Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Central to the UAE's success in the vEPC market is its unwavering commitment to fostering innovation and embracing digital transformation. The UAE government has consistently demonstrated forward-thinking initiatives such as the UAE Vision 2021 and the UAE Centennial 2071, both of which prioritize technology's pivotal role in the nation's development. These initiatives have instilled a sense of urgency and purpose among telecom providers and enterprises in adopting virtualized solutions like vEPC. In doing so, they aim to meet the escalating demands of customers living in an era of high-speed connectivity, 5G, and the burgeoning Internet of Things (IoT). The UAE's strategic geographic location has played a pivotal role in solidifying its position as a vital node for global data traffic. The nation boasts state-of-the-art telecommunications infrastructure and world-class data centers, making it an attractive destination for international businesses looking to establish a foothold in the Middle East and North Africa (MENA) region. Consequently, the demand for vEPC solutions has surged as telecom operators seek to efficiently manage and optimize data traffic while ensuring ultra-low latency connectivity, essential for next-generation applications like autonomous vehicles and real-time augmented reality experiences.

Furthermore, the UAE's unique model of public-private collaboration has been instrumental in driving its success in the vEPC market. Government entities, telecom operators, and technology vendors have joined forces to create an ecosystem that fosters innovation and accelerates the deployment of vEPC solutions tailored to the UAE's specific needs. This collaborative approach has yielded remarkable results, with telecom operators leveraging vEPC to enhance network performance, reduce operational costs, and offer cutting-edge services like remote surgery, smart city applications, and real-time industrial automation. Another significant factor fueling the UAE's prominence in the vEPC market is its early embrace of 5G technology. As 5G networks rely on a more agile and adaptable core network, vEPC has emerged as a critical enabler for delivering the high-speed, low-latency, and reliable connectivity that 5G promises. UAE telecom operators have proactively adopted vEPC to unlock the full potential of 5G, enabling a wide range of transformative applications, from smart cities and autonomous vehicles to industrial automation, remote healthcare, and immersive virtual experiences.

Moreover, the UAE's regulatory environment has been conducive to the growth of the vEPC market. The Telecommunications Regulatory Authority (TRA) has implemented policies that support innovation and competition, while also ensuring that consumers have access to world-class services. This regulatory framework has created a level playing field for both established telecom operators and newer entrants, stimulating innovation in vEPC solutions and fostering healthy competition.

In conclusion, the United Arab Emirates has rapidly ascended to prominence in the virtualized evolved packet core market due to its unwavering commitment to innovation, digitalization, strategic location, collaborative ecosystem, early adoption of 5G, and conducive regulatory environment. As the demand for high-speed connectivity, IoT, and data-intensive applications continues to surge, the UAE's vEPC market is poised for sustained expansion and innovation, cementing its status as a key global player in the telecommunications landscape. The nation's journey into the vEPC market is a testament to its vision for a digitally connected future, one in which it plays a central role in shaping the telecommunications landscape of tomorrow.

Key Market Drivers

Rapid Growth of 5G Networks

The rapid growth of 5G networks is a significant driver propelling the United Arab Emirates' (UAE) Virtualized Evolved Packet Core (vEPC) market. As the world embraces the transformative power of 5G, the UAE has been at the forefront of this technological revolution. The exponential increase in mobile data traffic, ultra-low latency requirements, and the need for massive device connectivity have necessitated the deployment of robust and flexible vEPC solutions. One of the primary drivers of the vEPC market in the UAE is the nation's ambitious 5G rollout plans. Telecom operators have been actively investing in 5G infrastructure, and vEPC has emerged as the key component to support the advanced capabilities of 5G networks. vEPC offers scalability and flexibility, allowing operators to efficiently manage the increasing data volumes and deliver services like augmented reality, virtual reality, and IoT applications.The demand for vEPC solutions is driven by the need for a more agile core network that can adapt to the dynamic requirements of 5G, ensuring high-speed, low-latency connectivity. The UAE's commitment to becoming a 5G leader has created a thriving market for vEPC vendors and solutions providers, positioning the country as a global player in the evolution of telecommunications networks.

Government Initiatives and Digital Transformation

The UAE's government initiatives and its commitment to digital transformation play a pivotal role in driving the growth of the vEPC market. The government's visionary programs, such as UAE Vision 2021 and UAE Centennial 2071, emphasize the importance of technology and digitalization in shaping the country's future. These initiatives have acted as catalysts for telecom providers and enterprises in the UAE, compelling them to adopt virtualized solutions like vEPC to meet the evolving demands of a digitally connected society. Government support, coupled with regulatory frameworks that encourage innovation, has created a favorable environment for vEPC deployment. Moreover, the UAE government's investments in smart cities, autonomous transportation, and e-government services rely on robust and flexible network infrastructure, making vEPC an indispensable component. The integration of vEPC into these initiatives not only enhances network performance but also fosters innovation, ensuring the UAE remains at the forefront of digital transformation.Strategic Geographic Location and Global Connectivity

The UAE's strategic geographic location as a global telecommunications hub has a profound impact on the vEPC market. Situated at the crossroads of Europe, Asia, and Africa, the UAE serves as a vital node for international data traffic. This position is further strengthened by the nation's world-class telecommunications infrastructure and cutting-edge data centers. International businesses looking to establish a presence in the Middle East and North Africa (MENA) region are drawn to the UAE due to its robust connectivity and digital infrastructure. This influx of international companies drives the demand for vEPC solutions, as operators seek to manage and optimize the growing data traffic while ensuring low-latency connectivity for global operations. The UAE's role as a global connectivity hub extends beyond just data traffic. It also makes the country an ideal location for technology development, testing, and innovation. This, in turn, fuels the demand for vEPC solutions to support a wide range of applications, including IoT, cloud services, and real-time communication with international partners.Collaborative Ecosystem and Innovation

The UAE's collaborative ecosystem, involving government entities, telecom operators, and technology vendors, has been instrumental in driving innovation and accelerating the adoption of vEPC solutions. This collaborative approach creates an environment where stakeholders work together to address the specific needs of the UAE market. Telecom operators in the UAE have actively engaged with vEPC vendors to deploy tailored solutions that enhance network performance, reduce operational costs, and deliver cutting-edge services. The focus on innovation has led to the development of use cases ranging from smart cities and remote healthcare to industrial automation and augmented reality experiences. The UAE's unique model of public-private partnership encourages technology providers to invest in research and development, further advancing vEPC technology. This synergy between stakeholders fosters a vibrant ecosystem that continuously pushes the boundaries of what vEPC can achieve, solidifying the UAE's position as a leader in the market.Key Market Challenges

Security Concerns and Cyber Threats

One of the significant challenges facing the United Arab Emirates' (UAE) Virtualized Evolved Packet Core (vEPC) market is the ever-increasing concern over security and the growing threat landscape. As the UAE continues to invest in advanced telecommunications infrastructure, including 5G networks supported by vEPC, it becomes an attractive target for cyberattacks and data breaches. The adoption of virtualized solutions, while offering numerous advantages in terms of flexibility and scalability, also introduces new vulnerabilities. The disaggregation of network functions in a virtualized environment creates multiple potential points of entry for cybercriminals. These threat vectors can include virtualized network functions (VNFs), software-defined networking (SDN) controllers, and cloud-based infrastructure. Furthermore, the UAE's strategic position as a global connectivity hub makes it a prime target for state-sponsored cyberattacks and other malicious activities. Protecting sensitive data, critical infrastructure, and ensuring the integrity and availability of telecommunications services are paramount concerns.Regulatory Compliance and Data Privacy

Another significant challenge facing the UAE's vEPC market revolves around regulatory compliance and data privacy concerns. As the nation aims to establish itself as a global technology leader, it must navigate a complex landscape of international and domestic regulations that govern telecommunications and data management. International data transfer regulations, such as the European Union's General Data Protection Regulation (GDPR), impose stringent requirements on the handling and transfer of personal data. Given the UAE's role as a global data traffic hub, compliance with these regulations is essential for international businesses and data service providers operating in the country. Ensuring data sovereignty and protection while allowing data to flow seamlessly across borders is a delicate balancing act. Furthermore, the UAE has implemented its own regulations, such as the UAE Data Protection Law, which govern the collection, processing, and storage of personal data within the country. Compliance with these local regulations adds complexity to the vEPC market, as telecom operators and technology providers must navigate a dual regulatory framework. Data privacy and security concerns can potentially hinder the adoption of vEPC solutions, as organizations may be hesitant to migrate sensitive data and applications to virtualized environments without assurances of compliance and data protection.Key Market Trends

Edge Computing Integration in vEPC

One prominent trend shaping the UAE's Virtualized Evolved Packet Core (vEPC) market is the integration of edge computing capabilities. Edge computing refers to the practice of processing data closer to the source or 'edge' of the network, rather than relying solely on centralized cloud data centers. This trend is driven by the growing demand for low-latency, real-time applications, and services, particularly in sectors such as autonomous vehicles, smart cities, and industrial automation. In the UAE, where the adoption of 5G networks and IoT devices is on the rise, edge computing plays a crucial role in optimizing network performance and reducing latency. By deploying vEPC solutions at the network edge, telecom operators can support applications that require near-instantaneous data processing, such as remote robotic surgery, connected vehicles, and augmented reality experiences.The convergence of vEPC and edge computing creates a powerful ecosystem for delivering innovative and latency-sensitive services. Telecom providers are investing in edge infrastructure to accommodate this trend, allowing them to offer differentiated services that cater to the specific needs of various industries. This shift towards edge-integrated vEPC solutions is expected to continue as the UAE strives to maintain its position as a global technology leader.

Network Slicing for Service Customization

Network slicing is emerging as a transformative trend in the UAE's vEPC market, enabling service providers to customize network resources for different use cases and industries. Network slicing allows a single physical network infrastructure to be divided into multiple virtual networks, each tailored to specific requirements, whether it's ultra-reliable low-latency communications (URLLC) for industrial applications or enhanced mobile broadband (eMBB) for consumer services. In the UAE, where industries like healthcare, logistics, and manufacturing are rapidly adopting IoT and automation, network slicing offers a compelling solution. By implementing vEPC solutions that support network slicing, telecom operators can allocate resources dynamically, ensuring optimal performance and service quality for diverse applications. For instance, in smart city initiatives, vEPC-enabled network slicing can prioritize critical services like traffic management and emergency response systems during peak times while simultaneously supporting high-speed internet for residents. This flexibility and customization are essential for meeting the unique demands of each sector, fostering innovation, and driving the growth of the vEPC market in the UAE.Cloud-Native Architectures and Orchestration

The adoption of cloud-native architectures and orchestration is another key trend in the UAE's vEPC market. Cloud-native principles involve designing and deploying applications that are optimized for cloud environments, such as containerization and microservices. This approach enhances scalability, agility, and resource utilization. In the UAE, telecom operators are transitioning from traditional monolithic architectures to cloud-native vEPC solutions. By doing so, they can harness the benefits of greater flexibility and resource efficiency. Cloud-native vEPC architectures allow for rapid deployment of new services and applications, reducing time-to-market and operational costs. Orchestration tools, which automate the provisioning and management of virtualized network functions, are also gaining traction in the UAE's vEPC landscape. Orchestration streamlines network operations, enabling providers to scale resources dynamically, optimize network performance, and respond to changing demands efficiently. As the UAE continues to invest in cutting-edge technology and digital transformation, the shift toward cloud-native vEPC solutions and orchestration will become increasingly prevalent. This trend not only enhances the competitiveness of telecom operators but also paves the way for innovative services and applications that cater to the evolving needs of businesses and consumers in the UAE and beyond.Segmental Insights

Deployment Mode Insights

Based on deployment mode, the cloud segment emerges as the predominant segment in the UAE virtualized evolved packet core market, exhibiting unwavering dominance projected throughout the forecast period. The prevalence of cloud-based vEPC solutions in the UAE is a testament to the nation's commitment to harnessing the power of cloud computing for its telecommunications infrastructure. Cloud-based vEPC offers unmatched scalability, flexibility, and cost-efficiency, aligning perfectly with the UAE's ambitions to embrace cutting-edge technology and digital transformation. This deployment mode not only optimizes network performance but also facilitates rapid deployment of new services and applications, crucial in an era of high-speed connectivity and ever-evolving customer demands. The UAE's relentless focus on cloud-based vEPC solutions underscores its determination to remain at the forefront of innovation in the telecommunications sector, serving as a beacon for the transformative potential of virtualized network architectures.End User Insights

Based on end user, the telecom operator segment in the UAE virtualized evolved packet core market emerges as a formidable frontrunner, exerting its dominance and shaping the market's trajectory throughout the forecast period. The enduring prominence of telecom operators in the vEPC market can be attributed to their pivotal role in delivering seamless, high-speed connectivity to consumers and enterprises alike. As the demand for data-intensive applications, 5G networks, and Internet of Things (IoT) devices surges, telecom operators in the UAE are increasingly turning to vEPC solutions to optimize network performance, reduce operational costs, and provide innovative services. Their commitment to enhancing network infrastructure aligns seamlessly with the UAE's digital transformation initiatives and positions them as the primary architects of the country's telecommunications future. The telecom operator segment's unwavering dominance underscores its instrumental role in shaping the UAE's vEPC market and driving technological innovation in the pursuit of a digitally connected nation.Regional Insights

Dubai Region firmly establishes itself as a commanding presence within the UAE virtualized evolved packet core market, affirming its preeminent position, and highlighting its pivotal role in shaping the industry's course. This dominance is a testament to Dubai's role as a global technology and business hub, where innovation converges with economic prowess. With a relentless focus on technological advancements and digital transformation, Dubai has become a fertile ground for the proliferation of fiber optic components. These components are indispensable in facilitating high-speed data transmission, supporting the burgeoning telecommunications sector, and underpinning critical applications in industries ranging from finance and logistics to healthcare and entertainment.Dubai's prominence in the fiber optic components market can be attributed to its dynamic ecosystem of businesses, data centers, and cutting-edge infrastructure projects. The city's commitment to harnessing the potential of fiber optics for delivering high-quality, high-capacity connectivity has fostered an environment conducive to growth and innovation. As Dubai continues to set the pace in the adoption of fiber optic technologies, it not only strengthens its position as a regional technology leader but also reinforces its status as a global telecommunications and data hub. This dominant presence in the UAE's fiber optic components market is poised to endure, further cementing Dubai's pivotal role in shaping the future of connectivity and digitalization.

Report Scope:

In this report, the UAE virtualized evolved packet core market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:UAE Virtualized Evolved Packet Core Market, By Component Type:

- Solution

- MME

- HSS

- S-GW

- PDN-GW

- Service

- Professional Services

- Managed Service

- Consulting

- Integration & Development

- Training & Support

UAE Virtualized Evolved Packet Core Market, By Deployment Mode:

- Cloud

- On-Premises

UAE Virtualized Evolved Packet Core Market, By End User:

- Telecom Operator

- Enterprises

UAE Virtualized Evolved Packet Core Market, By Region:

- Dubai

- Sharjah

- Abu Dhabi

- Rest of UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the UAE Virtualized Evolved Packet Core Market.Available Customizations:

UAE Virtualized Evolved Packet Core market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Etisalat Group Company PJSC

- Du Telecommunications Corporation

- Huawei Technologies UAE FZ-LLC

- Nokia Corporation

- Affirmed Networks FZE

- Mavenir Systems, Inc.

- Red Hat FZE

- Cisco Systems FZE

- NEC Corporation

- Dell Technologies FZE

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | November 2023 |

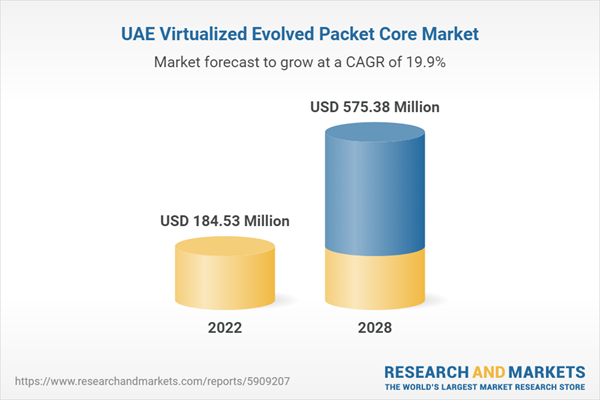

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 184.53 Million |

| Forecasted Market Value ( USD | $ 575.38 Million |

| Compound Annual Growth Rate | 19.8% |

| Regions Covered | United Arab Emirates |

| No. of Companies Mentioned | 10 |