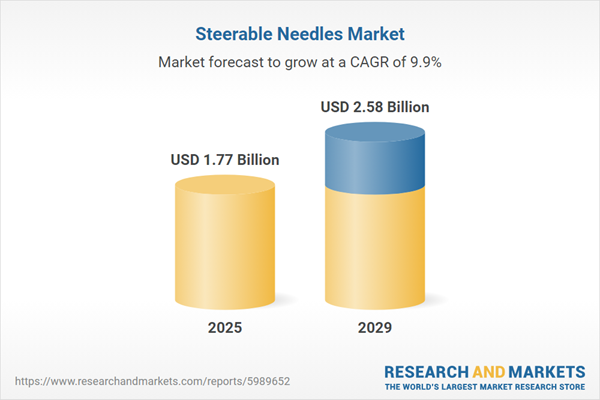

The steerable needles market size has grown rapidly in recent years. It will grow from $1.61 billion in 2024 to $1.77 billion in 2025 at a compound annual growth rate (CAGR) of 10.1%. The growth in the historic period can be attributed to regulatory approvals and standardization initiatives, increased demand for minimally invasive procedures, increased prevalence of chronic diseases, expanding applications in diagnostic imaging, and a growing geriatric population.

The steerable needles market size is expected to see strong growth in the next few years. It will grow to $2.58 billion in 2029 at a compound annual growth rate (CAGR) of 9.9%. The growth in the forecast period can be attributed to the adoption of artificial intelligence in medical procedures, expansion of telemedicine and remote surgery, emerging markets and untapped opportunities, integration of steerable needles with imaging technologies, and development of advanced materials for enhanced maneuverability. Major trends in the forecast period include enhanced robotic-assisted navigation systems, miniaturization of components for improved flexibility, incorporation of sensor technology for real-time feedback, integration of machine learning algorithms for trajectory optimization, and development of smart materials for self-steering capabilities.

The growing acceptance of minimally invasive procedures is expected to drive the steerable needles market in the future. These procedures involve medical interventions conducted through small incisions or natural body openings, reducing tissue damage and recovery time. The rising adoption of minimally invasive procedures is attributed to their shorter recovery times, decreased risk of complications, and reduced postoperative pain for patients. Steerable needles play a crucial role in these procedures by enabling precise navigation and targeting of specific tissues, improving accuracy and minimizing damage to surrounding areas. For example, in September 2023, the American Society of Plastic Surgeons reported an increase in minimally invasive procedures, such as HA fillers, from 28.78 million in 2020 to 48.83 million in 2022. Similarly, non-invasive fat reduction procedures rose from 38.65 million in 2020 to 68.29 million in 2022. Thus, the growing adoption of minimally invasive procedures is a key driver for the steerable needles market's growth.

Major companies in the field of steerable needles are innovating with products such as steerable biopsy needles to improve the precision of tissue sampling, minimize patient discomfort, and enhance diagnostic accuracy. These specialized medical needles are designed to extract tissue samples from specific, often challenging-to-reach areas within the body, enabling controlled directional adjustments during insertion. For example, in September 2022, Serpex Medical, a US-based medical device company, obtained FDA 510K clearance for Compass Steerable Needles. These needles allow precise access to lung nodules in the intrapulmonary region, offering precise three-dimensional positioning to reach all 18 lung segments and access small lesions outside the airways. They provide exceptional maneuverability, enabling more precise targeting and lesion access. This controlled approach to target locations allows sampling of multiple tumor aspects without unwanted tip deflection.

In October 2022, Halma plc, a UK-based technology company, completed the acquisition of IZI Medical Products for £138 million ($149.9 million). This strategic move by Halma aims to bolster its healthcare division's capabilities, especially in the realm of minimally invasive diagnosis and treatment, particularly for conditions such as cancer. IZI Medical Products, a US-based medical equipment manufacturer, specializes in providing steerable FNA biopsy needles, which are instrumental in patient care.

Major companies operating in the steerable needles market are Johnson & Johnson, Medtronic Plc, Siemens Healthineers AG, Becton Dickinson and Company, Koninklijke Philips, Stryker Corporation, GE HealthCare Technologies, Boston Scientific Corporation, Olympus Corporation, Terumo Corporation, Intuitive Surgical Inc, Smith & Nephew plc, Hologic Inc, Varian Medical Systems Inc, Coloplast A/S, Cook Medical Incorporated, Bio-Rad Laboratories Inc, Teleflex Incorporated, KARL STORZ SE & Co KG, Elekta Instrument AB, Merit Medical Systems Inc, ConMed Corporation, Penumbra Inc, AngioDynamics Inc, AprioMed Inc.

North America was the largest region in the steerable needles market in 2024. Asia Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the steerable needles market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the steerable needles market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Steerable needles represent a category of medical needles engineered to alter their direction inside the body, enabling them to reach precise targets that conventional straight needles may struggle to access. These needles integrate mechanisms permitting controlled adjustments to their trajectory in real-time, frequently under the guidance of imaging modalities such as ultrasound, magnetic resonance imaging (MRI), or fluoroscopy. By facilitating precise adjustments, steerable needles enhance the accuracy of medical procedures, minimize tissue trauma, and enhance outcomes, particularly in intricate interventions.

The primary varieties of steerable needles comprise bevel-tip flexible needles, symmetric-tip needles, and tendon-actuated tip needles. Bevel-tip flexible needles feature a slanted, beveled edge at their tip, aiding in smoother tissue penetration. These needles find utility in various applications such as biopsies, tumor ablations, pain management, robotic-assisted surgeries, among others. They are distributed to end-users including hospitals, ambulatory surgical centers, and others.

The steerable needles market research report is one of a series of new reports that provides steerable needles market statistics, including the steerable needles industry global market size, regional shares, competitors with steerable needles market share, detailed steerable needles market segments, market trends, and opportunities, and any further data you may need to thrive in the steerable needles industry. These steerable needles market research reports deliver a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The steerable needles market consists of sales of biopsy needles, catheter insertion needles, spinal needles, endoscopic needles, and vascular access needles. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Steerable Needles Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on steerable needles market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for steerable needles ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The steerable needles market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Bevel-Tip Flexible Needles; Symmetric-Tip Needles; Tendon Actuated Tip Needles2) By Application: Biopsy; Tumor Ablation; Pain Management; Robotic Assisted Surgery; Other Applications

3) By End User: Hospitals; Ambulatory Surgical Centers; Others End Users

Subsegments:

1) By Bevel-Tip Flexible Needles: Single Bevel-Tip Needles; Double Bevel-Tip Needles2) By Symmetric-Tip Needles: Standard Symmetric-Tip Needles; Curved Symmetric-Tip Needles

3) By Tendon Actuated Tip Needles: Single Tendon Actuated Needles; Dual Tendon Actuated Needles

Key Companies Mentioned: Johnson & Johnson; Medtronic Plc; Siemens Healthineers AG; Becton Dickinson and Company; Koninklijke Philips

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Steerable Needles market report include:- Johnson & Johnson

- Medtronic Plc

- Siemens Healthineers AG

- Becton Dickinson and Company

- Koninklijke Philips

- Stryker Corporation

- GE HealthCare Technologies

- Boston Scientific Corporation

- Olympus Corporation

- Terumo Corporation

- Intuitive Surgical Inc

- Smith & Nephew plc

- Hologic Inc

- Varian Medical Systems Inc

- Coloplast A/S

- Cook Medical Incorporated

- Bio-Rad Laboratories Inc

- Teleflex Incorporated

- KARL STORZ SE & Co KG

- Elekta Instrument AB

- Merit Medical Systems Inc

- ConMed Corporation

- Penumbra Inc

- AngioDynamics Inc

- AprioMed Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.77 Billion |

| Forecasted Market Value ( USD | $ 2.58 Billion |

| Compound Annual Growth Rate | 9.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |