A primary growth driver for storage software is data growth within industries, which is fueled by the changes brought about by digital transformation and boosted by cloud computing, Internet of Things (IoT), and big data analytics. With an ever-increasing pace of data production and consumption by organizations, effective data storage solutions have become highly imperative-and this represents a huge growth opportunity for the storage software market. With higher escalation in data volumes, businesses need more storage software that can look after large amounts of data with quicker access to data, integrity in data, and supports the requirement for regulation. The amplified trend towards digitalization has led to a greater dependency on cloud-native storage systems and Software Defined Storage (SDS), which help enhance adaptability, offer cost-effectiveness, and deliver high performance. For instance, in September 2024, IBM introduced the IBM Storage DS8000 (10th Generation) with 99.999999% availability, enhanced cybersecurity, AI-driven data management, and high-speed NVMe and FlashCore Module integration, optimizing performance for IBM Z mainframe workloads. Moreover, as organizations seek to improve operational efficiency and streamline data management, the storage software market will continue to expand globally, meeting the mounting demand for innovative solutions to handle evolving data storage needs.

Accelerating demand for the adoption of data-driven decision making in industries where storage software within the United States is one major driving factor. Through amplified demands, where industries can utilize data to analyze business with analytics, artificial intelligence (AI), and Machine Learning (ML). Heightened adoption of analytics, ML, and AI requires significant and scalable data storage. Many of the tech giants and startups in the U.S. drive the adoption of innovative storage software solutions for supporting growing data requirements from sectors, such as healthcare, finance, and retail. For example, in November 2024, NetApp launched new AFF A-Series and C-Series all-flash storage systems, enhancing performance, scalability, and AI readiness with 2.5X speed, 99% ransomware protection accuracy, and 97% power savings for businesses of all sizes. Additionally, remote work and digital collaboration also fuel demand for cloud storage and secure data management tools. With rising regulatory pressures by HIPAA, CCPA and others, more advanced data storage solutions enable compliance and safety which are being driven by U.S. companies as well. Moreover, the migration of enterprises into hybrid and multi-cloud environments becomes a driving force for the growing demand of high-performance and flexible storage software in the U.S. market.

Storage Software Market Trends:

Cloud Storage Growth

The cloud-based storage solution is a significant trend in the storage software market growth. As an organization starts relying more on digital data than physical data, the need for a readily available, cost-effective storage facility has grown to be severely important. Cloud-based solutions are highly adaptable for managing complex volumes of data without high one-time expenses for infrastructure with on-premises storage. According to the U.S. Department of Commerce, the global cloud computing market is estimated to reach USD 832.1 billion by 2025, with storage services being one of the core drivers of this growth. Such growth is propelled by factors like heightening adoption of cloud computing, the need for disaster recovery, and the growing remote workforce requiring accessible data storage. Key drivers of this rapid growth include the increasing adoption of cloud computing, need for disaster recovery, and the emergence of the remote workforce, which increases the demand for accessible data storage for employees. Additionally, businesses are drawn to cloud storage’s ability to handle big data analytics and backup, while offering a pay-per-use model that reduces long-term capital expenses. This trend is expected to accelerate as more organizations embrace hybrid and multi-cloud environments.AI and Automation Integration

The integration of AI and ML technologies into the storage software has transformed data management and operational efficiency. With the use of AI, storage solutions can automate some of the core processes, which include data migration, predictive maintenance, and data tiering. AI-driven systems can analyze gigantic datasets in real time, so storage solutions are able to make dynamic resource allocations based on a workload or changed data patterns. This level of automation reduces the need for manual intervention, thus lowering labor costs and human error. With AI-enhanced storage solutions, it is possible to optimize storage space by finding redundant data, thus cost-effectiveness improves. ML models can predict the storage future requirements and, hence, reallocate resources in advance so that business will run at all times without disruptions. With volumes of data continuing to increase, an industrial report predicts that by 2025 AI and automation will be central to managing and storing the projected 175 zettabytes of global data.Data Security and Compliance

Increasing concerns over data privacy and stringent regulatory frameworks around the world compel the companies who opt for storage software to be on high security and compliance standards. Areas of healthcare, finance, and government are most likely to be targeted with high views due to the nature of their work being highly sensitive. Storage solutions are, thus, expected to incorporate more sophisticated security features into their systems, such as end-to-end encryption, multi-factor authentication, and identity access management. According to data from the Identity Theft Resource Center, the United States witnessed a significant increase in data breaches in 2023, with data compromises reaching a total of 3,205 cases and over 353 million individuals affected. This rise in data breaches shows the importance of advanced data security measures. Storage solutions that offer robust compliance capabilities, like the ability to meet GDPR, HIPAA, and other regulatory standards, are in high demand. As organizations handle larger volumes of personal, financial, and proprietary data, the risk of data breaches also rises. To mitigate these risks, businesses are increasingly adopting software that can protect against unauthorized access, ensure data integrity, and maintain audit trails. This focus on data security and compliance will continue to drive demand for advanced storage software designed to safeguard critical information and reduce potential liabilities.Storage Software Industry Segmentation:

The publisher provides an analysis of the key trends in each sub-segment of the global storage software market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on software type, deployment type, organization size, and vertical.Analysis by Software Type:

- Data Protection and Recovery

- Storage and Device Management

- Storage Replication

- Archiving

- Storage Virtualization

- Software Defined Storage

- Storage Infrastructure

- Others

Analysis by Deployment Type:

- Cloud-based

- On-premises

Organizations that strictly need control over their data and infrastructure prefer to use on-premises storage solutions. Enhanced security and compliance capabilities make this a good solution for sectors like BFSI and healthcare, wherein data privacy and control are imperative. However, on-premises deployment will be more costly and less agile than cloud deployment.

Analysis by Organization Size:

- Small and Medium Enterprises

- Large Enterprises

Large enterprises usually prefer a hybrid model of cloud-based and on-premises storage solutions to manage large volumes of data securely and effectively. Such organizations usually require high performance, scalability, and disaster recovery capabilities. They invest in advanced storage systems to maintain business continuity, ensure data integrity, and comply with industry standards.

Analysis by Vertical:

- BFSI

- Healthcare

- Manufacturing

- Retail

- IT and Telecom

- Government

- Others

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Storage Software Market Analysis

The US storage software market is witnessing growth at a rate that is amazing. The growing rate of digital transformation and an increased demand for data across the industries are primarily driving the market. As per our report, the market size of the US digital transformation currently stood at USD 210.4 billion in the year 2024 and is poised to reach USD 1.37 trillion during 2033, by thereby registering a healthy CAGR of 21.6%. This expansion is largely driven by the widespread adoption of cloud computing, artificial intelligence (AI), machine learning, and data analytics. The healthcare, financial services, and retail industries are particularly active in digitizing operations, fueling the demand for scalable storage solutions to manage vast amounts of data. Furthermore, rising concerns over cybersecurity and stricter data governance regulations are accelerating the need for secure and efficient storage systems. As the U.S. continues to be a global technology hub, both local and international companies are heavily investing in innovative storage solutions to support the nation’s growing digital infrastructure.Europe Storage Software Market Analysis

The storage software market in Europe is growing because of increased data generation and the ever-increasing need for regulating compliance. Enterprise storage software revenue in the European geographical area reached USD 9.4 billion in 2023, according to the European Commission's 2023 DESI, mainly from Germany, the UK, and France. European companies are more concerned about data security as the data protection laws are more stringent, such as GDPR. Therefore, European companies are implementing newer storage solutions to maintain compliance. Almost 50 percent of European companies are using these hybrid and multi-cloud environments for data management purposes. Tech behemoths SAP and Oracle along with innovative start-ups are helping the cause through cutting-edge backup, archiving, and disaster recovery solutions. The regional market is further being shaped by an emerging focus on data sovereignty and the available options to host locally.Asia Pacific Storage Software Market Analysis

The storage software market in Asia Pacific is growing at a rapid pace, driven by the rapid digital transformation of various industries. According to industrial reports, Japan has experienced remarkable growth, its related solutions service market for digital transformation has grown from approximately USD 7.69 billion or 1.16 trillion JPY in 2019 to USD 12.96 billion or 1.96 trillion JPY in 2022, growing at an astonishing annual rate of 19%. The growth is due to the adoption of cloud computing, 5G technologies, and smart devices, which have increased the demand for data storage solutions. Even countries like China, India, South Korea, and Singapore have adopted digitalization, and respective governments are investing in smart cities, IoT, and data-driven infrastructure. Also, the boom in e-commerce, financial services, and AI-driven solutions boosts the demand for efficient storage software. This also increases strategic partnerships among local and international companies in developing technology, further solidifying Asia Pacific's place as a prime contributor to the global storage software market.Latin America Storage Software Market Analysis

In Latin America, storage software is on the increase because of the rapid digitalization of industries and increased requirements for data compliance. The overall revenue generated from the enterprise software industry in Latin America is approximately USD 8.47 billion in 2023, industrial reports suggest. Brazil has a budget for IT amounting to USD 12.4 billion in 2023, which is mainly directed towards the provision of cloud and data storage solutions for businesses. As business-houses are being moved to the cloud, the hybrid cloud model is gaining more end-users. More than 45% of organizations in Latin America are using hybrid solutions in their data management. Other factors include increased e-commerce and digital banking popularity, creating demand for safe storage systems. Local players like Totvs and Linx are, therefore, also teaming up with international suppliers such as Microsoft and Amazon Web Services to fortify their local offerings and take advantage of demand in Latin America, a budding market for storage software solutions.Middle East and Africa Storage Software Market Analysis

In the Middle East and Africa, increasing digitalization and regional investment in data infrastructure propel the market of storage software. According to the official portal of the UAE government, the economy of the UAE for 2023 stands at USD 509 billion with a population of 11 million and is currently investing heavily in digital transformation across all economic sectors. Developments here include the setting up of 5G wireless, Smart City technologies, and cloud computing ecosystems towards rising the digital economy from 12 percent of non-oil GDP in the UAE to 20 percent by 2030. All these measures help in developing it as a tech innovator in the region with data as a crucial value driver. UAE is also investing in large-scale data center infrastructure and AI-driven solutions to further improve digital job matching and support smart city initiatives. Public-private partnerships further strengthen the development of digital solutions, making the UAE a prominent player in the regional storage software market.Competitive Landscape:

The storage software market is highly competitive, with key players offering a range of solutions across various sectors, including data management, backup, and cloud storage. Market leaders focus on providing scalable, secure, and high-performance solutions to meet the increasing demand for data storage due to the rise in digitalization and big data. Innovations in the cloud-native and artificial intelligence (AI) fields, and greater automation, raise competitive stakes with high efficiency storage technology. Integration and hybrid multi-cloud solutions allow corporations to better balance their infrastructure strategies. Storage data protection, recovery from disasters and compliance with privacy regulations increasingly form critical part of software components. With the rise of IoT, AI, and ML, competition continues to evolve as companies push the boundaries of storage capabilities to accommodate ever-expanding data needs.The report provides a comprehensive analysis of the competitive landscape in the storage software market with detailed profiles of all major companies, including:

- Broadcom Inc.

- Citrix Systems, Inc.

- Dell Technologies, Inc.

- Fujitsu Limited

- Hewlett Packard Enterprise Development LP

- Hitachi Vantara LLC

- Huawei Technologies Co. Ltd

- International Business Machines Corporation (IBM)

- NetApp, Inc.

- Oracle Corporation

- Western Digital Corporation

Key Questions Answered in This Report

1. How big is the storage software market?2. What is the future outlook of storage software market?

3. What are the key factors driving the storage software market?

4. Which region accounts for the largest storage software market share?

5. Which are the leading companies in the global storage software market?

Table of Contents

Companies Mentioned

- Broadcom Inc.

- Citrix Systems Inc.

- Dell Technologies Inc.

- Fujitsu Limited

- Hewlett Packard Enterprise Development LP

- Hitachi Vantara LLC

- Huawei Technologies Co. Ltd

- International Business Machines Corporation

- NetApp Inc.

- Oracle Corporation

- Western Digital Technologies Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | August 2025 |

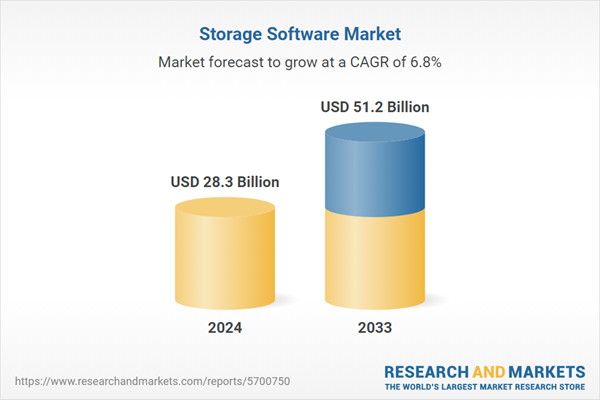

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 28.3 Billion |

| Forecasted Market Value ( USD | $ 51.2 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |