Global Steel Scrap Market - Key Trends & Drivers Summarized

Why Is Steel Scrap Important in the Recycling Industry?

Steel scrap is a vital component of the recycling industry, playing a crucial role in the production of new steel. Recycling steel scrap conserves natural resources, reduces energy consumption, and lowers greenhouse gas emissions compared to primary steel production from iron ore. The use of steel scrap in electric arc furnaces (EAF) significantly decreases the environmental impact of steelmaking, aligning with global sustainability goals. The circular nature of steel, where it can be recycled indefinitely without loss of quality, makes steel scrap a cornerstone of the circular economy. The growing emphasis on sustainable practices is driving the importance and demand for steel scrap in the recycling industry.What Are the Benefits and Challenges of Using Steel Scrap?

The benefits of using steel scrap are numerous, including reduced environmental impact, lower production costs, and conservation of natural resources. Recycling steel scrap requires significantly less energy than producing steel from virgin materials, resulting in lower carbon emissions and reduced operational costs. However, challenges exist in the collection, sorting, and processing of steel scrap to ensure consistent quality and remove impurities. Contaminants such as coatings, alloys, and non-metallic materials must be effectively managed to produce high-quality recycled steel. Advances in sorting and processing technologies are addressing these challenges, improving the efficiency and quality of steel scrap recycling.How Is Technology Enhancing Steel Scrap Recycling?

Technological advancements are enhancing the efficiency and effectiveness of steel scrap recycling. Innovations in sorting technologies, such as magnetic separation and advanced sensor-based sorting, are improving the purity and quality of recycled steel. The development of sophisticated shredding and processing equipment is increasing the recovery rates of steel from mixed waste streams. Advanced metallurgical processes are enabling the production of high-quality steel from scrap, meeting the stringent requirements of various industries. Automation and digitalization are also playing a role in optimizing recycling operations, reducing costs, and increasing productivity. These technological improvements are crucial for maximizing the benefits of steel scrap recycling and supporting the growth of the industry.What Factors Are Driving the Growth in the Steel Scrap Market?

The growth in the steel scrap market is driven by several factors. The increasing focus on sustainability and environmental regulations is encouraging the use of recycled materials in steel production. The rising cost of raw materials and the economic benefits of recycling are also boosting demand for steel scrap. Technological advancements in recycling and processing are enhancing the quality and efficiency of steel scrap utilization. Additionally, the growth of the construction, automotive, and manufacturing industries is increasing the demand for steel, further driving the need for steel scrap. These factors collectively ensure the continued growth and innovation in the steel scrap market.Report Scope

The report analyzes the Steel Scrap market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Obsolete Scrap, Prompt Scrap, Home Scrap); End-Use (Construction End-Use, Automotive End-Use, Shipping End-Use, Consumer Appliances End-Use, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Turkey; Rest of Europe; Asia-Pacific; India; South Korea; Rest of Asia-Pacific; Latin America; Brazil; Rest of Latin America; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Obsolete Scrap segment, which is expected to reach 407.2 Million Metric Tons by 2030 with a CAGR of 6.2%. The Prompt Scrap segment is also set to grow at 3.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at 51.5 Million Metric Tons in 2024, and China, forecasted to grow at an impressive 6.4% CAGR to reach 282.6 Million Metric Tons by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Steel Scrap Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Steel Scrap Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Steel Scrap Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ArcelorMittal S.A., Commercial Metals Company, EVRAZ North America, Gerdau S/A, Metalico, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 81 companies featured in this Steel Scrap market report include:

- ArcelorMittal S.A.

- Commercial Metals Company

- EVRAZ North America

- Gerdau S/A

- Metalico, Inc.

- Nucor Corporation

- Oryx Stainless Group

- Sims Metal Management Limited

- Steel Dynamics, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ArcelorMittal S.A.

- Commercial Metals Company

- EVRAZ North America

- Gerdau S/A

- Metalico, Inc.

- Nucor Corporation

- Oryx Stainless Group

- Sims Metal Management Limited

- Steel Dynamics, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 439 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

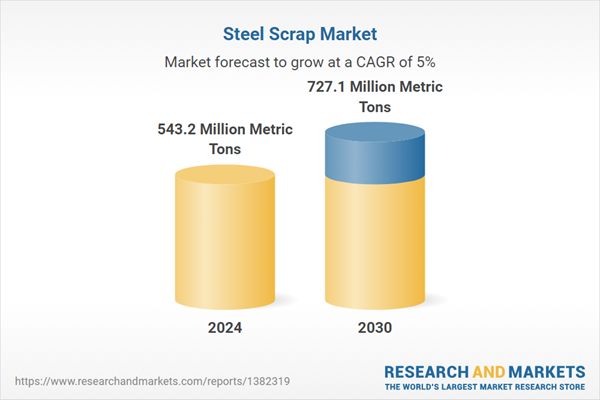

| Estimated Market Value in 2024 | 543.2 Million Metric Tons |

| Forecasted Market Value by 2030 | 727.1 Million Metric Tons |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |