Speak directly to the analyst to clarify any post sales queries you may have.

A concise framing of how stretch wrap machines are shifting from standalone capital purchases to integral components of automated, sustainable, and resilient distribution ecosystems

Stretch wrap machines play a pivotal role in modern logistics and materials handling, forming the last-mile protection layer that preserves product integrity from warehouse to end customer. As operational efficiency and sustainability criteria take on heightened importance, manufacturers and end users alike are reevaluating how wrapping solutions integrate with automation, warehouse management systems, and circular material strategies. This report’s executive summary synthesizes prevailing dynamics to equip executives with a clear understanding of technological trends, trade policy impacts, and differentiation imperatives.In parallel with facility automation investments, the stretch wrap machine category is being reframed as a systems decision rather than a discrete equipment purchase. Procurement teams weigh not only upfront capital and footprint considerations but also film consumption metrics, maintenance regimes, and compatibility with pallet configurations. As supply chains emphasize resilience, the interplay between machine flexibility and throughput responsiveness has become a decisive factor for operations leaders planning across short- and medium-term horizons.

How automation, advanced film technologies, and circularity mandates are converging to redefine performance, procurement, and lifecycle expectations for wrap machinery

The landscape for stretch wrap machines is undergoing transformative shifts driven by three intersecting forces: automation intensification within distribution hubs, material science advances in film technology, and regulatory pressure toward circularity. Automation intensification is prompting greater adoption of machines that integrate with conveyors, robotic palletizers, and warehouse execution platforms, enabling higher throughput and reduced manual handling. This movement favors machine designs that support remote diagnostics, modular upgrades, and seamless data exchange.Concurrently, innovations in pre-stretch and cold stretch film formulations are changing how manufacturers approach total cost of ownership. Improved film yield and load retention properties reduce consumption and cut downstream waste handling costs, thus reshaping procurement priorities. Regulatory and customer-driven circularity goals are also accelerating interest in recyclability and reuse schemes, which in turn influence machine configuration requirements around film tension control and residual film management. Together, these shifts are redefining performance criteria for vendors and users, accelerating the need for strategic alignment between equipment lifecycle planning and sustainability roadmaps.

Tariff-driven procurement recalibrations and supply chain diversification strategies reshaping sourcing, pricing, and service models across the wrap machine value chain

Tariffs and trade policy shifts continue to influence sourcing strategies, capital equipment decisions, and supplier relationships within the stretch wrap machine ecosystem. Recent adjustments to United States tariff classifications and duty schedules for machinery components, along with secondary impacts on imported films and critical electronic subcomponents, have prompted a reassessment of supply chain risk and vendor diversification strategies. These policy changes have not only affected landed costs but also pushed engineering and procurement teams to reconsider modular designs that can substitute higher-risk components with locally sourced alternatives.As a result, manufacturers and large end users are increasingly evaluating nearshoring options and dual-sourcing frameworks to insulate operations from future tariff volatility. Procurement cycles have become more deliberate, with longer lead-time planning and greater emphasis on contractual protections such as price adjustment clauses and inventory hedging. In parallel, vendors are enhancing service propositions-offering maintenance contracts, retrofit packages, and spare parts pools-to maintain competitiveness in an environment where total cost of ownership narratives influence purchase decisions. This policy environment underscores the importance of agility: firms that can adapt sourcing, finance structures, and service models will better manage tariff-driven margin pressures and ensure continuity of supply.

Strategic product and go-to-market differentiation driven by technology choices, operational modes, machine classes, application profiles, payload categories, and vertical compliance needs

Understanding segmentation across technology, operation mode, machine type, application, payload capacity, and end-user industry is essential for tailoring product development and go-to-market strategies. In terms of technology, differences between cold stretch and pre-stretch systems have implications for film consumption, tension control, and application suitability for fragile or irregular loads, and selecting between these technologies affects both operational profiles and maintenance planning. Operation mode distinctions such as orbital, rotary arm, and turntable systems dictate footprint, cycle time, and compatibility with conveyorized lines, influencing which configurations are optimal for continuous-flow distribution centers versus intermittent loading docks.Machine type segmentation across automatic, manual, and semi-automatic platforms maps directly to labor models and capital budgets; automatic systems are increasingly favored by high-throughput operations seeking integration with upstream automation, while semi-automatic and manual units retain relevance in lower volume or multi-purpose facilities. Application-focused distinctions among bundle wrapping, pallet packaging, and product-level packaging create divergent requirements for load stabilization, film pre-stretch capabilities, and machine programming flexibility, with pallet packaging further differentiated by euro pallet, industrial pallet, and standard pallet profiles that influence carriage designs and turntable sizes. Payload capacity segmentation into 1000-2000 kg, above 2000 kg, and below 1000 kg categories shapes structural design, motorization, and braking systems, making capacity planning a core engineering consideration. Finally, end-user industry segmentation across automotive, chemicals, consumer goods, food and beverages, and pharmaceuticals determines hygiene, traceability, and regulatory compliance requirements, compelling vendors to offer industry-specific features such as cleanroom-compatible components, corrosion-resistant finishes, and validated documentation packages.

How regional variations in regulation, labor dynamics, and logistics create differentiated demand profiles and competitive plays across the Americas, EMEA, and Asia-Pacific

Regional dynamics exert strong influence on regulatory regimes, labor costs, logistics structures, and customer expectations, shaping distinct opportunities and constraints for equipment suppliers. In the Americas, demand patterns are shaped by broad adoption of distribution automation, a growing emphasis on nearshoring, and high expectations for rapid service response; vendors that can provide localized spare parts inventories and regional service networks achieve competitive advantage. In the Europe, Middle East & Africa complex, regulatory diversity and varied warehouse footprints require machines with flexible configuration options and multilingual controls, while sustainability mandates and energy efficiency standards are increasingly central to procurement criteria.Across Asia-Pacific, fast-growing e-commerce volumes and diverse industrial activity create a demand for both high-throughput automated systems and cost-effective semi-automatic solutions suited to smaller facilities. The Asia-Pacific region also remains a critical manufacturing base for both machines and films, which presents sourcing advantages but also exposes buyers to regional policy shifts and component supply interruptions. Taken together, these regional characteristics point to differentiated market plays: service-led strategies in the Americas, compliance- and efficiency-led offerings in Europe, Middle East & Africa, and a blend of cost optimization and scale-focused automation in Asia-Pacific.

Why modular product design, expanded service portfolios, and digital integration partnerships are the primary levers shaping competitive advantage and customer stickiness

Competitive dynamics in the stretch wrap machine industry are increasingly defined by service depth, modular product architectures, and partnerships across the supply chain. Leading manufacturers are expanding after-sales portfolios that include preventative maintenance programs, remote diagnostics, and upgrade pathways that extend installed base value. These service enhancements serve dual objectives: they create recurring revenue streams and deepen customer dependency on vendor ecosystems. At the same time, product roadmaps are placing greater weight on modularity, enabling field retrofits to add features such as advanced film pre-stretch modules, energy recovery systems, or integrated sensor suites without requiring full machine replacement.Strategic partnerships with film suppliers, integrators, and systems houses are becoming more common as vendors seek to offer turnkey solutions that reduce buyer integration risk. Investment in digital capabilities-especially remote monitoring, predictive maintenance algorithms, and integration APIs for warehouse management systems-differentiates suppliers in bids for large-scale automation projects. Companies that balance product innovation with scalable service delivery models and clear total cost narratives are better positioned to capture enterprise contracts and to sustain margins under competitive pressure.

Practical strategic priorities for suppliers to build modularity, reinforce supply chain resilience, and convert equipment sales into recurring, service-led revenue streams

Industry leaders should pursue a three-pronged strategic agenda that aligns product development, supply chain resilience, and customer engagement to capture value as market dynamics evolve. First, prioritize modular machine platforms that permit incremental upgrades and support a range of technologies from cold stretch to high-yield pre-stretch films; this approach reduces replacement cycles and enables customers to adapt incrementally as throughput or compliance needs change. Second, strengthen supply chain resilience by qualifying secondary suppliers for critical electronic components and by establishing regional spares hubs; this reduces exposure to tariff fluctuations and short-term disruptions while preserving service-level commitments.Third, invest in service and digital offerings that convert equipment sales into multi-year commercial relationships. Remote diagnostics, predictive maintenance, and subscription-based spare parts programs create recurring revenue and reduce downtime for customers, improving retention. Additionally, craft verticalized go-to-market motions for industries with stringent requirements-such as food and beverages and pharmaceuticals-by offering compliance documentation, validated performance packages, and specialized materials handling features. Taken together, these priorities support a balanced strategy that protects margin, accelerates adoption, and advances sustainability commitments without necessitating wholesale changes to core manufacturing or distribution models.

A transparent synthesis of primary interviews, standards review, product specification analysis, and scenario testing to ensure robust, actionable insights for decision-makers

This research synthesizes primary interviews with industry practitioners, secondary review of standards and regulatory guidance, and structured analysis of published technical datasheets and supplier service descriptions. Primary inputs were drawn from confidential conversations with operations leaders in distribution, engineers from machine manufacturers, and procurement professionals responsible for equipment acquisition and lifecycle management. These qualitative insights were complemented by a systematic review of product specifications, patent filings related to film pre-stretch and tension control, and regulatory documents addressing packaging and waste management.Analytical techniques included cross-sectional segmentation mapping to align technology choices with operation modes and payload requirements, scenario analysis to test the implications of tariff shifts on sourcing decisions, and capability benchmarking to evaluate service portfolios and digital integration maturity. Careful triangulation between primary insights and documentary evidence was employed to ensure robust conclusions, while sensitivity checks were applied to qualitative findings to identify where further quantitative validation would be valuable for bespoke client use cases.

Why combining modular engineering, enhanced service offerings, and supply chain flexibility is essential for sustaining competitiveness and driving long-term value

The stretch wrap machine market is at an inflection point where technological evolution, trade policies, and shifting customer priorities are converging to favor adaptable, service-rich solutions. Firms that embed modularity into product architectures, invest in service ecosystems, and hedge supply chain risk will be better positioned to meet diverse regional demands and industry-specific compliance requirements. Equally, organizations that neglect to modernize spare-parts networks or to offer digital service propositions risk commoditization and margin compression as buyers increasingly purchase based on total lifecycle value rather than upfront price.Looking ahead, the imperative for manufacturers and end users is clear: align engineering roadmaps with sustainability and automation objectives, deepen service capabilities to capture recurring revenue, and maintain flexible sourcing strategies to respond to policy shifts. Executives who prioritize these initiatives will not only protect operational continuity but also unlock opportunities to lead within their regional and vertical markets.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China Stretch Wrap Machines Market

Companies Mentioned

The key companies profiled in this Stretch Wrap Machines market report include:- Aetnagroup S.p.A

- Alligator Automation India Pvt Ltd

- ATLANTA STRETCH

- Berran Industrial Group, Inc.

- Cousins Packaging Inc.

- Crown Packaging Corp.

- Durapak

- G.G. Macchine S.r.l.

- Global Packaging Automation

- Handle It Inc.

- Hangzhou Youngsun Intelligent Equipment Co., Ltd

- Impak Packaging Systems

- IPS Packaging & Automation

- M.J. Maillis Single Member S.A.

- Mosca GmbH

- PACKWAY INC.

- Phoenix Wrappers, Inc.

- ProMach Inc.

- RAJAPACK Ltd

- Reopack A/S

- Signode UK Ltd

- Technowrapp Srl

- U.S. Packaging & Wrapping LLC

- Webster Griffin Ltd.

- wrapsolut - Fährenkämper GmbH & Co. KG

Table Information

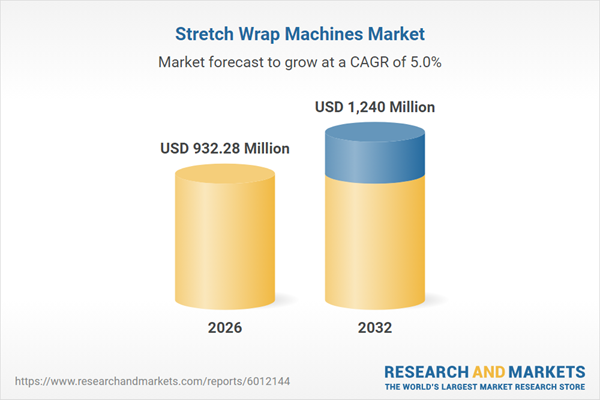

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 932.28 Million |

| Forecasted Market Value ( USD | $ 1240 Million |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |