COVID-19 has impacted the battery management systems market. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, South Korean battery management systems (BMS) are likely to have an upscaled demand due to their functional safety for the better performance of battery packs and the growing demand for energy storage systems in the country.

- On the other hand, the additional costs for integrating BMS solutions into the battery packs, which make them more expensive, are expected to hinder the market growth.

- Nevertheless, the country's renewable energy plans for the near future create ample opportunities for market development. The country's BESS projects and other renewable projects have so far stretched the Renewable Portfolio Standard (RPS) from 3.5% in 2016 to 9% in 2021.

South Korea Battery Management Systems Market Trends

Transportation Expected to Dominate the Market

- The EV industry is one of the biggest consumers of batteries produced in the country. The automotive leader Tesla was the biggest factor in the drift toward the electrification of transport in the country. However, many new foreign companies have also carved out their well-known positions in the country, particularly the European and US automakers.

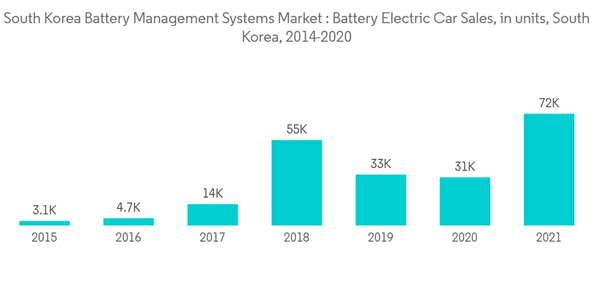

- The demand for electric vehicles has abruptly shot up in the country, particularly battery electric vehicles. According to the International Energy Agency, the battery electric car sales were recorded as 72,000 units in 2021, an uptrend in the last five years. South Korea is expected to envisage a boom in the EV market in the coming years due to the interest shown by new players to launch new EV models.

- For example, in November 2021, General Motors announced plans to launch ten new EV models in South Korea by 2025. The plan is a part of the company's new strategy of shifting toward zero-emission vehicles from internal combustion engines.

- Moreover, Kia, the other major South Korean automaker, introduced a new EV model, EV6, in South Korea. The Crossover Utility Vehicle (CUV) has an appealing appearance and is compared with the Jaguar-I Pace, one of the best-looking EVs yet.

- All such developments are expected to have an overwhelming effect on the battery management systems market in the country with the increased usage of battery packs in the EV industry.

Growth in Energy Storage Industry Expected to Drive the Market

- South Korea has attempted to strengthen the power security of the country with energy storage systems. Standalone and hybrid battery energy storage systems have been frequently established in the country in the last decade, which directly impacted the battery manufacturing industry and the associated systems positively.

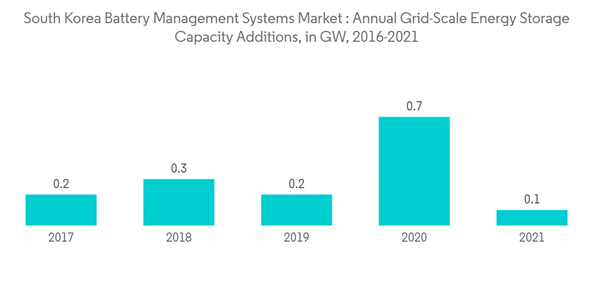

- The country is on a continuous spree to reduce its dependency on fossil fuels and nuclear power generation. Thus the new and renewable energy portfolio is the focus of the Korean government. The annual energy storage capacity additions in the country were around 0.1GW in the year 2021, and a higher value is expected in the coming years due to the energy storage projects.

- Many projects are planned in combination with renewable power projects in the country. For example, in January 2022, G8 Subsea, the Singapore-Norwegian company, signed an agreement with the Korean company Holim Tech to develop an offshore wind power project in Korea, along with the installation of battery energy storage systems in the plant. 3DOM, a Japan-headquartered company, is expected to provide the battery system.

- The country not only witnessed short-term projects but long-run initiatives, too, to develop the energy storage market. As an example, Energy Vault and Korea Zinc announced a strategic partnership in the energy storage business, with an investment of USD50 million.

- Such developments in the end-user industries are expected to drive the battery management systems market growth in the country.

South Korea Battery Management Systems Market Competitor Analysis

The South Korean battery management systems market is moderately consolidated. Some of the key players in the market (in no particular order) include Ficosa International SA, Schneider Electric SE, Renesas Electronics Corporation, NXP Semiconductors NV, and LG Energy Solutions Ltd.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ficosa International SA

- Schneider Electric SE

- Renesas Electronics Corporation

- NXP Semiconductors NV

- LG Energy Solutions Ltd

- AVL List GmBH

- Avnet Asia Pte Ltd

- SkOn Co. Ltd (SK Innovation)

- Panasonic Holdings Corporation