Introduction

A specialty adhesive is formulated and designed for specific, specialized, or unique applications. They are developed to address particular challenges, materials, or conditions in various industries and sectors. These adhesives exhibit characteristics and properties tailored to meet specific requirements such as extreme temperatures, high stress, chemical resistance, flexibility, optical clarity, electrical conductivity, or compatibility with certain materials. Specialty adhesives are commonly used in fields such as aerospace, automotive, electronics, healthcare, construction, textiles, and more. They play a crucial role in facilitating the assembly, bonding, or joining of materials in situations where standard adhesives may not provide adequate performance. The formulation and properties of specialty adhesives are carefully engineered to ensure optimal results in their intended applications.Key Drivers

Increase in demand from the building and construction sector is expected to drive the growth of specialty adhesives market. Specialty adhesives play a crucial role in the building and construction sector, offering unique properties and capabilities that cater to specific applications and challenges. These adhesives are designed to adhere to diverse building materials, providing strong and durable bonds while addressing various construction needs. Specialty adhesives offer superior bonding strength and are well-suited for a variety of materials, including metals, plastics, ceramics, and composites. As construction projects become more complex and involve diverse materials, these adhesives enable engineers and builders to ensure long-lasting, secure connections. This is especially critical in high-stakes applications, like in high-rise buildings, infrastructure projects, and environmentally sensitive areas, where traditional bonding methods may not provide the necessary resilience and longevity.Specialty adhesives are essential in the building and construction industry provide strong bonds between diverse materials, crucial for infrastructure projects in rapidly urbanizing economies such as the U.S., China, and India. This has increased government spending on the building & construction sector to develop various upcoming infrastructure projects. For instance, according to a report published by the National Investment Promotion and Facilitation Agency, infrastructure activities accounted for 13% share of the total foreign direct investment (FDI) inflows in 2021.

Specialty adhesives are used in areas such as pipelines, concrete floors, hospitals, and warehouses for surface protection, material reinforcement, and corrosion resistance. These factors are anticipated to fuel the demand for specialty adhesives in the growing building & construction sector. However, temperature stability and durability is expected to restraint the growth of specialty adhesives market. The performance of specialty adhesives is often constrained by limitations in temperature stability and overall durability. Specifically, these adhesives can lose their effectiveness when exposed to high temperatures, leading to a significant reduction in their bonding strength and structural integrity. Such temperature sensitivity restricts their use in applications where components are subjected to heat, such as automotive engine compartments, industrial equipment, or aerospace structures. In these environments, consistent and reliable adhesion is critical, and the potential for failure due to thermal stress poses a significant concern for manufacturers and engineers. All these factors hamper the growth of the market during the forecast period.

Growing environmental awareness and the need for more responsible manufacturing and construction practices propel the demand for sustainable, eco-friendly adhesives. These adhesives, used in diverse sectors such as packaging, construction, and healthcare, prioritize minimal environmental impact via renewable resources, biodegradable materials, and low VOC content. This shift aligns with eco-friendly goals and stricter regulations, reducing carbon footprints and enhancing corporate social responsibility. All these factors are anticipated to offer new growth opportunities for specialty adhesives during the forecast period.

Segments Overview

The specialty adhesives market is segmented on the basis of product, end-use industry, and region. By product, the market is segregated into cyanoacrylates, polyvinyl acetate, polyurethanes, acrylic, silicone, and others. By end-use industry, the market is divided into aerospace, automotive, construction, marine, medical, electronics, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.Competitive Analysis

Key players operating in the specialty adhesives market include 3M Company, Nexus Adhesives, Savare Specialty Adhesives LLC, Master Bond Inc., Permatex Inc., Specialty Adhesives and Coatings, Inc., Henkel Corporation, Bostik SA., Worthen Industries, Advanced Adhesive Technologies Inc., and Dow.Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the specialty adhesives market analysis from 2023 to 2033 to identify the prevailing specialty adhesives market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the specialty adhesives market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global specialty adhesives market trends, key players, market segments, application areas, and market growth strategies.

Additional benefits you will get with this purchase are:

- 5 additional Company Profile of client Choice pre- or Post-purchase, as a free update.

- Free Upcoming Version on the Purchase of Enterprise User License.

- 16 analyst hours of support* (post-purchase, if you find additional data requirements upon review of the report, you may receive support amounting to 16 analyst hours to solve questions, and post-sale queries)

- 15% Free Customization* (in case the scope or segment of the report does not match your requirements, 15% is equivalent to 3 working days of free work, applicable once)

- Free data Pack on the Enterprise User License. (Excel version of the report)

- Free Updated report if the report is 6-12 months old or older.

- 24-hour priority response*

- Free Industry updates and white papers.

Possible Customization with this report (with additional cost and timeline, please talk to the sales executive to know more)

- Analysis of raw material in a product (by %)

- End user preferences and pain points

- Installed Base analysis

- Investment Opportunities

- Upcoming/New Entrant by Regions

- Technology Trend Analysis

- Market share analysis of players by products/segments

- Patient/epidemiology data at country, region, global level

- Surgical procedures data- specific or multiple surgery types

- Additional company profiles with specific to client's interest

- Additional country or region analysis- market size and forecast

- Expanded list for Company Profiles

- Historic market data

- Import Export Analysis/Data

- List of customers/consumers/raw material suppliers- value chain analysis

- Market share analysis of players at global/region/country level

- SWOT Analysis

- Volume Market Size and Forecast

Key Market Segments

By Product

- Polyvinyl Acetate

- Polyurethanes

- Acrylic

- Silicone

- Others

- Cyanoacrylates

By End-Use Industry

- Aerospace

- Automotive

- Construction

- Marine

- Medical

- Electronics

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Spain

- Italy

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- South Africa

- Saudi Arabia

- Rest of LAMEA

Key Market Players

- Master Bond Inc.

- Advanced Adhesive Technologies Inc.

- 3M Company

- Nexus Adhesives

- Henkel Corporation

- Dow

- Savare Specialty Adhesives LLC

- Bostik SA.

- Worthen Industries

- Permatex Inc.

- Specialty Adhesives and Coatings, Inc.

Please note:

- Online Access price format is valid for 60 days access. Printing is not enabled.

- PDF Single and Enterprise price formats enable printing.

Table of Contents

Executive Summary

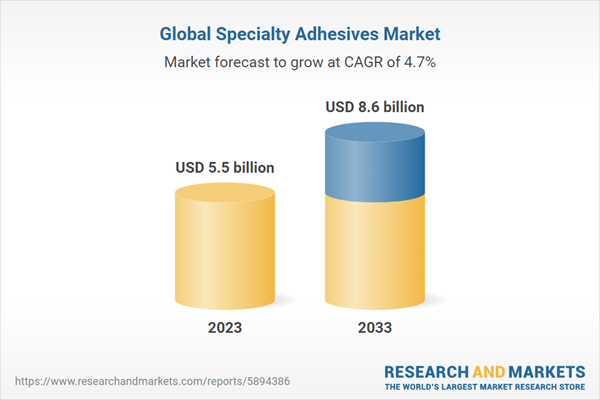

According to this report, the specialty adhesives market was valued at $4.7 billion in 2022, and is estimated to reach $7.3 billion by 2032, growing at a CAGR of 4.7% from 2023 to 2032.Specialty adhesives play a pivotal role in various industries by bonding materials together effectively and providing unique properties tailored to specific applications. These adhesives are formulated to cater to demanding requirements, often surpassing the capabilities of traditional adhesive solutions. Specialty adhesives are advanced adhesive formulations designed for specific applications and industries. They exhibit exceptional bonding properties, resistance to extreme conditions, and tailored attributes to meet the stringent demands of various sectors. Specialty adhesives are commonly composed of polymers, which are long chains of repeating molecules. The polymer matrix contributes to the adhesive's strength, flexibility, and overall performance.

Specialty adhesives are engineered to provide superior bonding strength, often outperforming traditional adhesives. This attribute ensures a secure and long-lasting connection between materials. These adhesives can be customized to match specific application requirements. Whether it's bonding dissimilar materials, withstanding extreme temperatures, or adhering to challenging surfaces, specialty adhesives can be tailored accordingly.

Specialty adhesives offer exceptional durability, even in harsh environments. They resist moisture, chemicals, UV radiation, and mechanical stress, making them ideal for industries like aerospace, automotive, and construction. Another brilliant benefit is the accelerated aesthetics they offer. Unlike mechanical fasteners, forte adhesives create nearly invisible bonds, improving the appearance of the finished product. This is especially necessary in industries the place visual appeal is a key factor, such as client electronics and luxury goods.

The adoption of specialty adhesives brings forth a multitude of benefits. One primary benefit is their high-quality bonding strength. These adhesives create connections that stand up to various stresses, vibrations, and temperature fluctuations, making sure the sturdiness of the bonded components. Furthermore, specialty adhesives regularly grant remarkable chemical resistance, defending the bonds from degradation when exposed to harsh substances.

Specialty adhesives allow for the creation of clean, smooth, and uninterrupted surfaces. This is particularly valuable in industries such as interior design, luxury goods, and consumer electronics, where the visual appeal of the product is a primary selling point. Traditional fasteners such as screws, nails, or rivets can create visual disruptions on the surface of a product. Specialty adhesives eliminate the need for such fasteners, resulting in a more cohesive and visually pleasing design.

Eco-friendly specialty adhesives are gaining traction as industries strive to reduce their environmental impact. Biodegradable and low-VOC (volatile organic compound) formulations are becoming more popular. The automotive industry's shift towards electric vehicles and lightweight materials necessitates specialty adhesives that can bond these materials reliably.

The adoption of forte adhesives brings forth a multitude of benefits. One major advantage is their awesome bondinEnvironmental issues also play a great position in the increasing adoption of distinctiveness adhesives. With a center of attention on sustainability and reduced waste, producers are turning to adhesives as picks to regular joining methods that can also produce extra waste or emissions. Specialty adhesives market growth require much less energy-intensive strategies and generate minimal waste, aligning with eco-friendly initiatives.

Furthermore, the vogue toward miniaturization in more than a few industries has led to the demand for smaller and lighter components. Specialty adhesives market forecast the meeting of intricate parts besides including full-size weight. This is mainly integral in industries like electronics and aerospace, where weight reduction at once influences performance and efficiency.

In the medical field, specialty adhesives market trend enabled advancements in wearable scientific gadgets and minimally invasive procedures. These adhesives provide biocompatibility, permitting them to be used safely inside or on the human body. These adhesives create connections that withstand various stresses, vibrations, and temperature fluctuations, ensuring the sturdiness of the bonded components. Furthermore, strong point adhesives often furnish incredible chemical resistance, protecting the bonds from degradation when exposed to harsh substances.

Another superb benefit is the elevated aesthetics they offer. Unlike mechanical fasteners, specialty adhesives create nearly invisible bonds, bettering the look of the completed product. This is specifically essential in industries where visible enchantment is a key factor, such as consumer electronics and luxury goods.

The specialty adhesive market is segmented on the basis of product, end-use industry, and region. By product, the market is segmented into cyanoacrylates, polyvinyl acetate, polyurethanes, acrylic, and others. By end-use industry, the market is divided into aerospace, automotive, construction, marine, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The major players operating in the global specialty adhesives market share include 3M Company, Advanced Adhesive Technologies Inc., Bostik, Henkel Corporation, Master Bond Inc., Nexus Adhesives, Permatex Inc., Savare Specialty Adhesives LLC, Specialty Adhesives and Coatings, Inc., and Worthen Industries. In addition, the market drivers, restraints, and opportunities are explained in the report.

Key Findings of the Study

:By product, the cyanoacrylates segment was dominated the market in 2022.By end-use industry, the marine segment was dominated the market in 2022, growing with a CAGR of 5.4%

By region, Asia-Pacific was the highest revenue contributed in 2022, and is estimated to register a CAGR of 4.9%.

Companies Mentioned

- Master Bond Inc.

- Advanced Adhesive Technologies Inc.

- 3M Company

- Nexus Adhesives

- Henkel Corporation

- Dow

- Savare Specialty Adhesives LLC

- Bostik SA.

- Worthen Industries

- Permatex Inc.

- Specialty Adhesives and Coatings, Inc.

Methodology

The analyst offers exhaustive research and analysis based on a wide variety of factual inputs, which largely include interviews with industry participants, reliable statistics, and regional intelligence. The in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. The primary research efforts include reaching out participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions.

They are also in professional corporate relations with various companies that allow them greater flexibility for reaching out to industry participants and commentators for interviews and discussions.

They also refer to a broad array of industry sources for their secondary research, which typically include; however, not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic news articles and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecast

Furthermore, the accuracy of the data will be analyzed and validated by conducting additional primaries with various industry experts and KOLs. They also provide robust post-sales support to clients.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 330 |

| Published | January 2025 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value ( USD | $ 5.5 billion |

| Forecasted Market Value ( USD | $ 8.6 billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |