Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Wireless mining sensor networks are the latest step in the evolution of my monitoring. To continually monitor the geological and geo-mechanical factors inside underground mines and assess potential safety and productivity risks posed by rapid or out-of-safe-range changes, many modern underground mines install a variety of geotechnical and other monitoring instruments.

Key Market Drivers

Resource Optimization

Resource optimization is emerging as a driving force behind the global Underground Smart Mining market, reshaping the mining industry by maximizing the efficient use of critical resources such as fuel, water, energy, and raw materials. Mining companies are under increasing pressure to operate sustainably and cost-effectively, and Underground Smart Mining technologies are providing the means to achieve these objectives. One of the key aspects of resource optimization in Underground Smart Mining is the efficient utilization of energy. Mining operations are often energy-intensive, and the rising cost of energy and environmental concerns have forced companies to seek more sustainable alternatives. Underground Smart Mining solutions enable real-time monitoring and control of energy consumption, allowing for the identification and reduction of wastage. Additionally, the integration of renewable energy sources, such as solar and wind, into mining operations is becoming increasingly common, further enhancing energy efficiency and reducing the carbon footprint.Water is another critical resource in mining, and its responsible use is crucial for both environmental and operational reasons. Underground Smart Mining technologies help in water resource management by monitoring water usage, quality, and recycling opportunities. By reducing water wastage and optimizing processes, mining companies can reduce their impact on local ecosystems and ensure a sustainable water supply for both their operations and nearby communities. Resource optimization also extends to the efficient use of raw materials and the reduction of waste in mining operations. Digital twin technology, for example, enables precise simulation and control of processes, ensuring that materials are extracted and processed as efficiently as possible. This not only minimizes waste but also maximizes the recovery of valuable resources from ore.

Furthermore, Underground Smart Mining solutions facilitate predictive maintenance, reducing the downtime associated with equipment failures and maintenance procedures. This optimization of equipment uptime results in increased production, reducing the need for additional resources to compensate for downtime. In summary, resource optimization is at the forefront of the Underground Smart Mining market, driven by the need to operate sustainably and cost-effectively. By leveraging technologies that enhance energy efficiency, water management, material utilization, and predictive maintenance, mining companies can achieve their goals of reducing costs, minimizing environmental impact, and ensuring the long-term viability of their operations. As the demand for responsible mining practices continues to grow, the Underground Smart Mining market is expected to flourish, transforming the industry into a more resource-efficient and sustainable sector.

Automation and Remote Monitoring

Automation and remote monitoring are poised to play a pivotal role in driving the global Underground Smart Mining market to new heights. These transformative technologies are revolutionizing the mining industry by enhancing efficiency, safety, and sustainability in ways previously unimaginable. Automation, including the use of autonomous vehicles, machinery, and robotics, is streamlining mining operations. These automated systems can work continuously without breaks, leading to significant increases in productivity and cost savings. They also contribute to improved safety by reducing the need for human workers to operate heavy machinery in hazardous environments. As mining companies seek to maximize profits while minimizing operational risks, automation becomes a compelling solution.Remote monitoring is another critical driver. Mining sites are often located in remote and challenging environments, making it essential to have real-time visibility into operations. Remote monitoring systems leverage sensors, cameras, and IoT technology to provide a comprehensive view of mining activities. This not only improves operational efficiency by identifying and addressing issues promptly but also enhances safety by enabling remote supervision and intervention in emergency situations.

One of the key advantages of automation and remote monitoring is their ability to collect vast amounts of data. This data can be harnessed for data analytics and artificial intelligence applications, offering insights into equipment performance, production optimization, and predictive maintenance. The result is reduced downtime, increased equipment longevity, and better overall resource management. Additionally, automation and remote monitoring support environmental sustainability in mining operations. These technologies enable the careful management of resources such as water and energy, which is essential for minimizing the environmental impact of mining activities. They also contribute to safety and sustainability by helping prevent accidents and disasters, such as mine collapses, through real-time monitoring and early warning systems.

In summary, automation and remote monitoring are driving forces in the global Underground Smart Mining market. Their ability to increase efficiency, enhance safety, reduce operational costs, and support sustainability initiatives makes them essential components of modern mining operations. As mining companies increasingly recognize these benefits, the adoption of Underground Smart Mining technologies is expected to continue growing, reshaping the industry for the better.

Environmental Regulations

Environmental regulations are emerging as a powerful driver of the global Underground Smart Mining market. As concerns about climate change, sustainability, and ecological preservation continue to gain traction worldwide, governments and regulatory bodies are tightening the reins on the mining industry. This heightened scrutiny is pushing mining companies to adopt Underground Smart Mining solutions as a means of meeting stringent environmental compliance requirements. One of the primary ways in which environmental regulations are driving the Underground Smart Mining market is by mandating reduced emissions and resource conservation. Underground Smart Mining technologies, such as real-time monitoring and data analytics, allow companies to optimize their operations, minimize waste, and reduce energy consumption. For example, predictive maintenance systems can help prevent equipment failures, reducing the need for emergency repairs and the associated emissions. Additionally, digital twin technology enables precise simulation and control of mining processes, contributing to more efficient resource utilization and reduced environmental impact.Moreover, environmental regulations often demand transparency and traceability in mining operations. Underground Smart Mining solutions provide the means to track and report on various aspects of the mining process, from the source of raw materials to the disposal of waste products. This transparency helps mining companies demonstrate compliance and mitigate the risk of fines and penalties. Furthermore, the pressure to reduce the environmental footprint extends beyond local regulations to global sustainability goals. Many countries and organizations are committing to net-zero emissions and sustainable development targets. To align with these objectives, mining companies are turning to smart technologies to improve their environmental performance, enhance sustainability reporting, and minimize their ecological footprint.

In summary, environmental regulations are not just encouraging but necessitating the adoption of Underground Smart Mining solutions. These technologies offer mining companies the tools they need to operate efficiently, reduce emissions, and meet increasingly stringent environmental standards. As such regulations continue to evolve and tighten, the Underground Smart Mining market is poised for significant growth, driven by the imperative to operate responsibly and sustainably in an environmentally conscious world.

Key Market Challenges

High Initial Investment

The high initial investment required for the implementation of Underground Smart Mining technologies is a significant hurdle that has the potential to hamper the global Underground Smart Mining market. While the benefits of these technologies in terms of efficiency, safety, and sustainability are well-documented, the substantial upfront costs can deter some mining companies from embracing them fully. Here's a closer look at how high initial investment can impede the growth of the Underground Smart Mining market, Capital Intensive Nature: Underground Smart Mining involves the deployment of advanced automation systems, IoT devices, data analytics tools, and digital twin technology, among others. The acquisition and integration of these technologies require substantial capital investments.Infrastructure Upgrades: Mining operations, especially those in remote or challenging environments, may need significant infrastructure upgrades to support Underground Smart Mining solutions. This includes the installation of high-speed internet, communication networks, and power infrastructure, which can be expensive. Cost of Retrofitting: Many existing mining operations rely on older equipment and processes that may not be compatible with modern smart technologies. Retrofitting these operations to accommodate new systems can be cost-prohibitive. Training and Workforce Development: Implementing Underground Smart Mining technologies often necessitates training existing employees or hiring new talent with the requisite skills. Training programs and talent acquisition can represent additional expenses.

Integration Challenges: Integrating Underground Smart Mining solutions with legacy systems and equipment can be complex and costly. Customization and interoperability issues may require additional investment. Cybersecurity Costs: As Underground Smart Mining systems become more interconnected, the cost of cybersecurity measures to protect against potential cyberattacks and data breaches rises significantly. Long Return on Investment (ROI) Period: Realizing the full benefits of Underground Smart Mining technologies may take time, and the ROI horizon can be longer than some mining companies are comfortable with. Risk Aversion: The high initial investment can deter risk-averse mining companies from embracing smart technologies, especially if they have concerns about technology adoption challenges and uncertainties.

Limited Access to Capital: Smaller mining companies and those operating in regions with limited access to capital may struggle to secure the necessary funding for Underground Smart Mining initiatives. To overcome these challenges and encourage wider adoption of Underground Smart Mining technologies, various stakeholders, including technology providers, governments, and financial institutions, can play a role. Government incentives and subsidies, access to financing options, and collaborative partnerships that share the cost burden can help mitigate the impact of the high initial investment. Additionally, as the Underground Smart Mining market matures and technologies become more standardized, costs may decrease over time, making adoption more feasible for a broader range of mining companies.

Cybersecurity Risks

Cybersecurity risks pose a significant and ever-growing concern in the global Underground Smart Mining market, potentially hampering the industry's progress. As mining operations increasingly rely on interconnected digital systems and data-driven technologies, they become more susceptible to cyberattacks and vulnerabilities. Here's an in-depth exploration of how cybersecurity risks can impact the Underground Smart Mining market, Data Breaches: Underground Smart Mining involves the collection and analysis of vast amounts of sensitive data, including operational data, employee information, and intellectual property. A data breach could result in the exposure of sensitive information, leading to financial losses and reputational damage for mining companies.Operational Disruption: Cyberattacks can disrupt mining operations by targeting critical infrastructure, such as automation systems, control networks, and communication channels. An attack on these systems can halt production, leading to significant financial losses due to downtime. Safety Concerns: Underground Smart Mining systems often include safety controls and monitoring systems. A cyberattack that compromises these safety measures can put workers at risk and lead to accidents or environmental incidents.

Ransomware Threat: Ransomware attacks, where hackers encrypt a company's data and demand a ransom for its release, have become a growing concern in the mining sector. Paying ransoms can lead to substantial financial losses and does not guarantee data recovery. Supply Chain Vulnerabilities: Mining operations rely on a global supply chain for equipment and technology components. Vulnerabilities in the supply chain can introduce malicious software or hardware into mining systems.

Regulatory Compliance: Mining companies are subject to various regulations related to data protection and cybersecurity. Non-compliance with these regulations can result in fines and legal consequences. Environmental Impact: A cyberattack on mining operations could have environmental consequences if it disrupts control systems that manage waste disposal or environmental monitoring.

Investor and Stakeholder Confidence: High-profile cyber incidents can erode investor and stakeholder confidence in mining companies, impacting their stock prices and access to capital. Lack of Cybersecurity Expertise: The mining industry may lack the in-house expertise required to combat sophisticated cyber threats. This shortage of skilled cybersecurity professionals can leave mining companies vulnerable.

Evolution of Threats: Cyber threats are constantly evolving, and attackers are becoming more sophisticated. Staying ahead of these threats requires ongoing investment in cybersecurity measures and technologies. To mitigate these risks, mining companies must prioritize cybersecurity by implementing robust security measures, conducting regular assessments, and providing cybersecurity training to employees. Collaboration with cybersecurity experts and the adoption of best practices can help safeguard mining operations in an increasingly digital and interconnected world. Failure to address these risks could not only hinder the Underground Smart Mining market's growth but also jeopardize the safety, productivity, and reputation of mining companies.

Skills Gap

The global Underground Smart Mining market faces a significant obstacle in the form of a skills gap, which has the potential to hamper its growth and widespread adoption. As mining operations increasingly turn to advanced technologies such as automation, data analytics, and IoT solutions to enhance efficiency and safety, there is a growing need for a skilled workforce to operate, maintain, and optimize these systems. The skills gap in the Underground Smart Mining industry can be attributed to several key factors, Specialized Knowledge: Underground Smart Mining technologies require specialized knowledge in areas such as data analytics, machine learning, robotics, and automation. Finding individuals with expertise in these fields can be challenging, especially in regions where mining is a dominant industry.Technological Complexity: The complexity of Underground Smart Mining systems can be daunting. Skilled personnel are needed to design, implement, and manage these technologies effectively. Without the necessary expertise, mining companies may struggle to fully utilize their investments. Training and Education: Traditional mining education and training programs may not adequately cover the skills required for Underground Smart Mining . As a result, there is a lack of qualified candidates entering the workforce with the skills needed to operate and maintain these technologies. Rapid Technological Advancements: Underground Smart Mining technologies are evolving rapidly, which can make it challenging for workers to keep up with the latest developments. Continuous training and professional development are essential but may be lacking. Aging Workforce: In many mining regions, the existing workforce is aging, and there is a shortage of younger talent with the skills needed for Underground Smart Mining . This demographic shift exacerbates the skills gap. Competition with Other Industries: The demand for technology professionals extends beyond mining, and the industry competes with sectors such as IT and telecommunications for talent.

Remote Locations: Mining operations are often situated in remote or rural areas, which can make it difficult to attract and retain skilled workers who may prefer to live in urban centers. The skills gap not only hampers the adoption of Underground Smart Mining technologies but also poses risks to safety and operational efficiency. Inexperienced or inadequately trained personnel operating advanced machinery and systems can lead to accidents and suboptimal performance. To address the skills gap in the Underground Smart Mining market, various measures can be taken: Education and Training Programs: Mining companies can collaborate with educational institutions to develop specialized programs that train students and workers in Underground Smart Mining technologies. Upskilling and Reskilling: Encourage existing mining employees to acquire new skills through training and upskilling programs.

Knowledge Transfer: Promote knowledge transfer from experienced workers to younger generations through mentorship programs. Collaboration: Foster collaboration between industry stakeholders, government bodies, and educational institutions to address the skills gap collectively. Investment in Training: Allocate resources and investments toward ongoing training and development for mining personnel. Recruitment Strategies: Develop strategies to attract technology professionals to the mining industry by highlighting its innovation and sustainability efforts. By addressing the skills gap, the Underground Smart Mining industry can unlock the full potential of advanced technologies and ensure the safe and efficient operation of mining operations in the digital age.

Key Market Trends

Automation and Autonomous Vehicles

Automation and autonomous vehicles are pivotal drivers propelling the global Underground Smart Mining market into a new era of efficiency, productivity, and safety. These transformative technologies are revolutionizing the way mining operations are conducted, making them more cost-effective, sustainable, and secure. Here's a comprehensive look at how automation and autonomous vehicles are reshaping the future of mining, Increased Efficiency: Automation allows mining companies to achieve higher levels of operational efficiency. Automated systems can work tirelessly 24/7 without breaks, leading to increased productivity and throughput. This reduces the need for labor-intensive, manual operations and minimizes downtime, ultimately maximizing resource utilization. Enhanced Safety: Autonomous vehicles and equipment are equipped with advanced sensors and artificial intelligence that enable them to operate with a high degree of precision and safety. They can navigate complex terrains, avoid obstacles, and respond to changing conditions, reducing the risk of accidents and injuries to human workers.Optimized Maintenance: Automation technologies facilitate predictive maintenance by continuously monitoring the condition of mining equipment. By analyzing data on factors like temperature, vibration, and usage patterns, these systems can predict equipment failures before they occur, reducing unplanned downtime and maintenance costs. Cost Reduction: With automation, mining companies can significantly cut labor costs. Autonomous vehicles and robotic systems reduce the need for a large workforce in potentially hazardous environments. Additionally, improved efficiency and predictive maintenance result in lower operational costs. Resource Management: Automation systems help optimize resource management, including fuel, water, and electricity. This is crucial for reducing waste, conserving resources, and operating in an environmentally sustainable manner.

Environmental Impact Reduction: Underground Smart Mining solutions, driven by automation, are designed to minimize the environmental footprint of mining operations. Reduced emissions from autonomous electric vehicles, efficient resource utilization, and improved environmental monitoring all contribute to a greener industry. Remote Operation: Automation enables mining operations to be conducted remotely. Operators can control and monitor equipment and processes from a safe distance, reducing the need for personnel to be physically present at the mine site. This is particularly valuable in remote or challenging environments. Productivity Gains: Automation results in increased production rates and consistency. Autonomous vehicles and equipment can operate with high precision and accuracy, reducing errors and variations in mining processes.

Scalability: Mining companies can scale their operations more easily with automation. They can adapt to fluctuating demand by adjusting the number of autonomous vehicles and equipment in use, providing flexibility in responding to market dynamics. Competitive Advantage: As mining operations become more complex, automation provides a competitive edge. Companies that invest in these technologies can improve their operational efficiency, reduce costs, and gain an advantage in the global mining market. In summary, automation and autonomous vehicles are driving the Underground Smart Mining market by delivering tangible benefits in terms of efficiency, safety, and sustainability. As mining companies continue to recognize the advantages of these technologies, their adoption is expected to accelerate, reshaping the industry and paving the way for a more advanced and sustainable future.

IoT and Sensor Integration

The integration of the Internet of Things (IoT) and sensor technologies is poised to be a driving force behind the global Underground Smart Mining market, revolutionizing how mining operations are conducted and managed. IoT and sensors enable real-time data collection, analysis, and communication, providing mining companies with valuable insights, enhancing operational efficiency, and improving safety. Here's an in-depth exploration of how IoT and sensor integration are shaping the future of Underground Smart Mining , Real-Time Data Collection: IoT devices and sensors are deployed throughout mining sites to collect a wide range of data, including equipment performance, environmental conditions, and worker safety metrics. This real-time data is crucial for making informed decisions and optimizing operations.Predictive Maintenance: IoT sensors continuously monitor the condition of mining equipment, such as excavators and drills. By analyzing data on factors like vibration, temperature, and usage patterns, predictive maintenance algorithms can predict equipment failures before they occur, reducing downtime and maintenance costs. Improved Safety: Sensors are instrumental in ensuring the safety of mining personnel. Wearable IoT devices can monitor workers' vital signs and location, alerting supervisors to potential accidents or emergencies. Additionally, environmental sensors detect hazardous conditions like gas leaks or unstable ground, allowing for rapid response and prevention of accidents.

Environmental Monitoring: Underground Smart Mining solutions use sensors to monitor environmental conditions, such as air quality and water quality, to ensure compliance with environmental regulations. This data helps mining companies minimize their environmental footprint and address sustainability concerns. Resource Optimization: IoT and sensors play a crucial role in resource management. They monitor the consumption of resources like water and energy, helping mining companies optimize their usage, reduce waste, and cut operational costs.

Geological Analysis: Sensors can be embedded in drilling equipment to collect geological data as cores are extracted. This data assists geologists and engineers in assessing the composition and quality of ore deposits, optimizing extraction methods, and minimizing waste. Supply Chain Visibility: IoT-enabled tracking devices are used to monitor the movement of minerals and materials along the supply chain, enhancing transparency and traceability. This is particularly important for complying with ethical sourcing and conflict mineral regulations. Remote Monitoring and Control: IoT technology allows mining operators to remotely monitor and control equipment and processes, even in remote or hazardous locations. This reduces the need for on-site personnel and enhances operational efficiency.

Data Analytics and AI: The vast amount of data collected by IoT sensors is analyzed using data analytics and AI algorithms to derive actionable insights. This data-driven decision-making helps mining companies optimize production processes and improve overall efficiency.

Reduced Environmental Impact: By providing real-time data on environmental conditions, IoT and sensors enable mining companies to proactively address potential environmental issues, reducing the industry's overall environmental impact. In conclusion, the integration of IoT and sensor technologies is transforming the mining industry by enabling data-driven, efficient, and safe operations. As mining companies recognize the value of these technologies in reducing costs, improving sustainability, and ensuring worker safety, the global Underground Smart Mining market is expected to continue growing significantly.

Segmental Insights

Solution Insights

Data Management and Analytics Software segment is expected to dominate the market during the forecast period. Data is a valuable asset. Every day, automated mining equipment produces enormous amounts of useful data. Several vendors combine data with intelligent analytics, AI, machine learning, and automation to improve the security and productivity of operations.Mining companies can unlock immediate value and increase revenues by gathering and utilizing big data from data sources, analyzing the same with contemporary data analytics, and putting the results into practice. With reliable data, the mining industry can increase output, decrease operational inefficiencies, and respond to risks more quickly.

The World Economic Forum estimates the mining industry's value due to digital transformation initiatives may exceed USD 320.0 billion in the following ten years. The next-generation digital transformation software for mining operations, Inter Systems IRIS, integrates seamlessly with current hardware and software programs. It provides customizable Key Performance Indicators (KPIs) delivered in real-time, such as Overall Equipment Effectiveness (OEE), and instant notifications when data levels and KPIs get close to predetermined thresholds.

Regional Insights

The North America region is expected to dominate the market during the forecast period. The North American region is a significant contributor to the Underground Smart Mining market, with the United States and Canada taking up major market shares. The Environmental Protection Agency of the United States developed a graphic to provide users of Toxic Release Inventory data with a better understanding of mining operations and related TRI-reportable chemical releases. The metal mining sector handles large volumes of material each year. This sector reports the most significant total quantity of releases of TRI-covered chemicals of any industry sector covered by the Toxic Release Inventory Program. This sector influences the TRI data viewed by the public, driving several significant national and local trends.Mining companies need software solutions to manage the exploration and production of minerals, optimize human resources and equipment use, and comply with environmental, health, and safety regulations.

In June 2022, the Biden-Harris administration invested over USD 74 million in Federal-State partnerships to map critical minerals. This investment will be distributed in 30 states to support mapping, geoscience data collection, scientific interpretation, and data preservation of areas with potential for critical minerals under the US Geological Survey (USGS) Earth Mapping Resources Initiative, or Earth MRI.

Report Scope:

In this report, the Global Underground Smart Mining Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global Underground Smart Mining Market, By Solution:

- Smart Control System

- Smart Asset Management

- Safety & Security System

- Data Management & Analytics Software

- Monitoring System

Global Underground Smart Mining Market, By Service Type:

- System Integration

- Consulting Service

- Engineering

- Maintenance

Global Underground Smart Mining Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Europe

- Germany

- United Kingdom

- France

- Russia

- Spain

- South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Egypt

- UAE

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Underground Smart Mining Market.Available Customizations:

Global Underground Smart Mining Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Cisco Systems Inc.

- Wenco International Mining Systems Ltd

- SAP SE

- Rockwell Automation Inc.

- Komatsu Mining Corporation (Joy Global)

- Symboticware Inc.

- ABB Ltd

- Trimble Inc.

- IBM Corporation

- Epiroc AB

Table Information

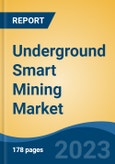

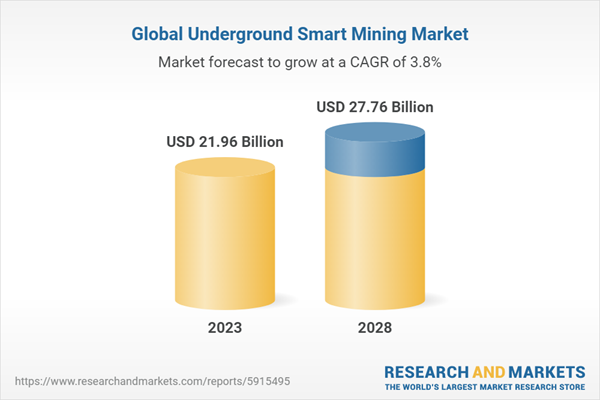

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | November 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 21.96 Billion |

| Forecasted Market Value ( USD | $ 27.76 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |