Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Consumers are increasingly seeking eco-friendly and chemical-free formulations, prompting brands to launch biodegradable and plant-based options. Convenience, efficiency, and antibacterial properties are key purchase influencers, with liquid gels and dishwasher tablets seeing the highest demand. Private label brands are gaining traction due to cost-effectiveness, while premium products offering superior performance and fragrance variety also maintain strong appeal. The shift toward sustainability, including recyclable packaging and reduced water usage formulations, is shaping innovation in the sector.

Key Market Drivers

Rising Health and Hygiene Awareness Among Consumers

One of the most influential drivers of the dishwashing detergents market in the United Kingdom is the growing emphasis on health and hygiene. . In 2024, UK government-aligned research shows that 90% of consumers consider diet important to their health, and 86% view fitness as key highlighting a marked rise in health-conscious behaviors nationwide. The COVID-19 pandemic significantly heightened public awareness of surface cleanliness and hygiene practices, and this concern has continued post-pandemic. Households are now more conscious about the potential risks of bacteria and food-borne pathogens lingering on kitchen utensils and crockery.As a result, consumers are increasingly prioritizing the use of dishwashing products that offer powerful germ-killing and antibacterial properties. This shift in consumer behavior has encouraged manufacturers to innovate and develop products with enhanced sanitizing capabilities, often highlighting “99.9% germ removal” or “antibacterial action” on packaging.

Moreover, the rising incidence of food allergies and sensitivities is leading households to seek residue-free cleaning solutions to avoid cross-contamination. The heightened focus on hygiene extends beyond personal safety to include guests and children, reinforcing the everyday necessity of effective dishwashing detergents. Brands that promote clinical testing, dermatologist approval, or allergen-free claims tend to enjoy higher consumer trust in this context. Consequently, this growing awareness around health has played a major role in shaping product development, marketing strategy, and brand positioning in the UK dishwashing detergent sector.

Key Market Challenges

Intense Market Competition and Price Sensitivity

One of the most pressing challenges in the UK dishwashing detergents market is the intense competition among established brands, emerging eco-friendly players, and aggressive private labels. Market leaders like Fairy (P&G), Finish (Reckitt), and Ecover are constantly vying for shelf space and consumer loyalty, often through price promotions, new launches, or sustainability claims. Simultaneously, retailers’ own brands, such as Tesco or Aldi private labels, are growing rapidly in both quality and consumer trust, offering products at significantly lower prices. This competitive environment puts immense pressure on manufacturers to balance product innovation with affordability.As inflationary pressures persist and consumers become more price-conscious, especially in low- to middle-income households, brand switching becomes common. Premium brands are forced to justify their price points through superior performance or added features, which drives up research and marketing costs. Meanwhile, discount brands thrive on price appeal but face razor-thin margins. This price-sensitive atmosphere leaves little room for error and makes it difficult for smaller or niche brands to scale without aggressive pricing or capital-intensive marketing strategies. The combination of brand rivalry, promotion-led buying behavior, and limited consumer loyalty creates a highly volatile market landscape.

Key Market Trends

Rise of Multifunctional and Hybrid Dishwashing Products

One of the most notable trends in the UK dishwashing detergents market is the growing consumer preference for multifunctional and hybrid products that combine various cleaning, care, and performance-enhancing features. As households look to simplify their cleaning routines, products that offer multiple benefits - such as cleaning, degreasing, shine-enhancing, and antibacterial protection - are gaining popularity. In particular, dishwasher tablets with built-in rinse aid, salt action, and glass protection are becoming standard among premium offerings. Similarly, hand dishwashing liquids that include skin moisturizers or are pH balanced for sensitive hands are being well received.Brands are innovating by developing "all-in-one" or “multi-action” formulations that eliminate the need for additional products, offering both value and convenience. This trend reflects the broader lifestyle shift towards efficiency and time-saving solutions. The demand for hybrid products is also driven by growing awareness of energy and water savings, as consumers prefer detergents that work effectively even in short or eco-friendly dishwasher cycles. The success of these multifunctional products lies not only in their enhanced performance but also in their ability to cater to consumers who seek minimalist consumption and reduced packaging clutter in their kitchens.

Key Market Players

- Essens UK Ltd

- Unilever UK Ltd

- Henkel Ltd.

- P&G UK & Ireland

- Reckitt Benckiser Group plc

- Godrej UK (Shipleys LLP)

- The Clorox Company

- CHURCH & DWIGHT UK Ltd.

- McBride plc

- SC Johnson U.K.

Report Scope:

In this report, the United Kingdom Dishwashing Detergents Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:United Kingdom Dishwashing Detergents Market, By Product Type:

- Dishwashing Bars

- Dishwashing Liquid

- Dishwashing Powder

- Others

United Kingdom Dishwashing Detergents Market, By End-Use:

- Residential

- Commercial

United Kingdom Dishwashing Detergents Market, By Distribution Channel:

- Supermarkets/Hypermarkets

- Departmental Stores

- Online

- Others

United Kingdom Dishwashing Detergents Market, By Region:

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United Kingdom Dishwashing Detergents Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Essens UK Ltd

- Unilever UK Ltd

- Henkel Ltd.

- P&G UK & Ireland

- Reckitt Benckiser Group plc

- Godrej UK (Shipleys LLP)

- The Clorox Company

- Church & Dwight UK Ltd.

- McBride plc

- SC Johnson U.K.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 84 |

| Published | September 2025 |

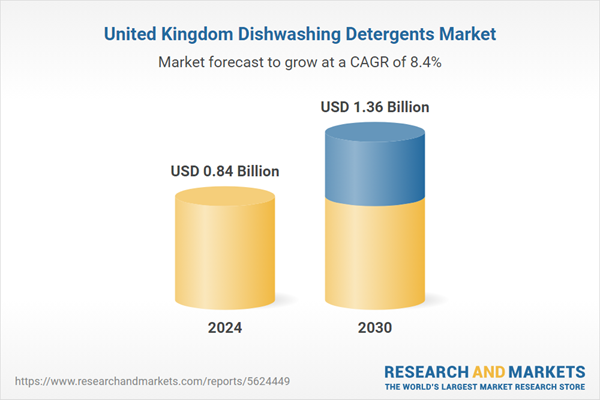

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 0.84 Billion |

| Forecasted Market Value ( USD | $ 1.36 Billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | United Kingdom |

| No. of Companies Mentioned | 10 |