Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

With the automotive sector undergoing structural shifts driven by electrification, connected vehicle technologies, and stringent emissions targets tire chemicals are being redefined as high-performance, precision-formulated components. Their value now lies in their ability to enhance energy efficiency, lifespan, and vehicle safety standards, aligning with the evolving requirements of both tire manufacturers and global automotive OEMs.

The market is positioned for qualitative transformation, not just quantitative expansion. Key strategic shifts include the localization of production to ensure regional regulatory compliance, the integration of smart and sustainable chemistries, and a growing emphasis on customized formulation for next-gen tire platforms. This evolution sets the stage for heightened competitive intensity and deeper collaboration between chemical suppliers, tire manufacturers, and automotive OEMs, fundamentally redefining the role of tire chemicals in the future of mobility.

Key Market Drivers

Rise in Automotive Production

The rise in global automotive production serves as a core catalyst for the sustained expansion of the Global Tire Chemicals Market, as tire demand scales directly with vehicle output across both OEM and aftermarket segments. This production growth especially concentrated in key manufacturing hubs across Asia Pacific, North America, and emerging markets is exerting upward pressure on the consumption of performance-driven and regulatory-compliant tire chemical formulations. Global automotive manufacturing output currently stands at approximately 94 million new vehicles annually, encompassing both passenger cars and commercial vehicles.This production volume underscores the sheer scale and sustained momentum of the global automotive industry, reflecting strong OEM activity across developed and emerging markets. Each new vehicle manufactured whether it’s a passenger car, commercial truck, two-wheeler, or off-highway vehicle requires multiple tires customized by size, load-bearing requirements, and performance characteristics. Tire production, in turn, necessitates a wide array of chemicals, including Elastomers (e.g., SBR, BR), Reinforcing agents (carbon black, silica), Antioxidants, accelerators, plasticizers, and coupling agents. As vehicle platforms evolve, the complexity of tire chemical formulations also increases, further amplifying demand in absolute volume and value terms.

Modern vehicles particularly SUVs, crossovers, and EVs demand tires with enhanced load capacity, noise reduction, and energy efficiency. Automotive OEMs are now integrating tires into the overall vehicle performance strategy, resulting in higher specifications and chemically intensive tire compositions. EV-specific tires, which require improved abrasion resistance and thermal stability. High-performance tires for premium and luxury vehicles, demanding advanced polymer-silica systems and multi-layered chemical additives. Heavy-duty commercial vehicle tires, requiring anti-tear agents, ozone stabilizers, and high-traction compounds.

The rise in vehicle production is no longer simply adding volume it is driving diversified demand for specialized chemicals, increasing both the formulation sophistication and per-unit chemical usage. Global tire manufacturing currently averages 2 billion units annually, reflecting the massive scale and critical role of tires within the global transportation and mobility ecosystem. To meet growing vehicle production targets, automotive manufacturers are expanding their tire sourcing footprint, often through localized tire production facilities near vehicle assembly plants.

Major tire manufacturers such as Michelin, Bridgestone, Goodyear, and Continental are ramping up production capacities in strategic locations such as: China, India, and Vietnam for Asia-based vehicle exports, Mexico and the Southeastern U.S. to support North American OEMs, Eastern Europe and Turkey to serve European automakers. This global dispersion of tire production sites has led to region-specific chemical sourcing, driving localized demand for tire chemicals that comply with local environmental regulations, road conditions, and vehicle usage patterns. It also incentivizes chemical suppliers to invest in regional compounding facilities, formulation labs, and just-in-time delivery networks, thereby expanding the market footprint.

Key Market Challenges

Volatility in Prices of Raw Materials Pricing and Feedstock Availability

One of the most disruptive challenges in the tire chemicals sector is the unpredictability in the cost and availability of key raw materials, many of which are petrochemical-derived. These include Synthetic rubbers (SBR, BR, EPDM), Aromatic oils and resins, Carbon black and processing additives. The fluctuating prices of crude oil, aggravated by geopolitical instability, refinery shutdowns, and environmental sanctions, directly affect the cost structure of tire chemicals. Additionally, supply chain bottlenecks, such as shipping delays or capacity shortages in Asia-based petrochemical complexes, cause erratic lead times and planning inefficiencies.This pricing and supply volatility not only compresses manufacturers’ margins but also hinders long-term procurement planning and limits R&D investment in new chemical formulations. Companies are often forced to prioritize cost containment over innovation, which ultimately slows market growth.

Key Market Trends

Convergence of Digitalization and Formulation Intelligence

A significant trend influencing the future of the tire chemicals market is the integration of digital technologies with chemical formulation science. The tire industry is increasingly turning to data-driven R&D to optimize chemical compositions and predict compound behavior under various real-world conditions. Through the use of AI-driven modelling, digital twin simulations, and predictive analytics, chemical companies can now: Accelerate the development of customized polymer blends and compound structures, Optimize tire chemical dispersion, curing behavior, and wear resistance, Reduce trial-and-error cycles in lab-to-scale-up transitions.This digitalization trend is expected to shorten innovation timelines, reduce production waste, and enable precise compound tailoring for specialized tire segments (e.g., EVs, autonomous vehicles). It represents a structural shift in how chemical innovation is commercialized in the tire industry.

Key Market Players

- Eastman Chemical Co

- Cabot Corporation

- Evonik Industries AG

- Jiangxi Black Cat Carbon Black Inc

- Birla Carbon India Private Limited

- ExxonMobil Corporation

- Emery Oleochemicals LLC

- Phillips Carbon Black Limited

- Lanxess AG

- Orion Engineered Carbon S.A

Report Scope:

In this report, the Global Tire Chemicals Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Tire Chemicals Market, By Vehicle Type:

- Passenger Car

- Light Commercial Vehicle

- Medium & Heavy Commercial Vehicle

- Two-Wheeler

- Three-Wheeler

- OTR

Tire Chemicals Market, By Demand Category:

- OEM

- Replacement

Tire Chemicals Market, By Tire Construction Type:

- Radial

- Bias

Tire Chemicals Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Tire Chemicals Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Eastman Chemical Co

- Cabot Corporation

- Evonik Industries AG

- Jiangxi Black Cat Carbon Black Inc

- Birla Carbon India Private Limited

- ExxonMobil Corporation

- Emery Oleochemicals LLC

- Phillips Carbon Black Limited

- Lanxess AG

- Orion Engineered Carbon S.A

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | August 2025 |

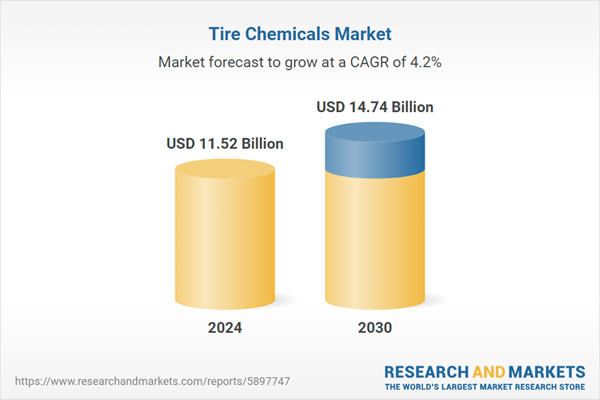

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 11.52 Billion |

| Forecasted Market Value ( USD | $ 14.74 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |