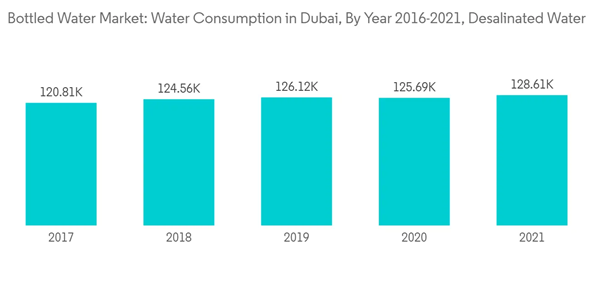

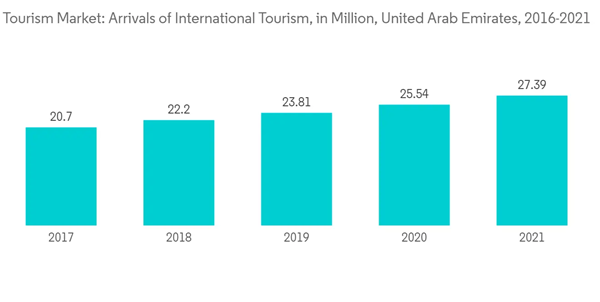

According to the Government of Dubai, 3.85 million tourists visited Dubai from January 2021 to September 2021. Thus, the United Arab Emirates bottled water market is driven by an increasing number of immigrants and the growing tourism sector, which leads to a surge in demand for functional, fortified, and flavored water. Also, the United Arab Emirates was reported to have witnessed one of the most significant numbers of international tourist arrivals among Middle Eastern countries. As a result, there has been an increase in consumption of bottled water since then, as this type of purified and mineral-treated water provides greater assurance of purity compared to tap or normal water.

Additionally, due to the increasing tourism in the country, food service channels, such as hotels and restaurants, are increasing in the region. Therefore, to offer quality service to their tourists, these channels are contributing to the high share of sales in the bottled water category, primarily from the still-bottled water segment. Furthermore, as per the International Bottled Water Association (IBWA), the region is the thirstiest country, with the highest temperature of 42 degrees Celsius in summer and the lowest temperature of 12 degrees in January. These climatic factors continue to drive the bottled water market.

UAE Bottled Water Market Trends

Surge in the Demand for Functional/Fortified and Flavored Water

The widening portfolio of functional water, which is infused with micronutrients, the addition of appealing flavors, and packaging level modifications to create its aesthetic appeal are driving the market for fortified, functional, and flavored water in the United Arab Emirates. Moreover, the rise in obese and diabetic populations across the country has shifted the focus of consumers from carbonated soft drinks to functional or fortified bottled water in the recent past. Functional water is set to receive a major boost, owing to strong category sales across various distribution channels and sales platforms. Consumers are gravitating towards the consumption of flavored water as they are able to avoid sugar consumption and calories that are often present in other juices and carbonated drinks, thereby making it more interesting than plain water and an alternative to other soft drinks.Furthermore, companies have started offering innovative solutions that spur growth momentum. Additionally, functional waters are relatively inexpensive when compared to other (ready-to-drink) RTD drinks, and different packaging options, including containers and single-serve bottles, are increasing consumer popularity, fueling the expansion of the functional water industry. The incorporation of vital components like amino acids, vitamins, and minerals in different functional waters is responsible for the spike in demand for functional water. For instance, Agthia Group PJSC (Al Ain) offers different types of water, like vitamin D-fortified bottled water, low sodium bottled water, and zero bromate bottled water, as per the needs of the consumer.

Growth in the Tourism Industry Owing to Favorable Government Initiatives Increasing the Sales of Bottled Water

The United Arab Emirates has long been recognized as a premier tourism and leisure destination. According to the World Bank data, the United Arab Emirates' population reached around 9.99 million in 2021, out of an expat population of 8.84 million. With the rise in the expat population over the past decade, these sectors have experienced rapid and sustained growth, becoming a key component of the country’s economic diversification strategy, which in turn has driven the growth of the food sector, including bottled water. For instance, the Ajman Strategic Plan (2015-2021), which focuses on the development and sustainability of its tourism sector, is one of the country's tourism initiatives, according to the United Arab Emirates Travel and Tourism organization. This plan, along with other strategies, is expected to drive the market for bottled water over the forecast period. Also, owing to increasing tourism in the United Arab Emirates, food service channels such as cafes, pubs, hotels, and restaurants are rising across the country, which is expected to increase the sales of bottled water. Additionally, in experiencing the opulent dine-in lifestyle, the United Arab Emirates is seeing growth in its upscale, refined eating scenario. Thus, companies manufacturing bottled water in the United Arab Emirates are developing various sizes of bottled water that tourists can easily carry as per their needs and requirements.UAE Bottled Water Market Competitor Analysis

The bottled water market in the United Arab Emirates is highly competitive. The leading participants like Agthia, Masafi, Oasis, Al Ghadeer Bottled Drinking Water, and PepsiCo are the major players in the market. Key players are now focusing on social media platforms and online distribution channels for the online marketing and branding of their products to attract more customers. The leading players in the market enjoy a dominant presence across the country. These players focus on leveraging the opportunities posed by emerging markets to expand their product portfolios so that they can cater to the requirements of various consumers, especially for functional and flavored water.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agthia Group PJSC

- Nestlé S.A.

- Masafi Inc.

- AL Ghadeer Drinking Water LLC

- National Food Products Company (Oasis Pure Water)

- PepsiCo Inc.

- Dubai Crystal Mineral Water & Refreshments L.L.C Co

- Hint Inc.

- Spindrift

- Mai Dubai