products are gaining prominence for their low emissions, enhanced safety, and alignment with environmental standards. Brands such as Henkel’s LOCTITE Liofol range exemplify this movement, offering high-performance adhesives for both food and non-food packaging.Water-based solventless adhesives support sustainability efforts while delivering reliable bonding, making them well-suited for industries with stringent safety and ecological requirements. Their increasing adoption reflects a broader shift toward green manufacturing practices, particularly in packaging sectors where minimizing VOCs and ensuring food safety are critical. As regulatory frameworks tighten and consumer demand for sustainable solutions intensifies, this trend is expected to play a pivotal role in market growth.

Key Market Players

- Ashland Inc

- Dow Inc

- Songwon International AG

- Bostik SA

- Morchem SA

- DIC Corp

- ACTEGA Kelstar, Inc.

- Toyochem Co Ltd

- Toyo-Morton Ltd

- BASF SE

Report Scope:

In this report, the Global Solventless Laminating Adhesive Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Solventless Laminating Adhesive Market, By Type:

- Isocyanate

- Polyol

Solventless Laminating Adhesive Market, By Application:

- Food Packaging

- Beverage Packaging

- Others

Solventless Laminating Adhesive Market, By Region:

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Solventless Laminating Adhesive Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Ashland Inc

- Dow Inc

- Songwon International AG

- Bostik SA

- Morchem SA

- DIC Corp

- ACTEGA Kelstar, Inc.

- Toyochem Co Ltd

- Toyo-Morton Ltd

- BASF SE

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | June 2025 |

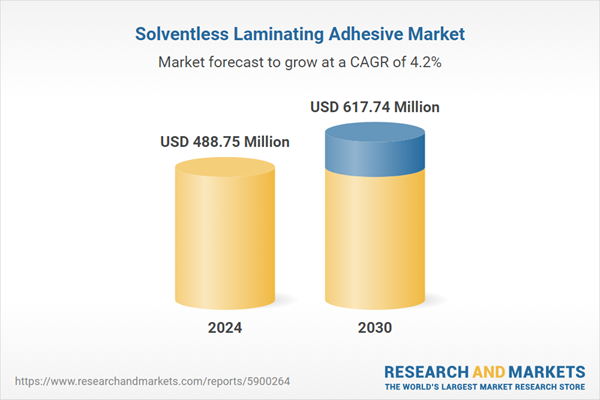

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 488.75 Million |

| Forecasted Market Value ( USD | $ 617.74 Million |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |