Truck Platooning Market Analysis:

- Major Market Drivers: Continual technological advancements in the automotive sector coupled with the rising adoption of automated technologies and the implementation of Internet of Things (IoT)-enabled devices in various vehicles are escalating the market growth.

- Key Market Trends: The rising integration of automated driving assistance systems (ADAS) with trucks along with the growing environmental concerns among the masses are positively influencing the market growth. Moreover, rapid digitization and industrialization, increasing investments by public and private firms in product innovation and extensive research and development (R&D) activities conducted by key players, are further projected to drive the market growth on the global level.

- Competitive Landscape: Some of the prominent companies in the market include AB Volvo, Aptiv PLC, Continental Aktiengesellschaft, DAF Trucks N.V. (PACCAR Inc.), Hino Motors Ltd. (Toyota Motor Corporation), Intel Corporation, Iveco Group N.V., Knorr-Bremse Aktiengesellschaft (Kb Holding GmbH), Peloton Technology, Robert Bosch GmbH, Scania AB (Traton SE), and ZF Friedrichshafen AG (Zeppelin-Stiftung), among many others.

- Geographical Trends: According to the truck platooning market dynamics, advancements in vehicle-to-vehicle (V2V) communication technology and autonomous driving systems drive adoption in the North American region. Moreover, Europe has been at the forefront of truck platooning technology development and deployment. Apart from this, in the Asia Pacific region, governments are promoting smart transportation solutions to enhance efficiency and reduce environmental impact, thereby propelling the market demand.

- Challenges and Opportunities: Insufficient infrastructure development especially, and the rising concerns among drivers are hampering the market growth. However, truck platooning can lead to significant fuel efficiency gains (up to 10% or more) by reducing aerodynamic drag and optimizing vehicle spacing, further driving the market demand.

Truck Platooning Market Trends:

Rising Demand for Road Safety

The increasing demand for road safety is significantly driving the growth of the truck platooning market. Heavy-duty trucks are involved in a significant portion of road accidents, often due to factors like driver fatigue, distraction, or human error. For instance, according to an article published by TruckInfo.net in May 2023, there were more than 168,000 truck accidents every year, nearly 32% of which involved an injury and around 3% resulted in a fatality. Similarly, according to another article published by Injury Facts, in 2022, 5,837 heavy trucks were involved in a fatal crash, up 1.8% from 2021 and 49% over the prior decade. Truck platooning systems enhance safety by reducing these risks through automated driving features and coordinated vehicle maneuvers. These factors are further contributing to the truck platooning market share.Stringent Government Rules and Regulations

Governments are setting stringent emission reduction targets to combat climate change and improve air quality. For instance, in March 2024, the EPA released a final rule revising existing criteria to minimize greenhouse gas emissions from heavy-duty vehicles in model year 2027 and setting new, more rigorous limits for model years 2028-2032. Truck platooning contributes to these goals by optimizing fuel efficiency and reducing carbon emissions per transported goods. These factors are further positively influencing the truck platooning market forecast.Technological Advancements

Technological advancements play a pivotal role in driving the growth and adoption of the truck platooning market. Truck platooning relies heavily on V2V communication systems that enable trucks to communicate with each other. This technology allows platooning vehicles to synchronize their movements, including acceleration, braking, and steering. For instance, in November 2019, Hyundai tested platooning of its 40-tonne Xcient trucks on the Yeoju Smart Highway, a 4.5-mile section of road set aside by the Korean Government for the development of autonomous cars. For safety reasons, the trucks were limited to 37 mph and put through a series of tests to assess close proximity convoy driving, emergency braking, vehicle-to-vehicle (V2V) communications, and responsiveness to other road users. These factors are further bolstering the truck platooning market revenue.Global Truck Platooning Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global truck platooning market report, along with forecasts at the global, regional and country levels from 2025-2033. The report categorizes the market based on platooning type, communication technology, technology, services and sensor type.Breakup by Platooning Type:

- Driver-Assistive Truck Platooning (DATP)

- Autonomous Truck Platooning

DATP involves trucks that require a human driver to actively monitor and intervene as needed, despite benefiting from advanced driver assistance systems (ADAS). It enhances safety by reducing driver fatigue and human error, which are common causes of truck accidents. While autonomous truck platooning involves trucks operating without human intervention, using AI, machine learning, and advanced sensors to navigate and communicate with each other autonomously.

Breakup by Communication Technology:

- Vehicle-To-Infrastructure (V2I)

- Vehicle-To-Vehicle (V2V)

- Vehicle-To-Everything (V2X)

According to the truck platooning market outlook, V2I communication enables vehicles to exchange data with roadside infrastructure, such as traffic signals, road signs, and toll booths. It provides real-time information on traffic conditions, road hazards, and route optimization to trucks participating in platoons. While V2V communication enables direct wireless exchange of data between vehicles within close proximity. It is crucial for maintaining safe distances and synchronized movements within a truck platoon. Trucks can share real-time data on speed, braking, and position, allowing for coordinated maneuvers. Moreover, V2X communication encompasses both V2I and V2V technologies, as well as interactions with pedestrians, cyclists, and other road users. Governments are fostering the deployment of V2X technologies through regulatory frameworks and incentives, aiming to enhance road safety, reduce emissions, and optimize transportation efficiency.

Breakup by Technology:

- Adaptive Cruise Control (ACC)

- Blind Spot Warning (BSW)

- Global Positioning System (GPS)

- Forward Collision Warning (FCW)

- Lane Keep Assist (LKA)

- Others

According to the truck platooning market overview, ACC automatically adjusts a vehicle's speed to maintain a safe following distance from the vehicle ahead, even in varying traffic conditions. While BSW uses sensors to detect vehicles in the truck's blind spots and alerts the driver through visual or auditory signals. Moreover, GPS provides accurate location data and navigation information to vehicles based on satellite signals. Furthermore, FCW uses sensors to detect objects or vehicles in the truck's path and alerts the driver to potential collision risks.

Breakup by Services:

- Telematics-Based Services

- Automatic Crash Notification

- Emergency Calling

- Navigation and Infotainment

- On-Road Assistance

- Remote Diagnostics

- Vehicle Tracking

- Platooning-Based Services

- Pricing

- Financial Transaction

- Match Making

Telematics enables real-time monitoring of vehicle location, fuel consumption, engine diagnostics, and driver behavior. This data allows fleet operators to optimize routes, reduce idle times, and improve overall fleet efficiency. While platooning reduces aerodynamic drag and fuel consumption by enabling trucks to travel closely together. This efficiency leads to significant fuel savings, particularly on long-haul routes. Platooning technology helps mitigate the impact of driver shortages by allowing a single driver to oversee multiple trucks within a platoon, maximizing driver productivity and operational efficiency.

Breakup by Sensor Type:

- Image Sensor

- Radar Sensor

- LiDAR Sensor

According to the truck platooning market outlook, image sensors capture visual data using cameras mounted on trucks. They provide real-time video feeds and imagery of the surroundings, enabling object detection, lane recognition, and traffic sign recognition. Moreover, these sensors detect vehicles, pedestrians, and obstacles in the vicinity of trucks within a platoon. While radar sensors use radio waves to detect objects and measure their distance, speed, and direction relative to the vehicle. These sensors detect potential collisions and trigger alerts or automatic braking systems within a platoon. Apart from this, LiDAR sensors emit laser pulses and measure the time it takes for the pulses to reflect off objects, creating detailed 3D maps of the environment.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

According to the truck platooning market statistics, supportive regulatory frameworks and pilot projects in states like California and Texas encourage the testing and adoption of platooning systems, thereby driving the market growth in North America. Moreover, European countries have been at the forefront of implementing platooning trials and regulatory frameworks. Well-developed road infrastructure and supportive policies in Europe promote the integration of platooning technologies, aiming to enhance efficiency and reduce emissions. Furthermore, rapid urbanization and the growth of e-commerce in Asia Pacific drive the demand for efficient freight transport solutions, fostering interest in platooning technologies.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major market companies have also been provided. Some of the key players in the market include:- AB Volvo

- Aptiv PLC

- Continental Aktiengesellschaft

- DAF Trucks N.V. (PACCAR Inc.)

- Hino Motors Ltd. (Toyota Motor Corporation)

- Intel Corporation

- Iveco Group N.V.

- Knorr-Bremse Aktiengesellschaft (Kb Holding GmbH)

- Peloton Technology

- Robert Bosch GmbH

- Scania AB (Traton SE)

- ZF Friedrichshafen AG (Zeppelin-Stiftung)

Key Questions Answered in This Report

1. How big is the truck platooning market?2. What is the future outlook of truck platooning market?

3. What are the key factors driving the truck platooning market?

4. Which region accounts for the largest truck platooning market share?

5. Which are the leading companies in the global truck platooning market?

Table of Contents

Companies Mentioned

- AB Volvo

- Aptiv PLC

- Continental Aktiengesellschaft

- DAF Trucks N.V. (PACCAR Inc.)

- Hino Motors Ltd. (Toyota Motor Corporation)

- Intel Corporation

- Iveco Group N.V.

- Knorr-Bremse Aktiengesellschaft (Kb Holding GmbH)

- Peloton Technology

- Robert Bosch GmbH

- Scania AB (Traton SE)

- ZF Friedrichshafen AG (Zeppelin-Stiftung).

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | May 2025 |

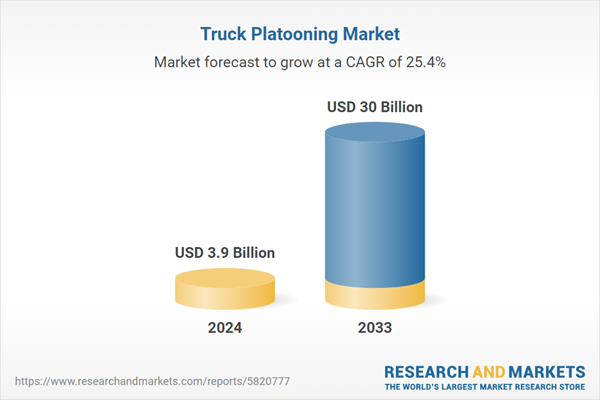

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 3.9 Billion |

| Forecasted Market Value ( USD | $ 30 Billion |

| Compound Annual Growth Rate | 25.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |