Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Moreover, initiatives like Dubai's Smart Mobility Strategy and the UAE Vision 2031 have created a favorable ecosystem for automotive innovation, prompting both global and regional OEMs and Tier 1 suppliers to expand their presence. The rising popularity of connected cars and integration of AI, IoT, and 5G technologies further enhance the market potential for connectors, as they play a critical role in ensuring seamless communication across electronic control units (ECUs).

Additionally, the aftermarket for connectors is gaining traction due to increased vehicle parc and a growing preference for high-performance upgrades and retrofits in luxury vehicles. The UAE’s strong logistics and re-export capabilities make it a strategic base for automotive component manufacturers looking to serve not only the domestic market but also the broader GCC and African regions. Environmental regulations encouraging fuel-efficient and emission-reducing technologies are further boosting the deployment of electric and hybrid vehicles, which inherently require a higher number of connectors compared to traditional ICE vehicles.

Key Market Drivers

Rising Electrification of Vehicles and Smart Mobility Adoption

One of the primary drivers propelling the UAE automotive connectors market is the rapid electrification of vehicles combined with the country's commitment to smart mobility. With increasing global pressure to reduce carbon emissions and the UAE's national strategy to diversify away from oil dependency, electrification of the transport sector has become a top priority. Dubai had approximately 15,100 EVs in 2022, rising to 25,929 by end-2023; Abu Dhabi currently hosts around 250 public chargers, while Dubai has over 370, with plans to reach 1,000 by 2025.The UAE has implemented multiple strategic initiatives such as the UAE Energy Strategy 2050 and the Dubai Clean Energy Strategy, which promote electric vehicle (EV) adoption and infrastructure development. This shift towards EVs and hybrid vehicles significantly amplifies the demand for high-quality automotive connectors, as EVs typically require more electronic control units (ECUs), power modules, and battery management systems - all of which rely heavily on robust connectors for power transfer, signal communication, and safety assurance.

Additionally, government incentives for EV ownership, such as free parking, toll exemptions, and charging infrastructure expansion, are pushing both consumers and fleet operators toward cleaner mobility options. Furthermore, Dubai’s ambitious autonomous and smart mobility strategy, targeting 25% of all trips to be driverless by 2030, has attracted global automotive and technology firms to test and deploy advanced mobility solutions. These developments necessitate complex, high-speed data transmission systems, which in turn demand reliable, miniaturized, and durable connectors. As a result, the rise in electrified and intelligent transportation solutions is expected to remain a strong driver for connector demand over the forecast period.

Key Market Challenges

High Dependence on Imports and Limited Local Manufacturing Capability

One of the primary challenges hindering the growth of the UAE automotive connectors market is the high dependence on imported components and the limited development of local manufacturing capabilities. Despite the country's strategic initiatives to boost industrial output and promote localization, the UAE continues to rely heavily on imports from regions such as Europe, China, Japan, and the United States for advanced automotive components, including connectors. This dependence exposes the market to global supply chain disruptions, shipping delays, and foreign exchange volatility. The UAE continues to depend heavily on imports for automotive parts, highlighting its limited domestic production capacity.In 2023, vehicle and parts imports reached AED 56 billion, with over 77% of auto-component trade being import-based. In recent years, the global semiconductor shortage and geopolitical tensions have highlighted the vulnerabilities of import-reliant supply chains, significantly affecting the timely availability of connectors and driving up costs for OEMs and system integrators.

Additionally, establishing local manufacturing facilities for precision electronic components like connectors requires substantial capital investment, skilled labor, and advanced technological infrastructure - areas where the UAE still faces developmental gaps. Moreover, the relatively small size of the domestic automotive production market does not provide enough volume to justify large-scale local connector manufacturing, deterring global players from setting up full-fledged production bases. While the government is actively promoting industrial clusters and incentivizing manufacturing, overcoming this structural dependence remains a long-term challenge for the automotive connectors segment in the UAE.

Key Market Trends

Emergence of High-Speed and Miniaturized Connectors to Support Advanced Vehicle Electronics

One of the most prominent trends transforming the UAE automotive connectors market is the growing demand for high-speed, high-performance, and miniaturized connectors to accommodate increasingly complex vehicle electronic systems. Modern vehicles, particularly electric and premium models popular in the UAE, now feature an extensive array of onboard technologies, including infotainment systems, advanced driver-assistance systems (ADAS), real-time navigation, and vehicle-to-everything (V2X) communication. These systems require fast data transmission with minimal signal loss, compelling connector manufacturers to innovate smaller, more compact solutions that can operate reliably in high-density electronic environments.Miniaturized connectors not only save space and reduce weight - a critical factor in electric vehicles for maximizing energy efficiency - but also allow for the integration of multiple functionalities within confined spaces such as electronic control units (ECUs) and battery packs. Additionally, the trend toward centralized and zonal electrical/electronic (E/E) architectures in vehicles is pushing the development of connectors that can handle higher data rates, thermal loads, and electromagnetic interference without compromising reliability. As the UAE automotive landscape continues to evolve toward luxury, electric, and semi-autonomous vehicles, this miniaturization trend is expected to gain further traction, influencing both OEM design choices and aftermarket solutions.

Key Market Players

- Delphi Automotive

- Sumitomo Electric Industries Ltd.

- Molex Incorporated

- Yazaki Corporation

- Japan Aviation Electronics Industry, Ltd.

- JST Mfg. Co, Ltd.

- AVX Corporation

- Amphenol Corporation

- Hirose Electric Co. Ltd.

- Foxconn Technology Group

Report Scope:

In this report, the UAE Automotive Connectors market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:UAE Automotive Connectors Market, By Vehicle Type:

- Passenger Cars

- Commercial Vehicle

UAE Automotive Connectors Market, By Connection Type:

- Wire to Wire Connection

- Board to Board Connection

- Wire to Board Connection

UAE Automotive Connectors Market, By Application Type:

- Powertrain

- Safety & Security

- Power Distribution & Body Wiring

- CCE

- Others

UAE Automotive Connectors Market, By Region:

- Dubai

- Abu Dhabi

- Sharjah

- Rest Of UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the UAE Automotive Connectors market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this UAE Automotive Connectors market report include:- Delphi Automotive

- Sumitomo Electric Industries Ltd.

- Molex Incorporated

- Yazaki Corporation

- Japan Aviation Electronics Industry, Ltd.

- JST Mfg. Co, Ltd.

- AVX Corporation

- Amphenol Corporation

- Hirose Electric Co. Ltd.

- Foxconn Technology Group

Table Information

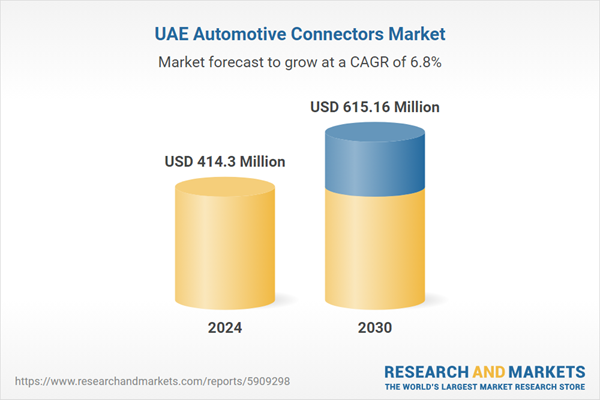

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 414.3 Million |

| Forecasted Market Value ( USD | $ 615.16 Million |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | United Arab Emirates |

| No. of Companies Mentioned | 11 |